Information Revelation in Auctions with Common and Private Values

advertisement

Information Revelation in Auctions with Common and

Private Values∗

Xu Tan†

January, 2014

Abstract

Incentives to reveal private information are explored when there are both common

and private components to agents’ valuations and private information is held on both

dimensions. When agents only observe one signal, they do not have incentives to

reveal it, because revealing the only signal makes them fully lose their information

advantage. However, when agents observe multiple signals, they may have incentives

to reveal some signals in order to earn higher profits from other signals. This paper

shows that there exists an equilibrium with revelation of common-value signals and

concealment of private-value signals in standard auctions. This equilibrium achieves full

efficiency and may give the seller a higher profit. Experiments confirm these theoretical

predictions. For example, subjects tend to hide private information in a pure common

value environment, and choose to reveal the common-value signal in the presence of an

additional private-value signal.

Keywords: information revelation, auctions, two-dimensional values, efficiency

JEL Classification Codes: D44, D82, L13

∗

I am very grateful to my advisors Matthew Jackson, Kyle Bagwell and Muriel Niederle for the valuable

suggestions and support. I also thank Douglas Bernheim, Yan Chen, Matthew Elloit, Ben Gulob, John

Hatfield, Han Hong, Yuichiro Kamada, Fuhito Kojima, Eric Mayefsky, Paul Milgrom, Tomas RodriguezBarraquer, Ilya Segal, Alex Wolitzky, and audience from Caltech, University of Washington, MEDS Kellogg,

Johns Hopkins University, Cornell and UBC for their helpful comments. Financial support from the B.F.

Haley and E.S. Shaw Fellowship for Economics through SIEPR is gratefully acknowledged.

†

Department of Economics, University of Washington, Seattle, Washington 98105, USA. Emails:

tanxu@uw.edu.

1

1

Introduction

Communication plays an important role in many games with private information, such as

deliberation among voters and information sharing in oligopoly competitions. Private information is prevalent in auctions, however, communication does not get much attention.

Among a few papers studying the value of information in auctions with one signal (like

Milgrom and Weber (1982b) and Kovenock, Morath and Munster (2010)), the common conclusion is that information is valuable and no incentive to share it. But when we extend to

a general setting of auctions with multiple signals, communication becomes important.

Valuations in many auctions include both common and private components. For instance,

in markets with clear common values, private values exist when players are heterogeneous

in some aspects. One example is the oil tract auction, where firms care about not only the

common quantity of the oil, but also their private costs of extracting from the tract.1 On

the other hand, in markets with clear private values, common values exist if the item will be

resold in the future. For instance in the housing market, buyers have private preferences for

a particular house, and they also care about the future price (common value) of the house.

This paper explores the incentives of verifiable information revelation2 in auctions, where

private information includes both common-value and private-value signals. Consider the

following example: The government sells an oil tract in an auction. There are two bidders:

one “insider” who knows the quantity of the oil in the tract and one “outsider” who does

not know the quantity information. Both bidders have their own costs of extracting from

the tract, which are private information. We ask the following questions: Do they want to

share the quantity and/or cost information (via verifiable evidence) with each other? And

how does the social welfare and the seller’s profit change with information revelation?

The first contribution of this paper is to illustrate the differences in information revelation between auctions with one signal and multiple signals. Following Milgrom and Weber

(1982b), the idea that agents earn a positive rent from private information is generally accepted, and thus there is no incentive to share information. After all, if there is only one

signal, sharing the signal makes agents fully lose their information advantage, and hence is

not profitable. However, this implication may not hold with two-dimensional signals. Take

the oil tract example: Suppose the insider has an extremely low cost of extracting from the

tract and observes the quantity of the oil is small. If the insider can still make a positive

profit because of the extremely low cost, I claim that the insider may have incentives to

reveal the quantity. This is because if the insider reveals the small quantity, the outsider

1

Another example is the sale of timber-harvesting contracts studied in Pesendorfer and Swinkels (2000).

This paper focuses on revelation with verifiable evidence: Agents need to provide evidence when revealing

a signal, such that they can truthfully reveal a signal or hide it, but cannot lie about the signal.

2

2

would submit a lower bid as the value of the tract is lower. As a result, the insider can win

the tract with a higher probability and/or with a lower price. Therefore, revealing the small

common quantity increases the insider’s payoff from the low private cost. To generalize this

intuition: when there are two signals, agents do have incentives to reveal the signal that

could lower other competitors’ bids, and earn a higher profit from the other signal.

The second contribution of this paper is to explain the fact that considering information

revelation makes the two-dimensional signal model more tractable and yields different results.

Recent studies point out some issues in auctions with two-dimensional signals, such as

losing full efficiency as discussed in Pesendorfer and Swinkels (2000) and losing existence of

equilibrium as shown in Jackson (2009). When observing two signals, agents can submit

only one bid. Unlike the case of one signal, where the equilibrium bidding strategy is a

one-to-one monotone mapping,3 the bidding strategy now is a two-to-one mapping where

monotonicity cannot be naturally defined. For instance, a realization of a low private value

and a high common value cannot be compared to another realization of a high private value

and a low common value. Thus, the equilibrium turns out to be a harder (even impossible)

problem to solve. We also lose full efficiency due to the loss of monotonicity, since there is

no guarantee that the winner is the agent with the highest value.

If information revelation is considered, the predictions are different. First, there generally

exists an equilibrium where agents fully reveal their common-value signals. The auction is

then reduced to a pure private-value setting, and agents use the monotone bidding strategy. Second, there is no efficiency loss in this monotone equilibrium, because the winner is

guaranteed to be the agent with the highest value. In addition, the seller may also prefer

information revelation, since it increases the seller’s profit by reducing agents’ information

rents.

The third contribution of this paper is to validate the theoretical predictions on information revelation by experiments. I confirm that subjects do not want to reveal information

when there is only one signal, while they are incentivized to reveal some information in the

case of multiple signals. For instance, with just one low common value, only 25% of subjects

chose to reveal at least once, and none of them chose to reveal with a probability higher than

50%. While with two-dimensional signals where the common value is low, the revelation is

much higher: 83% of subjects chose to reveal at least once, and 58% chose to reveal with a

probability higher than 50%. This difference in revelation between pure common value and

two-dimensional values is significant.

In summary, agents’ incentives to reveal information are different between auctions with

one signal and multiple signals. In contrast to the fact that agents do not want to reveal the

only signal, they choose partial revelation when observing multiple signals. Common-value

3

Monotonicity generally means bids are monotone in signals.

3

signals are revealed to lower other agents’ bids and to earn higher profits from private-value

signals. The reduction of information asymmetry from revelation also leads to a improved

social welfare and a possible higher profit for the seller.

In addition, this paper also studies the incentive to acquire the common-value signals.

Milgrom and Weber (1982b) predicts that agents want to overtly collect information in

order to show off their information advantage. However, if communication is considered, the

prediction is the opposite. Common-value information would be fully revealed after being

overtly collected, such that agents don’t have incentives to do so if it is costly. On the other

hand, agents do want to covertly acquire some information in order to get an information

advantage.

1.1

Related Literature

This paper is mainly related to two strings of literature: strategic communication and twodimensional valuations.

First, in strategic communication, one related paper is Okuno-Fujiwara, Postlewaite and

Suzumura (1990), where they also work with information revelation of multiple signals. They

provide sufficient conditions for full revelation, which require differentiable payoffs.4 However, auctions do not have differentiable payoffs, because the winner takes all. A recent paper

by Hagenbach, Koessler and Perez-Richet (2013), nesting Okuno-Fujiwara, Postlewaite and

Suzumura (1990), doesn’t require continuity. They show that the full revelation equilibrium

exists if we can find a worst-case type, such that if a hidden signal is believed to be this

worst-case type, agents have incentives to reveal the signal. We share a similar spirit when

constructing the incentives of revelation. This paper examines and emphasizes the communication in two-dimensional auctions, which is a well-acknowledged important setting but

hard to analyze without considering revelation. Moreover, if we consider revelation of both

common and private signals, this paper doesn’t predict full revelation.

