MAN256 – Introduction to Management Science Questions:

advertisement

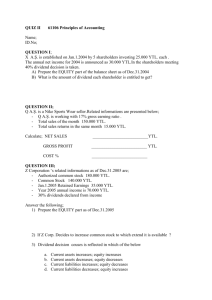

MAN256 – Introduction to Management Science Sections 01 & 02 FINAL EXAM – May 21, 2004, 15:00 Student Name: Student Number: Notes: The exam’s duration is 135 minutes. Use your time efficiently. This is a closed-book exam. Please try not to detach the exam booklet. However, if you do detach them, do not forget to write your name on all the pages. You can use a calculator, but you are not allowed to use a GSM device as a calculator or a watch. Show all your work on the exam papers. Good Luck Questions: (20 points) 1. A small company produces only two sizes of frames for stereo receivers: standard size and slim-line. The accounting department has provided the following table for the price and unit cost of the products: Standard Slim-line Selling Price $6.00 $4.25 Raw Materials $0.75 $0.50 Packaging $0.25 $0.25 Since the company is paying each employee $1200 per month, independent of their productivity (i.e., independent of their working hours), labor cost is excluded from profit margin calculations. The company has 350 units of raw material and 300 packing boxes available daily to be used for products. In order to produce a standard frame 0.4 labor-hr and 1.5 units of raw material are required. Similarly for one slim-line frame production 0.25 labor-hour and 1 unit of raw material are required. Assume that the labor force of the stereo production line is at most 10 workers (each works 8 hr/day). In order to find out the profit maximizer daily production plan, an LP model is generated. The following tables are the answer and sensitivity reports of this model run on Excel Solver: Using the Excel Solver Reports, answer the following questions: a) What is the optimal daily production plan? b) What is the maximum profit earned from standard frames, if the company produces exactly the same amount as it was found in part (a)? c) What is the new optimum solution and optimal profit if an additional worker is assigned to frame production line? d) Suppose the selling price of standard frames is increased to $6.50. Would the optimum profit change? If yes, how much is the change? e) Suppose simultaneously the amount of material available increased from 350 to 500 units, the number of boxes available increased from 300 to 310, and the number of man-hours decreased from 80 to 78. Is it possible to calculate the new optimum profit without re-solving the LP model? If yes, what would be the new optimum profit? 3 (20 points) 2. Evans Enterprises has bought a prime parcel of beach-front property and plans to build a luxury hotel. After meeting with the architectural team, the Evans family has drawn up some information to make preliminary plans for construction. Excluding the suites, which are not part of this decision, the hotel will have four kinds of rooms: beach-front non-smoking, beach-front smoking, lagoon view nonsmoking, and lagoon view smoking. In order to decide how many of each of the four kinds of rooms to plan for, the Evans family will consider the following information. 1. After adjusting for expected occupancy, the average nightly revenue for a beach-front non-smoking room is $175. The average nightly revenue for a lagoon view non-smoking room is $130. For smoking rooms: nightly revenues are $190, and $145 for beach-front and lagoon types, respectively. 2. Construction costs vary. The cost estimate for a lagoon view room is $12,000 and for a beach-front room is $15,000. Air purifying systems and additional smoke detectors and sprinklers add $3000 to the cost of any smoking room. Evans Enterprises has $6.3 million available for the building construction. 3. There will be at least 100 but no more than 180 beach-front rooms. 4. Design considerations require that the number of lagoon view rooms be at least 1.5 times the number of beach-front rooms, and no more than 2.5 times that number. 5. Industry trends recommend that the number of smoking rooms be no more than 50% of the number of non-smoking rooms. Develop the linear programming (LP) model to maximize revenue. 4 (20 points) 3. ABC Manufacturing must produce 1650 units for an important customer. If machine 1 is used, its production will be between 300 and 1500 units. Machine 2 and/or machine 3 can be used only if machine 1’s production is at least 1000 units. Machine 4 can be used with no restrictions. The following table provide the fixed and variable (per unit production) cost of production at each machine type; as well as the min. and max. allowed production limits of each machine: Machine 1 2 3 4 Fixed Cost($) 500 800 200 50 Variable Cost($) 2.00 0.50 3.00 5.00 Minimum Production 300 500 100 any Maximum Production 1500 1200 800 any Formulate a mixed-binary linear programming model to help ABC managers to determine production quantities on the machines to minimize costs. 