18 March 2013

Vol. 12, No. 3

•

Published by

www.pharmamarketingnews.com

Pharma Marketing

Network®

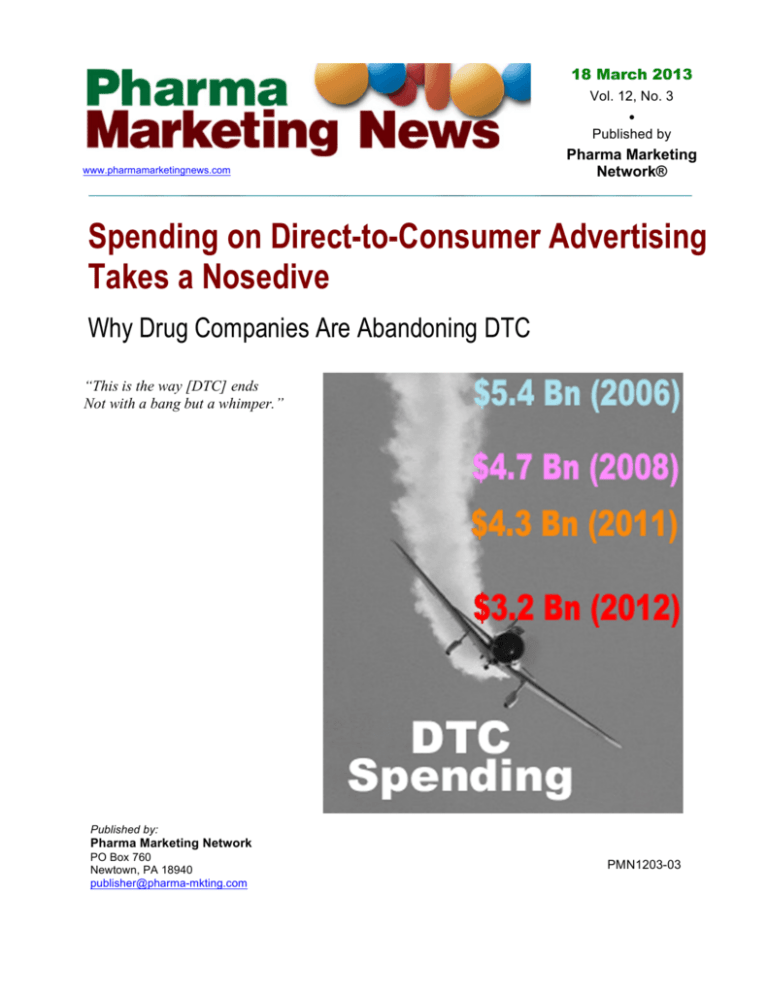

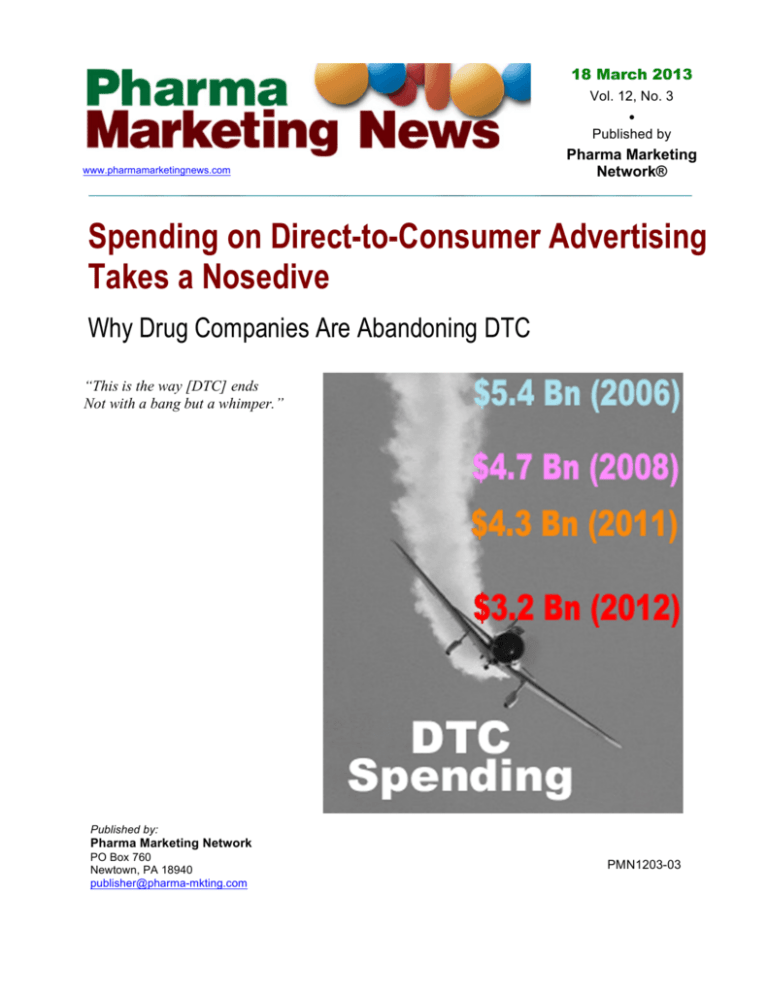

Spending on Direct-to-Consumer Advertising

Takes a Nosedive

Why Drug Companies Are Abandoning DTC

“This is the way [DTC] ends

Not with a bang but a whimper.”

Published by:

Pharma Marketing Network

PO Box 760

Newtown, PA 18940

publisher@pharma-mkting.com

PMN1203-03

Pharma Marketing News

Vol. 12, No. 3: March 18, 2013

D

irect-to-Consumer (DTC) advertising took a

nosedive in 2012. According to data from

cegedim Strategic Data (CSD), DTC spending

decreased by 22% in 2012 compared to 2011(see

Figure 1, below).

The Downward Spending Spiral

The last time DTC spending decreased by doubledigital percentage points was in the recession of 2008,

which saw a 10% drop in DTC spending compared to

2007. The decline in DTC spending has been more or

less steady since the 2006 when the industry spent

more than $5.4 billion (see Figure 2, page 3).

Industry pundits with skin in the game such as Bob

Ehrlich of DTC Perspectives magazine, see the DTC

glass half full instead of half empty. Actually, the glass

is 40% empty/60% full; i.e., the 2012 spend was about

60% of the 2006 spend.

“While no one, particularly media outlets, thinks of 20%

declines as good news, we must keep the latest decline

in context,” said Ehrlich in an editorial. “New brands and

new categories will use DTC. Most will get a payback of

$1.5-2.5 dollars to each one invested. Some will fail

badly. Some of those should have not done DTC because it does not work well for all brands or categories.”

p. 2

Execs Think It’s Time to Trim DTC

Some pharmaceutical executives—including current

CEOs and former VPs—present a different view of

DTC. Joseph Jimenez, the CEO of Novartis, for

example, lamented the fact that spending on marketing

was taking away money better spent on research and

development of news drugs.

In a video interview with the Wall Street Journal

Jimenez said "The industry needs to spend more