Analysis here makes a strong use of the communication models where agents can conceal

information but cannot overtly lie. This fits many applications where the signals are in the

form of verifiable evidence (hard information), such as the inspection reports in the housing

market. There is a large literature that distinguishes soft information (Crawford and Sobel,

1982) from hard information (Milgrom, 1981 and Grossman, 1981). The “persuasion games,”

as introduced by Milgrom (1981) and Grossman (1981)5 , are cases with hard information.

The unraveling argument from this literature is used in this paper.

4

See Assumption 4 in Okuno-Fujiwara, Postlewaite and Suzumura (1990) for details.

Subsequent investigations include Milgrom and Roberts (1986), Shin (1994) and Lipman and Seppi

(1995), among others (see Milgrom (2008) for some recent discussion).

5

4

Very few studies have been done on information revelation in auctions, mainly because

bidders rarely have the incentive to share information in the symmetric one-dimensional

valuation setting. For example, Milgrom and Weber (1982b) established the idea that private information is valuable by showing “the bidder with only public information make no

profit at equilibrium and the bidder with private information generally makes positive profits

in common-value auctions.” Moreover, Kovenock, Morath and Munster (2010) considered

information revelation in all-pay auctions, and they concluded that in both pure commonvalue and pure private-value auctions, agents do not have incentives to share information

individually.

The closest related literature on information revelation in auctions is Benoit and Dubra

(2006), where they show that bidders have incentives to share information when their values

are asymmetric. Incentive of revealing information in their paper is similar. Agents want to

reveal information in order to lower other agents’ bids, when they can earn positive payoffs

after the revelation. The positive payoffs may come from asymmetric values as in Benoit

and Dubra (2006) or from another dimension of private values as in this paper. Instead of

the one-dimensional signal setting in Benoit and Dubra (2006)6 , this paper considers a more

general setting of two-dimensional signals, and shows that information revelation happens

in this very standard setting and on the other hand it helps to make the model tractable.7

Another remotely related literature is information revelation in an oligopoly, which mainly

focuses on ex ante choices (trade association) with one-dimensional signals, and the results

are mixed8 . The ex ante problem is very different and does not answer the interim questions,

such as after observing a change in the cost, does one firm has incentive to reveal or conceal

it? Some oligopoly (such as Bertrand) is similar to auctions, so some results can be adapted.

Second, recent studies of two-dimensional valuations in auctions show that many standard results are not robust when changing from one signal to multiple signals. Pesendorfer

and Swinkels (2000) show that inefficiency appears with a positive probability in auctions

with two-dimensional valuations, but the asymptotic efficiency could be achieved in a large

society. Goeree and Offerman (2003) solve the equilibrium when the common value has a

specific (linear) form, and further confirm the positive efficiency loss. Jackson (2009) provides a simple discrete example in a standard second-price auction that equilibria can fail

6

In their paper, they consider adding private-value components to a common-value auction. But the

private-value components are common knowledge, so agent still observe one signal.

7

Another difference: in their general theorem 1 and 2, they impose restrictions on the equilibrium payoffs

in auctions, and these restrictions simplify the analysis because equilibrium payoffs from asymmetric auctions

could be very complicated. In this paper, I don’t impose such restrictions but instead focus on three popular

types of auctions, first-price, second-price and all-pay auctions.

8

Vives (1990) provides a good survey, and the main papers in the literature include Clarke (1983), Vives

(1984), Gal-Or (1985) and (1986), Li (1985), Shapiro (1986), among others.

5

to exist with two-dimensional valuations. Similarly, I show that incentives of sharing information are also different between cases with one signal and multiple signals. Considering

communication yields different predictions: the existence of equilibrium and full efficiency

hold with information revelation.

Another related paper is McLean and Postlewaite (2004), where they study a general

multi-dimensional signal setting, and show that a modification of a Vickrey auction with

side payments from the seller to the bidders could lead to an efficient outcome. Even though

I don’t focus on the mechanism design question, it can be addressed by the main results of

this paper in the setting of two-dimensional signals. With communication among bidders, a

standard second-price auction could achieve full efficiency and a higher profit for the seller

than that in the mechanism designed in McLean and Postlewaite (2004), because there are

no side payments to the bidders.

Finally, Jehiel and Moldovanu (2001) study the efficient mechanism with multi-dimensional

signals, and show that it only exists in nongeneric cases. The communication method in Jehiel and Moldovanu (2001) is cheap talking, while this paper considers communication with

verifiable evidence. Thus, the efficiency result in this paper doesn’t imply that the model is

nongeneric. In contrast, it covers most two-dimensional valuation models in the literature

such as Pesendorfer and Swinkels (2000) and Goeree and Offerman (2003).

The reminder of the paper is organized as follows. Section 2 introduces the basic intuition

of information revelation in the oil-drilling example. Agents have incentives to reveal the

common-value signal in the presence of an additional private-value signal, while they don’t

have such incentives without the private-value signal. Section 3 describes the setup of the

model, and Section 4 characterizes the equilibrium of the general model, the social welfare

and the seller’s profit. Section 5 provides two extensions of the model, including extensions

on communication and information acquisition. Section 6 presents the design and results of

the experiments, and confirms the theoretical predictions. Section 7 concludes.

2

Oil-Drilling Example

This section uses an oil-drilling example to explain the following results:

1. When agents only observe one common-value signal, there is no incentive to reveal

that signal (intuition we know from the literature).

2. When agents observe both the common-value and the private-value signals, there is

incentive to reveal the common-value signal.

Suppose there is one oil tract for sale in a second-price auction. The quantity of the oil in

the tract is q ∈ {qH , qM , qL } (qH > qM > qL > 0), where q = qi with a probability pi and

6

pH + pM + pL = 1. There are two bidders: the “insider” knows the exact quantity, while the

“outsider” only knows its prior probability distribution.9

2.1

Pure Common Value

The value of the oil tract for both bidders equals the quantity of the oil times the difference

between the price of the oil and the cost of extraction:

u = (p − c)q

The price of the oil (p) and the cost of extraction (c) are exogenous and common knowledge

in the pure common-value setting.

The timeline is as follows: At time 0, the insider privately observes the true quantity

q; at time 1, the insider decides whether to truthfully (via verifiable evidence) reveal q or

hide it; the outsider observes the insider’s revelation decision and the true quantity q if it is

revealed; at time 2, both bid in a second-price auction.

I focus on the perfect Bayesian equilibrium surviving iterative elimination of weakly

dominated strategies.10 The refinement requires:

• The bidding strategy is undominated in a second-price auction.

• The revelation strategy is undominated given bidders use undominated bidding strategies, and so on.11

Considering undominated strategies is helpful to eliminate some degenerate equilibria. It

is well known that there exists an asymmetric equilibrium in second-price auctions. For

example, let the outsider unconditionally bid the highest possible value (p − c)qH , and let

the insider bid 0. This is an equilibrium regardless of the true quantity. In order to eliminate

this sort of degenerate equilibrium, the bidding strategy is required to be undominated. In

a second-price auction, the undominated strategy is bidding the true value. Given bidders

use undominated bidding strategies in the auction, some revelation strategies are weakly

dominated as follows.

Consider the insider’s incentive of revealing the quantity q: if the insider reveals q, the

outsider knows the true value is u = (p − c)q, and his/her unique undominated strategy

is bidding the true value in a second-price auction. Such bidding strategy of the outsider

9

These settings, such as asymmetric bidders, discrete quantities and second-price auctions, simplify the

example. The general model doesn’t require these settings.

10

This refinement is useful to predict the unique equilibrium in this example. The main existence results

for the general model don’t need it.

11

The proofs use 2-3 iterations of eliminating weakly dominated strategies, and the order of elimination

doesn’t matter unless clearly stated as in Example 1.

7

makes the insider earn a payoff of 0. This is because even if the insider wins the auction,

the price is the outsider’s bid, which equals the true value u = (p − c)q. On the other hand,

if the insider doesn’t reveal the quantity (assuming q 6= qL ), depending on the outsider’s

bidding strategy there are cases where the insider could earn a positive payoff. So revealing

the quantity is weakly dominated given bidders use undominated bidding strategies.

