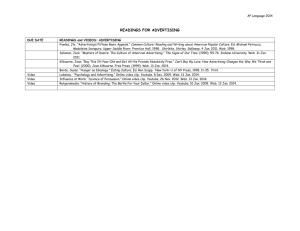

The Shift to Digital Advertising: Industry Trends and Policy Issues for

advertisement