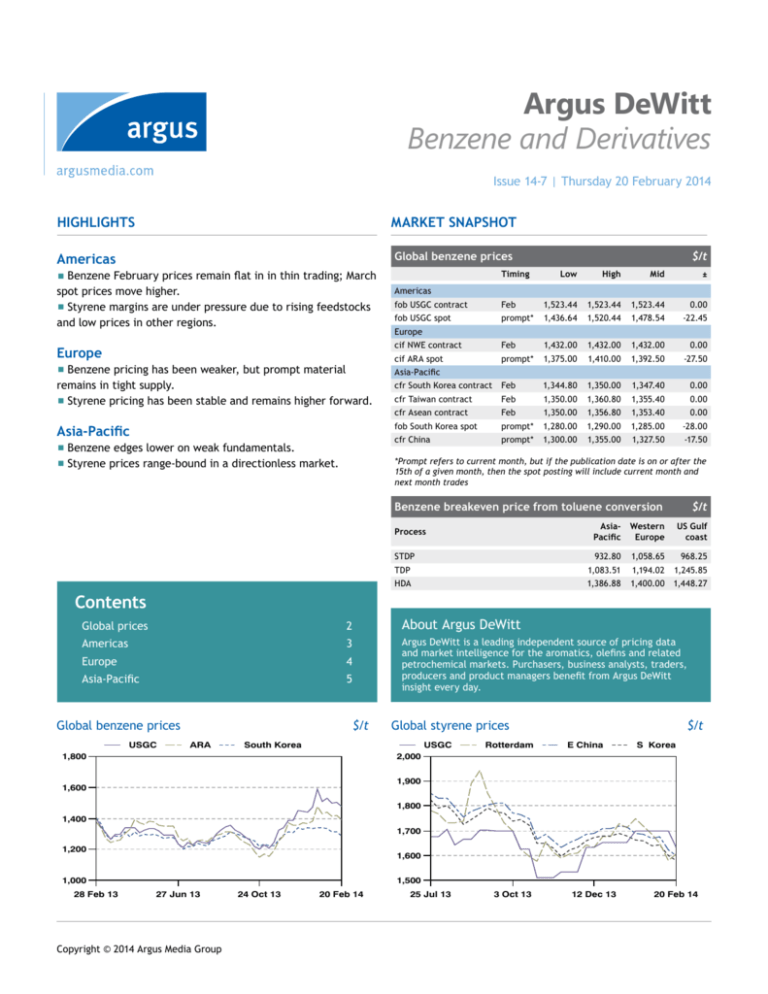

Argus DeWitt

Benzene and Derivatives

Issue 14-7 | Thursday 20 February 2014

Market snapshot

Highlights

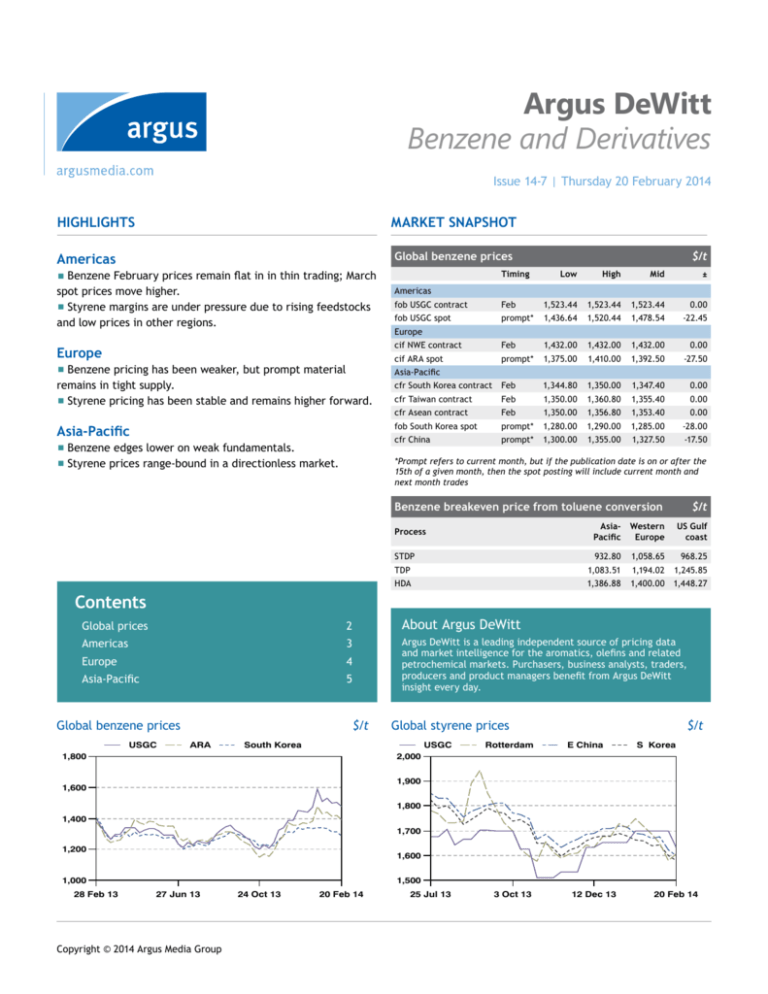

Global benzene prices

Americas

▪▪

▪▪

Benzene February prices remain flat in in thin trading; March

spot prices move higher.