Claim 1 Consider the oil-drilling auction with two bidders (one insider and one outsider)

and pure common value (quantity); in all iteratively undominated perfect Bayesian equilibria,

all quantities except the lowest one (q > qL ) are concealed.

Proof of Claim 1: First eliminate all weakly dominated bidding strategies in the secondprice auction. The undominated strategy for the insider is bidding the true value u = (p−c)q,

and for the outsider is as follows: bidding the true value u = (p − c)q if q is revealed, and

bidding within the lowest and highest possible values otherwise, bO ∈ [(p − c)qL , (p − c)qH ].

Then consider the insider’s revelation strategy when q > qL : If the insider reveals q, the

outsider bids the true value u = q(p − c) and the payoff for the insider is 0; if the insider

doesn’t reveal q, the outsider bids in an interval of [(p − c)qL , (p − c)qH ], and the payoff for

the insider is either positive or 0. Thus, revealing the quantity is weakly dominated, and is

eliminated. When q = qL , the payoff for the insider is 0 regardless of revealing or concealing

the quantity, so the insider is indifferent.

So, in all iteratively undominated perfect Bayesian equilibria, only the lowest signal qL

might be revealed, and all other signals must be concealed.

Revealing the only signal is not profitable, because it completely eliminates an agent’s

information advantage and reduces his/her the payoff from the auction to zero. The result

holds in a more general setting where q takes values from any finite or infinite set.12 The

result could also be extended to a setting where bidders are symmetric: each bidder observes

one common-value signal, and the true quantity is determined by both signals. In this

symmetric setting, concealing information is a perfect Bayesian equilibrium. Kovenock,

Florian and Munster (2010) obtain similar, but ex ante, results in all-pay auctions. They

show that agents don’t prefer to reveal private signals about their common or private values

individually.13

These results ensure that we can usually skip discussing information revelation before

auctions and proceed to analyze the bidding strategies assuming information remains private.

12

Let q ∈ Q where Q is a finite or infinite subset of R+ , and q is the infimum of Q. Claim 1 could

be generalized as follows: Consider the oil-drilling auction with two bidders (one insider and one outsider)

and pure common value (quantity); in all iteratively undominated perfect Bayesian equilibria, all quantities

except the infimum value (q > q) are concealed.

13

Besides no revelation on the individual level, they also show that an industry-wide agreement to share

information can arise in equilibria with private values.

8

However, the next part shows that this intuition doesn’t hold when agents observe multiple

signals.

I remark that the refinement of iterative elimination of weakly dominated strategies

removes some equilibria where q is revealed. For example, there exists a perfect Bayesian

Nash equilibrium: the insider fully reveals q and bids the true value; the outsiders believes any

hidden signal is qH and bids the value according to the belief. This equilibrium involves the

insider using weakly dominated revelation strategy when bidders use undominated bidding

strategies, so it is eliminated by the refinement.

Lastly, if revelation is costly, all quantity signals (including qL ) are predicted to be concealed in the pure common-value setting. The cost of revelation is not introduced to the

theory part to keep it simple, but it is introduced to the experiments to eliminate the indifference between revealing and concealing the low common-value signal and thus give a

unique prediction of the equilibrium revelation strategy.

2.2

Values with both Common Quantity and Private Costs

Bidder i’s cost of extraction (ci ) is now assumed to be a private-value variable, which is

identically independently distributed in [cL , cH ] with a strictly increasing and atomless distribution (density f (c)). Assume cH < p, such that the price of the oil is always higher than

the costs, and therefore the value of the oil tract to bidder i, ui = (p−ci )q, is always positive.

The updated timeline is as follows. At time 0, the insider privately observes the quantity

q and the cost cI , and the outsider privately observes the cost cO ; at time 1, the insider

decides whether to truthfully reveal q or conceal it; and at time 2, they bid in a second-price

auction. To make the example simple, bidders’ incentives of revealing their costs are not

considered for now. They are discussed later in Example 1.

Let’s say an equilibrium is common-revealing equivalent if, with probability one, the

outcome is the same as in an equilibrium where all common-value signals (the quantity) are

revealed.

Proposition 1 Consider the oil-drilling auction with two bidders (one insider and one

outsider) and values with both common-value quantity and private-value costs; all iteratively

undominated perfect Bayesian equilibria are common-revealing equivalent.

Proofs are provided in the Appendix.

Suppose the insider observes a low quantity, but still wants to win the auction because of

a low private-value cost (cI < cH ). If the insider reveals the low quantity, the outsider would

generally bid lower, and hence the insider can win with a higher probability and pay a lower

9

price. So by revealing the low quantity, the insider earns a higher profit from the privatevalue cost.14 Given the low quantity is fully revealed, when the quantity is not revealed, the

outsider can infer it must be the medium or high quantity. Following the same argument, the

insider has the incentive to reveal the medium quantity. Thus it unravels to full revelation

of all quantities, and this is the unraveling argument from Milgrom (1981) and Grossman

(1981). This result holds in other settings, such as a different form of the utility ui = pq − ci .

Minimal incentives of information revelation in the pure common-value setting are not

robust to a perturbation in agents’ information structure. With only one common value

(quantity), the insider generally doesn’t want to reveal the value in order to keep his/her

information advantage. With an additional private-value cost, the insider wants to reveal

the quantity signal to earn a higher profit from the private-value cost. Such incentive of information revelation would also happen when costs are common-knowledge but asymmetric.

For example, if the insider has a lower cost, he/she has incentives to reveal the low quantity;

but if the insider’s cost is higher, there is no strict incentive to reveal. Benoit and Dubra

(2006) provide more details on this part.

When bidders can also truthfully reveal their cost information, the common-revealing

equilibrium in Proposition 1 remains to be one equilibrium, and under some orders of eliminating weakly dominated strategies it is unique. However, under some other orders it does

not survive.

Example 1 Order of iterative elimination of weakly dominated strategies matters when

agents can reveal both signals.

Consider the oil-drilling example with two modifications: (i) ci ∈ [cL , cH )15 ; (ii) At time

1, the insider can truthfully reveal both q and cI , only reveal q or cI , or conceal both; and

the outsider can truthfully reveal cO or conceal it.

The common-revealing equilibrium in Proposition 1 is equivalently unique under some

orders of eliminating weakly dominated strategies:

1. Agents do not play weakly dominated bids in the second stage conditional on the

information is given to them: The outsider bids in an interval ([(p − cO )qL , (p − cO )qH ])

if seeing nothing, bids the true value if seeing q, and the insider bids the true value.

2. Conditional on 1, eliminate the insider’s weakly dominated revelation strategy which

is hiding qL .

14

Recall that when there are no endogenous costs, lowering the outsider’s bid doesn’t make the insider

earn a higher profit because the payoff of the insider is always 0 when q = qL .

15

Assuming the interval is open at cH makes this example simple, so that I can focus on illustrating the

effect of the order on eliminating weakly dominated strategies. The proof of Proposition 1 in the Appendix

considers the closed interval, and shows why it makes the proof more complicated.

10

3. Conditional on 2, eliminate the outsider’s weakly dominated strategy when nothing is

revealed. So the outsider bids in an interval of [(p − cO )qM , (p − cO )qH ].

4. Conditional on 3, eliminate the insider’s weakly dominated revelation strategy which

is hiding qM .

So the outcome is equivalent to full revelation of quantities under this order, where qL

and qM are fully revealed and the concealment of qH can be fully inferred. The revelation of

private costs is irrelative, as agents have a unique undominated bidding strategy in secondprice auctions.

However, there are some other orders of eliminating weakly dominated strategies, which

lead to different equilibrium behaviors:

1. Eliminate the insider’s weakly dominated bidding strategy, so the insider bids the true

value.

2. Conditional on 1, eliminate the outsider’s weakly dominated bidding strategy conditional on the information: the outsider bids in [(p − cO )qL , (p − cO )qH ] when seeing

nothing, bids the true value when seeing q, bids (p − cO )qL when only seeing cI < cO ,

and bids (p − cO )qH when only seeing cI > cO .

