INTERNAL CONTROL POLICY AND PROCEDURES

advertisement

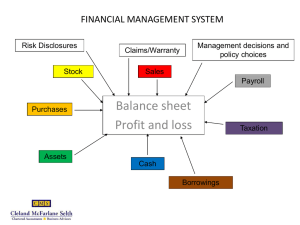

INTERNAL CONTROL POLICY TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY AND PROCEDURES Rev 03 (13th July 2010) 1 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY TABLE OF CONTENTS INTERNAL CONTROL POLICY ......................................................................................... 4 LEGISLATION AND REFERENCES ................................................................................................................. 4 (1) Legislation ............................................................................................................................... 4 (2) Council Governance Framework ...................................................................................... 4 POLICY ............................................................................................................................................................ 4 (1) Policy Scope ........................................................................................................................... 4 PRINCIPLES ..................................................................................................................................................... 5 ROLES AND RESPONSIBILITIES ...................................................................................................................... 5 BACKGROUND .............................................................................................................................................. 6 PROCEDURES ................................................................................................................................................. 6 REVIEW AND EVALUATION OF POLICY ..................................................................................................... 6 AVAILABILITY OF THE POLICY ...................................................................................................................... 6 RECORD OF AMENDMENTS ........................................................................................................................ 7 INTERNAL CONTROL PROCEDURES ................................................................................ 8 1. 2. 3. 4. 5. 6. 7. 8. Definition ............................................................................................................................................... 8 Internal Control Policies ..................................................................................................................... 8 Internal Control Framework .............................................................................................................. 8 Purchases and Payments System .................................................................................................... 8 4.1 Creditors .................................................................................................................................. 8 4.2 Purchase Orders/Works Orders ........................................................................................... 8 4.3 Petty Cash and Travelling Allowances .............................................................................. 9 4.4 Credit Cards ......................................................................................................................... 10 4.5 Receipt of Good/Services ................................................................................................. 11 4.6 Processing Invoices ............................................................................................................. 11 4.7 Payments .............................................................................................................................. 12 4.8 Reconciliations ..................................................................................................................... 12 4.9 Other ...................................................................................................................................... 13 Payroll Systems ................................................................................................................................... 13 5.1 Changes in Employee Details ........................................................................................... 13 5.2 Time Recording .................................................................................................................... 13 5.3 Leave Entitlements .............................................................................................................. 13 5.4 Payment ................................................................................................................................ 14 5.5 Records ................................................................................................................................. 14 5.6 Group Certificates............................................................................................................... 14 General Receipts and Debtors System ......................................................................................... 14 6.1 Receipts (Counter & Mail) ................................................................................................. 14 6.2 Banking .................................................................................................................................. 15 6.3 Bank and Investment Accounts ....................................................................................... 15 6.4 Investments ........................................................................................................................... 15 6.5 Invoicing ................................................................................................................................ 15 6.6 Loan Borrowings................................................................................................................... 16 Rates .................................................................................................................................................... 16 7.1 Determination of Rates ...................................................................................................... 16 7.2 Rates Notices - Generation ............................................................................................... 17 7.3 Rates Fines ............................................................................................................................ 17 Fixed Assets......................................................................................................................................... 17 8.1 Additions and Disposals ..................................................................................................... 17 8.2 Classification and Capitalisation Policies ....................................................................... 18 8.3 Recording/Registers ............................................................................................................ 18 8.4 Year End Considerations .................................................................................................... 18 8.5 Other ...................................................................................................................................... 18 Rev 03 (13th July 2010) 2 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY 9. Stock .................................................................................................................................................... 19 9.1 Stock Policy ........................................................................................................................... 19 9.2 Physical Storage .................................................................................................................. 