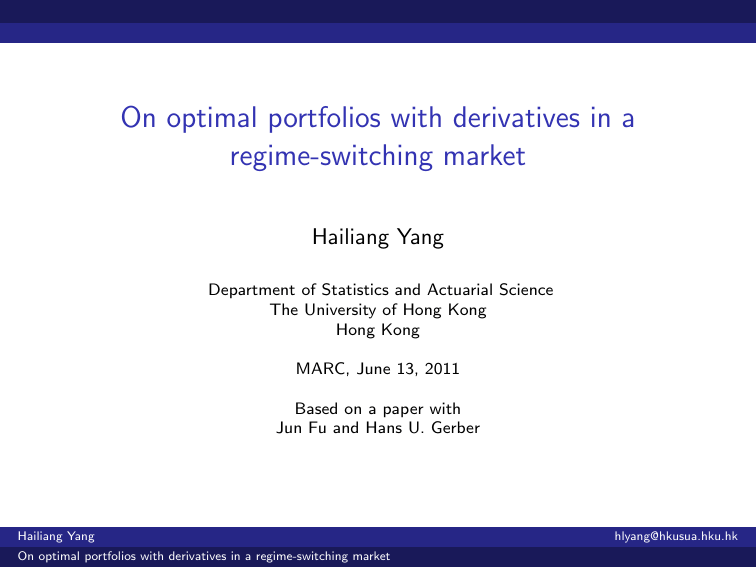

On optimal portfolios with derivatives in a

regime-switching market

Hailiang Yang

Department of Statistics and Actuarial Science

The University of Hong Kong

Hong Kong

MARC, June 13, 2011

Based on a paper with

Jun Fu and Hans U. Gerber

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Introduction

I

Portfolio selection problem is one of the key topics in finance.

I

This is recent work

I

This topic is one of Marc’s research areas

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Literature review

I

de Finetti (1940), in the context of choosing optimum

reinsurance levels, Bruno de Finetti essentially proposed

mean-variance analysis with correlated risks.

I

Markowitz’s single-period mean-variance model (1952, 1959)

— tradeoff between return (mean) and risk (variance).

I

Tobin (1958) extends Markowitz’s model to include a risk-free

asset — market portfolio, separation theorem.

I

Samuelson (1969) extended the work of Markowitz to a

multi-period setting. Dynamic programming method was

employed to find the optimal consumption strategy so as to

maximize the overall utility of consumption.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Literature review

I

Merton (1969, 1971) extended these work to continuous-time

setting. Ito calculus and the methods of continuous-time

stochastic optimal control were introduced.

I

Cox and Huang (1989, 1991), and Pliska (1986) introduced

the martingale technique to deal with the continuous-time

optimal consumption and investment problem. The problem,

which is dynamic in nature, can be reduced to a static one by

using the martingale representation theorem.

I

Van Weert, Dhaene and Goovaerts, (2010) Optimal portfolio

selection for general provisioning and terminal wealth

problems, Insurance: Mathematics and Economics, vol. 47,

no. 1, pp. 90 - 97.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Literature review

I

In the literature, most models contain risky and risk free assets

I

Kraft (2003) considers the optimal portfolio problem with

wealth consisting of stock, option and bond. By introducing

the elasticity of the portfolio with respect to the stock price,

the paper shows that we can use the elasticity as the single

control variable.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Literature review

I

Options: Di Masi et al. (1994), Buffington and Elliott (2001),

Guo (2001)

I

Optimal Trading Rules, Optimal Portfolio: Zariphopoulou

(1992), Zhang (2001), Zhou and Yin (2003), Cheung and

Yang (2004)

I

Risk Theory: Asmussen (1989)

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Portfolio with derivatives

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Notation

I

Wt :

standard Brownian motion

I

αt : continuous-time stationary Markov chain which takes

values in the regime space M = {1, ..., d} and has a transition

rate matrix Q = (qij ) ∈ R d×d .

