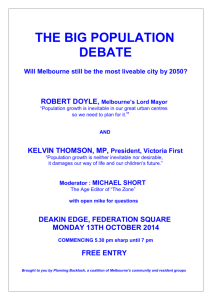

Property Update

advertisement

Property Update APRIL 2014 www.m3property.com.au AUTOMOTIVE MANUFACTURING AND PROPERTY The decision by Holden, Ford and Toyota to stop manufacturing in Australian has generated a range of property market opportunities. It is estimated that over 260 Ha of land will be directly affected by the car makers’ decision. The majority of this land is located in Victoria with sites including those currently occupied by Toyota (Port Melbourne and Altona North), Holden (Port Melbourne) and Ford (Campbellfield and Norlane in Geelong). There will be an additional impact on the properties currently occupied by car suppliers and other firms in the automotive manufacturing value chain. While the exit of the three large manufacturers will present several challenges – not least to workers and policy makers in the short and medium term – the infill locations and collective size of the land parcels present a rare opportunity for developers and investors. This update considers some of the associated property opportunity and economic development issues. Economy Wide Impacts The exit of the car manufacturers has re-ignited debate about national economic policy and the decline in Australia’s manufacturing industry. In the long run these issues will affect all industries including the property sector. In addition to South Australia the automotive manufacturing industry is especially important to Victoria. Victoria accounts for around 60% of the nation’s automotive turnover and 54% of all automotive manufacturing employees. Around 70% of automotive producers’ purchases of Australian made components are manufactured in Victoria. It is expected that around 5,000 Victorian workers will be directly affected by the plant closures. Half of these workers will be affected by the closure of Toyota’s Altona plant while the other half will be impacted by the combined closures of the Ford and Holden manufacturing plants. The overall impact will be largely determined by the broader economy’s long-run response to this economic event. A range of views have been expressed in this regard. On the one hand it is argued that Australian manufacturing, more broadly, has undergone significant structural change and change will continue. This process of structural change will lead to Australia having a smaller manufacturing sector but higher overall economic welfare given inputs (e.g. capital and labour) will flow to more productive and efficient uses. In contrast, it is suggested manufacturing is unique and provides a range of strategic and public benefits (such as an above average level of knowledge and innovation) and that Australian manufacturers face unfair competitive practices (from foreign firms and governments) and domestic competitive disadvantages (such as a high Australian dollar). Victoria’s Automotive Manufacturing Urban Geography The decision to cease domestic automotive manufacturing operations will have far-reaching implications for Melbourne’s economic geography and various property markets. www.m3property.com.au Property Update April 2014 | P1 In the short to medium term the loss in employment could affect property demand in some regions. In particular, the Ford (Broadmeadows and Geelong), Holden (Port Melbourne) and Toyota (Altona) plants are generally located in Melbourne’s north and 2013 west where the bulk of their workers also live. JUNE www.m3property.com.au In its recent Position Paper (Australia’s Automotive Manufacturing Industry - January 2014) the Productivity Commission noted that the highest concentrations of Australia’s automotive manufacturing employees were concentrated in only four regions, three regions being in Melbourne (Adelaide-North, Melbourne-West, Melbourne-South East and Melbourne-North West). Table 1 - Automotive Manufacturing Employment, selected regions, 2011. Based on usual place of residence Regions & sub-regions Number of residents employed in automotive manufacturing Share of Australian automotive manufacturing employment (%) Share of employed residents that are employed in automotive manufacturing (%) Adelaide Adelaide - North Playford Salisbury Gawler - Two Wells Adelaide - South Onkaparinga Selected regions (Adel.) total 3,408 1,043 1,284 301 1,564 1,036 4,968 Melbourne - South East Dandenong Casey - North Casey - South Cardinia Melbourne - West Brimbank Wyndham Melton - Bacchus Marsh Hobsons Bay Maribyrnong Melbourne - Outer East Yarra Ranges Melbourne - North East Whittlesea - Wallan Melbourne - North West Tullamarine - Broadmeadows Melbourne - Inner Melbourne - Inner South Mornington Peninsula Frankston Selected regions (Melb) total 5,329 1,638 1,392 1,067 516 5,114 1,769 1,390 930 585 440 2,702 887 2,527 1,483 2,209 1,302 1,372 1,258 1,176 831 21,689 Geelong (region) Geelong (sub-region) Barwon - West 1,694 1,355 119 Ballarat (region) Ballarat (sub-region) 964 748 7 2.1 2.6 0.6 3.2 2.1 10.1 1.9 3.4 2.3 2 1 1.4 10.9 3.3 2.8 2.2 1.1 10.4 3.6 2.8 1.9 1.2 0.9 5.5 1.8 5.2 3 4.5 2.7 2.8 2.6 2.4 1.7 44.3 1.8 2.3 2.3 1.8 1.4 1.8 2.4 1.8 1.6 1.6 1.3 1.1 1.2 1.2 1.9 1.6 2.5 0.5 0.7 0.9 1.4 3.5 2.8 0.2 1.5 1.7 1.5 2 1.5 1.5 1.7 Melbourne Geelong Ballarat Source: Productivity Commission estimates using ABS (TableBuilder Pro, 2011, Cat. no. 2073.0), m3property Research. www.m3property.com.au Property Update April 2014 | P2 Plant closures will predominantly affect blue-collar workers. However, white-collar workers will also be affected given the range of supporting activities in Australia (e.g. corporate, R&D, marketing and sales). JUNE 2013 www.m3property.com.au The flow on impacts to the automotive value chain are expected to be significant given the reliance on the major automotive manufacturers of several automotive component manufacturers and other firms. These firms are distributed throughout Melbourne. The greatest concentrations of these firms is in Melbourne’s South East. The region is a nationally significant automotive manufacturing location. The South East also has nearly 11% of Australia’s automotive manufacturing employment. This is the largest share in Australia, despite the region no longer having a major automotive manufacturing plant. As shown by the following table two municipalities in the South East (Greater Dandenong and Kingston) accounted for nearly a quarter of total Melbourne’s motor vehicle and parts business establishments in 2011-12. Table 2 - Metropolitan Melbourne, top ten locations for motor vehicle and motor vehicle parts manufacturing business establishments LGA Business establishments, 2011-12 Net change, 2001-02 to 2011-12 Number Share of total Number Per cent Hume 115 22% 48 72% Greater Dandenong 81 16% 0 0% Kingston 39 8% -2 -5% Knox 35 7% -6 -15% Whittlesea 23 4% -4 -15% Frankston 23 4% 1 5% Brimbank 22 4% 2 10% Monash 19 4% 7 58% Casey 18 3% 0 0% Wyndham 14 3% 7 100% Subtotal 389 76% 53 16% Remainder 126 24% -32 -20% Total 515 100% 21 4% Source: Worksafe Victoria (unpublished data), Victorian Government, m3property Research. Property Impacts Before considering specific property market issues and opportunities (such as the redevelopment potential of various sites) it is important to understand the broader impacts on regional and metropolitan property markets. These impacts will be influenced by a range of factors including if, when and how quickly workers find new employment, the effectiveness of government structural adjustment packages, whether other sectors can absorb workers (e.g. defence manufacturing) and growth in the economy more broadly. While the short term impact on broader property markets is likely to be negative (e.g. higher industrial vacancy rates translating into limited rental growth and rising incentives) it is useful to consider some key factors which will shape the overall long-run impact in a positive way. www.m3property.com.au Property Update April 2014 | P3 These include: 2013change is not new – While the end of Australia’s large scale automotive manufacturing www.m3property.com.au • JUNE Structural capability is unique structural change in manufacturing is not. Structural change has led to many firms becoming more efficient and globally competitive; • Some high-skilled employment will remain with the potential for future growth – For example, Ford and Holden are expected to maintain a design capability in Australia. This is important as, while the global automotive industry shifts production to regions of high demand growth and low labour costs, global car production volumes are growing. This implies an increase in demand for a range of high-skilled workers (e.g. design, R&D etc); • Exporting and diversification – While some component firms could shut down (or reduce their operations) others might respond by exporting and diversifying into new product and international markets; and • Opportunities in related sectors – Some workers will be absorbed into related sectors such as the aftermarket parts manufacturing and the truck/bus manufacturing sectors. Nationally, it is estimated that over 230,000 workers are employed in the repair, maintenance and retailing of motor vehicles and this sector is largely independent of domestic automotive manufacturing. Finally, the property industry will play an important role in the economy’s adjustment through the redevelopment and conversion of sites to a range of uses. These include economic/employment and residential/mixed uses. In addition, it is likely that Ford, Holden and Toyota firms will reconsider their property requirements which may involve a move of head offices and other facilities. By creating the spaces and conditions for industries to grow and expand the property industry has to date played an important role in facilitating the process of structural