Liquidity Ratio Analysis

advertisement

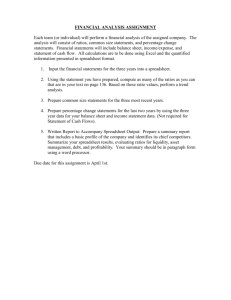

This column covers fundamental analysis, which involves examining a company’s financial statements and evaluating its operations. The analysis concentrates only on variables directly related to the company itself, rather than the stock’s price movement or the overall state of the market. Liquidity Ratio Analysis Liquidity ratios are used to determine a company’s ability to meet its short-term debt obligations. Investors often take a close look at liquidity ratios when performing fundamental analysis on a firm. Since a company that is consistently having trouble meeting its short-term debt is at a higher risk of bankruptcy, liquidity ratios are a good measure of whether a company will be able to comfortably continue as a going concern. Any type of ratio analysis should be looked at within the correct context. For instance, investors should always look at a company’s ratios against those of its competitors, its sector and its industry and over a period of several years. In this issue’s Fundamental Focus, we investigate liquidity ratios using time-series analysis, competitive analysis and sector and industry analysis. As an example of how to properly examine liquidity ratios, we will use the financial statement data for J. Alexander’s Corp. (JAX) found in AAII’s fundamental research database, Stock Investor Pro. While you can access financial statements directly on company websites, J. Alexander’s only offers two years of balance sheets at its site. For our purpose of examining trends in liquidity ratios, we need several years of financial statements in order to gather all the data. And since Stock Investor Pro contains yearly balance sheet figures going back seven years, our task is made much easier if we use the data offered there rather than downloading several years of reports from another source. You may also find financial statement data at websites such as Yahoo! Finance and SmartMoney.com. Table 1 provides all the revelvant data for calculating these ratios. tor, the quick ratio uses a figure that focuses on the most liquid assets. The main asset left out is inventory, which can be hard to liquidate at market value in a timely fashion. The quick ratio is more conservative than the current ratio and focuses on cash, short-term investments and accounts receivable. The formula is as follows: Current Ratio Quick Ratio = (Cash & Equivalents + ShortTerm Investments + Accounts Receivable) ÷ Current Liabilities The current ratio is the first of three financial ratios that we will examine. The formula for the current ratio is as follows: Current Ratio = Current Assets ÷ Current Liabilities As stated earlier, liquidity ratios measure a company’s ability to pay off its short-term debt using assets that can be easily liquidated. In this case, the current ratio measures a company’s current assets against its current liabilities. Generally, higher numbers are better, implying that the firm has a higher amount of current assets when compared to current liabilities and should easily be able to pay off its short-term debt. As shown in Table 1, the company’s 2010 current assets are $13,900,000 and its 2010 current liabilities are $13,100,000. Plugging these numbers into our formula gives us a current ratio of 1.061 (rounded to 1.1). Quick Ratio The quick ratio, also known as the acid-test ratio, is a liquidity ratio that is more refined and more stringent than the current ratio. Instead of using current assets in the numera- Once again, taking a look at the 2010 financial statements for J. Alexander’s, we find that cash and equivalents are $8,600,000, accounts receivable are $2,700,000 and shortterm investments are $0. Current liabilities are $13,100,000 for the year. Plugging these figures into our formula gives us a quick ratio of 0.863, rounded to 0.9, for fiscal-2010. Cash Ratio The cash ratio is the most conservative of the three liquidity ratios covered in this article. As the name implies, this ratio is simply the ratio of cash and equivalents compared to current liabilities. This ratio looks only at assets that can be most easily used to pay off short-term debt, and it disregards receivables and shortterm investments. The argument for using the cash ratio is that receivables and short-term investments often cannot be liquidated in a timely manner. Receivables can be sold, or monetized, but the firm will not be able to get the full value of the receivables sold. Keep in mind that, due to their Table 1. Financial Statement Data for J. Alexander’s Corp. (JAX) Cash & equivalents ($ thous) Accounts receivable ($ thous) Short-term investments ($ thous) Inventories ($ thous) Other current assets ($ thous) Total current assets ($ thous) Total current liabilities ($ thous) 2010 $8,600 $2,700 $0 $1,300 $1,300 $13,900 $13,100 2009 $5,600 $3,400 $0 $1,300 $1,500 $11,800 $15,200 2008 $2,500 $3,900 $0 $1,400 $2,700 $10,500 $13,000 2007 $11,300 $3,400 $0 $1,300 $2,500 $18,500 $14,100 2006 $14,700 $2,300 $0 $1,300 $2,300 $20,600 $13,700 Source: AAII’s Stock Investor Pro, Thomson Reuters. 