Styrene margins are under pressure due to rising feedstocks

and low prices in other regions.

Europe

▪▪

▪▪

Benzene pricing has been weaker, but prompt material

remains in tight supply.

Styrene pricing has been stable and remains higher forward.

Asia-Pacific

▪▪Benzene edges lower on weak fundamentals.

▪▪Styrene prices range-bound in a directionless market.

Timing

$/t

Low

High

Mid

±

Americas

fob USGC contract

Feb

1,523.44

1,523.44

1,523.44

0.00

fob USGC spot

prompt*

1,436.64

1,520.44

1,478.54

-22.45

Europe

cif NWE contract

Feb

1,432.00

1,432.00

1,432.00

0.00

cif ARA spot

prompt*

1,375.00

1,410.00

1,392.50

-27.50

cfr South Korea contract

Feb

1,344.80

1,350.00

1,347.40

0.00

cfr Taiwan contract

Feb

1,350.00

1,360.80

1,355.40

0.00

Asia-Pacific

cfr Asean contract

Feb

1,350.00

1,356.80

1,353.40

0.00

fob South Korea spot

prompt*

1,280.00

1,290.00

1,285.00

-28.00

cfr China

prompt*

1,300.00

1,355.00

1,327.50

-17.50

*Prompt refers to current month, but if the publication date is on or after the

15th of a given month, then the spot posting will include current month and

next month trades

Benzene breakeven price from toluene conversion

Process

STDP

AsiaPacific

Western

Europe

$/t

US Gulf

coast

932.80

1,058.65

968.25

TDP

1,083.51

1,194.02

1,245.85

HDA

1,386.88

1,400.00

1,448.27

Contents

Global prices

2

About Argus DeWitt

Americas

3

Europe

4

Asia-Pacific

5

Argus DeWitt is a leading independent source of pricing data

and market intelligence for the aromatics, olefins and related

petrochemical markets. Purchasers, business analysts, traders,

producers and product managers benefit from Argus DeWitt

insight every day.

$/t

Global benzene prices

USGC

ARA

South Korea

USGC

1,800

$/t

Global styrene prices

Rotterdam

E China

S Korea

2,000

1,900

1,600

1,800

hhh

1,400

1,200

1,600

1,000

28 Feb 13

hhh

1,700

1,500

27 Jun 13

Copyright © 2014 Argus Media Group

24 Oct 13

20 Feb 14

25 Jul 13

3 Oct 13

12 Dec 13

20 Feb 14

Argus DeWitt Benzene and Derivatives

Issue 14-7 | Thursday 20 February 2014

Global Prices

$/t

1,392.50 ▼

cif ARA spot

fob USGC spot

1,478.54 ▼

USGC benzene premium to USGC gasoline

fob South Korea spot

¢/USG

$/t

Global naphtha prices

300

1,000

250

950

200

1,285.00 ▼

900

hhh

150

hhh

850

100

87M gasoline = 0

800

50

21 Mar

3 Dec

13 Jun

5 Sep

26 Nov

ARA benzene premium to NWE naphtha

20 Feb

Singapore

$/t

600

500

500

hhh

300

Naphtha 65 Para NWE

20 Feb

USGC

400

$/t

hhh

300

NWE naphtha = 0

Benzene = 0

200

21 Feb 13

24 Jan

South Korea styrene premium to benzene

600

400

30 Dec

200

20 Jun 13

Copyright © 2014 Argus Media Group

17 Oct 13

20 Feb 14

21 Mar 13

Page 2 of 9

13 Jun 13

5 Sep 13

26 Nov 13

20 Feb 14

Argus DeWitt Benzene and Derivatives

Issue 14-7 | Thursday 20 February 2014

Americas

Benzene

Americas prices

Spot prices remained remarkably firm, despite expectations

of improved supply and import volumes and weaker demand.

February volumes traded in the 505-508¢/USG range.

March trading was much more active, and as this reporting

period moved on, any March ddp prices improved as the

front of the price curve remained stable. Late last week,

March ddp barrels traded as low as 472¢/USG compared to

corresponding February barrels at 508¢/USG. The February/

March backwardation exceeded 25¢/USG until Wednesday, and

Thursday it dropped to 15¢/USG. Some speculate efforts to

support the March monthly contract price led to higher prices

for any March barrels, and others suggested delays in import

arrivals motivated buyers to cover March positions at the

higher price levels.

Most agree that inventories remain lean. Scheduled

maintenance at several major production sites in February and

March also constrained supplies. In its weekly report, the EIA

reported Gulf coast (PADD 3) refinery utilization was below

90pc for the fifth consecutive week. That level is high for the

season, but below rates attained in the fourth quarter.