When only cI < cO is revealed and q is not revealed, the insider bids uI = (p − cI )q

and the outsider bids as low as possible because the profit is always negative when

winning; on the other hand when only cI > cO is revealed, the outsider bids as high as

possible because the profit is always positive when winning.

3. Conditional on 2, eliminate insider’s weakly dominated revelation strategy: when q =

qM or q = qH , q is concealed and cI is revealed; when q = qL , revealing q or cI is

indifferent.

Revealing only cI dominates revealing q when q = qM or q = qH . When q is revealed,

the outsider bids uO = (p − cO )q, and the insider wins only when cI < cO and pays a

price of (p − cO )q. On the other hand, when only cI is revealed, the insider still wins

only when cI < cO , but pays a lower price of (p − cO )qL .

So the equilibrium surviving includes full revelation of the insider’s cost and full concealment

of the quantity.16 Two lessons can be learned from this example.

First, the argument that there is no communication in auctions because of “information

rent” highly depends on the one-dimensional information setting. When there are multiple

16

Special thanks to John Hatfield for pointing out this possible equilibrium.

11

pieces of information, agents usually want to reveal some information, common-value or

private-value signals. Therefore, communication should play an important role in auctions.

Second, the communication with both signals could be very complicated. Even the refinements as iterative elimination of weakly dominated strategies cannot give a clear prediction.

In most applications, the verifiable evidence usually exists for the common-value signals,

while it rarely exists for private values because they are very personal. Thus in the main

model focuses on communication of the common-value signals, and the revelation of both

signals is discussed in the extension section.

3

General Model

A group of agents, N = {1, ..., n}, bid for one item in an auction.17

3.1

Valuation and Revelation

There are two components related to agent i’s valuation of the item:

u(vi , q) : V × Q → R+

a private-value component vi ∈ [vL , vH ] = V , which only affects agent i’s valuation, and a

common-value component q ∈ [qL , qH ] = Q, which affects all agents’ valuations. We assume

the valuation u(vi , q) is increasing in vi and q. The valuation is called linear if there exists

some λ ∈ (0, 1) such that u(vi , q) = λvi + (1 − λ)q.

Agent i’s private-value component, vi , is drawn independently according to a continuous

and strictly positive density f (·). Agent i doesn’t observe the true common-value component,

q, but instead observes a realization of a random signal si ∈ [sL , sH ] = S. Signals are drawn

according to a continuous and strictly positive joint density g(s1 , ..., sn ). For simplicity,

we assume all private values vi are independent from all common-value signals si .18 For

example, the information about the quantity of the oil is independent of the private-value

costs of extraction, which depend on firms’ own technologies. The common-value component

is fully determined by all signals,19

q = q(s1 , ..., sn )

17

The results can be generalized to auctions with multiple identical items, for instance the setting in

Pesendorfer and Swinkels (2000).

18

When vi and si are correlated, the results in this paper remain true in second-price auctions. In other

auctions (e.g. first-price auctions), this correlation leads to asymmetric private-value bidders (because they

observe different common-value signals), which worths a whole paper to study (see Maskin and Riley (2000),

and Reny and Zamir (2004)).

19

When q is not fully determined by all signals, considering the expected common-value component is

usually sufficient for risk-neutral agents.

12

where q is (weakly) increasing in each si . It is possible that si has no impact on q, then

agent i is an outsider since his/her common-value information is irrelevant. Thus the general

model covers the example except expanding the set of common-value signals from a finite

set to an interval.

I remark that this two-dimensional valuation setting is different from the affiliated signals

discussed in Milgrom and Weber (1982a). In their paper, each bidder observes only one

signal, which may relate to both common and private values, but the bidding strategy is

still a one-to-one mapping. Here each bidder observes two signals, where one relates to the

common value and the other relates to the private value. The equilibrium strategy is a more

complicated mapping. In reality, agents usually observe many signals. For instance, in the

oil tract auction, firms might know the quantity of the oil, the depth of the tract, the weather

condition nearby, the salary of the captain, the technology of the extracting equipments, and

etc. Some of them could be summarized to one common-value signal, and others could be

summarized to one private value.

Prior to the auction, agents could communicate their signals in the form of verifiable

evidence.20 I focus on the communication of common-value signals, because they are usually

supported by hard documents. Agents can choose to either reveal the signal or not, but they

cannot “lie”. This matches a variety of applications. For instance, in the housing market

the inspection reports could indicate the value of a house. As shown in Example 1, the

communication involving both private-value and common-value signals is less tractable, so I

defer the analysis to the extension section.

Formally, a revelation strategy for an agent i ∈ N is a function (including mixed strategies),

ri (vi , si ) ∈ 4{si , ∅}

r(v, s) = (r1 (v1 , s1 ), ..., rn (vn , sn )) represents all agents’ revelation strategies.

All of the settings are common knowledge except for the private information (vi , si ). All

agents are risk-neutral.

3.2

Game and Equilibrium

The game takes two stages. In the first stage, agents simultaneously choose their revelation

strategies, ri (vi , si ). All revealed signals are observed by all agents. I = I(r(v, s)) is the

belief of the signals after the revelation. In the second stage, agents simultaneously choose

their bids, bi (vi , si , I(r(v, s))), which is a function of agent i’s own signals and the belief I.

20

The main result holds when agents can partially reveal the evidence but not all of them, and it is

discussed in the remarks after the theorem.

13

An equilibrium is a list of strategies, ri (vi , si ) in the first stage and bi (vi , si , I(r(v, s))) in

the second stage for each agent i, and the belief system I, that form an interim undominated

perfect Bayesian equilibrium, where both the revelation and bidding strategies could be

mixed. Undomination is required to eliminate degenerate equilibria, such as the ones in

second-price auctions.

4

Equilibria and Welfare

This section starts by showing the set of PBE is non-empty, then describes the revelation

strategies in these equilibria, and concludes with efficiency analysis.

4.1

Equilibrium Existence

We conjecture that there exists at least one equilibrium where agents fully reveal their

common-value signals. This is based on two observations from the oil-drilling example: 1)

agents bid lower when the common value is lower; 2) agents observing low common-value

signals want to reveal their signals, and it unravels to full revelation.

The following lemma establishes the first observation: the monotone relationship between

agents’ equilibrium bidding strategies and the common value.

Lemma 1 When q is common knowledge, the equilibrium bidding strategy bi (vi , q) increases

in q, in any first-price and all-pay auction with linear values and all second-price auctions.

The lemma is proved by examining the equilibrium bidding strategies in these auctions.

In any second-price auction, the equilibrium is bidding the true valuation,

A

bSP

(vi , q) = u(vi , q)

i

thus the bidding strategy is an increasing function of q. With linear valuations u(vi , q) =

λvi +(1−λ)q, an increase to the common value, say q 0 = q +, leads to an increase of (1−λ)

to all valuations. In a first-price auction, the equilibrium bid is

bFi P A (vi , q 0 ) = bFi P A (vi , q) + (1 − λ)

this increase in valuations is fully absorbed by the increase in the bids. In an all-pay auction,

the equilibrium bid is

A

A

(vi , q) + (1 − λ)(F n−1 (vi ) − F n−1 (vL ))

bAP

(vi , q 0 ) = bAP

i

i

the increase in bids equals the increase in valuations times the probability of winning the

auction. Agents with low private values are less likely to win and enjoy the increase in q but

they need to pay their bids regardless, so the increase in their bids is smaller.

14

However, this monotone relationship between the bidding strategy and the common value

cannot be easily generalized to cover non-linear value functions. For example, it is possible

that a lower q also suggests a stronger competition when the valuation does not change

linearly, and this stronger competition may lead to higher bidding strategies. If the effect

of an increase in competition dominates the decrease in valuations, the equilibrium bidding

strategy may increase even if the common value decreases.

Example 2 In first-price auctions, equilibrium bidding strategies may increase when q decreases with a non-linear valuation.