20 Computerized Investing be slightly higher. Either J. Alexander’s to its sector and indusformula works as long try medians. As you can see, both the J. Alexander’s Corp. (JAX) as you remain consist in company’s current and quick ratios 2010 2009 2008 2007 2006 your analysis. For our dipped significantly below the sector Current ratio (X) 1.1 0.8 0.8 1.3 1.5 analysis here, we use the medians during the economic recesQuick ratio (X) 1.0 0.7 0.7 1.2 1.4 figures provided by Stock sion. Once again, this should come as Cash ratio (X) 0.7 0.4 0.2 0.8 1.1 Investor Pro. no surprise. While it is to be expected McCormick & Schmick’s Seafood Restaurant (MSSR) As we stated, firms with that the services sector may experi2010 2009 2008 2007 2006 higher liquidity ratios are ence slight difficulties during tough Current ratio (X) 0.5 0.6 0.6 0.7 0.8 better able to meet their economic times, it makes sense that Quick ratio (X) 0.4 0.5 0.5 0.6 0.6 short-term obligations. high-end restaurants are especially Cash ratio (X) 0.1 0.2 0.1 0.1 0.3 From Table 2, you can affected. The same can be said for the Source: AAII’s Stock Investor Pro, Thomson Reuters. see that J. Alexander’s restaurant industry. The industry as has significantly higher a whole may not suffer the declines liquidity ratios across the that high-end restaurants experience. high liquidity, short-term Treasuries board compared to McCormick & Consumers may opt for fast food or are considered cash equivalents, not Schmick’s. For fiscal-2010, McCorlow-cost diners rather than steak and short-term investments. The formula mick & Schmick’s has a cash ratio seafood. Overall, J. Alexander’s liquidfor the cash ratio is as follows: of just 0.1, meaning that it only has ity figures are rebounding back toward enough cash on hand to cover 10% the sector medians and have always Cash Ratio = Cash & Equivalents ÷ Current of its short-term obligations. been strong compared to the industry. Liabilities Another major observation can be made using time-series analysis. RaConclusion For fiscal-2010, the calculation for tios for both firms were the strongest Liquidity ratios are just a small part cash ratio involves using $8,600,000 at the end of 2006, bottomed out in of fundamental analysis. Looking only for the numerator of the equation late 2008, and rebounded in 2009 at these ratios would lead you to beand $13,100,000 for the denominathrough the end of 2010. This can be lieve that J. Alexander’s is the stronger tor. After plugging in the numbers, easily explained by the recession we firm. Furthermore, the ratios imply we find that the cash ratio for fiscalexperienced in 2008. J. Alexander’s that the best time to invest would 2010 is 0.656, rounded to 0.7. and McCormick & Schmick’s are have been sometime in early 2009. both high-end American restaurant However, there is often another chains known for their steaks and Interpreting the Ratios side to the story. McCormick & seafood. The firms are classified as Calculating the ratios is typically Schmick’s is a larger firm with more consumer cyclical, meaning they will the easy part. The difficulties lie in locations. Weaker liquidity ratios follow the market cycle. As our econanalyzing the ratios, interpreting their may be due to aggressive expansion omy fell into recession, it was natural meaning and making an educated policies. As always, it is prudent not that fewer people dined at high-end investment based on the findings. As to rely too heavily on a single set of restaurants. The two firms have less with any fundamental ratio analysis, ratios, but to research the firm as a cash coming in and will possibly have performing a time-series analysis, a whole. to borrow more in order competitive analysis and industry and to weather the downturn. sector analyses are good first steps. Table 3. Sector and Industry Comparison Both of these scenarios In Table 2, the liquidity ratios will place an added burfor 2006 through 2010 are listed Current Ratio (X) den on liquidity ratios. for J. Alexander’s and one of its 2010 2009 2008 2007 2006 Unsurprisingly, as the main competitors, McCormick & J. Alexander’s (JAX) 1.1 0.8 0.8 1.3 1.5 economy recovered, so Schmick’s Seafood Restaurants Sector (services) 1.2 1.2 1.3 1.3 1.4 did the liquidity ratios. Industry (restaurants) 0.8 0.8 0.8 0.8 0.8 (MSSR). Note that the quick ratio Finally, we perform we calculated for J. Alexander’s for Quick Ratio (X) an industry and sector 2010 is slightly different than the 2010 2009 2008 2007 2006 analysis. J. Alexander’s is one shown in Table 2. Instead of J. Alexander’s (JAX) 1.0 0.7 0.7 1.2 1.4 in the services sector and short-term investments, Stock InvesSector (services) 1.0 1.0 1.0 1.0 1.0 the restaurants industry. Industry (restaurants) 0.7 0.7 0.6 0.7 0.6 tor Pro uses marketable securities Table 3 compares the curin the numerator of the equation, Source: AAII’s Stock Investor Pro, Thomson Reuters. rent and quick ratios for causing its quick ratio calculation to Table 2. Comparing Liquidity Ratios Fourth Quarter 2011 21