19 9.3 Issues and Returns ............................................................................................................... 19 9.4 Stock-Takes (Fuel and Oil) ................................................................................................. 19 9.5 Year End Considerations .................................................................................................... 19 10. General Ledger .................................................................................................................................... 19 10.1 Journals.................................................................................................................................. 19 10.2 General ................................................................................................................................. 20 10.3 Budgetary Control ............................................................................................................... 20 10.4 Annual Financial Statements ............................................................................................ 20 11. Other ...................................................................................................................................................... 20 11.1 Access Controls – Property ................................................................................................ 20 11.2 Access Controls – Computer ............................................................................................ 20 11.3 Internal ................................................................................................................................... 21 11.4 Prescribed Services ............................................................................................................. 21 11.5 Registers ................................................................................................................................ 21 11.6 Hiring of Properties .............................................................................................................. 21 11.7 Trust Funds ............................................................................................................................. 22 11.8 Subsidiaries of Council ........................................................................................................ 22 11.9 Computer Environment ...................................................................................................... 22 11.10 Records Retention and Destruction ................................................................................ 22 11.11 Records Security .................................................................................................................. 22 11.12 Insurable Risk ........................................................................................................................ 22 11.13 Machinery Costs and Indirect Expenditure – Allocation ............................................. 22 11.14 Elected Members ................................................................................................................ 22 11.15 Activity Based Costing........................................................................................................ 23 11.16 Westpac Bank In-Store ....................................................................................................... 23 Rev 03 (13th July 2010) 3 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY INTERNAL CONTROL POLICY LEGISLATION AND REFERENCES (1) Legislation S125 of the Local Government Act 1999 requires Councils to have Internal Control Policies. The Act does not prescribe the content of these policies, procedures and practices. S126 states that a Council may have an Audit Committee and states what the functions of an audit committee may include. S130 states that the Chief Executive Officer must provide assistance to the auditor in the conduct of his/her duties. Regulation 14.2 states that the auditor must give due consideration to Council‟s policies, practices and procedures of internal control under S125 in forming an opinion on the financial accounts per S129. The Australian Auditing Standards require Councils to have systems of internal controls sufficient for the auditor to be able to form an opinion on the financial accounts. (2) Council Governance Framework Internal Control and Risk Management are key elements of this framework. POLICY Council shall develop and maintain such management structures, organisational behaviors, policies, procedures, records and methods of reporting that are necessary to collectively ensure that the financial and non-financial operations of Council is conducted in an orderly and efficient manner to achieve Council‟s objectives by: Assessing and containing the risks faced by Council to an acceptable level. Detecting and correcting irregularities. Safeguarding assets against loss or misuse. Ensuring financial and other records are complete and accurately and reliably reflect the conduct of Council. Preventing the misuse or misappropriation of resources. the Council's Strategic Plans and the objectives and goals contained therein are achieved; Resources are acquired economically and employed efficiently, quality business processes and continuous improvement are emphasised; The actions of all Council officers (including Council members, senior management and staff) are in compliance with the Council's policies, standards, plans and procedures, and all relevant laws and regulations (1) Policy Scope Internal Control is concerned with responding to the risk management of all of the internal operations of Council including both the financial and other operations. Internal Control is not concerned with risk management as it applies to matters external to the operations of Council. Specifically, Internal Control is not concerned with risks faced by the Council including potential disasters or political, economic and environmental risks. Rev 03 (13th July 2010) 4 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY PRINCIPLES Internal Control requires a full risk analysis of the internal operations of Council. This should be addressed within the analysis of the Control Environment. Internal control and risk management are key components of a sound governance framework. Governance concerns leadership and incorporates long-term planning, compliance, internal control, risk management, resource allocation, accountability and transparency. Internal Control is based on three elements: Control environment Information system Control procedures The control environment comprises organisational structures and culture and includes: Management operating style Levels of responsibilities and authorities Audit practices Use of information technology Human resource management practices The control environment requires Council to conduct an evaluation of the risks to which council operations are exposed. This should include both financial and non-financial risks. The information system comprises all of the records and reporting methods of Council used to maintain accountability for assets, liabilities, income and expenses and for the achievement of the objectives of council. Control procedures comprise those policies and procedures established to ensure that the objectives of council are achieved in an efficient and effective manner. These include: Document control Reconciliations Physical access controls Protection of assets Financial accounting procedures Information technology controls Budgeting and reporting Management controls Internal control is integral to risk management. In establishing and assessing internal control practices, it is necessary to recognise that in practical terms a certain level