I

B(t):

I

St :

risk free bond price

stock price

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Price dynamics

dB

B

dS

S

= r (t, αt )dt,

= µ(t, αt )dt + σ(t, αt )dWt .

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(1)

hlyang@hkusua.hku.hk

Dynamic for derivatives

dO(t, αt , St ) = Ot (t, αt , St )dt + OS (t, αt , St )dSt

d

+

X

1

qαt k O(t, k, St )dt,

OSS (t, αt , St )(dSt )2 +

2

k=1

(2)

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

The discounted price of derivative V (t, αt , St )

Zt

r (u, αu )du) · O(t, αt , St ).

V (t, αt , St ) = exp(−

(3)

0

V (t, αt , St ) is a martingale.

Vt (t, αt , St ) + VS (t, αt , St )r (t, αt )St

d

X

1

+ VSS (t, αt , St )σ 2 (t, αt )St2 +

qαt k V (t, k, St ) = 0. (4)

2

k=1

From this we have

d

X

1

Ot + OS rS + OSS σ 2 S 2 +

qαt k O(t, k, St ) = rO

2

(5)

k=1

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

I

Here we are not pricing the regime switching risk. That is we

do not change the transaction probability of the Markovian

chain when we obtain the risk neutral probability.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

We construct a self-financing portfolio which contains short one

option, long OS the underlying stock, the portfolio value is

Π = −O + OS · S,

(6)

from the self-financing property and (2), we have

dΠ = −dO + OS dS

d

X

1

= −Ot dt − OSS σ 2 S 2 dt −

qαt k O(t, k, St )dt, (7)

2

k=1

and (5) leads to

dΠ = −rOdt + OS rSdt

= r (−O + OS S)dt.

(8)

Therefore, Π = −O + OS S is risk free, hence −O + OS · S is a

delta-neutral portfolio.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Substituting dΠ = r (−O + OS S)dt into dO = −dΠ + OS dS

results in

dO = −r (−O + OS S)dt + OS dS

= rOdt + OS (µ − r )Sdt + OS σSdW

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(9)

hlyang@hkusua.hku.hk

dO

= [r + εO (µ − r )]dt + εO σdW ,

O

where

εO (t, αt , St ) =

(10)

OS (t, αt , St )St

O(t, αt , St )

is the elasticity of the option price with respect to the stock price

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

For a portfolio of option, stock, and bond of the form

X = χO O + χS S + χB B,

the dynamics of X is

dX = χO dO + χS dS + χB dB,

where χO , χS , and χB denote the number of shares of options,

stocks and bonds respectively and dB = rBdt

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

dX

X

χO dO

χS dS

χB dB

+

+

X

X

X

dO

dS

dB

= xO

+ xS

+ xB

,

O

S

B

=

(11)

where

χS S

χB B

χO O

,

xS =

,

xB =

,

X

X

X

denote the percentages of wealth invested in the three assets and

we have

xO + xS + xB = 1.

xO =

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

dX

X

= [xO (r + εO (µ − r )) + xS µ + xB r ]dt + [xO εO σ + xS σ]dW

= [xO εO (µ − r ) + xS (µ − r ) + r ]dt + [xO εO σ + xS σ]dW

= [r + ε(µ − r )]dt + εσdW

(12)

where, as in Kraft (2003), ε denotes the elasticity of the whole

portfolio with respect to the stock price, i.e.

ε = xO εO + xS ,

(13)

and note that the elasticities of the stock price and bank account

value with respect to the stock price are

εS = 1,

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

εB = 0.

hlyang@hkusua.hku.hk

Optimization problem

J(t, αt , , Xt ) = max{E [U(XT )|Ft ]},

ε

s.c.