Suppose there are 2 bidders in a first-price auction. Let q ∈ [0, 1], and vi is uniformly

distributed in [0, 1]. Bidder i’s value of the item equals:

vi ∈ [0, 1/2)

V aluei = vi ,

= 1/2 + (vi − 1/2)q, vi ∈ [1/2, 1]

When q = 1, V aluei is uniformly distributed in [0, 1] and the equilibrium bidding strategy

is bq=1 (v) = v/2. When q = 0, V aluei is uniformly distributed in [0, 1/2) with a probability

of 1/2, and V aluei = 1/2 with a probability of 1/2. The equilibrium bidding strategy is

v ∈ [0, 1/2)

bq=0 (v) = v/2,

= mixed in [1/4, 3/8] with a cdf G(b),

v ∈ [1/2, 1]

1

where G(b) = 2(1−2b)

− 1 is the distribution function of the mixed strategy.

When q decreases from 1 to 0, the equilibrium bidding strategy changes from bq=1 (v) to

bq=0 (v). This change is not monotone. For instance, if bidder 1 has v1 = 5/8, bq=1 (v1 ) = 5/16

and bq=0 (v1 ) ∈ [1/4, 3/8]. Thus, I focus on linear valuations for first-price and all-pay auctions when establishing

the existence result. An equilibrium is common-revealing if in the outcome all common-value

signals are revealed.

Theorem 1 There exists a common-revealing equilibrium in any first-price and all-pay auction with linear values and all second-price auctions.

Proof of Theorem 1: The common-revealing equilibrium includes revelation and bidding

strategies and a belief system. For the strategies, agents reveal their common-value signals

and bid according to the following equilibrium bidding strategies in these three auctions.

R vi

F (s)n−1 ds

v

A

, bSP

(vi , q) = u(vi , q)

bFi P A (vi , q) = vi + q − L

i

F (vi )n−1

15

A

(vi , q)

bAP

i

Z

vi

(s + q)dF (s)n−1

=

vL

For the belief system, if no signal is revealed, all other agents believe the signal is sH .

We need to verify this is a perfect Bayesian equilibrium. First, no signal being revealed

happens off equilibrium path, so the belief is valid. Also all the bidding strategies are the

equilibrium strategies in auctions with private values. Thus they are best responses given

the belief of q. The last part is to prove revealing si is a best response for agent i. Suppose

agent i hides si instead, other agents believe it is sH and thus believe the common value is

weakly higher. As a result, other agents bid higher and agent i’s payoff gets smaller. So

revealing common-value signals is a best response.

This equilibrium existence result remains true in some more general settings. I provide

two possible generalizations.

Remark 1 Consider the generalization based on the setting in Pesendorfer and Swinkels

(2000): 1) k(≥ 1) identical items is sold by (k + 1)th-price auction; 2) the private values

vi can be correlated with the common-value signals si . The equilibrium bidding strategy is

still bidding the true value, bi (vi , q) = u(vi , q), which increases in q. So the same perfect

Bayesian equilibrium constructed in the proof remains valid.

Remark 2 Consider a partial revelation of the common-value signals: agents can reveal

some evidence but not all of them, which narrows the set of the possible common-value

signals:

ri (vi , si ) ∈ 4{B : si ∈ B, B is closed}

The perfect Bayesian equilibrium still exists: the same strategies as in the proof and the

belief system is believing si = sup(B) when the revelation from agent i shows B.

4.2

Revelations in Equilibria

The theorem establishes the existence of the equilibrium where the common-value signals are

fully revealed. But the possibility of other equilibria with no revelation or partial revelation

remains.

First, other equilibria might appear because agents’ beliefs could be more complicated.

For instance, the following example shows no revelation of common-value signals could appear in an equilibrium. If one agent (agent 1) deviates from the common-hiding equilibrium

and reveals the common-value signal, agent 2 may not only update the belief of agent 1’s

signal, but also update the beliefs of others’ signals. For example, agent 2 might completely

change his/her belief of other agents’ revelation strategies from common-hiding to commonrevealing. Thus all others’ hidden signals are now believed to be the highest possible signal,

16

and agent 2 might submit an even higher bid based on this new belief. So agent 1 does not

have an incentive to reveal any common-value signal.

Example 3 Fully-hiding equilibrium in a second-price auction.

Suppose there are 4 agents in the society (n = 4), common-value signals are independent,

f and the marginal density gsi are uniform on [0,1]21 , the common value is the average of

the four signals q = (s1 + s2 + s3 + s4 )/4, and the value for each agent (agent i) is ui = vi + q.

Let ci = vi + si /4 be the surplus of agent i. From Goeree and Offerman (2003), without

information revelation the symmetric bidding strategy (for agent i) is an increasing function

of the surplus

b(ci ) = ci + E(s/4|c = ci ) + 2E(s/4|c < ci )

Thus b(ci ) < ci + 1/4 + 2(1/8).

Suppose in the equilibrium, all 4 agents won’t reveal any signal. If some agent (say agent

1) deviates and reveals a common-value signal s1 , all other agents change their beliefs to the

common-revealing equilibrium where the hidden signal is believed to be sH = 1. Then all

other agents bid their values under their beliefs b0 (ci ) = ci + s1 /4 + 2(1/4) in a second-price

auction. The new bid is higher than the original bid (b0 (ci ) ≥ b(ci )). Thus, revealing any

common-value signal increases other agents’ bids, which is not a profitable deviation. The

initial fully-hiding equilibrium is valid. The example above cannot be refined away by iterative elimination of weakly dominated

strategies nor intuitive criterion, but it can be eliminated by trembling-hand perfection.

Thus in the following part, I focus on trembling-hand perfect Bayesian equilibrium where

agents have independent beliefs on other agents’ revelation strategies (e.g. one change in

one agent’s revelation does not change beliefs about other agents’ revelations).

The second challenge is the non-existence and complication of equilibrium bidding strategies in auctions with multiple signals (Jackson (2009) and Pesendorfer and Swinkels (2000)).

When agents don’t fully reveal the common-value signals, they may have multiple private

signals when bidding. Goeree and Offerman (2003) is the only setting where the equilibrium

can be solved to the best of my knowledge, So I focus on their settings and show there

doesn’t exist an equilibrium where the common-value signals is fully hidden. This is because

agents have incentives to reveal low common-value signals.

(A1) (Goeree and Offerman (2003)) Common value signals si are independent, q = (s1 +

... + sn )/n, ui = vi + q and the densities f and gsi are logconcave.

21

This is enough to ensure that conditions in Goeree and Offerman (2003) are satisfied, such that the

equilibrium with no information revelation can be solved.

17

Let ci = si /n + vi be the surplus of agent i. Goeree and Offerman (2003) shows that the

symmetric equilibrium bidding strategy in a second-price auction is

b(c) = E(q + vi |ci = c, yi = c)

(1)

where yi is the highest surplus from all other agents.

Proposition 2 Consider the setup in (A1) and agents use symmetric monotone bidding

strategy as a function of their surplus c, the common-hiding equilibrium is not a PBE surviving trembling-hand perfection in second-price auctions

Proof of Proposition 2: In second-price auctions, agents bid the expected value when

they are the pivotal winner (tie with another agent) in equilibrium. The equilibrium bidding

strategy after player 1 observes and reveals s1 = sL is (b1 (v1 ), B(c2 ), ..., B(cn )).

b1 (v1 ) = E(q + v1 |s1 = sL , B(yi ) = b1 (v1 ))

B(c) < E(q + vi |ci = c, s1 = sL , y1,i = c)

where y1,i is the highest surplus from agents other than 1 and i (i ≥ 2). The last inequality

comes from the fact that with some probability P , 1 submits the highest bid among all other

bidders (except i), in which case the expected utility from being pivotal is E(q + vi |ci =

c, s1 = sL , y1,i < c). So to be precise,

B(c) = P E(q + vi |ci = c, s1 = sL , y1,i < c) + (1 − P )E(q + vi |ci = c, s1 = sL , y1,i = c)

where the first part of the sum is smaller than the second part. Since s1 = sL , B(c) < b(c)

in (1) unless c = sL + vL . Revealing sL can lower other bidders bids, so it is profitable to do

so.