of risk will always exist within organisations. The purpose of internal control is to provide assurance that the internal risks faced by Council are contained to acceptable levels. This must be defined in respect to risk in respect to the financial, political, human resource, technical, information, and technological operations of council. ROLES AND RESPONSIBILITIES The Elected Member Body is responsible for the internal control policy of Council. The Chief Executive Officer is accountable to the Elected Member body for developing and implementing such internal controls as are necessary to ensure that the objectives of Council are achieved in an orderly and efficient manner. The management of Council is responsible for the development of adequate internal controls and for their implementation, evaluation and revision on an ongoing basis in respect to all of the functions of Council under their control. Rev 03 (13th July 2010) 5 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY The Council employees are responsible for conducting their duties in accordance with internal control policies, procedures and practices of Council. They are also responsible for reporting to management instances where they consider that internal control procedures are inadequate or are not being complied with. BACKGROUND The previous Local Government Act placed responsibility for internal control with the Chief Executive Officer. Councils have therefore always been required to maintain adequate systems of control. With the new Act placing responsibility for internal control with Council, it is necessary to clearly document and explain internal control practices in such a way that will provide sufficient confidence to Council that the organisation is being properly managed within acceptable limits of risk. Definition: Internal Control comprises those management policies, procedures and practices which collectively ensure that the level of internal risk of an organisation is contained so that its objectives are achieved in an orderly and efficient manner. Control is any action taken by management to enhance the likelihood that established objectives and goals will be achieved. Controls may be preventive (to deter undesirable events from occurring), detective (to detect and correct undesirable events that have occurred), or directive (to cause or encourage a desirable event to occur). PROCEDURES Evaluate the control environment within Council Identify and evaluate the risks faced by Council Evaluate the information system used by Council Based on the above prepare such policies and document and evaluate such procedures as necessary to maintain sound internal control. Conduct such internal audit procedures as necessary to ensure that over time the system of internal control of Council is adequate and is operating in a sound manner. In response to any matters identified, take timely remedial action. Provide from time to time such reports to management and Council to evidence the adequacy of the internal control system in operation. REVIEW AND EVALUATION OF POLICY The effectiveness of this Policy shall be reviewed at least once every four years, being the term of the Council. The Chief Executive Officer of the Council will report to Council on the outcome of the evaluation and make recommendations for amendment, alternation or a substitution of a new policy. AVAILABILITY OF THE POLICY This Policy will be available for inspection at the Council‟s principal office during ordinary business hours. Copies will also be provided to interested members of the community upon request, and upon such payment of such fee (if any) as the Council may, in its discretion, fix. Rev 03 (13th July 2010) 6 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY RECORD OF AMENDMENTS DATE 13th June 2006 8th December 2009 6th July 2010 13th July 2010 REVISION NO Rev: 00 Rev: 01 Rev: 02 Rev: 03 REASON FOR AMENDMENT Original Issue Draft Policy reviewed and adopted Policy expanded and adopted Credit card reference added and adopted by Council Rev 03 (13th July 2010) 7 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY INTERNAL CONTROL PROCEDURES 1. Definition Internal control comprises the plan of the organisation and all of the coordinated methods and measures adopted by the Council and contained within the Local Government Accounting manual, to safeguard its assets, check the accuracy and reliability of its accounting data, promote operational efficiency and encourage adherence to prescribed managerial policies. This definition possibly is broader than the meaning sometimes attributed to the term. It recognises that a “system” of internal control extends beyond those matters which relate directly to the functions of the accounting and financial departments and such a system includes budgetary control, periodic operating reports, statistical analysis and the dissemination thereof, a training programme designed to aid personnel in meeting their responsibilities and internal audit staff as needed to provide additional assurance to management as to the adequacy of its outline procedures and the extent to which they are being effectively carried out. 2. Internal Control Policies It is Council‟s policy to:Develop an adequate system of Internal Control, which will promote a high level of compliance with Council‟s policies and procedures and allow full compliance with statutory obligations. Implement and maintain this system to assist the Council in carrying out its activities in an efficient and orderly manner to ensure adherence to management policies, safeguard its assets and secure the accuracy and reliability of its records. 3. Internal Control Framework Council shall maintain accounting records and procedures of the following kind:1. Purchases and Payments System; 2. Payroll System; 3. General Receipts and Debtor System; 4. Rates; 5. Fixed Assets; 6. Stock; 7. General Ledger; and 8. Other 4. Purchases and Payments System 4.1 Creditors The following functions should be, where possible, independent of each other:receiving goods; ordering goods; invoice authorisation; invoice processing; and cheque signatories 4.2 Purchase Orders/Works Orders Purchase Orders/Works Orders/Electronic Orders should be used for the purchase of all goods and services and signed as approved by an authorised Council official as listed in Council‟s policy manual (Tenders and Purchasing policy) and taking into account delegated purchase limits. Rev 03 (13th July 2010) 8 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY It may not be necessary to issue an official order for:o fees or payments imposed under the Act; o professional fees, insurance, freight or real estate acquisitions; o payments pursuant to an award binding upon Council; or o goods purchased from petty cash. o goods/services that can only be ordered (via the internet or phone) by credit card that are required on an urgent basis. o Utilities for supply of phone services, electricity, water supply etc. o Purchases under which Council has contractual relationship, eg lawn mowing, waste collection. o Minor items purchased at local business where council has an account. E.g. Newsagency, Hardware store. In these situations the staff member shall sign the docket. Goods purchased should comply with Australian Design Standards where possible and meet Council‟s requirements in terms of Occupational Health, Safety and Welfare. Purchase/Works orders are to be pre numbered and raised in triplicate to allow copies to be immediately forwarded to the accounts area, the supplier and a copy retained in the book or alternatively electronic ordering. In this case copies of orders are not required to be kept. Purchase/Works Orders shall include the following details:suppliers name; details of goods/services ordered; Whether GST is inclusive or exclusive agreed prices when available – if prices are not available the Purchase/Works Order should at least note an estimate of the amount payable. Electronic orders require prices in all instances. account number; in the case of a Works Order, whether a head contract or not is to be signed by the contractor undertaking the service; unfilled or uncompleted Purchase/Works Orders shall be regularly followed up by the Creditors Officer and/or the person who placed the order; Unused and completed purchase/works order books are to be kept in the Bordertown Office safe, with a register maintained regularly to whom purchase order books have been issued; The purchase of goods or services may only be made in accordance with purchasing delegations under Council‟s Contracts and Tenders Policy, as amended from time to time, and pursuant to Council‟s Occupational Health, Safety and Welfare Policy, and that the goods or services required are in accordance with Council‟s approved Business Plan and/or Budget. A statement is required on back of Orders giving effect to certain requirements (eg OHS & W policies for contractors). All order books are to be returned to the Creditors Officer once completed. 