Revised MESDAQ Market Entry Requirements

advertisement

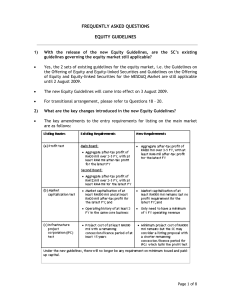

SECURITIES COMMISSION ANNUAL REPORT 2005 PROMOTING QUALITY COMPANIES – REVISED MESDAQ MARKET ENTRY REQUIREMENTS Historical Background The MESDAQ Market, which was launched on 6 October 1997 as the Malaysian Exchange of Securities Dealing and Automated Quotation (MESDAQ), originated as an idea in the 7th Malaysia Plan and germinated in the Securities Commission Concept Paper presented to the Ministry of Finance in May 1996. It received endorsement in Budget 1997 and its framework was announced officially to the public in February 1997. MESDAQ was conceived as a strategy towards the achievement of Vision 2020 by bringing together investors and growth companies. In essence, MESDAQ was to provide a suitable avenue for capital raising by quality and high growth technology-based issuers in Malaysia. In March 2002, as part of the consolidation process of the exchanges, MESDAQ was merged with the KLSE, now known as Bursa Malaysia Securities Bhd (Bursa). The merger between MESDAQ and Bursa sparked renewed interest in MESDAQ, resulting in a tremendous resurgence in activity in the renamed MESDAQ Market. technology-based, high growth companies easier access to public funds from the capital market, thus providing an invaluable alternative to bank loans as a source of funding. The MESDAQ Market today remains true to its principal objective, as encapsulated in the framework for its establishment. Recent Developments With effect from 1 January 2005, the consideration and approval for listings and corporate proposals on the MESDAQ Market are undertaken by the Commission, while Bursa continues to approve admission to the Official List and quotation for trading of securities on the MESDAQ Market. Under this new arrangement, approval for MESDAQ Market corporate proposals need only be sought from one authority, under section 32 of the SCA, which is in line with the approval process for Main and Second Board companies. The MESDAQ IPO Guidelines The consolidation of the two equity exchanges was a significant step towards not only the creation of a single Malaysian exchange as recommended in the CMP but also the development of a more efficient financing base for emerging high growth and technology-based issuers in Malaysia. Since the merger, the number of listings on the MESDAQ Market grew from five to over 100 companies as at end-2005, raising over RM1.6 billion through IPOs. In 2005 alone, the MESDAQ Market recorded 46 new listings, surpassing both the Second and Main Boards of Bursa, which collectively recorded 33 new listings. Proceeds raised from IPO were mainly applied towards business expansion and research and development initiatives. This attests to the fact that the MESDAQ Market continued to fulfil its objective in providing 2-10 DEVELOPMENTAL REVIEW Objective Since assuming the role of sole approving authority, the Commission embarked on a review of the existing entry requirements set out in the listing requirements of Bursa for the MESDAQ Market and, on 29 November 2005, introduced the Guidelines for Initial Public Offerings and Listings on the MESDAQ Market of Bursa Malaysia Securities Berhad (MESDAQ IPO Guidelines), which sets out the requirements relating to IPOs and listings on the MESDAQ Market. The MESDAQ IPO Guidelines was formulated to ensure that while the MESDAQ Market’s objectives are upheld, the MESDAQ Market will remain resilient, in light of the consolidation of the SECURITIES COMMISSION ANNUAL REPORT 2005 global technology sector which has seen the closure of several alternative markets for technology and high growth companies globally. The thrust of the MESDAQ IPO Guidelines is to promote quality companies on the MESDAQ Market and to continue to leverage on the uniqueness of the MESDAQ Market as a fund-raising platform with a “technology” focus. The release of the MESDAQ IPO Guidelines represents the Commission’s continuous efforts to further enhance the efficiency of fund-raising, and at the same time promote a strong, vibrant and credible securities market, facilitate an orderly development of the capital market and ensure adequate investor protection. by the Commission in determining whether companies are suitable for listing on the MESDAQ Market. This enables such companies and their advisers to have greater certainty in making their own assessment of the companies’ eligibility to be listed on the MESDAQ Market, before submitting applications to the Commission. The enhanced requirements in the MESDAQ IPO Guidelines are aimed at