In the past three to four months, the direction of spot

prices has often run counter to market fundamentals, as

consumers and traders shorted the market and were forced

to cover positions with little product available. Once again,

fundamentals clearly indicate a downward price correction will

occur in the near term.

Refineries will begin to run reformers harder, as gasoline

specifications shift to lower vapor pressure blends. With

natural gas prices now at a five-year high, the light ends of

the reformers’ material balance (hydrogen and LPGs) have

considerably higher credits than they did two years ago. In

March 2012, when natural gas prices were at a third of current

prices, refiners ran reformers at reduced rates, or extremely

low severity, to minimize the conversion of naphtha to light

ends. This practice yielded less aromatics. This spring,

reformers should be run at higher throughputs and higher

severity, yielding more aromatics per ton of feedstock.

Although domestic ethylene producers continue to maximize

use of light feedstocks, pygas imports have supplement

extraction units. As the US gasoline specifications shift to

spring and summer grades, the non-benzene portion of pygas

carries a better value in the US gasoline pool than it does

on a naphtha-related basis in other regions. Because of this

seasonal phenomenon, pygas imports should continue through

the first semester of the year.

The benzene-toluene spread should compel operators of

conversion units to maximize rates whenever possible.

Chinese domestic benzene prices are now well below the fob

Korea price. The weakness of the China market and upcoming

▪▪

▪▪

▪▪

▪▪

Copyright © 2014 Argus Media Group

Timing

Low

High

Mid

±

Benzene ¢/USG

fob USGC contract

Feb

509.00

509.00

509.00

0.00

fob USGC spot

prompt*

480.00

508.00

494.00

-7.50

Styrene ¢/lb

fob USGC contract

Feb

88.00

91.00

89.50

0.00

fob USGC spot

prompt*

74.00

74.00

74.00

-3.00

Feb

71.00

71.00

71.00

0.00

Jan

87.00

90.00

88.50

0.00

Cumene formula ¢/lb

fob USGC contract

Phenol ¢/lb

fob USGC contract

Cyclohexane ¢/USG

fob USGC contract

Feb

461.93

461.93

461.93

0.00

marker with NG escalator Feb

454.03

454.03

454.03

0.00

*Prompt refers to current month, but if the publication date is on or after the

15th of a given month, then the spot posting will include current month and

next month trades

Benchmark margins

¢/USG

Margin

±

BTX US reformate extraction vs floor contract

100.35

+6.34

BTX US reformate extraction vs floor spot

106.99

+5.05

BT US reformate extraction vs floor contract

121.66

+6.34

BT US reformate extraction vs floor spot

117.91

+4.47

$/t

USGC styrene premium to benzene

500

400

300

hhh

200

100

Benzene = 0

0

8 Aug

10 Oct

12 Dec

13 Feb

heavy schedule of styrene maintenance will undoubtedly lead

to benzene inventory builds in northeast Asia, and even larger

export volumes to the US Gulf coast. Additional volumes could

also move in from Europe, India, Brazil and Saudi Arabia.

On the demand side, exports of US benzene derivatives

remain uncompetitive. A US styrene producer would need to

purchase benzene at 440¢/USG just to cover raw material

costs for a styrene shipment to China, and would need to

purchase benzene near 470¢/USG to justify shipments to

Europe. Without relief on raw material costs, producers will be

forced to cut rates until exports can be competitive.

▪▪

Page 3 of 9

Argus DeWitt Benzene and Derivatives

Issue 14-7 | Thursday 20 February 2014

Americas

Styrene

One spot deal was reportedly done for 9,000t to South America,

but terms of the deal were confidential. Producers offered

volumes at 74¢/lb, and even at that level, the margin over raw

materials costs is very thin. Traders indicated that purchase

prices would need to move below 70¢/lb for US product to move

to Asia, and only slightly higher for volumes to move to Europe.

With all units in North America now operable, export volumes

are critical to maintaining operating rates. If exports to South

America and Mexico cannot fill the void, producers will need to

cut rates significantly in March.

Domestic demand from most segments remains sluggish. Very

cold weather has complicated logistics and hurt consumption,

particularly from the construction segment of the market.

Contrary to the general bearish sentiment, one producer

confirmed that the ABS segment has shown strong demand.

Europe

Benzene

Europe prices

February material traded down from $1,400/t early in the

week to a low of $1,385/t, before picking up on short covering

ahead of the end of the month. $1,410/t was confirmed done

on Thursday. March pricing is lower, with $1,375/t trading

twice on Thursday. First half of March traded at $1,385/t.

All plants appear to be now running normally, but stocks

are only just beginning to rebuild. Demand in February has

been no more than steady, with consumers preferring where

possible to postpone orders in the expectation of lower prices.

The March contract price will be settled on 28 February

and should show a modest reduction from February, but

is likely to remain at a high level, at or above $450/t over

naphtha.

Energy prices have been rising this week. North Sea Dated

has risen to above $110/bl from below $109/bl. Naphtha has

risen to $925/t from $905/t. The euro has remained firm,

above $1.37.