4.3 Petty Cash and Travelling Allowances Cash payments for minor purchases may be made out of a petty cash account established by Council. A cash payment should not, in respect of any particular docket or voucher, exceed $100.00. All staff purchasing small local purchases must sign for all goods received, provide the date goods were received, and write on the invoice the details as to what the goods are to be used for. This is particularly important to allow claiming of GST input credits. Rev 03 (13th July 2010) 9 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY The Council may provide a responsible officer with cash advances for the purpose of defraying the cost of travel and accommodation, while on Council business, of members, officers or employees. The amount to be advanced is to be approved by either the Chief Executive or Manager Corporate & Community Services or the Fi8nance Manager. However wherever possible Credit Cards are to be used. Under no circumstances are IOU‟s to be issued and taken from Petty Cash or Customer Service Officer - Cashiers‟ Floats. 4.4 Credit Cards (1) The Mayor of Council plus the Chief Executive Officer, Manager Technical Services, Manager Corporate & Community Services, Manager Development and Inspectorial Services and Library Manager are authorised to use Credit Cards to be charged to Tatiara District Council for the procurement of goods and services on behalf of Council. (2) Limitations - Such credit card: Shall be used exclusively for the payment of Council related expenditure only. Such expenditure shall be primarily (but not limited to) used for the payment of accommodation, meals and travel expenses. There shall be absolutely no use for non Council related purposes. Improper use of the card may render the cardholder liable to disciplinary/legal action/criminal prosecution. (3) Transaction Methods - The following are the approved methods of processing transactions: Across the counter (the card holder signs a purchase slip at the time of purchase); By telephone (the transaction is completed by quoting corporate card details to the supplier). In these circumstances the card holder should maintain a record of transactions; By mail, quoting card number on orders to suppliers, e.g. library subscription renewals, book supplier accounts etc. Similarly, records need to be maintained of transactions; and By Internet (the transaction is completed by quoting corporate card details to the supplier). In these circumstances the cardholder should maintain a record of transactions. (4) Credit Limit - The credit limit applied to each card is authorised by the Chief Executive Officer and is to be used in accordance with Councils Delegated Authority Document. (5) Chief Executive Officer - shall ensure that appropriate approvals and reporting to meet audit requirements are adhered to. (6) Finance Manager - shall: Maintain a record of the authorised credit card holders. Ensure authorised officers sign a declaration for use of credit cards and are issued with instruction for use and coding of expenditure. Ensure an individual credit limit is imposed on each credit card and is reviewed annually or as required. Prepare a report where the card has been used contrary to guidelines. Report on any matters, which could affect the efficiency of card usage. Rev 03 (13th July 2010) 10 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY (7) Creditors Officer - shall: Ensure that all purchases are supported with an appropriate receipt. Sign the statements to indicate that all receipts/documentation are attached and certified by the card holder and then by the Chief Executive Officer and in the CEO‟s case by the Council Mayor. (8) Employees - All officers issued with a credit card shall: Sign the reverse of the card in the appropriate place at time of issue. Have personal responsibility for the security, confidentiality and observance of conditions for the use of the card. Not use the card other than for its approved purpose. Ensure that the transaction sales slip shows sufficient details of the nature and purpose of expenditure. Ensure that a tax invoice is obtained for all purchases on a credit card. The receipt shall be appropriately endorsed by the employee outlining clearly the nature of the purchases and coded to the appropriate account. Where a credit card is used for meals etc. the receipt will be appropriately marked with details of the purchases, including details of names of those attending and the purposes of the function. Attach all receipts to Corporate Mastercard Account and forward to the Creditor Officer for processing. Where an invoice/receipt is not available (e.g. lost) the employee is to ensure all necessary details relating to the transaction are recorded on the Corporate Mastercard Account form. Must immediately advise the Finance Manager if the credit card is lost or stolen. Be responsible for all purchases on her or his card. Under no circumstances should a cardholder permit another person to use her or his credit card number to make a purchase. If the card is to be used on behalf of the nominated cardholder (e.g. for conference, airline etc bookings) an order must be signed by the cardholder prior to the transaction being finalised. (9) Termination of Employment - Cards will be cancelled immediately on termination of employment of the cardholder. The cardholder remains responsible to provide details of any expenditure included on a credit card statement up to and including their final day of employment. 4.5 Receipt of Good/Services On receipt of goods, delivery dockets/cart notes where supplied are to be signed as evidence of receipt of goods, noted on the docket and that they are in good condition. When delivery dockets/cart notes are not received invoices shall be signed by the officer as evidence of receipt of goods. Delivery dockets and invoices are to be matched to purchase orders (manually or electronically) promptly to ensure that goods received are those ordered. Unmatched documentation will be immediately queried with the supplier. 