5 (15 points) 4. The Soni Company produces two types of transistor radios: standard and deluxe models. It requires 5 minutes of labor and 10 unit of raw material to produce a standard radio. A deluxe radio requires 8 minutes of labor and 15 units of raw materials. Soni has 4,800 minutes of regular production time per week. If more time is required, then the workers have to work overtime. Soni also has 22,000 units of raw materials. The unit profit for a standard and deluxe radio is $0.20 and $0.25, respectively. The weekly demand is 500 standard and 400 deluxe radios. Soni’s goals are given below with their priority levels: Goal Number 1 2 3 Goal Description Limit overtime to 480 minutes. Achieve a profit of at least $300 per week. Fulfill the demand for standard radio. Construct a non-preemptive goal programming model for Soni assuming that Goal 2 is twice more important than Goal 1, and Goal 3 is three times more important than Goal 2. a) Write down the constraint associated with Goal 1. b) Write down the constraint associated with Goal 2. c) Write down the constraint associated with Goal 3. d) Write down the objective function. e) Write down the other constraints, if there are any? 6 f) Which constraint(s) above are hard and which one(s) are soft constraints? g) Assume the problem is defined as a preemptive Goal Programming (with 3 levels of priority): Priority Level Goal Number Goal Description 1 1 Limit overtime to 480 minutes. 2 2 Achieve a profit of at least $300 per week. 3 3 Fulfill the demand for standard radio. Also, solution of the LP model for the first two levels results optimum objective values of 0 minutes and 1000, respectively. Then formulate the LP model for the third priority level of the problem (write down the objective function and all the constraints of the model). 7 (10 points) 5. Alex Boldwin is shopping for a new car and has identified three models from which he will choose – an Explorer, a Trooper and a Passport. He will make his selection based on AutoCar ratings, price and each vehicle’s appearance. One of his friends from Bilkent has offered him to use AHP to make his decision. They constructed the necessary pairwise comparison matrices and conducted the other required calculations; the Excel sheet on the next page shows the calculations. Alex’s pairwise comparisons of the vehicles for each criterion, and his criteria preferences, and also the AHP related calculations are provided in the next page as an Excel worksheet. Using the information on the next page, answer the following questions: a) Are Alex’s comparisons consistent? Show your work! Hint: You can use these RI values: n 3 4 5 6 RI 0.58 0.90 1.12 1.24 b) Assume all matrices are consistent, and using AHP determine which car should Alex purchase? 8 (15 points) 6. Ali Hesapbilir is an MBA student in Bilkent University, who has been having problems with his bank account. His monthly income mostly relies on his Bilkent Graduate-Student scholarship, but he also makes extra money in most months by working as a consultant at a small Cyberpark company. His chances of various monthly income levels are shown in the table below-left. Also, Ali’s monthly expenditures vary, and the following table on the right shows the probability distribution of his monthly expenses: Monthly Income Probability Monthly Expenses Probability 900 YTL 0.40 800 YTL 0.15 1000 YTL 0.25 1000 YTL 0.55 1100 YTL 0.30 1200 YTL 0.30 1150 YTL 0.05 Ali begins his last year in the program with 1000 YTL in his bank account. Assume that all his income is received at the beginning of each month, and his expenses are deducted from his bank account at the end of each month. At the end of any month if his account balance is negative (which is allowed) it will be paid by his next month earning. a) Simulate his cash random numbers: Random # 1 Stream 1 92 Stream 2 80 At the end of this flows for 12 months using the following two streams of 12 2 3 4 5 82 18 65 13 14 85 24 90 simulation run: 6 6 91 7 91 3 8 71 73 9 51 75 10 62 14 11 97 21 12 41 93 ∗ What is his ending bank account balance? ∗ What is the probability that his bank account has a negative balance at the end of any month? b) In order to get more accurate results this simulation is repeated 9 times. The following table summarizes the outcome of these 9 runs: Simulation Run 12-month End Balance P(End-Month Balance ¡ 0) 1 900 0.00 2 150 0.42 3 950 0.00 4 300 0.42 5 1,150 0.00 6 -100 0.08 7 -250 0.08 8 -250 0.33 9 -250 0.17 ∗ Using the results of 9 simulation runs, would you update your answers the questions i and ii in part (a)? If yes, how? ∗ Do you think Ali Hesapbilir can manage to finish his MBA with a positive bank account balance? Give reasons. 10