Annual Report FINAL/ALL.ddi - ITT Educational Services, Inc.

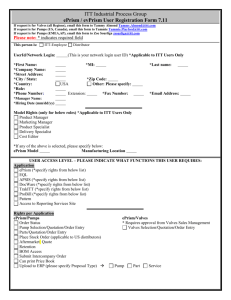

advertisement