do liquidated damages encourage efficient breach?

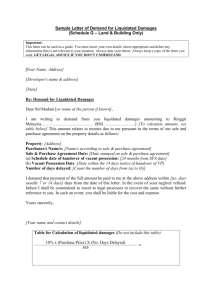

advertisement