Trade statistics show that net imports into western Europe

rose by 156,000t to 714,000t in 2013, returning close to the

level of 2011. Imports from central Europe rose significantly

to 250,000t, while exports, which were principally to the US,

more than halved. The EU net import total, which includes the

exporting countries of central Europe, was virtually unchanged

at 550,000t.

Western Europe benzene annual net trade

‘000t

United States

South America

North America

North Africa

MEAG

East Med

Africa

Central Europe

East Europe

South Asia

East Asia

900

exports ‐ imports

600

300

0

-300

2004

2005

2006

2007

2008

Copyright © 2014 Argus Media Group

2009

2010

2011

2012 2013

- Eurostat

Timing

$/t

€/t

Low

High

Low

High

Benzene

cif NWE contract

Feb

1,432.00

1,432.00

1,055.00

1,055.00

cif ARA spot

prompt*

1,375.00

1,410.00

1,004.00

1,029.00

Styrene

fca Rotterdam contract

Feb

1,966.21

1,966.21

1,435.00

1,435.00

fob Rotterdam contract

Feb

1,955.25

1,955.25

1,427.00

1,427.00

fca Rotterdam spot

prompt*

1,616.81

1,644.22

1,180.00 1,200.00

fob Rotterdam spot

prompt*

1,595.00

1,617.00

1,164.00

1,180.00

Feb

2,082.67

2,137.48

1,520.00

1,560.00

Feb

1,659.29

1,659.29

1,211.00

1,211.00

Phenol

delivered ARA contract

Cyclohexane

fob ARA contract

*Prompt refers to current month, but if the publication date is on or after the

15th of a given month, then the spot posting will include current month and

next month trades

Styrene

Pricing has stabilized, with February trading at $1,595/t. March

has retained a $20/t premium, done at $1,617/t. All plants are

running, but there have been some cutbacks on EB/SM units

because of narrow margins. Two large producers have been

spot sellers, one a POSM operator, the other an integrated

EB/SM player. A non-integrated EB/SM producer was seen as

a buyer, as were traders, who continue to expect tightening

in the forward market as demand picks up seasonally and

shutdowns reduce supply in Asia and, to a more limited extent,

Europe.

Trade statistics show that styrene imports into western

Europe rose to 500,000t in 2013, following the closure of the

INEOS Marl unit in the fourth quarter of 2012. Imports from

the US doubled compared with the previous year, to 400,000t.

Imports from the Middle East fell to low levels, in part because

of shutdowns, but also because of the redirection of exports

from the Mideast Gulf towards Asia-Pacific. Product continued

to move into Scandinavia from Russia.

Page 4 of 9

Argus DeWitt Benzene and Derivatives

Issue 14-7 | Thursday 20 February 2014

Europe

‘000t

Western Europe styrene annual net trade

United States

MEAG

East Europe

South America

East Med

South Asia

North America

Africa

East Asia

North Africa

Central Europe

600

Phenol

400

exports - imports

disruption, but the market remains generally well supplied.

Consumers have been managing inventories tightly in the

expectation of lower prices in March and April.

200

0

-200

-400

2004

2005

2006

2007

2008

2009

2010

2011

2012 2013

- Eurostat

Cyclohexane

Weather and shipping delays have caused some minor

NWE styrene premium to benzene

$/t

700

500

500

400

400

hhh

300

hhh

300

200

Benzene = 0

Eurobob = 0

100

15 Aug

$/t

cif ARA benzene premium to Eurobob

600

600

200

February demand has been flat as consumers have reacted to

high prices, reflecting benzene values. March is expected to

be stronger.

INEOS has announced the formation of a joint-venture

company with Sinopec YPC for the construction of a phenol/

acetone plant in Nanjing, China. The partners will each own

50pc of the company, which will be called INEOS YPC Phenol

(Nanjing). The plant is scheduled for completion at the end

of 2016. Cumene for the unit will be provided by the local

partner.

100

17 Oct

19 Dec

20 Feb

21 Feb 13

20 Jun 13

17 Oct 13

20 Feb 14

Asia-pacific

Benzene

Asia-Pacifc prices

Crude prices were relatively firm during the week amid

encouraging US economic data and continuing Libyan supply

disruptions. North Sea Brent crude was at around $108-110/

bl, while Dubai crude was at about $103-105/bl. Singapore

92R gasoline prices were also firmer at around $113-115/bl.

Naphtha prices rose, tracking a rebound in crude values, to

around $928-934/t cfr Japan during the week. The cracker

maintenance season has started in Asia-Pacific, although

several of these shutdowns will take place concurrently

with their respective refineries shutdowns. Up to 1.5mn t of

arbitrage cargoes are expected in Asia in March, with the bulk

of them scheduled to arrive in the first half of the month.

The Asian benzene market edged lower during the week

ended 20 February, influenced largely by last week’s downturn

in downstream styrene monomer (SM) prices in the region.

