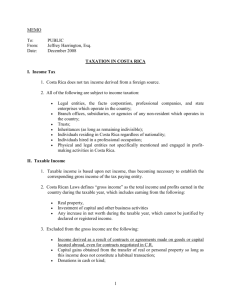

taxable entities, tax formula, introduction to property transactions

advertisement