4.6 Processing Invoices Invoices are to be matched to a purchase order either manually or electronically where available prior to processing and delivery details attached as evidence of receipt of goods. Authorisation for payment of the invoice will be evidenced on the invoice cheque requisition form and only authorised by those with financial delegations as per Council‟s policy Additions, extensions, prices (including GST applicability) of invoices are evidenced as checked by the Creditors Officer. Variations of 10% or more between the invoice and purchase order will require the invoice to be returned to the authorising officer for checking/authorisation. Rev 03 (13th July 2010) 11 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY Authorisation for payment of the invoice and account allocations must be made by the relative Manager or authorised officer. Where invoice relates to a service supply or contract, invoice details and amount are to be cross checked against contract sum or master service register i.e. Power or Water accounts, Waste Management accounts etc. On processing of invoices the person posting invoice is to stamp it ENTERED (this denotes the cancelling of the invoice). A list of the Batch numbers is to be stored with the invoices paid in that run. Account allocations and amount of payment are made by the Creditors Officer and checked by an authorised officer, budget limits should be checked prior to authorisation. Where invoices are posted in batches, batch totals are calculated prior to posting and agreed to the totals posted and the „Creditors to be Paid‟ counter signed by an authorised officer with financial delegations. 4.7 Payments All cheques are printed/written and issued in sequential order. All cheques are to be crossed “not negotiable” “Account Payee Only”. Documentation, i.e. invoice, orders, goods received advice, are to be accompanied with the cheques as evidence for review by cheque signatories prior to signing. Cheques are to be signed by two authorised Council signatories as set out in the Policy Manual of which one should preferably be either the Chief Executive, the Manager of Corporate & Community Services or the Finance Manager. Remittance advice‟s are to be supplied to all creditors with the exception of electronic payment. All cheques which have been cancelled are to be recorded in a register, as well as the details of their cancellation. 4.8 Reconciliations Supplier statements to be reconciled monthly to Creditors Ledger and creditor invoices and payments made. Creditors control account is to be reconciled to the creditor ledger and discrepancies/reconciling items are promptly followed up. Creditors ledger balances are regularly reviewed and unusual items such as debit balances are investigated. New creditor accounts are not to be opened without authorisation from a responsible officer preferably a departmental Manager (this is particularly important with GST obligations). A revision of existing creditors lists is to be undertaken yearly in conjunction with purchasing staff to reduce multiple suppliers, review trading terms, reduce costs and ensure full exploitation of contracts and discounts available from the Local Government Purchasing and MAPS Purchasing group. Electronic Fund Transfers. All electronic payment amounts recorded against our bank account are to be verified by the Creditors Officer to ensure the amount invoiced and received equals the amount paid. Staff are to be aware of all current Council bank signatories at all times. Creditors master-file amendments are to be undertaken only under the direction of the Finance Manager. A monthly reconciliation (creditors audit trail) of changes to bank details is to be printed and signed off by the Finance Manager. Rev 03 (13th July 2010) 12 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY 4.9 Other • The following functions where practical are to be independent of each other: ordering goods; receiving goods; invoice authorisation; invoice processing; cheque signatories. 5. Payroll Systems 5.1 Changes in Employee Details Access to computer payroll maintenance is strictly limited to authorised personnel only, and breaches of access will be dealt with according to Council‟s employee disciplinary procedures. No employee should be added to payroll records or paid without receipt of the appropriate forms, including employment declaration forms (taxation):Induction Checklist; Pre-placement Medical; Employee Personal Information Form; OHS & W Policy; Staff policies and practices. Employee history files are to be maintained for all employees. Files should contain employment details and contracts, job specifications, authorisations for payroll or deduction changes, annual leave, long service leave and sick leave entitlements together with hours worked and rate of pay, gross salary or wages, tax and details of all other payments and deductions. The recording of such data on computer records must be strictly controlled and adequate regular backup facilities in place. No adjustments are made to employee records ie names, addresses, deduction details without receipt of written authorisation from the employee. No adjustments are made to salary or wage rates without written authorisation from a Departmental Manager or the Chief Executive Officer. Adjustments to the employee master-file can only be undertaken by Payroll Officer under the supervision of the Finance Manager. On the termination of an employee, their payroll records are to be coded on payroll records as ceased employees immediately. Wherever possible personnel functions should be segregated from payroll functions. The Register of Salaries shall be updated as required by the Local Government Act 1999 periodically and authorised by the Chief Executive Officer. Monthly Audit Tail Report is reconciled by the Finance Manager. 5.2 Time Recording All staff must complete daily timesheet/wages records, which are to be signed by the employee and their supervisor at the end of the pay period (or lesser period if daily or weekly timesheets) to authorise time worked, overtime, sick leave, etc and to verify TOIL, RDO‟s outstanding and taken. All timesheets are to be marked as evidence of processing. Prior to pays finalisation, Payroll reports are to be reviewed for unusual rates, excess overtime, salary amounts or employee names and evidenced as reviewed by a responsible officer not involved in the pay processing and signed. 5.3 Leave Entitlements All employees applying for leave must complete a Leave Application Form in advance. This form is to be authorised by the appropriate Supervisor or Manager and the Chief Executive if necessary and passed on to the payroll department. Rev 03 (13th July 2010) 13 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY Completed Leave Application Forms are filed in the employee‟s personnel file. Annual leave and long service leave is not to be paid without receipt of the appropriate authorised form. Leave entitlements are to be immediately updated to reflect annual, sick and long service leave taken. Annual leave, sick leave and long service leave entitlements are to be reviewed half yearly and arrangements made with employees with excessive entitlements to reduce these. All applications for payment of Long Service Leave in lieu of leave is to be authorised by the Chief Executive Officer in consultation with the relevant Manager. 5.4 Payment Pay slips will be distributed to employees on pay day where possible. Pays are only to be paid by bank transfer unless written authorisation advising otherwise has been received and approved by departmental Manager. If pays are via direct bank deposit, listings should be reconciled to:net pay total; total number of employees paid; and listings received from relevant bank/institution The payment of electronic pays is strictly controlled by selected personnel) through Westpac E-Bank facilities. This involves logging into Westpac and inputting two authorised passwords and pin numbers following which “active card” passwords are generated to allow full access into the direct pay/account system. All payroll control accounts are to be balanced and cleared at least on a monthly basis. 5.5 Records Records shall be maintained in a secure area in respect of each officer and employee showing:hours worked and rate of pay; gross salary or wages; tax and details of all other payments and deductions such as annual and long service leave available and taken; and all pay records shall be retained for periods stated in legislation/regulations. 