money on R&D and less on sales and marketing. In the

past two decades, a lot of the value creation came from

sales and marketing muscles for new drugs. And now

there is probably less investment by some companies

to ensure that there is going to be a continuous flow of

innovation" (see "Spend Less Money on Sales &

Marketing, Says Novartis Chief Joseph Jimenez”;

http://bit.ly/XI2Zs5).

John LaMattina, former Pfizer president of Research

and Development, said in his new book “Devalued and

Distrusted” that drug TV ads "may be doing more harm

than good. The litany of side-effects that must be discussed is numbing and probably doesn’t provide a

sense of the true risk-benefit for that medication” (see

Continues…

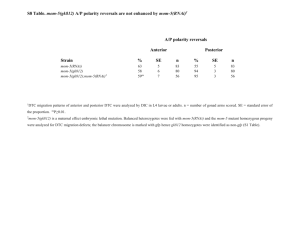

Figure 1. Annual Changes in

Channel Spending. Source:

cegedim Strategic Data (CSD);

http://bit.ly/ZVuyDc The

numbers below channel names

are 2012 spend (in $Millions).

Note: CSD did not have data for

the change in print advertising

spending for 2011-2012. The 50% bar shown here was

estimated so that the total

spending in 2012 equaled the

$27,354.7 million cited by CSD.

© 2013 Pharma Marketing Network (www.pharma-mkting.com). All rights reserved.

Pharma Marketing News

PMN1203-03

Pharma Marketing News

Vol. 12, No. 3: March 18, 2013

“Bad, Devalued, Distrusted & Defensive Pharma: A

Tale of Two Books”; http://bit.ly/ZeDXVd). LaMattina,

however, doesn’t believe such ads take money away

from R&D, although he thinks the public believes so:

“Plus, the public views these ads to be a waste of funds

that could otherwise be invested in R&D or in lessening

drug costs." The public may also think the ads are

causing people to self-diagnose (see “An Anti-DTC

Crossword Puzzle”; page 4).

What Are the Causes?

Not so long ago, the drug industry was up against a

public and legislative onslaught that threatened to ban

DTC altogether (see “To Ban or Not to Ban DTC, That

is the Question”; http://bit.ly/10RUAX2). But it now

appears that DTC will not end with a bang, but with a

whimper.