(14)

dX

= [r + ε(µ − r )]dt + εσdW ,

X

X0 > 0,

XT

≥ 0.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Hamilton-Jacobi-Bellman (HJB) optimality condition

max DJ = 0,

(15)

where D is the Dynkin operator and DJ is given by

d

X

1

DJ = Jt + JX [r + ε(µ − r )]X + JXX ε2 σ 2 X 2 +

qαt ,k J(t, k, Xt ),

2

k=1

(16)

where the subscripts denote the partial derivatives of J with

respect to t and x.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Optimal elasticity

∂DJ

= JX (µ − r )X + JXX εσ 2 X 2 ,

∂ε

by setting

∂DJ

∂ε

(17)

= 0, we can obtain the optimal elasticity as

ε∗ = −

JX (µ − r )

,

JXX X σ 2

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(18)

hlyang@hkusua.hku.hk

HJB equation

JX (µ − r )2

]

JXX X σ 2

d

X

1

2 JX (µ − r ) 2

+ JXX X [

] +

qαt ,k J(t, k, Xt ) = 0,

2

JXX X σ

Jt + JX X [r −

k=1

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

HJB equation

d

X

1 2

JX (µ − r )2 = JXX σ 2 [Jt + JX Xr +

qαt ,k J(t, k, Xt )],

2

(19)

k=1

with the terminal condition

J(T , αT , XT ) = U(XT ).

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(20)

hlyang@hkusua.hku.hk

CRRA utility

Assuming that the agent has constant relative risk aversion

(CRRA) with utility function given by

U(x) =

xγ

,

γ

where γ < 1 and γ 6= 0

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Solution

J(t, i, x) = a(t, i)

xγ

,

γ

(21)

where a(·, i) is a continuous function with a(T , i) = 1 for each

i ∈ M. Then, immediately it follows that

xγ

,

γ

JX (t, i, x) = a(t, i)x γ−1 ,

0

Jt (t, i, x) = a (t, i)

JXX (t, i, x) = a(t, i)(γ − 1)x γ−2 .

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

0

λ(t, i)a(t, i) = a (t, i) +

d

X

qi,k a(t, k),

(22)

k=1

where

1 µ(t, i) − r (t, i) 2 γ

λ(t, i) = [

]

− r (t, i)γ.

2

σ(t, i)

γ−1

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Matrix form

0

(Λ(t) − Q)a(t) = a (t),

(23)

where

λ(t, 1)

Λ(t) =

0

..

.

..

.

···

0

..

.

0

···

..

.

..

.

0

..

.

0

λ(t, d)

0

,

0

a(t) = (a(t, 1), a(t, 2), · · · a(t, d)) ,

0

0

0

0

0

a (t) = (a (t, 1), a (t, 2), · · · a (t, d)) ,

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Solution

J(t, i, x) = a(t, i)

xγ

,

γ

∀i ∈ M,

where a(t, i) is uniquely determined by (23). Furthermore, due to

(18), we have

ε∗ (t, i) =

µ(t, i) − r (t, i)

.

(1 − γ)σ 2 (t, i)

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(24)

hlyang@hkusua.hku.hk

Solution

For a portfolio of only stock and option with xS + xO = 1, by

tracking this optimal elasticity, the optimal portfolio policy (xS∗ and

xO∗ ) can be obtained through (13). But if an agent also invests in

the bank account beyond the stock and option, the processes (xS∗ ,

xO∗ and xB∗ ) cannot be determined uniquely.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

According to (24) where γ < 1 and γ 6= 0, we find that the smaller

is γ, the smaller is the elasticity of the portfolio. This is consistent

with the definition of Arrow-Pratt index of risk aversion

−

xU ” (x)

= 1 − γ,

U 0 (x)

(25)

which indicates higher level of risk aversion for smaller value of γ.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

CARA utility

1

U(x) = − e −γx ,

γ

where γ > 0. Similarly, we conjecture that the solution to (19) and

(20) is given by

1

J(t, i, x) = − exp[−γg (t, i)x]a(t, i),

γ

(26)

where a(·, i) and g (·, i) are continuous functions and

a(T , i) = g (T , i) = 1 for each i ∈ M.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

CARA utility

0

g (t, i) + g (t, i)r (t, i) = 0,

0

d

J(t, k, x)

a (t, i) X

+

qi,k

a(t, i)

J(t, i, x)

=

k=1

(27)

1 µ(t, i) − r (t, i) 2

(

) ,

2

σ(t, i)

(28)

r (s, i)ds).