5.6 Group Certificates Year End Preparation:The totals appearing on the group certificates for the year shall be reconciled with general and payroll ledgers by a the Payroll Officer and presented to the Manager Corporate & Community Services and/or Finance Manager for verification prior to printing. 6. General Receipts and Debtors System 6.1 Receipts (Counter & Mail) All money received through the mail is to be handed to the principal cashier for receipting that day where possible. If a person is unsure of the cost allocation the documentation and cheque should be handed to the Finance Manager for determination. After receipt, all cheques are to be written up in a computer produced cheque listing. The payer shall be issued with a receipt on request. The receipt or cash receipt record shall indicate the mode of payment. Cheques received by Council shall, on receipt, be restrictively crossed. Receipts shall be issued on Council stationery and be pre-printed or machine produced and numbered and be issued in numerical sequence. Rev 03 (13th July 2010) 14 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY Unused pre-printed receipt stationery (interim receipt books) shall be in the custody of a responsible officer who shall maintain a register in accordance with Internal Control Policy. A copy of the details of each receipt printed (included in end of day reports) shall be maintained. Floats/cashiers‟ balances are counted daily and reconciled to receipts listing and banking for the day. The receipts‟ listing is signed by the appropriate cashier. Discrepancies (unders and overs) are to be entered into the unders and overs book and reported to the Manager of Corporate & Community Services or Finance Manager and promptly followed up. Where possible cash change given shall be counted back to the customer to avoid errors. Bank transfers (ex DEFT payment systems) are to be down loaded from the Internet by Finance staff only with totals balanced against bank reconciliations immediately. Segregation of duties is achieved by ensuring cash handling is separated from the Finance Manager. 6.2 Banking All money received by an officer or employee of the Council must be receipted as soon as practicable. Council must keep detailed records of its banking. Banking shall be reconciled with receipts and discrepancies reported to the Finance Manager. Banking is to occur at least daily. During times when rates are due and daily cash takings build up, an interim banking is to be undertaken Excessive cash is to be removed from the front counter area where practicable to a secure area. 6.3 Bank and Investment Accounts Council shall approve the establishment and closure of every bank and overdraft account. Council may operate bank accounts as required with the officers and employees authorised to operate such accounts approved by Council. Bank reconciliation statement for each account operated by Council including general cheque account, investment accounts, reserve accounts line of credit, overdrafts and business credit accounts shall be prepared at least once in every month by the Finance Manager. The Reconciliation Statement shall be prepared and presented to the Manager, Corporate & Community Services monthly whom shall evidence its review. 6.4 Investments All investments are to be in the name of Tatiara District Council. Investments are only to be made in authorised investments allowed by the Act. Council officers shall where possible obtain competitive interest rates to maximise investment yield. The Local Government Finance Authority is to be given an opportunity to quote for investments. Investment certificates shall be placed in investment files under the control of the Records Officer. All investments must be reviewed at least on an annual basis. 6.5 Invoicing The charging of invoices shall be in accordance with established policies and fees and charges Council may have in place i.e. block clearing, licences, rentals, water fees etc. Rev 03 (13th July 2010) 15 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY Sundry debtors shall only be raised following the completion of an “authority to raise sundry debtor form” and staff are to ensure that forms/records are maintained detailing all works undertaken which require invoicing. Invoices shall be raised as soon as practicable after the work is complete or the service provided and relate to the year in which the work was performed. Unused invoice stationery shall be in the custody of a responsible officer. General Ledger account allocations are to be made or authorised by a responsible officer. All Private Works Invoices are to be raised on a strict monthly basis. Statements shall be forwarded to debtors on a monthly basis. Outstanding debtor balances shall be reviewed at least monthly and appropriate action initiated to recover the debt. Outstanding debtor balances shall be reviewed at least annually near year end to ensure doubtful debts are adequately provided for and bad debts written off. Debtors ledgers (rates and others) shall be reconciled monthly to the general ledger control accounts. This reconciliation is to be reviewed by the Finance Manager. Any discrepancies are immediately investigated. New debtor ledger accounts are not to be opened without authorisation from an authorised officer. 6.6 Loan Borrowings All loan borrowings shall be as allowed by the budget papers presented and approved by Council. All borrowings including roll-overs require a resolution of the Council, including authorisation for the signing and sealing of documents. The Local Government Finance Authority is to be given an opportunity to quote for loan borrowing requirements. On receipt of loans, details shall be entered in the loan register, appropriate journal entries made and documentation placed in our central records system. All loans raised by Council shall be separately accounted for and identifiable in the accounting records. The Finance Manager shall maintain a register of loans raised by Council in accordance with Internal Control Policy (registers) which shall be stored on the corporate computer system with loan documents retained in central records. The register shall record:number of the loan; the lending institution; the repayment schedule of the loan; the purpose for which the loan was taken out; the date of the loan; the interest rate of the loan; the term of the loan; and the date on which the loan will be redeemed. 7. Rates 7.1 Determination of Rates Rate charges, amounts, minimum values and concessions are to be authorised by Council. Amounts to be charged/valuations, attribution of land use codes and budget estimates are gazetted pursuant to the Local Government Act. Property values are to be down-loaded directly from the disc provided by the Valuer General‟s Department onto the Council‟s system. All updates received from the Valuer General are to be promptly processed and reconciled with Council‟s corporate system listing of capital values, with records kept for audit verification. Rev 03 (13th July 2010) 16 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY Parameters entered (i.e. rates in $, minimum rate, rebates, concession etc) are to be authorised by a responsible official. Only authorised persons make any changes to these parameters. 