Sentiment also turned more bearish this week on the back of

a reduction in a key Chinese producer’s listed offers. Supplies

Copyright © 2014 Argus Media Group

$/t

Timing

Low

High

Mid

±

Benzene

cfr South Korea contract

Feb

1,344.80

1,350.00

1,347.40

0.00

cfr Taiwan contract

Feb

1,350.00

1,360.80

1,355.40

0.00

cfr Asean contract

Feb

1,350.00

1,356.80

1,353.40

0.00

fob Korea spot

prompt*

1,280.00

1,290.00

1,285.00

-28.00

cfr China spot

prompt*

1,300.00

1,355.00

1,327.50

-17.50

cfr China month avg

Jan

1,343.33

1,375.71

1,359.52

na

Styrene

cfr Taiwan contract

Jan

1,673.00

1,673.00

1,673.00

0.00

cfr China spot

prompt*

1,590.00

1,610.00

1,600.00

-24.00

fob South Korea spot

prompt*

1,575.00

1,585.00

1,580.00

-20.00

*Prompt refers to Mar/Apr for benzene fob Korea and Feb/Mar for styrene and

benzene cfr China

also remain high, with poor demand from other downstream

sectors like phenol.

Page 5 of 9

Argus DeWitt Benzene and Derivatives

Issue 14-7 | Thursday 20 February 2014

Asia-pacific

South Korea benzene premium to Japan naphtha

$/t

500

450

400

hhh

350

300

Japan cfr naphtha = 0

250

21 Feb 13

20 Jun 13

24 Oct 13

20 Feb 14

Benzene assessments on a fob South Korea basis for March

slipped to $1,295/t by Wednesday this week from $1,310/t at

the end of last week. Assessments for April loading edged

higher on Wednesday to $1,285/t, up from $1,282.50/t seen

last Friday. Sentiment was mostly bearish among market

participants, resulting in a slowdown in deals this week.

Trading activity was its most active last Friday, with several

deals done for April loading at $1,281-1,284/t fob South Korea.

Few cargoes for April loading subsequently sold at $1,280/t

earlier this week. The intermonth spread for March- and Aprilloading cargoes were at a $10-20/t backwardation this week.

The backwardation spread for March and April on 19 February

narrowed by $10/t on the back of a hike in April values.

An overnight hike in US benzene prices also supported this

upwards movement in prices for April-loading cargoes.

Benzene oversupply in this region remained a cause for

concern, especially as demand from the SM sector that is

the largest downstream component in Asia, is nearing a

lull period. Demand from the SM sector is expected to dip

in the March-April period because of a series of scheduled

turnarounds. SM prices hovered close to $1,600/t cfr China this

week after taking a sharp dip last week. Benzene production

from regional crackers and reformers remained largely stable

this week. A key South Korean producer was operating its No.1

reformer at high rates following a small fire at this unit about

two weeks ago. Production margins based on naphtha as a

feedstock remained positive, backed by a wide $359/t spread

between benzene-naphtha prices this week, but it was $22/t

lower week-on-week.

Asian sellers continued to look for opportunities to ship

more cargoes in February to the US given the current stable to

weak market fundamentals and the strong US benzene market.

It was estimated that South Korea exported around 38,000t

of benzene to the US during 1-15 February. It also exported

another 12,000t to Taiwan, 6,000t to China and 2,000t to

Japan. It was forecast that total exports from Japan and

South Korea for the US will reach 60,000-70,000t by the end of

Copyright © 2014 Argus Media Group

February. The freight rates for 5,000-10,000t of benzene from

South Korea to the US Gulf coast was at $58-68/t.

An Indonesia-based producer is planning to issue a tender

to sell benzene next week, with details disclosed next week.

Benzene supplies in southeast Asia are ample at present,

which are dampening prices and sentiment. The discount

on fob southeast Asia prices from fob South Korea prices

was at about $10/t and higher, according to some market

participants, but a regional producer denied that the discount

has crossed the $10/t mark yet.

Styrene

Asian styrene prices moved within a narrow band during the

week, as markets failed to find direction after a sharp price

drop last week. A further inventory buildup in China this week

showed continued sluggishness in buying activity and weighed

on Asian styrene prices. Buying activity will likely only

start picking up in March. But the extent of actual demand

growth from the key EPS and PS segments is still in question,

dependent on various macroeconomic fundamentals including

economic growth in the large export and domestic styrenic

markets.

