Empirical testing of CAPM and APT models

advertisement

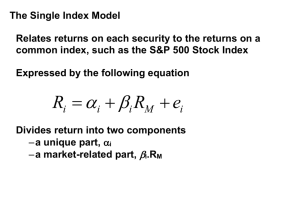

Empirical testing of CAPM and APT models Author: Ştefan Robert Coordinator: Laura Obreja Braşoveanu Key words: Arbitrage pricing theory (APT), Capital asset pricing model (CAPM), expected return, data analysis, stocks, testing Abstract This paper investigates the determinants of stock returns in Bucharest Stock Exchange (BVB) using both frameworks, the classical CAPM and the statistical APT model. The analysis is conducted with monthly data from the Romanian stock market. The purpose of the research is to identify possible reasons for deviations from the theories. The conclusions arrived at through data analysis reveal weak correlation between realized excess returns and the expected return based on CAPM. In the case of APT model, the study reflects that macroeconomic factors including changes in inflation, exchange rate and market return are relevant for the business companies. Introduction CAPM was introduced by Sharpe, Linter and Mossini and four decades later is still widely used in applications, as the evaluation of managed portfolios performance.It formalized one of the important and majors problems in finance ,the quantification of the trade-off between risk and expected return. Ross introduced the APT as an alternative to the CAPM. APT is supposed to be superior than CAPM, because it requires less and more realistic assumptions, but also its explanatory power is better than CAMP’s ,because is a multifactor model .However which model is better academicians are divided between CAPM defenders, like Sharpe, APT defenders, as Fama and French and finally academicians and researchers, who are questioning the testability and performance of both models , like Shankenand Dhrymes . 1 In this paper we estimate CAPM and APT using the stocks prices of four companies assets. Before this, we construct a market portfolio and we consider each stock as an separate asset. The structure of the paper consists of several chapters. Chapter two includes a summary of the literature review on CAPM and APT. Chapter three describes the research methodology used. Chapter four proceeds to the statistical analysis of the two financial models. Finally, the last two chapters ends the paper with all important empirical results and conclusions deriving from the preceding statistical analysis and the comparison of the two models, CAPM and APT. Literature review Finance was transformed with the publication of the Markowitz article on Portfolio Selection. The most important contribution made by Markowitz is his distinction between the variability of returns of an individual security and its contribution to the riskiness of a portfolio. He notes that, in trying to make variance small, an investor is not enough to invest in many securities. It is necessary to avoid investing in securities with high covariances among themselves. After the publication of Markowitz's1 Portfolio Selection book, Treynor2 (1961) started intensive work on the theory of asset pricing. After a time since Treynor began his work on asset pricing, Sharpe also set out to determine the relationship between the prices of assets and their risk attributes. The paper published by Sharpe (1964) notes that through diversification, some of the risk inherent in an asset can be avoided so that its total risk is obviously not the relevant influence on its price; unfortunately little has been said concerning the particular risk component which is relevant. Sharpe3 aims to use the theory of portfolio selection to construct a market equilibrium theory of asset prices under conditions of risk and notes that his model sheds considerable light on the relationship between the price of an asset and the various components of its overall risk. 1 Markowitz, H.M. (1959). Portfolio Selection: Efficient Diversification of Investments Treynor, J. (1961) Toward a Theory of the Market of Risky Assets, unpublished manuscript. 3 Sharpe W.(1964), Capital Asset Prices: A Theory of Market Finance, Vol 19, No. 3, pp 425-442; W. Sharpe a fost laureat al premiului Nobel in economie. 2 2 After the publication of the Sharpe (1964), Lintner4 (1965) and Mossin5 (1966) articles, there was a wave of papers seeking to relax the strong assumptions that sustain the original CAPM. In general, the empirical results have offered very little support of the CAPM, although most of them suggested the existence of a significant linear positive relation between realised return and systematic risk as measured by beta. However, the special prediction of SharpeLintner version of the model, that a portfolio uncorrelated with market has expected return equal to risk free rate of interest, has not done well, and the evidence have suggested that the average return on zero-beta portfolios are higher than risk free rate. Most of the early empirical testing of CAPM has