What is causing the whimpering end of DTC?

As many experts have pointed out, there are several

likely causes, including the recession of 2007-2008,

shrinking pipeline (fewer new drugs means fewer ads),

and the rise of generics (which generally are not

advertised).

p. 3

One cause not often mentioned is a shift in developing

drugs for small populations of patients (so-called “orphan” drugs) and complex biologics, which may also be

targeted to small populations. It’s not economical to

reach potential patients for these products using expensive broadcast advertising.

Could the rise of orphan drugs and biologics be a factor

in the most recent 22-26% drop in DTC spending (2012

compared to 2011)?

Pfizer’s Xalkori (crizotinib), for example, is approved for

a rare form of lung cancer. Pfizer plans to charge

$115,200 a year per patient for this drug (see “Big

Pharma's Future: Niche Mega Blockbusters”;

http://bit.ly/YwmNPI). At that rate, Pfizer needs only

about 9,000 patients worldwide to generate $1 billion in

annual sales of Xalkori. In comparison, 1,671,000

Lipitor patients are required to generate the same level

of sales.

Continues…

Figure 2. DTC Measured Media Ad

Spend. Source: Nielson. The three 2012

bars are estimates calculated as follows:

the BLUE estimate ($4.16 Bn) is based on

the loss of Lipitor advertising (see “Lipitor

Holds Key to DTC Ad Spending in 2012”;

http://bit.ly/TWJAJ2). This is obviously

too optimistic—it only takes into account

the loss of Lipitor brand advertising,

everything else remaining the same. The

PINK estimate ($3.35 Bn) is based on

CSD's estimate of a 22% decrease in

spending in 2012 compared to 2011 ($4.30

Bn). The ORANGE estimate is based on

Nielsen data comparing Q2 spending in

2012 vs 2011 ($0.896 Bn vs 1.137 Bn,

respectively). You can find that data here:

http://bit.ly/1411k9F. That's a 21%

decrease. To calculate a total for 2012, the

following assumption was used: The ratio

of Q2 spending in 2012 to the 2012 total is

equal to the ratio of Q2 spending in 2011

to the 2011 total. The equation is: (Q22012/x) = (Q2-2011/Total-2011). Based on

the available data, x = $3.15 Bn, which is

about 27% less than the total DTC spending for 2011. That's quite a nosedive!

© 2013 Pharma Marketing Network (www.pharma-mkting.com). All rights reserved.

Pharma Marketing News

PMN1203-03

Pharma Marketing News

Vol. 12, No. 3: March 18, 2013

Rise of Biologics

Recently, the sales of biologics have taken off. Biologics are complex, difficult to produce, and cost

thousands of dollars per treatment. On top of that, they

are often targeted to a small group of patients genetically predisposed to benefit the most. All this means

that DTC advertising may not be a cost-effective means

of increasing scripts for these products.

Forbes published a list of "Best Selling Drugs of All

Time," the peak sales of which are plotted in Figure 3

below. This chart highlights the many biologics that are

part of the list. Most of these biologics have not yet

reached the all-time sales records of DTC-advertised

pills. Given time, however, we are likely to see an even

higher proportion of biologics on this list.

p. 4

Avastin, exceeding $100,000 per year. Given that use

of new biologics is concentrated among a smaller number of patients with relatively rare conditions treated

primarily by specialists, we would expect promotion to

providers and consumers to also be highly targeted."

A Change in Paradigm

Pfizer is confident it can find patients for Xalkori through

diagnostic tests that pinpoint patients most likely to

benefit. "There's been a change of paradigm," said a

Pfizer researcher. "The new school of thought is, 'If you

find the patients that the drug will work in, and if you

see enough benefit, we will find a way to get this to

market.”

Continues…

An Anti-DTC Crossword Puzzle

Anti-DTC sentiment has worked its way into

popular culture. Even crossword puzzles these

days reference DTC ads and NOT in a good way.

The following puzzle published in Newsday is an

example.

Below is the partial solution to the puzzle titled

"HEAL THYSELF?" published in Newsday on

February 15, 2012 (accessed via iPad). The

theme message of the puzzle is a three-part quip

answer to the title. The solution fits in the

highlighted empty squares. Can you solve it?

Figure 3. Peak Year Sales of Top Drugs. Source: Forbes;

http://onforb.es/159Ht3V

Table 1, page 5, shows the top US-selling biologics (in

2010) along with product-specific expenditures and

promotional spending toward consumers and providers.

Although these are 2010 data, we can see that relatively little was spent on DTC advertising for these 25

top selling biologics—a total of $189.5 million compared to $4,371 million for total 2010 DTC spending,

according to data from this source.