7.2 Rates Notices - Generation Rates Debtors Subsidiary Ledger is balanced with General Ledger prior to printing of notices. A reconciliation is performed to check that the total capital value of properties per the Valuer General‟s report (print out) equals that per the rates system. Only rates staff are permitted to maintain the rates master-file with periodic checking to be undertaken by Rates Manager. Prior to initiating the rates billing on the live system a test must be undertaken on the “Play Account” to ensure correctness of totals and values. Total value of rates generated must be compared to the value as per the Rates model. Large variances should be investigated. When processing rates notices internally, sample of rates notices are to be randomly checked to ensure that:correct rates have been used; concessions have been correctly calculated; any discounts are correctly calculated; and name, address and rate details are correct. Barcodes are correct Where notices are printed externally tests are to be undertaken to ensure correctness of function and totals raised with unused notices returned to the Council immediately. 7.3 Rates Fines Fines and interest payable on outstanding rates, are changed in accordance with the Act:fines – two percent of the amount of instalment payable; and interest – on expiration of each month from the due date, at the prescribed percentage applied to the total amount in arrears. Prescribed Percentage per month = cash advance debenture rate for financial year + 3% /12 Monthly reconciliation of rates subsidiary to General Ledger. 8. Fixed Assets 8.1 Additions and Disposals All additions must be allocated to Capital areas within our chart of accounts and be within budget allocations approved. On acquisition or as soon as practicable all:assets are to be added to the fixed assets register with the exception of Infrastructure assets; useful life of the individual asset is estimated; basis of depreciation (i.e. straight line, reducing balance method, or other) is decided by an authorised officer; rate of depreciation (and hire rates if required) calculated; and asset depreciated from date first used or held ready for use. All land assets are to be reconciled to Valuation services valuation print-outs to ensure assets received free of charge are properly recorded. Copies of invoices relating to plant purchases are forwarded to the Finance Manager to ensure GST, FBT (log book) compliance. Rev 03 (13th July 2010) 17 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY On disposal:asset depreciated to date of disposal; accumulated depreciation and cost of the asset to be written back in the general ledger and removed from the fixed asset register, at the end of that particular financial year; and profit/loss on disposal is calculated. This calculation should be prepared or authorised by the Finance Manager. 8.2 Classification and Capitalisation Policies Capitalisation policies are implemented such that staff is able to distinguish between capital and maintenance expenditure. A minimum threshold is established for recording assets, taking into consideration their materiality (e.g. only record assets greater than $1,000) or limits set under the policy manual. Departmental Managers should classify whether capital or maintenance according to Asset policy. Systems are implemented to classify assets based on the functions or activities they are used for. 8.3 Recording/Registers Fixed Assets Registers shall be maintained for all assets controlled by Council. Wherever possible assets will be recorded as separate items in the registers. Fixed Asset Registers should be reconciled periodically to balances per the General Ledger. This reconciliation is evidenced as reviewed by a responsible official. All discrepancies are to be promptly investigated and the fixed asset register or general ledger appropriately updated. A physical count of all fixed assets per the fixed assets register is to be undertaken periodically. All discrepancies are to be investigated and the condition of the assets noted. Registers are regularly to be reviewed, noting “unusual” items or items included in fixed assets, which have been sold or scrapped. Authorisation is to be obtained before any items are deleted from the registers (due to sale or scrapping). The Finance Manager is to be advised of all acquisitions, disposals, trade-ins and scrapping. 8.4 Year End Considerations Fixed Assets Register should be reviewed to consider:carrying value of assets; existence of assets; condition of assets; relevance of current depreciation rates /methods given the condition of the assets; and non current assets shall be revalued at least every five years or more frequently if desired. 8.5 Other Adequate security arrangements should exist over all premises and storage areas. These arrangements are to be regularly reviewed and improved where they have become inadequate. Arrangements restricting access to authorised personnel and protection from accidental destruction, deterioration, theft or fraudulent or illegal use. Adequate security exists to prevent unauthorised access to Council‟s computer “servers” and other sensitive IT equipment. Insurance coverage is regularly reviewed to ensure that it is adequate in conjunction with Council‟s Insurance Brokers. Rev 03 (13th July 2010) 18 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY Maintenance plans implemented and reviewed to ensure that the asset is:used to maximum capacity; being operated correctly; not deteriorating excessively; and maintained to an acceptable standard. 9. Stock 9.1 Stock Policy Council encourages the direct debit of stocks and materials purchased direct to jobs where possible due to the close proximity to most suppliers the need to hold stock is minimal and investment return is maximised. Only fuel has been classified as stock in hand with the other exception being oils and rubble materials. 9.2 Physical Storage All storage areas are to be adequately secured. The security arrangements will be regularly reviewed and improved where they have become inadequate. 9.3 Issues and Returns All stock delivered is to be recorded on relevant stock sheets with invoices authorised by relevant officers as per purchases procedure. Only Council personnel have the authority to issue stock items, which must be recorded on the appropriate stock issue forms. Issues are to be monitored to ensure timely ordering of stock items and to ensure items are not over-stocked. All stock issue sheets must be signed with relevant information completed thereon. All stocks and materials will be accounted for and issued on the “average price” basis. All stock recorded at cost. Stores are to be held for the length of their useful life or until such time that they may become dangerous to handle, volatile, outdated or obsolete. 9.4 Stock-Takes (Fuel and Oil) Stock-takes are to be carried out at least monthly and reconciled with subsidiary ledgers. Staff independent to the depot should also undertake random checks periodically. Adequate stock-take instructions are to be issued to all persons involved in the stock-take by a responsible officer. Stock-take is to be supervised by a responsible official. Damaged or obsolete stock or shortages are to be noted on stock sheets. 9.5 Year End Considerations Consistent valuation policies are to be adopted and applied to all stock on hand. Damaged or obsolete stock is noted during stock-take is to be followed up – valuation of these items to be carefully considered. 10. General Ledger 10.1 Journals All journals are to be authorised and reviewed by the Finance Manager or Manager Corporate & Community Services and initialled accordingly. A sequentially numbered journal book is to be used. All journals are to be adequately explained or supported by full explanatory vouchers. Once posted, journals are marked (initialled) to ensure no journals are overlooked or posted twice and journal number entered. Rev 03 (13th July 2010) 19 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY 10.2 General Control of clearing accounts is reconciled monthly and clearing and suspense accounts are regularly cleared. These reconciliations are to be evidenced by the Finance Manager. A Chart of Accounts is to be regularly updated (at least annually) to ensure correct allocations are made. Appropriate/relevant registers are maintained. Full disclosure is made to Council through the Administration and Finance Committee and Council‟s Audit Committee. 