There was more clarity about supplies. Asian supplies

are expected to fall, with nearly 1.4mn t of styrene capacity

either shut or ready to be shut for planned turnarounds during

February. Another nearly 3mn t of styrene capacity is due to

be shut during March. The economics of standalone styrene

producers in Asia have begun to look weak, with ethylene

prices continuing to stay high at around $1,450/t cfr China

and benzene prices just under $1,300/t fob South Korea. Such

standalone units, which comprise around 30-35pc of Chinese

Asia Styrene shutdown schedule

Company

Location

KTA

Duration

Month

Shuangliang PC

Jiangyin, China

420

30 days

GPPC

Kaosiung, Taiwan

130

25 days

15 Feb- 11 Mar

Asahi

Mizushima, Japan

320

60 days

20 Feb- 17 Apr

Early Feb-early Mar

SP Chemical

Taixing, China

320

30 days

End Feb-end Mar

NSSM

Oita,Japan

240

40 days

25 Feb-7 Apr

Asahi

Mizushima, Japan

390

30 days

7 Mar - 31 Mar

Idemitsu

Chiba, Japan

210

30 days

Mar

Tianjin Dagu

Tainjin, China

500

30 days

Mar

LG Chemcials

Daesan, Korea

170

20 days

20 Mar - 10 April

Samsung Total

Daesan, Korea

650

21 days

Mid Mar - early Apr

NSSM

Oita,Japan

190

35 days

14 Mar-19 Apr

SECCO

Caojing, China

650

42 days

Mar-Apr

GPPC

Kaosiung, Taiwan

200

47 days

Mid Apr-early Jun

Chiba SM

Chiba, Japan

270

30 days

May

TSMC

Kaosiung, Taiwan

160

21 days

2H May-Jun

ZRCC

Ningbo,China

620

42 days

May-Jun

Formosa

Mailiao, Taiwan

600

40 days

Early Sep- mid Oct

Page 6 of 9

Argus DeWitt Benzene and Derivatives

Issue 14-7 | Thursday 20 February 2014

Asia-pacific

styrene production and a lowering of these operating rates, will

also curtail styrene supplies. This expected tapering of supplies is

one reason most market participants believe that styrene prices

may have hit a bottom in Asia and will rebound in March.

Chinese styrene inventories at key ports this week rose

by another 10,000t to more than 160,000t, staying above

typical 70,000-80,000t levels. Inventories are high, although

not alarming, given that China imported an average of around

300,000t of styrene on a monthly basis in 2013. Chinese domestic

prices during the week moved in a narrow range of 11,000-11,100

yuan/t ex-tank, or an equivalent import parity of $1,525-1,535/t

cfr China. They remain depressed and nearly Yn100/t lower than

the Yn12,000/t and above seen during January.

Some Chinese EPS units have restarted after the lunar

new year holiday, but many still remain shut. EPS production

is expected to ramp up once the cold weather conditions

moderate and construction activity picks up. It is crucial to any

recovery in Asian styrene demand, with nearly 6mn t of EPS

production capacity in China and a third of styrene demand

coming from this segment.

Imported cargoes traded mostly in a $1,595-1,610/t cfr China

range for March. The market continues to remain in contango

with the March-April spread at around $15-17/t.

The spread with naphtha was assessed at $646/t, $20/t

higher than last week. The spread with benzene rebounded to

around $288/t, $33/t higher from last week.

Argus DeWitt Petrochemical Review

Downtown Aquarium

Houston, Texas

March 25, 2014

In-depth analysis of the global petrochemical industry.

www.argusmedia.com/tx-petrochem

Argus DeWitt Benzene and Derivatives is published by the Argus Media Group

Registered office

Argus House, 175 St John St, London, EC1V 4LW

Tel: +44 20 7780 4200 Fax: +44 870 868 4338

email: sales@argusmedia.com

ISSN: 2053-6259

Copyright notice

Copyright © 2014 Argus Media Group. All rights reserved.

All intellectual property rights in this publication and

the information published herein are the exclusive

property of Argus and and/or its licensors and may

only be used under licence from Argus. Without

limiting the foregoing, by reading this publication you

agree that you will not copy or reproduce any part

of its contents (including, but not limited to, single

prices or any other individual items of data) in any

form or for any purpose whatsoever without the prior

written consent of Argus.

Trademark notice

ARGUS, ARGUS MEDIA, ARGUS DEWITT, the ARGUS

logo, ARGUS DEWITT BENZENE DAILY, other ARGUS

publication titles and ARGUS index names are

trademarks of Argus Media Inc.

Visit www.argusmedia.com/trademarks for more

information.

Publisher

Adrian Binks

Customer support and sales:

email: support@argusmedia.com

Chief operating officer

Neil Bradford

Technical support:

email: technicalsupport@argusmedia.com

CEO Americas

Euan Craik

Houston, US

Tel: +1 713 968 0000

Disclaimer

The data and other information published herein

(the “Data”) are provided on an “as is” basis. Argus

makes no warranties, express or implied, as to the

accuracy, adequacy, timeliness, or completeness of

the Data or fitness for any particular purpose. Argus

shall not be liable for any loss or damage arising from

any party’s reliance on the Data and disclaims any

and all liability related to or arising out of use of the

Data to the full extent permissible by law.