I remark that the result is presented in a quite restricted setting because of the complication of the equilibrium bidding strategies. But the intuition of non existence of commonhiding equilibrium is quite general. As long as revealing some signals (usually bad news

of the common value) can lower others’ bids and increase one agent’s profit, agents have

incentives to communicate.

Lastly, the partial revelation is harder to rule out, because there are many possible partial

revelation strategies and each of them is associated with a complicated (if existing) bidding

strategy. A possible equilibrium with partial revelation is provided later in Example 5 in

the experiment setting. In general, proving the uniqueness of common-revealing equilibrium

must require more subtle refinements to remove all equilibria with partial or no revelation.

18

4.3

Welfare and Profit

This section proceeds to show that there is no efficiency loss in monotone equilibria with

revelation of common-value signals, in contrast to positive efficiency loss in equilibria with

no revelation.

It is efficient to select the winner to be the agent with the highest private value since

the common-value component is the same for all agents. However, in auctions without

information revelation, there is a positive expected efficiency loss22 . Because it is quite

possible that the winner observes a high enough common-value signal, but does not have

the highest private value. With information revelation, the story is different. If agents

fully reveal their common-value signals, the auction only involves private information of

private values and thus the winner is the agent with the highest private value in a monotone

equilibrium. Thus, there is no efficiency loss in auctions with two-dimensional valuations if

information revelation is considered.

Corollary 1 There is no efficiency loss in a monotone common-revealing equilibrium in

any first-price and all-pay auction with linear values and all second-price auctions.

Not only does the social planner support information revelation, the seller may also prefer

information to be shared. As before, in order to calculate and compare the seller’s profit

when information is not revealed, I focus on the settings in Goeree and Offerman (2003).

The following example shows that the expected payoffs of agents decrease with information

revelation, and thus the expected profit of the seller increases when n = 2.23

Example 4 The seller’s expected profit increases when common-value signals are revealed.

Suppose there are two agents in a second-price auction (n = 2), and (A1) holds except

q = s1 + s2 . Let ci = vi + si be the surplus of agent i.

With revelation of si , the auction is a standard private-value second-price auction, and

the bid equals the true value, b(v1 ) = c1 + s2 . The ex ante expected payoff of agent 1 is

Z v1

∗

π = Ev1

(v1 − v2 )f (v2 )dv2

vL

where agent 1 wins with a payoff of v1 − v2 when v1 > v2 .

From Goeree and Offerman (2003), without information revelation, the symmetric bidding strategy (for agent 1) is an increasing function of the surplus

b(c1 ) = c1 + E(s2 |c2 = c1 )

22

See Pesendorfer and Swinkels (2000) and Goeree and Offerman (2003).

When n > 2, the agents’ payoffs may increase or decrease with information revelation depending on the

distributions of signals, and thus the change in the seller’s profit is uncertain.

23

19

The ex ante expected payoff of agent 1 is

Z c1

∗∗

π = Ev1 ,s1

(u(c1 , c2 ) − b(c2 ))fc (c2 )dc2

cL

where agent 1 wins when c1 > c2 . Conditional on c2 , the value for agent 1 is u(c1 , c2 ) =

c1 + E(s2 |c2 ), and the price to pay is agent 2’s bid which is b(c2 ) = c2 + E(s1 |c1 = c2 ). Since

E(s2 |c2 ) = E(s1 |c1 = c2 ), we have

Z c1

∗∗

(c1 − c2 )fc (c2 )dc2

π = Ev1 ,s1

cL

In order to show π ∗∗ ≥ π ∗ , we need this claim:

Claim 2 If x and y are two independent variables with mean 0 and symmetric density h(x)

and k(y)24 on [−x∗ , x∗ ] and [−y ∗ , y ∗ ] , then

Z

Z x∗

(x + y)h(x)k(y)dxdy ≥

xh(x)dx

(2)

x+y>0

0

The proof is in the Appendix and Equation (2) can be re-written as

Z z∗

Z x∗

zhz (z)dz ≥

xh(x)dx

0

(3)

0

where z = x + y, z ∈ [−z ∗ , z ∗ ], and hz (z) is the density of z. Take x = v1 − v2 , y = s1 − s2

and z = x + y = c1 − c2 , π ∗∗ ≥ π ∗ is true by (3).

The expected payoffs of agents decrease with information revelation while the social

welfare increases as discussed in Corollary 1, thus the seller’s expected profit must increase.

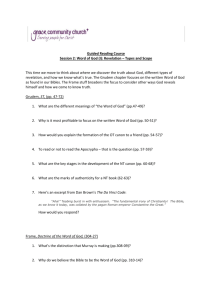

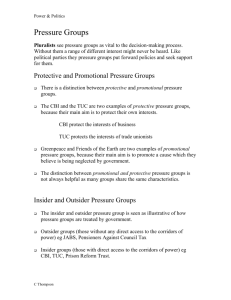

Figure 1 shows the cumulative distribution functions of the changes in social welfare

and the seller’s profits with 100 simulations.25 Figure 1(Up) shows that with about 80%

probability, there is no change in social welfare, and with the remaining 20% probability,

there is an increase in social welfare with information revelation. Figure 1(Down) shows that

with about 20% probability, the seller’s profit decreases with information revelation, mainly

because low common-value signal is revealed, and with the remaining 80% probability, the

seller’s profit increases with information revelation, mainly because of the increase in social

welfare or the revelation of high common-value signal. Overall, the seller’s expected profit

increases with the revelation of common-value signals. The intuition of the decrease in agents’ payoffs and the increase in the seller’s profit is easy

to see in pure common-value auctions. If signals are common knowledge, all agents submit

24

Symmetry suggests h(x) = h(−x) and k(y) = k(−y).

When vi and si are uniformly distributed in [0, 1], the equilibrium bidding strategy with no information

revelation is b(ci ) = 3/2ci .

25

20

Cumula.ve Distribu.on Func.on of Welfare with Info Revela.on -­‐ Welfare without Info Revela.on 1 probability 0.8 0.6 0.4 0.2 0 -­‐0.4 -­‐0.3 -­‐0.2 -­‐0.1 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 Welfare with Info Revela=on -­‐ Welfare without Info Revela=on Cumula.ve Distribu.on Func.on of Seller's Profit with Info Revela.on -­‐ Profit without Info Revela.on 1 probability 0.8 0.6 0.4 0.2 0 -­‐0.4 -­‐0.3 -­‐0.2 -­‐0.1 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 Profit with Info Revela>on -­‐ Profit without Info Revela>on Figure 1: Cumulative distribution functions for the differences (values with information

revelation minus those without information revelation) for social welfare (up) and the seller’s

profits (down), based on 100 simulations. The settings follow Example 4 where all signals

are uniformly distributed in [0, 1].

21

the same bid, which is the true common value in the equilibrium. Thus, the expected payoff

is 0 for all agents. However, if signals are private information, agents generally have positive

expected payoffs. So with full information revelation, agents’ expected payoffs decrease and

the seller’s expected profit increases.

In reality, communication is restricted by rules, such as the anti-trust law. One potential

policy implication of this welfare analysis is that laws shouldn’t restrict certain kinds of

communication, for instance the public announcement with verifiable evidence about the

common value.

5

Extensions of Theory

In this section, two extensions are considered: (i) communication of private values; (ii)

incentives of acquiring the common-value signals.

5.1

Communication Including Private Values

In this part, agents can reveal their private values in addition to their common-value signals:

ri (vi , si ) ∈ 4{(vi , si ), (vi , ∅), (∅, si ), (∅, ∅)}

The set of PBE is still non-empty: there exists a common-revealing and private-hiding

equilibrium where the common-value signals are revealed and the private values are hidden.

Let’s start with examining agents’ incentives to reveal private values when q is common

knowledge.

Proposition 3 There exists a private-hiding equilibrium in first-price auctions with linear

values and any second-price auction, when q is common knowledge.