(29)

and the terminal conditions imply that

Z

g (t, i) = exp(

T

t

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

CARA utility

If the interest rate is independent of the state of the Markovian

chain,

0

d

a (t, i) X

a(t, k)

1 µ(t, i) − r (t) 2

+

qi,k

= (

) ,

a(t, i)

a(t, i)

2

σ(t, i)

k=1

and similar to what we have done for CRRA utility, it follows that

0

(Λ(t) − Q)a(t) = a (t)

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(30)

hlyang@hkusua.hku.hk

CARA utility

1 µ(t, i) − r (t) 2

[

] ,

2

σ(t, i)

λ(t, 1) 0 · · ·

..

..

.

.

0

Λ(t) =

..

..

..

.

.

.

0

··· 0

λ(t, i) =

0

..

.

0

λ(t, d)

,

a(t) = (a(t, 1), a(t, 2), · · · a(t, d),

0

a(t)

0

= (a(t, 1), a(t, 2), · · · a(t, d)) ,

and a(T ) = 1.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Solution

1

J(t, i, x) = − exp[−γg (t)x]a(t, i),

γ

∀i ∈ M.

By substituting this result into (18), we have

ε∗ (t, i) =

µ(t, i) − r (t)

.

γg (t)xσ 2 (t, i)

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(31)

hlyang@hkusua.hku.hk

In contrast to CRRA utility, for smaller value of γ, the Arrow-Pratt

index of risk aversion for CARA utility given by

−

xU ” (x)

= γx

U 0 (x)

(32)

indicates lower level of risk aversion, and (31) implies higher

elasticity of portfolio which is more sensitive to the changes in the

stock price.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Analyzing the optimal portfolio: Without risk free asset

For the portfolio containing only stock and option, we have

xS∗ + xO∗

xS∗

+

xO∗ εO

= 1,

= ε∗ ,

and these two equations imply that

xS∗ = −

JX (µ − r ) 1

εO

−

.

2

JXX X σ 1 − εO

1 − εO

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(33)

hlyang@hkusua.hku.hk

Analyzing the optimal portfolio: Without risk free asset

I

)

− JJX (µ−r

:

X σ2

I

) 1

:

− JJX (µ−r

X σ 2 1−εO

I

− 1−εO :

XX

XX

εO

optimal strategy in Merton’s model

the modified term of speculation

the pure delta neutral hedging term

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Analyzing the optimal portfolio: Without risk free asset

X = χO O + χS S,

to make it delta-neutral, we require that

χO OS + χS = 0,

and equivalently,

xS = −xO OS

S

= −xO εO ,

O

(34)

which, combined with xS + xO = 1, results in

xS = −

εO

.

1 − εO

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Effect of γ

We use the CRRA utility function, which, due to (21), admits

−

JX (µ − r )

JXX X σ 2

=

xS∗ =

µ−r

,

(1 − γ)σ 2

1

εO

µ−r

−

,

(1 − γ)σ 2 1 − εO

1 − εO

(35)

(36)

where γ < 1, γ 6= 0.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Observations

Same as the optimal solution of the Merton’s problem, for the

reduced portfolio optimization problem, the smaller is γ, the more

risk-averse is the agent as indicated by the Arrow-Pratt index of

risk aversion, so the less is its wealth invested in stock and the

more is invested in the bank account.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Observations