Commercial manager

Karen Johnson

Petrochemicals

illuminating the markets

Global compliance officer

Jeffrey Amos

Editor in chief

Ian Bourne

Managing Editor, Global

Cindy Galvin

Managing Editor, Americas

Jim Kennett

Contact: Chuck Venezia

Tel: +1 713 360 7569

benzenedaily@argusmedia.com

New York, US

Tel: +1 646 376 6130

Washington DC, US

Tel: +1 202 775 0240

London, UK Tel: +44 20 7780 4200

Astana, Kazakhstan Tel: +7 7172 54 04 60

Beijing, China Tel:+ 86 10 6515 6512

Dubai Tel: +971 4434 5112

Moscow, Russia Tel: +7 495 933 7571

Rio de Janeiro, Brazil

Tel: +55 21 3514 1450

Singapore Tel: +65 6496 9966

Tokyo, Japan Tel: +81 3 3561 1805

DeWitt

Argus DeWitt Asian MTBE and

Blendstocks 2014

4-5 March 2014

Pan Pacific Singapore

www.argusmedia.com/mtbe

In partnership with:

Group Discounts are available

Save more when you register as a

group. See the reverse page for more

details.

Rapid changes in the gasoline market

and its impact on blendstocks

Conference Highlights

Current demand and production outlook for MTBE across major

Asian markets, with an emphasis on China

Upcoming refining capacity and gasoline consumption growth in

Asia-Pacific and the Mideast Gulf and its impact on octane

requirements

New MTBE investments, capacity and production technology

options

Factors influencing MTBE pricing and forecasts

Competition and limitations of alternate blendstocks — reformate

mixed aromatics and methanol

Confirmed Speakers

Sophia Liu

Business Development

Huntsman Polyurethanes

Mark Tinkler

Commercial Director

Fortrec

Roel Salazar

Fuels and Octane Consultant

Argus DeWitt

Ray Hogger

Country Manager

ED&F Man

Clarence Woo

Executive Director

ACFA

and many more....

Potential in further growth of ethanol and ETBE in Asia

Confirmed participants

Global outlook for MTBE, specifically Latin America, Europe and

Asia

ɧ/$1;(66%XW\Oɧ7RQHQ*HQHUDO6HNL\Xɧ*LQJD

ɧ 6XPLWRPR &KHPLFDO ɧ *ROGPDQ 6DFKV ɧ

(1$3 ɧ 3&6 ɧ %UDVNHP 6$ ɧ&KHPLFDO &RQWUDFW

&RUSRUDWLRQɧ(1$3 ɧ7ULFRQ (QHUJ\ ɧ+HQJOL

3HWURFKHPLFDOɧ3DQMLQ+H\XQ1HZ0DWHULDOVɧ&.*

&KHPLFDOVɧ7UDѡJXUDɧ,QWHUFKHPɧ8&KHP7UDGLQJ

ɧ:DQKXD &KHPLFDO *URXS ɧ 0XQWDMDW ɧ 4$)$& ɧ

6DELFɧ(YRQLNɧ,WRFKXɧ(')0DQɧ/DXJIV

*DVɧ%$6)6RXWK (DVW$VLD ɧ6LQRSHF&KHPLFDO

&RPPHUFLDO +ROGLQJ +RQJ.RQJ &R ɧ 3KLOOLSV

,QWHUQDWLRQDO 7UDGLQJ ɧ 5HOLDQFH ,QGXVWULHV

ɧ 7RWDO 3HWURFKHPLFDOV+RQJ .RQJ ɧ %DQJNRN

6\QWKHWLFV ɧ &URS (QHUJ\ +RQJ .RQJ ɧ (12& 6LQJDSRUH ɧ +XQWVPDQ 3RO\XUHWKDQHV ɧ )RUWUHF

DQGPDQ\PRUH

Sponsor:

DQGPDQ\PRUH

Petrochemicals

illuminating the markets

Market Reporting

Consulting

Events

Event registration : Argus DeWitt Asian MTBE and Blendstocks 2014

EMAIL:

FAX:

MAIL:

asiaconferences@argusmedia.com

Complete this form and fax to

Complete this form and post to the address below

+65 6533 4181

DATES & VENUE

REGISTRATION FORM

4 -5 March 2014

Please print in BLOCK letters and return to:

Pan Pacific Singapore

Argus Media Ltd., 50 Raffles Place, #10-01 Singapore Land

7 Raffles Boulevard, Marina Square, Singapore 039595

Tower, Singapore 048623

Attn: Josephine Pulvera

www.panpacific.com/en/singapore

Tel: +65 64969966 | Fax: +65 6533 4181

SG$ 1450 /

REGISTRATION FEE

US$ 1200

asiaconferences@argusmedia.com

For group rates, please contact Josephine Pulvera (josephine.pulvera@argusmedia.com)

www.argusmedia.com/mtbe

*Full conference fee includes two-day conference pass to participate at all sessions, networking luncheon

and refreshment breaks, one invitation to the cocktail reception and one set of conference documentation

**A 7% Goods & Services Tax (GST) is applicable to all Singapore based companies for Singapore venue.

Alternatively, registration fees are subject to the prevailing government tax.

COMPANY DETAILS:

Register and make your credit card payment online at

www.argusmedia.com/mtbe

OR fill in the registration form to make your payment via bank transfer

Invoice my company

Cheque enclosed (Make payable to “Argus Media Limited”).

