Financial Policy and Regulation: APEC Region Initiatives

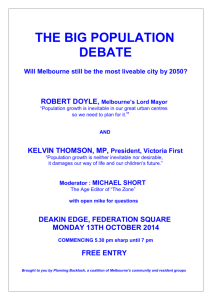

advertisement

Financial Policy and Regulation: APEC Region Initiatives Kevin Davis Professor of Finance, University of Melbourne Research Director, Australian Centre for Financial Studies (and Professor, Monash University) University of Melbourne 1 Financial Sector Functions Traditional view: a “handmaiden of industry” But financial sector development is an important determinant of economic growth But not an end in itself! (and there are risks) interrelationships between globalization and financial sector development Want good performance of key economic functions • • • • • • Clearing and settlement of payments Pooling financial resources for investment Transferring financial resources – time & space Managing risk (diversification, insurance) Information provision for efficient financing (financial prices) Resolving incentive problems (monitoring etc) University of Melbourne 2 Assessing Financial Sector Performance • Objectives: low cost of capital; efficient allocation of capital; financial inclusion; efficient risk-bearing; optimal savings behaviour; financial & economic stability • Measuring achievements – Financial sector size, composition, competition – International ratings, expert assessment – Statistical indicators (spreads, transactions costs, participation, cost of capital) University of Melbourne 3 Markets v Government Initiatives • Market forces tend to lead to innovations to fill gaps – but impediments may exist – Property rights; barriers to entry; taxes; inadequate information; regulation; corruption • But current position arising from historical evolution may now be sub-optimal and market unable to “leap” to new optimal position – Example: bank intermediation v bond market – latter requires liquidity which requires market depth University of Melbourne 4 A range of initiatives • • • • • • • • • • • Asian funds passport Mutual recognition (re securities issuance) Stock exchange integration (cross listings etc) Ratings agencies Credit bureaus Bond market development Trade in financial services Investor protection Creditor rights Corporate insolvency Retirement Incomes Policy University of Melbourne 5 • • • • • • • • • • • • • Deposit insurance Prudential regulation and supervision Resolution arrangements OTC markets Clearing & settlement systems Financial inclusion Remittances Financial literacy Microfinance SME financing Infrastructure financing Public sector financing and treasury management Central bank FX swap agreements University of Melbourne 6