improving the investibility of the MESDAQ Market companies and focus on the following: • Qualitative attributes to be demonstrated by the potential issuers. The MESDAQ IPO Guidelines places great emphasis on issuers’ justifications of their suitability for listing by demonstrating certain qualitative attributes pertinent to the nature of their business activities and growth prospects; • Price-discovery process and method of distribution of securities. The MESDAQ IPO Guidelines encourages offerings via book-building, while introducing enhanced requirements for offerings made via placements; • Corporate governance, commitment and accountability of directors and promoters. The MESDAQ IPO Guidelines aims to enhance the reliability of financial forecasts and business plans submitted for the Commission’s consideration by requiring reporting accountants to review the profit and cash flow forecasts submitted to the Commission. Applicants are also required to submit follow-up questionnaires, which report on the progress of implementation of the business development plan over the entire business plan period and the achievement of financial forecasts; and • Enhanced role of advisers as quality controllers. Principal advisers are now required to act as lead underwriter and placement agent, and provide an Approach Since the MESDAQ Market is intended as a fundraising platform that caters to young and dynamic companies with high growth potential but typically lacking an established profit track record, the MESDAQ IPO Guidelines focuses on qualitative factors, such as robust business model and plans, growth prospects, management strength and integrity, corporate governance and risk management which can indicate long-term business viability as well as quality and sustainability of earnings. Adopting this approach, the Commission views proposals beyond mere compliance with quantitative requirements, as these cannot ensure a company’s suitability for listing and its investibility over the long term. Advisers are expected to justify to and convince the Commission on the suitability of the issuers for listing, supported where necessary by expert reports/ opinions. Rationale for Its Introduction The MESDAQ IPO Guidelines makes available clear, transparent and predictable criteria that will be applied DEVELOPMENTAL REVIEW 2-11 SECURITIES COMMISSION ANNUAL REPORT 2005 opinion on the adequacy of the applicant’s procedures, systems and controls, as well as the competency of the applicant’s management. With greater transparency in the requirements provided by the MESDAQ IPO Guidelines, applications for IPOs and listings are envisaged to be more comprehensive and complete, and should translate into a shorter review and approval process. The advent of the MESDAQ IPO Guidelines is also expected to usher in better quality companies for listing on the MESDAQ Market. The MESDAQ IPO Guidelines also emphasises the roles expected of the various stakeholders in a corporate exercise. In addition to delivering the promises made in the listing application and business plans, directors and promoters of the issuer are expected to understand and perform their fiduciary duties and responsibilities in managing the issuer as a PLC, complying with laws, regulations and rules applicable to the issuer’s business and listing, and safeguarding the rights and interests of shareholders, including the minority shareholders. In this regard, advisers as sponsors, are also expected to play a greater role in nurturing the issuer and ensuring that the directors 2-12 DEVELOPMENTAL REVIEW and promoters understand their duties and accountabilities during the sponsorship period before and after listing. Moving Forward The Commission is currently in the process of developing guidelines governing post-listing transactions and fund-raising proposals. The publication of the second instalment of guidelines for the MESDAQ Market will provide a complete set of comprehensive requirements for MESDAQ Market aspirants and listed companies to raise funds from the capital market and embark on a myriad of corporate proposals. The MESDAQ Market is intended to be an exchange for smaller high growth companies and hence, its regulatory regime should be relatively more flexible and facilitative than that for the main market. As a public exchange, it is accessible to all types of investors, retail and institutional alike. Thus, a delicate balance must be struck between ensuring a facilitative regulatory regime that is sufficiently attractive for targeted companies, and yet ensuring that investors are adequately protected.