Bus 320 (Corporate Finance) Spring 2013 Tue/Thur 11:30

advertisement

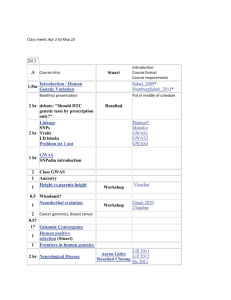

Bus 320 (Corporate Finance) Tue/Thur 11:30-12:45 (Room 208) Tue/Thur 1:00-2:15 (Room 208) Tue/Thur 2:30-3:45 (Room 208) Spring 2013 Professor T. Clifton Green GBS Room 503 Phone: 404-727-5167 Email: clifton.green@emory.edu Overview of the Course This course provides an introduction to finance. It addresses the theory and practice of financial management the generation and allocation of financial resources. It has three major objectives: 1. To provide you with a foundation in the basic concepts of finance, including the time value of money, the role of financial markets, asset valuation, portfolio theory, asset pricing, and the risk-return tradeoff. 2. To develop your skills in financial analysis, planning, and decision-making. 3. To expand your awareness of institutions and practices in business and finance. Readings The required readings for this course are: 1. Fundamentals of Corporate Finance, Ross, Westerfield, Jordan, 10th (Standard) Edition, Irwin/ McGraw-Hill Publishing. ISBN: 0078034639 2. Articles and notes handed out in class. The following items are optional but highly recommended. 1. A subscription to the Wall Street Journal. Regular reading of the WSJ will increase your understanding of financial markets and the business world in general. WSJ articles will often form the basis of class discussions. You can obtain a student discount and subscribe at: www.WSJ.com/studentoffer 2. A financial calculator. Most finance electives will require you to have one. Several good calculators by Hewlett-Packard and Texas Instruments are available. If you choose to get a financial calculator, you are responsible for learning how to use it. Office Hours Wednesday 2:00 - 4:00 You don’t need an appointment during office hours. If this time conflicts with your schedule, send me an email and suggest a couple of potential meeting times. You should have a 320 conference on your First Class email account. I post important messages, including lecture slides, to this conference. You can email questions to me or to the conference. Grading Students will be evaluated based on the following scheme: Quiz 1 Quiz 2 Quiz 3 Company Analysis Final Exam 20% 20% 20% 10% 30% The final exam will be comprehensive. There will be no makeup tests. If you miss a quiz and have a university accepted excuse (you must discuss your situation with the Assistant Dean of the BBA Program), the weight of that quiz will be added on to the cumulative final. Company Analysis Each student will be assigned a company (from a pre-screened list) and perform a number of different analyses over the course of the semester. The objective is to provide practical applications for the concepts we cover in class, give exposure to spreadsheet software, and provide an opportunity to learn about a company (which may be helpful with interviews, etc.). TA Problem Sessions There will be finance labs each week (except for Spring Break): Fridays Sundays 2-4 pm 4-6pm Room 334 Room 334 (except Feb 22nd in room 204) The TAs are BBAs that took the class last year and performed well. They will work problems and answer questions during the problem sessions. Attendance Policy I do not enforce an attendance policy. However, you are responsible for all material assigned and/or covered in class. The course involves subtle arguments and some fairly complicated problems. Thus, it is difficult to do well in the class without attending the lectures and problem sessions. Class Behavior Remember to silence your cell phones! And please no smelly or noisy food. The Daily Schedule The schedule below is intended as a guide. It may be modified depending on the speed and comfort level of the class. Session 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Date 1/15 1/17 1/22 1/24 1/28 1/29 1/31 2/5 2/7 2/11 2/12 2/14 2/18 2/19 2/21 2/26 2/28 3/4 3/5 3/7 3/12 3/14 3/19 3/21 3/25 3/26 3/28 4/2 4/4 4/9 4/11 4/16 4/18 4/27 4/23 4/25 Day Tu Thur Tu Thur Mon Tu Thur Tu Thur Mon Tu Thur Mon Tu Thur Tu Thur Mon Tu Thur Tu Thur Tu Thur Mon Tu Thur Tu Thur Tu Thur Tu Thur Mon Tu Thur Topic Introduction to Finance Financial Statements Ratio Analysis and applications Pro Forma Statements Company Analysis: Company Information Due Pro Forma Statements Pro Forma Statements Quiz 1 Time Value of Money Company Analysis: Ratio Analysis Due Time Value of Money Time Value of Money Company Analysis: Pro Forma Due Time Value of Money Security Valuation: Bonds Quiz 2 Security Valuation: Stocks Company Analysis: Dividend Discount Model Due Security Valuation: Stocks Portfolio Theory & Applications Spring Break Spring Break Portfolio Theory & Applications Portfolio Theory & Applications Company Analysis: Beta and CAPM Due Market Efficiency & History Market Efficiency & History Quiz 3 Capital Budgeting Capital Budgeting Capital Budgeting Cost of Capital Cost of Capital Company Analysis: WACC and Valuation Due Leverage and Capital Structure Leverage and Capital Structure Book Chap 1 Chap 2 Chap 3 Chap 4 Chap 5 Chap 6 Chap 7 Chap 8 Chap 13 Chap 12 Chap 9 Chap 10 Chap 11 Chap 14 Chap 16