As γ decreases, the modified term of speculation in xS∗ approaches

zero and xS∗ converges to the term of pure delta neutral hedging.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Discrete-Time Model with Regime Switching

Based on a paper with K.C. Cheung:

K. C. Cheung and H. Yang, “Asset Allocation with

Regime-Switching: Discrete-Time Case”, ASTIN Bulletin, Vol. 34,

No. 1, 99-111, 2004.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Discrete-Time Model with Regime Switching

I

Discrete-time setting: investor can decide the level of

consumption, cn at time n = 0, 1, 2, . . . , T − 1

I

After consumption, all the remaining money will be invested

in a risky asset

I

The random return of the risky asset in different time periods

will depend on the credit ranking which is modeled by a

time-homogeneous Markov chain {ξn }0≤n≤T with state space

M = {1, 2, . . . , M} and transition probability matrix P = (pij )

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Absorption State — Default Risk

I

Assume that state M of the Markov Chain is an absorbing

state:

pMj

= 0

pMM

= 1.

j = 1, 2, . . . , M − 1,

I

Default occurs at time n if ξn = M. In this case, the investor

can only receive a fraction, δ, of the amount that he/she

should have received.

I

The recovery rate δ, is a random variable, valued in [0, 1]

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Wealth Process

I

{Wn }0≤n≤T : wealth process of the investor

Wn+1 =

(Wn − cn )Rnξn (1{ξn+1 6=M} + δ1{ξn+1 =M} )

W n − cn

if ξn 6= M,

if ξn = M,

n = 0, 1, . . . , T − 1, where 1{··· } is the indicator function.

I

Rni is the return of the risky asset in the time period [n, n + 1],

given that the Markov chain is at regime i at time n.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Assumptions

I

I

I

The random returns R0i , R1i , . . . , RTi −1 are i.i.d. with

distribution Fi ; they are assumed to be strictly positive and

integrable

j

Rni is independent of Rm

, for all m 6= n

The Markov chain {ξ} is stochastically independent of the

random returns in the following sense:

P(ξn+1 = in+1 , Rnin ∈ B | ξ0 = i0 , . . . , ξn = in ) = pin in+1 P(Rnin ∈ B)

for all i0 , . . . , in , in+1 ∈ S, B ∈ B(R) and n = 0, 1, . . . , T − 1

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Assumptions

I

0 ≤ cn ≤ Wn (Budget constraint)

I

The recovery rate δ is stochastically independent of all other

random variables

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

I

Given that the initial wealth is W0 and the initial regime is

i0 ∈ M∗ := M \ {M}, the objective of the investor is to

#

" T

X1

(cn )γ

max E0

γ

{c0 ,...,cT }

n=0

over all admissible consumption strategies. Here 0 < γ < 1.

I

Admissible consumption strategy: a feedback law

cn = cn (ξn , Wn ) satisfying the budget constraint

I

Optimal Consumption Strategy: Ĉ = {cˆ0 , . . . , cˆT }

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

I

For n = 0, 1, . . . , T , the value function Vn (ξn , Wn ) is defined

as

#

" T

X1

γ

Vn (ξn , Wn ) =

max

En

(ck ) .

γ

{cn ,cn+1 ,...,cT }

k=n

I

Bellman’s

Equation:

V

(ξ

,

W

n n n ) = max0≤cn ≤Wn En [U(cn ) + Vn+1 (ξn+1 , Wn+1 )]

n = 0, 1, . . . , T −

γ

1

VT (ξT , WT ) = γ WT

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

I

Suppose λ > 0, w > 0, and 0 < γ < 1 are fixed constants.

The function f : [ 0, w ] → R defined by

f (c) = c γ + λ(w − c)γ

(37)

will achieve its unique maximum at

w

ĉ =

(38)

1

1 + λ 1−γ

and the maximum value is given by

1

f (ĉ) = w γ (1 + λ 1−γ )1−γ .