change. For example, transport, logistics and distribution has become an increasingly important sector, as manufacturing has declined, helping to absorb a growing number of workers. This is illustrated by trends in warehouse approvals, which have remained relatively robust over the last decade, while that of factories has declined. Looking forward it is expected that, as automotive firms move to an import-driven business model, the importance of the transport, logistics and distribution (and therefore demand for storage space and pre-delivery services) will also grow. Victorian Annual Building Approvals - Warehouses & Factories, (Building Jobs Valued $50,000+) 1,000 No. 800 600 400 Factories 200 Warehouses 0 Source: ABS and m3property Research. Factories include other secondary production buildings. Although difficult to generalise, changing patterns in Melbourne’s economic geography in recent decades suggests those manufacturing sites which are relatively close to the CBD or key activity centres (e.g. the Port Melbourne Holden and Toyota sites) could be partly or completely redeveloped into higher value-added employment uses (e.g. with a commercial and high-technology focus). www.m3property.com.au Property Update April 2014 | P4 This would also reflect changes in the Central City’s employment and industrial base towards higher value-added activities and uses while capitalising on these sites’ various advantages. These advantages include an inner city location, proximity to the Port of Melbourne and the redevelopment of the Fishermans Bend precinct. www.m3property.com.au There is a unique opportunity for developers, policy makers and other stakeholders to think creatively about what current and emerging industries could be located on these sites (including those displaced due to the redevelopment of Fishermans Bend) while also ensuring other important policy goals are met. Other sites which are currently used for manufacturing, especially those which are in close proximity to strategic transport infrastructure (and/or in locations facing strong demand from industrial occupiers) could find new uses as modern employment and mixed use formats (e.g. business and industrial parks). Toyota’s Altona North site and Ford’s sites in Campbellfield and Geelong are potential candidates in this regard. Although the level of current and future industrial land supplies may present some challenges to less centrally located sites these locations have other advantages. In particular Ford’s Campbellfield site adjoins the Upfield rail line and offers highvisibility (given the Hume Highway frontage). Ford’s Geelong site faces robust competition from the industrial land markets in both Geelong and Melbourne. However, again, there is an opportunity for stakeholders to think creatively about how the site could capitalise on its advantages and current and future conditions. For example, the Geelong site has good infrastructure access (e.g. to the Geelong Port and major road/rail connections to Melbourne and Victoria’s western regions) and could facilitate growth in a range of important industries in Geelong (e.g. construction, health, education, retail, advanced manufacturing and transport, logistics and distribution). The previous redevelopment of other automotive manufacturing sites provides a good first step in assessing what might be possible. One example of a former automotive manufacturing site undergoing transformation and redevelopment is the Estate One business park. The business park is located on the corner of the Princes Highway and South Gippsland Freeway in Dandenong and was formerly the GMH Dandenong car plant. The site is being developed by Cbus Property and has access to strategic transport infrastructure including arterial road links and transport nodes. Upon completion Estate One is expected to function as a major employment hub providing space for commercial, retail, industrial and other uses. Another example is Nissan’s Clayton site which hosted the company’s manufacturing operations until the early 1990s. The site now includes a business park and both older and more modern spaces (e.g. warehouses and offices). Finally, although the question of what to do with the large automotive manufacturing sites is challenging – and will receive considerable attention – so too is the issue of what to do with the many smaller sites that might become candidates for conversion and redevelopment. The task will be made more challenging by these sites’ dispersion (although mainly in the South East) and will face a range of complex site-specific issues (e.g. environmental). If you would like to discuss opportunities arising from the Property Update please do not hesitate to contact your existing m3property contact or George Bougias (+613 9605 1075 or george.bougias@m3property.com.au). www.m3property.com.au Property Update April 2014 | P5