Credit card

Bank Details:

BANK TRANSFER

Bank name: National Westminster Bank plc

Address: Hampstead Village branch, 25 Hampstead High Street, London, NW3 1QJ

Bank account number: USD: 01329383

Sort code: 60-73-01

IBAN NO: USD: GB49NWBK60730101329383

SWIFT CODE: NWBKGB2L

*Please indicate company name when making payment

Argus Media VAT: GB229714941 - Company registration no. 1642534

illuminating the markets

argusmedia.com

DELEGATE 1 DETAILS

Name: Dr/Mr/Ms:

Job Title:

Telephone:

Email:

Special dietary/disability requirements (if any):

PAYMENT METHOD

In these Terms and Conditions the expressions:

“we”, “us” and “our” refer to Argus Media Limited a company incorporated in England with registered company

number 01642534 and whose registered office is at Argus House, 175 St John Street, London, EC1V 4LW; and “you”

and “your” refer to you.

Subject to availability, we accept bookings for events through the online, electronic or postal submission of a

registration form. Upon our communication to you (including by email) of our acceptance of your booking, there

shall be a legally binding contract between you and us incorporating these Terms and Conditions.

Payment

1. If payment is not received in full at the time of booking, your booking will be provisional until payment is

received in full in accordance with paragraph 2 below. You acknowledge that we cannot guarantee bookings made

on a provisional basis.

2. Payment must be made by the earlier date of the following: (i) within 30 days of the date of this invoice; (ii) by

no later than 7 days before the event.

3. Fees are a fixed price and unless otherwise stated reductions and discounts cannot be offered should you not

wish to attend the entire event.

4. In order to qualify for any “early bird” discounts, booking and payment in full must be received prior to the date

specified above and on the invoice.

Cancellations and Substitutions

1. If you are unable to attend the event, you may send a substitute provided that you inform us in writing to

asiaconferences@argusmedia.com at least 48 hours before the commencement of the event.

2. Cancellations made in writing to asiaconferences@argusmedia.com at least 1 calendar month prior to the event

will be refunded in full, less a 15% administration charge. No refunds will be given for cancellations received

thereafter.

3. Failure to attend all or part of an event for any reason whatsoever will be treated as a late cancellation and no

refunds will be given.

4. If the event is cancelled for any reason within our control, then the registration fee will be fully refunded. We

shall not be liable for any other loss, damage, costs (including without limitation travel, visa or accommodation

costs), expenses or other liabilities incurred by you in connection with such cancellation. Refunds may take up

to 25 business days.

Events

1. Our agendas are correct at the time of issue; however, it may be necessary to make some amendments to the

content, speakers, location, and/or timing of the event.

Address:

City:

Postal Code:

Country:

VAT number:

IT IS EASIER AND FASTER

TERMS AND CONDITIONS

Company Name:

DELEGATE 2 DETAILS

Name: Dr/Mr/Ms:

Job Title:

Telephone:

Email:

Special dietary/disability requirements (if any):

Tick here to request a free trial of :

JJ&A Methanol Report

Argus DeWitt Butadiene

2. Please advise us of any special requirements (such as access or dietary requirements) at the time of booking.

3. We reserve the right to refuse admission to an event for any reason.

4. Views expressed by speakers at the event may not be the views of Argus. All event materials are provided to you

on an “as is” basis and we make no warranty as to the completeness or accuracy of such materials.

5. You agree that, unless otherwise expressly stated, we own all intellectual property rights in all event materials

and delegate lists.

6. You may not film, photograph or otherwise record all or any part of the event without our prior written consent.

7. You must comply with all applicable laws and any health and safety requirements (including no smoking signs)

in respect of the event.

Privacy and Marketing

1. Any personal data you disclose to us will be processed in accordance with the Data Protection Act 1998 and

our privacy policy.

2. Your personal data may be used by us and carefully selected third parties to inform you about other products

and services that may be of interest to you via telephone, post and/or email. If you do not wish to receive such

marketing information, please contact us.

3. You agree that we may use your company name in marketing promotions in connection with this event.

4. We may record (by audio and/or visual means) all or part of the event. You agree that we may use and distribute

such recordings for the purposes of training, publicity and documentation.

General

1. It is your responsibility to arrange appropriate insurance cover for your attendance at the event.

2. You are fully responsible and liable for any loss or damage caused by you to property or individuals at an event.

3. Except in respect of death or personal injury caused by our negligence or for fraud, our total aggregate liability

in connection with the event shall be limited to the fee paid by you.

4. You are responsible for safeguarding your own property at the event. We accept no liability in respect of any

damage to, or theft or loss of, your property.

5. These Terms and Conditions together with the registration form set out the entire agreement between you and

us.

6. If any provision of these Terms and Conditions (in whole or in part) is found by any competent authority to be

unenforceable or illegal, the remainder of provisions shall remain in force.

7. These Terms and Conditions shall be governed by the laws of England and you agree to submit to the exclusive

jurisdiction of the English courts.

DeWitt