financial - Factcheck.ge

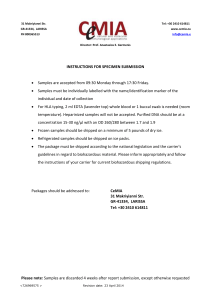

advertisement