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(39)

hlyang@hkusua.hku.hk

I

Define some symbols recursively:

1

i ∈ M∗ ,

H (i) = {E[(R i )γ ]} 1−γ ,

(i)

L0

(i)

Ln

(i)

K1

(i)

Kn

i ∈ M,

= 0,

=

(i)

H (i) Kn 1{i6=M}

+ n1{i=M} ,

i ∈ M, n = 1, 2, . . . , T ,

1

1−γ

= [1 − piM + piM E(δ γ )] ,

i ∈ M∗ ,

1

M−1

1−γ

X

(j) 1−γ

(M) 1−γ

γ

,

=

pij (1 + Ln−1 )

+ piM E(δ )(1 + Ln−1 )

j=1

i ∈ M∗ , n = 2, . . . , T .

I

(M)

Note that K· ’s are not defined. M (i) is well-defined since

we have assumed that R i is integrable.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

I

For n = 0, 1, . . . , T , the value function is given by

VT −n (i, w ) =

1 γ

(i)

w (1 + Ln )1−γ ,

γ

(40)

and the optimal consumption strategy is given by

(i)

ĉT −n (i, w ) = w (1 + Ln )−1 .

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(41)

hlyang@hkusua.hku.hk

I

From this result, we see that if we are now at time T − n, and

in regime i, then we should consume a fraction of our wealth

which is equal to

1

.

(n)

1 + Li

Thus our optimal consumption strategy depends heavily on

the current regime and the remaining investment time

through the function L.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

I

(·)

For each i ∈ M, Li

is increasing in n:

(i)

(i)

(i)

0 = L0 ≤ L1 ≤ . . . ≤ LT .

I

(·)

For each i ∈ M∗ , Ki

(42)

is increasing in n:

(i)

(i)

(i)

0 ≤ K1 ≤ K2 ≤ . . . ≤ KT .

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

(43)

hlyang@hkusua.hku.hk

I

The monotonicity of L implies at the same regime, we should

consume a larger fraction of our wealth when we are closer to

the maturity.

I

This strategy is quite reasonable. If we are closer to the

maturity, a short-term fluctuation in the return of the risky

asset will bring a loss to us that we may not have enough time

to cover. Therefore, we should consume more and invest less.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

I

For any fixed i ∈ M and w > 0,

ĉ1 (i, w ) ≤ ĉ2 (i, w ) ≤ . . . ≤ ĉT (i, w ).

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Next, we may guess that at any time period, say T − n, if we are at

a “better” regime, then we should consume less and invest more.

We need two ingredients:

1. A criterion to compare the distributions of the returns in

different regimes =⇒ second order stochastic dominance

2. Market has to “regular” enough =⇒ stochastically

monotone transition matrix

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Insurance: Mathematics and Economics 31 (2002) 3–33

Review

The concept of comonotonicity in actuarial

science and finance: theory

J. Dhaene, M. Denuit, M.J. Goovaerts, R. Kaas, D. Vyncke∗

DTEW, K.U. Leuven, Naamsestraat 69, 3000 Leuven, Belgium

Received December 2001; accepted 6 June 2002

Abstract

In an insurance context, one is often interested in the distribution function of a sum of random variables. Such a sum

appears when considering the aggregate claims of an insurance portfolio over a certain reference period. It also appears when

considering discounted payments related to a single policy or a portfolio at different future points in time. The assumption

of mutual independence between the components of the sum is very convenient from a computational point of view, but

sometimes not realistic. We will determine approximations for sums of random variables, when the distributions of the terms

are known, but the stochastic dependence structure between them is unknown or too cumbersome to work with. In this paper,

the theoretical aspects are considered. Applications of this theory are considered in a subsequent paper. Both papers are to a

large extent an overview of recent research results obtained by the authors, but also new theoretical and practical results are

presented.

© 2002 Elsevier Science B.V. All rights reserved.