employed the methodology of two-stage examination, first estimating betas using time series regression, and then, running a cross section regression using the estimated betas as explanatory variables to test the hypothesis implied by the CAPM. APT, founded upon the work of Ross (1976), aims to analyse the equilibrium relationship between assets’ risk and expected return just as the CAPM does. Moreover, in line with the CAPM, the APT assumes that portfolios are sufficiently diversified, so that the contribution to the total portfolio risk of assets’ unique (unsystematic) risk is approximately zero. The first difference is, that the CAPM was essentially derived from a single- factor model, more exactly from a process generating asset returns which was only a function of returns unique to the asset (predictable and unpredictable) and returns on two factors, the market portfolio itself and the risk less asset, or the zero-beta portfolio. The sensitivity of the asset’s returns to the markets was defined as the asset’s beta, measuring systematic risk, while the unsystematic risk of the asset tended to zero through diversification. APT can then be seen as a multi-factor model, so, one in which the returns generating process of the portfolio is a function of several factors, generally excluding the market portfolio. Possible factors may include particular sector-specific influences, such as price-dividend ratios, leverage, and stock size, as well as aggregate macroeconomic variables such as inflation and exchange rates. The second difference between the CAPM and the APT has to do with the equilibrium notion. In contrast to the CAPM’s assumption of an efficient market portfolio, which every 4 Lintner, J. (1965) The Valuation of Risk Assets and the Selection of the Risky Investments in Stock Portfolios and Capital Budgets", The Review of Economics and Statistics, pp 13-37. 5 Mossin, J. (1966)Equilibrium in a Capital Asset Market, Econometrica, pp 768-783. 3 investor desires to hold, the APT relies on the absence of free arbitrage opportunities. In particular, two portfolios with the same risk . An investor could then guarantee a risk less positive expected return by short-selling one portfolio and holding an equal and opposite long position in the other. As such, free arbitrage cannot persist; equilibrium in the APT specifies a linear relationship between expected returns and the betas of the corresponding risk factors. The short-selling assumption is crucial to the equilibrium, as it constitutes one side of the arbitrage portfolio. Testing the APT is tricky. Arbitrage arguments can only be used to provide an approximate factor pricing equation for some unknown number of unidentified factors. Shanken (1982), however, argues that testing requires an exact pricing equation, which in turn requires additional assumptions. Roll and Ross6 (1980) put forth a series of arguments to support the contention that the APT could be rejected without having to rely on exact factor pricing. This explains why, from the very earliest APT tests, it was always considered essential to check the cross-sectional relation between sample mean returns and factor betas. The prime candidate which should not be there is a beta against a market index. But own variance and other variables were also tried. Of course, one can never prove the absence of arbitrage, but one could certainly demonstrate its existence and hence reject the APT. The Arbitrage Pricing Theory of Ross (1976) provides a theoretical framework to determine the expected returns on stocks, but it does not specify the number of factors nor their identity. Hence, the implementation of this model follows two avenues: factors can be extracted by means of statistical procedures, such as factor analysis or be pre-specified using mainly macro-economic variables. 6 Ross, "The Arbitrage Theory of Capital Asset Pricing" 4 Empirical review When testing the validity of the CAPM in the real world, there are two key questions. First, how stable is beta? It is important to establish the validity of past betas for predicting stock returns in the future, since beta measures the only risk under consideration. Second, is there a positive linear relationship as hypothesized between beta and the rate of return on risky assets? More specifically, how far is the CAPM equation able to explain stock market returns. Various tests have also been conducted to test the usefulness of CAPM in explaining returns on risky assets and the existence of a significant positive linear relationship between beta and stock returns. Black, Jensen and Scholes7 (1972) studied the risk and return relationship for portfolio of stocks and found a positive linear relationship between monthly excess return i.e. return over and above the risk free rate and portfolio beta, although the intercept was higher than the expected value. Fama and French8 (2004) revealed that empirical