The proof is in the Appendix. The intuition is similar to most literature on information

revelation in auctions: no incentive to reveal the only signal, because otherwise agents completely lose their information advantage. Moreover, Kovenock, Morath and Munster (2010)

obtain a similar result for all-pay auctions. Combining Theorem 1 and Proposition 3, we

can get a full description of the revelation strategies in equilibrium.

Proposition 4 There exists a common-revealing and private-hiding equilibrium in firstprice auctions with linear values and any second-price auction.

Proof of Proposition 4: The common-revealing and private-hiding equilibrium includes

revelation and bidding strategies and a belief system. For strategies, agents reveal their

22

common-value signals, hide their private values, and bid according to the equilibrium bidding

strategies in these auctions. For the belief system, if no common-value signal is revealed, all

other agents believe the signal is sH .

The proof of Theorem 1 shows that the bidding strategies are best responses, the belief

system is consistent, and agents don’t have incentives to hide any common-value signal.

From Proposition 3, agents don’t have incentives to reveal any private value. So the only

thing that we haven’t checked is a double deviation, e.g. one agent revealing vi and hiding

si . Suppose agent i does this double deviation, other agents believe si = sH . I claim that

this double deviation cannot be profitable, because other agents bid higher under the belief

A

(vi , q) = u(vi , q). In firstsi = sH . In second-price auctions, agents bid their valuation bSP

i

0

FPA

FPA

price auctions, bi (vi , q ) = bi (vi , q) + (1 − λ) which is true even if agent i reveals vi .

Thus no deviation is profitable and the equilibrium is valid.

Enlighten by Example 1, we wonder whether there exists another equilibrium where

private values are revealed and common-value signals are hidden. I claim that in general,

this equilibrium doesn’t exist. Suppose this equilibrium happens; the revealed private values

are almost surely different among agents, so they are asymmetric. Benoit and Dubra (2006)

examine such asymmetric one-signal auctions and show agents have incentives to reveal

common-value signals, because low common-value signals can lower agents’ bids. Since

agents want to deviate from the revelation strategies, the private-revealing and commonhiding equilibrium doesn’t exist. In addition, if the common-value signals are fully revealed,

agents don’t have incentives to fully reveal their private values as shown in the next claim.

The following claim shows that there doesn’t exist a private-revealing equilibrium in

first-price auctions with linear values.26

Claim 3 There doesn’t exist a private-revealing equilibrium in first-price auctions with linear

values, when q is common knowledge.

Proof of Claim 3: Suppose there exists one private-revealing equilibrium, and let v(1) be

the highest private value and v(2) be the second highest one. I claim that in the first-price

auction, all possible equilibrium behaviors are equivalent to the following one: (i) If there are

multiple agents with v(1) , at least two of them must bid v(1) because of competition; (ii) If

there is only one agent with v(1) , this agent bids v(2) and wins with probability one. Part (ii)

is proved in 2 steps. First, the agent with v(1) won’t bid higher than v(2) because all others’

bids are at most that high by undomination. Suppose the agent with v(1) bids strictly lower

than v(2) with a positive probability, the agent with v(2) could bid close enough to v(2) and

earn a positive payoff. In that case, the agent with v(1) wants to deviate and bid higher than

26

In second-price auctions, private-revealing equilibrium is identical to private-hiding equilibrium.

23

the agent with v(2) . So the agent with v(1) must bid v(2) with probability 1, and the agent

with v(2) must use a mixed strategy in the equilibrium.

Now consider some agent i deviates from the private-revealing equilibrium by hiding the

i

be the highest signal from other agents.27 We claim the agent

signal vi > vL , and let v(1)

i

i

with probability 1 in the equilibrium after agent

must bid strictly lower than v(1)

with v(1)

i deviates. It is proven in two cases depending on the common belief of vi . First, if it is

i

with a positive probability, the agent

common belief that the hidden vi is lower than v(1)

i

i

. Second, if it is the

with v(1) earns a positive expected payoff by bidding lower than v(1)

i

common belief that the hidden vi is higher than v(1) with probability one28 , it is similar to

i

i

uses a

and the agent with v(1)

case (ii) above such that in the equilibrium, agent i bids v(1)

i

mixed strategy which is lower than v(1) with probability 1. Thus agent i is strictly better off

i

, agent i now have a chance of winning with a positive payoff while

by hiding vi : if vi ≤ v(1)

i

i

there are no such chance without the deviation; if vi > v(1)

, agent i could still bid v(1)

(or

even lower) which is identical to the case when vi is revealed. So, the deviation is profitable

which means the private-revealing equilibrium is not valid.

5.2

Incentives of Acquiring Common-Value Signals

In a lot of applications, agents need to pay some cost in order to get signals of the commonvalue component. For instance, firms need to hire experts to estimate the potential value of

a forest or an oil tract, or individuals need to pay for the inspection of a house.

In this subsection, incentives of acquiring information about the common-value component are explored. I focus on the oil-drilling example because it has a unique prediction of

the equilibrium. The timeline is as follows. At time 0, the insider first observes the privatevalue cost (cI ), and then makes a choice whether to acquire information or not.29 The insider

decides whether to pay a positive cost and acquire the quantity or not pay the cost and not

acquire the quantity. If the insider doesn’t acquire the quantity, both bidders hold the same

prior belief about q, which takes value from {qL , qM , qH } with probability pL , pM and pH .

Between time 0 and time 1, the insider observes q if choosing to acquire information. The

rest of the game proceeds as before.

There are two possibilities about the common knowledge after time 0: whether the

action of acquiring information is publicly observed by the outsider or not. Both of these

27

i

i

We only need to consider the case where there is only one agent has v(1)

and v(1)

> vL , because other

cases have zero probability.

28

i

There is another case where the common belief is vi = v(1)

. Since agent i chooses to hide vi before

i

knowing v(1) , the probability of this case is 0 and omitted.

29

I look at the ex post question where the insider observes cI before making acquisition decision. The

result of ex ante question, where the insider makes acquisition decision before observing cI , is the same.

24

possibilities fit some applications, and they lead to different results. On one hand, if the

action of acquiring information is observable, in the end of time 0 it is common knowledge

whether the insider observes the quantity or not. It fits the applications like offshore oildrilling auctions, where the action of investigation is easy to detect. On the other hand, it

is possible that agents could privately investigate the common-value component or purchase

information from consulting firms. The following proposition states the results separately

for these two possibilities:

Proposition 5 Consider the oil-drilling example:

• If the action of acquiring information is overt, no information is acquired in all iteratively undominated perfect Bayesian equilibria;

• If the action of acquiring information is covert and the cost of information is small

enough, some information must be acquired in all undominated perfect Bayesian equilibria.

Proof of Proposition 5: In the first case, the action of acquiring information is observable.

If the insider pays the cost and acquires the quantity information, by Proposition 1 all

iteratively undominated equilibria are common-revealing equivalent, and both bidders bid

the true value. The insider’s expected payoff is

Z cH

a

π (cI ) = Eq

(cO − cI )qf (cO )dcO

cI

On the other hand, if the insider chooses not to acquire the information, both agents only

know the prior distribution of the quantity, and bid the expected value because they are

risk-neutral. The insider’s expected payoff is

Z cH

na

π (cI ) =

(cO − cI )Eqf (cO )dcO

cI

Thus, in time 0, the insider’s expected payoffs are the same between acquiring the quantity

information or not. However, acquiring information requires a positive cost, such that it is

not profitable.

In the second case, the action of acquiring information is not observable. Supposing there

is an equilibrium where the insider doesn’t acquire the quantity information, we claim that

the insider has incentives to deviate when the cost of acquiring information is small enough.

In particular, there exists c∗I ∈ (cL , cH ) such that: if the insider has cI ∈ [c∗I , cH ], he/she is

strictly better when observing q = qH and weakly better otherwise; and if the insider has

cI ∈ [cL , c∗I ], he/she is strictly better when observing q = qL and weakly better otherwise.

25

When q = qH , the insider doesn’t have incentives to reveal this signal. The insider’s bid

when observing qH is (p − cI )qH , instead of (p − cI )Eq when not acquiring information. With

the higher bid, the insider wins with a higher probability.