Keywords: Comonotonicity; Actuarial science and finance; Sums of random variables

1. Introduction

In traditional risk theory, the individual risks of a portfolio are usually assumed to be mutually independent.

Standard techniques for determining the distribution function of aggregate claims, such as Panjer’s recursion, De

Pril’s recursion, convolution or moment-based approximations, are based on the independence assumption. Insurance is based on the fact that by increasing the number of insured risks, which are assumed to be mutually

independent and identically distributed, the average risk gets more and more predictable because of the Law of

Large Numbers. This is because a loss on one policy might be compensated by more favorable results on others.

The other well-known fundamental law of statistics, the Central Limit Theorem, states that under the assumption

of mutual independence, the aggregate claims of the portfolio will be approximately normally distributed, provided

the number of insured risks is large enough. Assuming independence is very convenient since the mathematics

for dependent risks are less tractable, and also because, in general, the statistics gathered by the insurer only give

∗

Corresponding author.

E-mail address: david.vyncke@econ.kuleuven.ac.be (D. Vyncke).

0167-6687/02/$ – see front matter © 2002 Elsevier Science B.V. All rights reserved.

PII: S 0 1 6 7 - 6 6 8 7 ( 0 2 ) 0 0 1 3 4 - 8

Compound binomial model

I

Suppose X and Y are two random variables. If

E[g (X )] ≤ E[g (Y )]

I

for any increasing and concave function g such that the

expectations exist, then we say X is dominated by Y in the

sense of second order stochastic dominance and it is denoted

by X ≤SSD Y .

Suppose P = (pij ) is an m × m stochastic matrix. It is called

stochastically monotone if

m

X

pil ≤

l=k

m

X

pjl

l=k

for all 1 ≤ i < j ≤ m and k = 1, 2, . . . , m.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Suppose P is a M × M matrix. Let ek = (1, . . . , 1, 0, . . . , 0)0 (i.e.

first k coordinates are 1, the rest are 0) for k = 1, 2, . . . , M. Let

DM = {(x1 , . . . , xM )0 ∈ RM | x1 ≥ · · · ≥ xM } and

PD = {y ∈ DM | Py ∈ DM }.

Suppose that P is an M × M stochastic matrix. The following

statements are equivalent:

1. P is stochastically monotone;

2. PD = DM ;

3. ek ∈ PD for all k = 1, 2, . . . , M.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Suppose that the transition probability matrix P is stochastically

monotone. Assume that

R 1 ≥SSD R 2 ≥ · · · ≥SSD R M−1 ,

(44)

and

(i)

H (i) K1 ≥ 1

∀i ∈ M∗ .

(45)

Then we have for n = 1, 2, . . . , T ,

(1)

(2)

(M−1)

Ln ≥ Ln ≥ · · · ≥ Ln

(M)

≥ Ln ,

(46)

and

(1)

Kn

(2)

≥ Kn

(M−1)

≥ · · · ≥ Kn

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

.

(47)

hlyang@hkusua.hku.hk

Meaning of R 1 ≥SSD · · · ≥SSD R M−1

Preference of investor: increasing and concave utility function

+

Return of the risky asset in regime i: R i

+

Definition of SSD order

⇓

The M − 1 regimes are ranked according to their

favorability to the risk-averse investor:

regime 1 is the most favorable, regime M − 1 is the most unfavorable

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk

Meaning of P being stochastically monotone:

For 1P≤ i < j ≤ M − 1 (regime i is more favorable to regime j)

• M

l=k pil is the probability of switching to the worst M − k + 1

regimes

PMfrom regime i

• l=k pjl is the probability of switching to the worst M − k + 1

regimes from regime j

Intuitively, if the market is “regular” enough, we should have

M

X

pil ≤

l=k

M

X

pjl

l=k

for all possible k. This precisely means that P is stochastically

monotone.

Hailiang Yang

On optimal portfolios with derivatives in a regime-switching market

hlyang@hkusua.hku.hk