work since the late 1970s challenged the Black version of the CAPM. Specifically, evidence assemble that much of the variation in expected return is unrelated to market beta. Validity of CAPM and APT has been empirically tested by researchers for various markets across the world. A study involving 100 quoted companies of China quoted on the Shanghai Stock Exchange was done by Xi Yang9 in 2006. This study which covered the period from the year 2000 to 2005 showed that for the Shanghai stock market, CAPM was not a valid predictor for stock prices. The study revealed that in line with CAPM, the expected stock returns and their betas had a linear relationship. Cagnetti10 (2008) studied stocks belonging to six different sectors from companies quoted on the Milan Stock Exchange. He examined the linkage of the sign of market returns with company beta and found that the intercept in line with CAPM was equal to zero, thereby 7 Black, F., Jensen, M.C., Scholes, M.S., The pricing of commodity contracts,Journal of Financial Economics, Vol.3, (1)1976, pp. 167-179. 8 Eugene Fama, Kenneth French (1999): Value versus Growth: International Evidence, The Journal of Finance 9 Yang, Xi and Xu, Donghui (2006), Testing the CAPM Model, A Study of the Chinese Stock Market 10 Cagnetti A (2007) CAPM and APT in the Italian stock market: an empirical study. 5 evidencing the importance of market risk premium as the sole relevant variable in the regression. Thus, it could be inferred that stock betas could totally explain the cross sectional changes in expected excess returns and consequently serve as a valid determinants of asset risk. Statistical tests making use of a fifteen-year data sample of monthly returns analyzed the linkage of the sign of market returns with beta coefficients. It was found that a positive relationship existed between market returns of stocks and their betas when the market was going up but the relationship reversed when the market, on the average, was going down. Study case For the study of the CAPM and APT models we chose to analyze the evolution of four companies assets transactioned in Bucharest Stock Exchange (BVB), from different activities sectors. Data were taken over a period of 10 years. The selected companies are: DAFORA S.A, ANTIBIOTICE S.A, SIF 1 and OIL TERMINAL S.A. Those assets are not random, they are representative firms in our local economy. The series of values were constructed with monthly values of closing prices. For estimating this models we considerated as variables of interest, the following: BET-C (stock index), CV (exchange rate) and IPC (inflation rate). Before applying regressions were tested stationarity, collinearity and heteroskedasticity for the interest variables. After performing these tests we implemented the empirical testing of CAPM and APT models by using the specified variables of interest. Conclusions The Arbitrage Pricing Theory performs better, compared to the CAPM, in all the tests considered. From the evidence gathered in this study, the APT is a more powerful method that allows consideration of the risk borne on additional systematic “state variables”, other than the market portfolio. 6 The study was originally designed to compare CAPM and APT, but one of the main results obtained, is the appreciation of the wide range of potentialities offered by a relatively new tool used in testing the APT: factor analysis. The overall conclusion of the study is that even if the market return is an important element, the behaviour of securities’ returns in the BVB is complex and cannot be fully explained by a single factor. Shares and portfolios are significantly influenced by a number of systematic forces and their behaviour can be explained only through the combined explanatory power of several factors or macroeconomic variables. Considering that the APT does not explain the overall variance, we can ask ourselves where the missing information is, and why the APT fails to explain fully the returns’ covariance’s and means returns. Bibliography a. Sharpe, W.F (1964) Capital Asset Prices: A theory of market Equilibrium under Condition of Risk. Journal of finance. b. Lintner, J (1965) Security Prices, Risk and Maximal Gains from Diversification. Journal of Finance. c. Mossin J. (1966): " Equlibrium in a Capital Market ", Econometrica. d. Black, F., Jensen, M.C. and Scholes, M. (1972) The capital Asset Pricing Model: Some empirical tests. Studies in the Theory of Capital Markets. New York: Praeger. e. Roll R. and Ross S. (1980) " An empirical Investigation of the Arbitrage Pricing Theory " . Journal of Finance f. Cagnetti, A.(2002) - "CAPM and APT in the Italian Stock Market: an empirica!study", Management School and Economics, University of Edinburgh. g. Fama,E.F and French (2004) The capital Asset Pricing Model: Theory and Evidence. The Journal of Economic Perspectives. h. www.bvb.ro i. www.kmarket.ro 7 Annexes 8 9