(p − cI )Eq < (p − cO )Eq < (p − cI )qH

(4)

where the left inequality means the insider doesn’t win when not acquiring the information,

and the right inequality means the insider wins when observing qH (ignoring tie here). ConqH

−Eq

−Eq

dition (4) implies cO ∈ ( Eq

cI − qHEq

p, cI ), and the length of the interval is qHEq

(p − cI ).

qH −Eq

Let δ = min( Eq (p − cH ), cH − cL ) is the shortest length of all intervals, and define

c∗I = cH − δ/2. For all cI ∈ [c∗I , cH ], cO ∈ (cH − δ, c∗I ) guarantees condition (4). With the

additional probability of winning, the additional gain is at least:

Z c∗I

H

((p − cH )qH − (p − cO )Eq)f (cO )dcO

4π =

cH −δ

When q = qL , the insider reveals this signal. The outsider’s bid when observing qL is

(p − cO )qL , instead of (p − cO )Eq when not observing qL . With the outsider’s lower bid, the

insider (with cI ∈ [cL , c∗I ]) wins with the same probability but pays a lower price:

Z cH

L

(p − cO )(Eq − qL )f (cO )dcO

4π =

c∗I

where (p − cO )(Eq − qL ) is the change of the price.

The insider always can make the outsider submit the same bid by hiding the signal q,

such that the insider is always weakly better off. Let = min(4π H pH , 4π L pL ), the insider

earns a higher expected payoff by deviating and acquiring q if the cost is smaller than .

I remark that if the insider has a choice of whether acquire the information overtly or

covertly, he/she should choose to acquire the information covertly. Because if the information

is acquired overtly, it will be revealed publicly in the communication stage and yields no

benefit to the insider. On the other hand, if the information is acquired covertly, the agent

could hide positive information, show negative information, and earn a higher payoff. This

gives a different prediction against Milgrom and Weber (1982b).

Moreover, the social welfare could be ranked in the following way: It is optimal if no

information is acquired, such that no cost (assumed to be loss of the society) is spent to

acquire information and the winner is the agent with a lower cost of extraction; it is the

second best if information is acquired and revealed, such that the loss is only the cost of

information; it is the worst if information is acquired and concealed, where the loss includes

both the cost of information and the possibility of a misallocation. Thus, for a social planner,

it is best if acquiring information action is overt, then in equilibrium no information is

acquired.

26

6

Experiment Design and Results

The experiment is designed to be the same as the oil-drilling example, except adding a

positive cost to any revelation.

The positive cost has two benefits. First, it strengthens any observed revelation behavior

from the experiments: agents must believe revealing the signals is profitable enough when

choosing to reveal them. Without the positive cost, we cannot distinguish whether agents

truly find the revelation profitable or they just randomize since the revelation is free. If we

consider an application where revelation is free, if anything, more signals would be revealed.

Second, introducing the cost eliminates the multiplicity of equilibrium behaviors. For example, theory now predicts no revelation of the low common-value signal in pure common-value

auctions, instead of indifference between revealing or not when it is not costly. Adding the

cost requires some additional examinations of the theory, but it worths the price.

6.1

Theory

Consider a second-price auction with two bidders, labeled as one “insider” and one “outsider”. Bidder i observes his/her private value vi , and the insider observes the common value

q.

The private value vi is identically independently chosen from a finite set of positive

values V , where v j ∈ V (0 < v 1 < v 2 < ... < v m ) is chosen with a probability of pj such that

Pm

j=1 pj = 1. The common value q is randomly chosen from {qH , qM , qL } (qH > qM > qL > 0)

with probability pH , pM and pL such that pH + pM + pL = 1. Bidder i’s valuation is the sum

of his/her private value and the common value

ui = vi + q

There are 2 different treatments of values: (i) pure common value: private values are 0 for

both bidders; (ii) two-dimensional values: private values are randomly chosen from V .

Pure Common Valuation

The timeline of the game is as follows: At time 0, the insider privately observes the true

common value q; at time 1, the insider decides whether to truthfully reveal q to the outsider

with a cost > 0 or hide it with no cost; at time 2, the outsider observes the insider’s

revelation decision and the true common value q if it is revealed, and both bidders bid in a

second-price auction.

The positive cost of revelation eliminates the indifference between revealing and concealing the low common value in Claim 1, so all common values are now fully concealed.

27

Claim 4 Consider the second-price auction with two bidders (one insider and one outsider),

pure common value and a positive revelation cost, in all undominated perfect Bayesian equilibria, all common-value signals are concealed.

Proof of Claim 4: First eliminate all weakly dominated bidding strategies in the secondprice auction. The remaining strategy for the insider is bidding the true value u = q, and

for the outsider is as follows: bidding the true value q if it is revealed, and bidding in an

interval from the lowest to the highest possible value otherwise, bO ∈ [qL , qH ].

Then check the insider’s revelation strategy: If the insider reveals the common value

(by paying a cost ), the outsider bids q and the payoff for the insider is −; if the insider

doesn’t reveal the common value, the outsider bids in an interval of [qL , qH ], and the payoff

for the insider is either positive or 0. Thus, revealing the common value is strictly worse

than concealing it. In all undominated perfect Bayesian equilibria, all common-value signals

are concealed.

Two-Dimensional Valuations

When changing from the pure common value to two-dimensional valuations, incentives of

sharing the common value change from no revelation to positive revelation.

The updated timeline is as follows: At time 0, the insider privately observes the common

value q and own private value vI , and the outsider privately observes own private value vO ;

at time 1, the insider decides whether to truthfully reveal q to the outsider with a cost > 0

or hide it with no cost30 ; at time 2, the outsider observes the insider’s revelation decision and

the true common value q if it is revealed, and both bidders bid in a second-price auction.

Claim 5 Consider the second-price auction with two bidders (one insider and one outsider)

and valuations with both common and private values, when the revelation cost is small

enough, there exists an equilibrium where the insider reveals q when vI > v 1 and q < qH ,

conceals q otherwise, and the outsider bids as if q = qH when q is concealed.

Proof of Claim 5: Construct the equilibrium as follows: The insider reveals q when vI > v 1

and q < qH , conceals it otherwise, and always bids q + vI ; the outsider bids q + vO if q is

revealed, and bids qH + vO otherwise. In order to show it is an equilibrium, we need to prove

the insider doesn’t want to deviate from the revelation strategy and the outsider doesn’t

want to deviate from the bidding strategy.

Check the outsider’s bidding strategy first. When q is concealed, there are two possibilities: (a) vI = v 1 , and (b) q = qH . If (b) is true, bidding qH + vO is the outsider’s unique

30

Same as the oil-drilling example, subjects are only allowed to reveal common-value signals in the experiments.

28

undominated strategy. If (a) is true, the insider’s bid is q + v 1 , and the outsider’s value is

uO = q + vO , which is equal to or larger than the insider’s bid since vO ≥ v 1 . The outsider

earns a non-negative payoff when winning, so there is no incentive to deviate.

Then, check the insider’s revelation strategy. The insider doesn’t have an incentive to

reveal q when (a) or (b) above is true. If (a) is true, the insider earns 0 when revealing q but

needs to pay ; if (b) is true, the insider’s revelation of qH doesn’t change the outsider’s bid

but costs . We claim that the insider has incentives to reveal q when q < qH and vI > v 1 .

If the insider reveals q, the outsider bids q + vO , and if the insider conceals q, the outsider

bids qH + vO . If the insider wins in both cases, the price is lower by qH − q, and if the insider

wins only in one case (this must be the case with revelation), the winning payoff is vI − vO .

With probability p1 , vO = v 1 and at least one of the above is true. The increase in payoff by

revealing q is at least

4 = p1 min(vI − vO , qH − q)

= p1 min(v 2 − v 1 , qH − qM )

When < 4, the insider prefers to reveal q.

In the experiments, = 1, both v and q are randomly selected from {10, 30, 50} each

with a probability of 1/3. Thus,

4 =

1

20