10.3 Budgetary Control Budgets are to be prepared, presented and adopted by Council by the second week in July each year. The budgets of Council (including reviews) shall include the following information:budgeted operating statement; budgeted statement of financial position; budgeted statement of changes in equity; budgeted statement of cash flows; and budgeted statement as to the basis for the determination of rates. The budget must be reviewed at least three times, at intervals of not less than three months, between 30 September and 31 May (both dates inclusive) in the relevant financial year. All General Managers are responsible for allocations, expenditures and revenues made within their areas and reporting of anomalies immediately. These shall be reported to the Chief Executive or Manager Corporate & Community Services. Management reports will be prepared and distributed at least monthly and are to be reviewed by the Managers within 7 days of receipt with discrepancies/variances reported to the Finance Manager or the Chief Executive. Individual officers using computer equipment provided can initiate ad-hoc reports. 10.4 Annual Financial Statements All Annual Financial Statements must be completed, Audited and adopted by Council before the November Council meeting of each year. 11. Other 11.1 Access Controls – Property Access to Council facilities will be controlled by Departmental Managers. Keypad access to branch and main offices are generally available to all staff however, deadlock/security system key is restricted to authorised officers and appropriate key registers kept. Similarly with Council Depots only authorised personnel shall be granted access to keys/security systems. A key register will be strictly controlled by a designated person in respect to other Council properties. All breaches of security are to be reported to the Manager Corporate & Community Services who will investigate the need for key/lock/password replacement. 11.2 Access Controls – Computer The Manager Corporate & Community Services shall ensure adequate security measures are in place to ensure:restriction of physical access to hardware to authorised personnel only; Rev 03 (13th July 2010) 20 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY 11.3 Internal individuals access as set out in Council computer usage policy is restricted to functions considered relevant to their respective needs; controls over the availability and knowledge/passwords; general users passwords are changed when necessary; and for officers where system maintenance is accessible, shall be reviewed annually or when security has been breached. attempted breaching of access reported by the system are promptly investigated and appropriate action taken; on and off site back up data, programs and documentation; adequate protection from accidental destruction, deterioration, misplacement and pilferage; all updates and changes to programs are authorised, tested and documented; formal disaster recovery plan is established for this area which shall list total configuration of equipment held including software to enable immediate replacement in case of a disaster; the control of IT equipment issued for out of hours use; and all documentation of the policy and procedures relate to the above controls are contained within Council‟s IT strategy. 11.4 Prescribed Services Where Council imposes a service charge under Section 155 of the Act, Council must:Keep a record of the pieces of land on which the charge is imposed. In relation to each of those pieces of land, keep an account in which the Council records:the amount received in payment of the charge; any amounts standing to the credit of the land because of payments in advance; any amounts repaid because a service for which a payment in advance has been made is not provided to the land. 11.5 Registers Registers shall be maintained (containing the information set out in the attached listings) as follows:o land and buildings and leases; o Receipt Books o plant and machinery; o office furniture and equipment; o licences and leases issued; o leased road reserves; o insurances; o accountable documents (including order books, cheques.); o personnel; Member allowances and benefits. o contracts; o debentures issued; o streets and roads; o Loan guarantees; o salaries; and o register of interests – Councillors, Chief Executive, General Managers. A register need only be maintained where there are appropriate items to include in the register. 11.6 Hiring of Properties A record of all hiring of halls and other properties under the care, control and management of Council shall be maintained giving particulars of each hiring. A responsible officer shall make periodical checks of the hiring record and the charges raised. Rev 03 (13th July 2010) 21 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY 11.7 Trust Funds All monies received by Council subject to any trust restrictions thereon shall be paid into a separate account or accounts at a bank determined under the terms of the trust of by Council, as the case may be. Every such account shall be entitled “Trust Account” together with the name or particulars of the specific trust. Accounting records for trust money shall be separate from the Council records. A bank reconciliation statement for each trust bank account shall be prepared at least once in every month. 11.8 Subsidiaries of Council NONE LISTED AT THIS TIME. 11.9 Computer Environment Refer to specific computer usage policies held under separate cover. 11.10 Records Retention and Destruction Refer to State Records Disposal Manual. 11.11 Records Security Full details of all Council owned properties shall be maintained with custodial security over certificates of title being independent of accounting functions. 11.12 Insurable Risk All identified insurable risks will be covered with a policy of insurance issued by a recognised insurance company. The cover will be equivalent of full replacement. The extent of cover, both risk and sum insured, shall be reviewed at least annually by a responsible officer and supported by a report covering the review prepared by the broker in association with a Council Officer. Cover will include as appropriate:local government special risks; consequential loss; public liability; motor vehicle; fidelity guarantee; house holders; boiler, plate glass, fusion and other. general and products liability Machinery breakdown Computer Electronic equipment Personal accident and liability Income protection The up to date policies and all annexure shall be kept in a secure place. 11.13 Machinery Costs and Indirect Expenditure – Allocation Machinery costs and charge out rates are to be reviewed at least annually by the Manager Technical Services and presented to the Plant & Machinery Sub Committee. Overhead recovery rates are to be reviewed annually by the Finance Manager and/or Manager Technical Services. 11.14 Elected Members Elected Members shall submit at least quarterly a claim schedule requesting reimbursement for travel and associated costs whilst on Council business in accordance with Council policy. These claims are to be authorised by the CEO. Rev 03 (13th July 2010) 22 of 23 TATIARA DISTRICT COUNCIL INTERNAL CONTROL POLICY Elected members and senior staff must lodge a primary or ordinary register of interest yearly in accordance with the regulations. Such a return shall be lodged with the Chief Executive. 11.15 Activity Based Costing Not used at present 11.16 Westpac Bank In-Store Council has a contractual arrangement with Westpac Bank to operate an In-Store at Council‟s Office in Hender Street Keith. All operations by Council staff relating to the In-store shall be as outlined in Westpac‟s In-store Manual Policy and Procedure. Rev 03 (13th July 2010) 23 of 23 TATIARA DISTRICT COUNCIL