"Declining promotion may also reflect the increasing

biologics share of the market," suggest the authors of

the PLOS study cited in Table 1. "Declines in DTCA

may accelerate as biologics make up a greater share of

new therapies. Biologics often have unique routes of

delivery and storage and can be very costly compared

to small molecules, with costs for one cancer drug,

Find the answer here: http://bit.ly/10YhKim

© 2013 Pharma Marketing Network (www.pharma-mkting.com). All rights reserved.

Pharma Marketing News

PMN1203-03

Pharma Marketing News

Vol. 12, No. 3: March 18, 2013

The new drug development "paradigm" requires a new

marketing paradigm as well. That marketing paradigm

will focus almost exclusively on medical specialists such

as oncologists. Under this paradigm it will be difficult to

justify broadcast DTC advertising (e.g., TV) because it

will cost too much to reach the small group of potential

patients with such a broad brush.

Targeted Advertising

Pharma marketers are likely to use broadcast DTC only

when the target audience is greater than 10% of the

adult population. For smaller markets targeted advertising works best. What's the best medium for "targeted"

advertising? Well, it’s not TV or even print (magazines).

It’s the Internet, stupid!

p. 5

However, as the PLOS study authors note, "Although

relative increases in DTCA through media such as the

Internet and social networking have occurred, these

expenditures remain a small fraction of overall consumer-targeted promotion." According to the authors'

data, Internet DTC spending in 2010 (not including

search advertising) represented only 4.6% of the total

DTC spend for that year.

What about 2011 and 2012? Has the percent of Internet

spending versus total DTC spending increased significantly? Data from 2011 suggests this percent was

4.7%; i.e., no increase (see Figure 4, page 6). Low

pharma online spending in 2012 was also mentioned

Continues…

Table 1. Promotional Spending on Biologics. Source: "Promotion of Prescription Drugs to Consumers and Providers, 2001–2010";

http://bit.ly/13XTD3T

© 2013 Pharma Marketing Network (www.pharma-mkting.com). All rights reserved.

Pharma Marketing News

PMN1203-03

Pharma Marketing News

Vol. 12, No. 3: March 18, 2013

as a factor in the downsizing of WebMD (see “Decline

in Online Drug Advertising Leads to 14% Downsizing at

WebMD,” below).

It seems that pharma marketers either don't have to do

much DTC marketing of any sort to sell orphan drugs or

biologics or they haven't figured out how to use the

Internet to do targeted marketing of these products to

consumers.

Meanwhile, Ehrlich believes DTC is merely experiencing a “lull.” “I have never been more encouraged by

the DTC opportunity,” said Ehrlich, who predicts DTC

spending can once again reach $5 billion, even $10

billion annually.

p. 6

Between the desire

And the spasm

Between the potency

And the existence

Between the essence

And the descent

Falls the Shadow

This is the way the world ends

This is the way the world ends

This is the way the world ends

Not with a bang but a whimper.

Pharma Marketing News

Decline in Online Drug Advertising Leads to

14% Downsizing at WebMD

(Originally published on Pharma Marketing Blog;

http://bit.ly/ZFBJMn)

There may be no better bellwether for the state of online

pharma advertising than the health of WebMD, a leading

website that depends on health industry—mostly pharma—

advertising.

In a December 11, 2012, press release, WebMD announced "a

comprehensive program to streamline its operations, reduce

costs and better focus its resources on increasing user

engagement, improving customer satisfaction and driving

innovation." By "streamline," WebMD means laying off 250

employees, about 14% of the company's workforce.

According to Tech Crunch:

"During its most recent quarterly results, the company saw

revenue decline from $135 million during the year ago

period to $117 million, with sponsorship and advertising

income especially taking a downward turn. WebMD

reported a net loss of $900K on the quarter, compared to

positive income of $14.2 million during the same quarter

last year. Still, its site traffic continues to grow, according

to its quarterly financials, with 22 and 24 percent increases

for unique visitors per month and page views between Q3

2011 and Q3 2012. So what’s behind the losses and the

resulting need for budget cuts? Despite a growing

audience, it seems like advertisers are either less

interested or less able to create campaigns on WebMD."

Figure 4. Allocation of DTC Spending Dollars

(2011). Source: http://bit.ly/DTCspend

Back in January, 2012, the Wall Street Journal reported that

WebMD's Chief Executive Wayne T. Gattinella resigned, and the

health-website operator "called off a search for a buyer as it

braces for weaker financial results this year. A key issue, the

company said, is pharmaceutical companies holding back on

spending as they deal with expiring drug patents."

© 2013 Pharma Marketing Network (www.pharma-mkting.com). All rights reserved.

Pharma Marketing News

PMN1203-03