Competitive Strategies in Commodity Oligopolies

advertisement

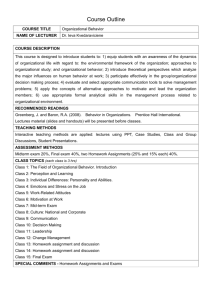

Prof. Dr. Dodo zu Knyphausen-Aufseß Fachgebiet Strategische Führung und Globales Management Fakultät VII, Technische Universität Berlin Straße des 17. Juni 135 10623 Berlin Telefon: 030 314 28744 eMail: knyphausen@strategie.tu-berlin.de Syllabus Wintersemester 2014/2015 „Competitive Strategies in Commodity Oligopolies“ Time: Lecturer: Assistance: Contact: Homepage: Four Friday block sessions on 19 December, 16 January, 23 January and 30 January, 9:30 – 13:00 and 14:00 – 17:30 (Rooms HL 001 & H2036). Dr. Ulrich Pidun, Director, The Boston Consulting Group Dr. Martin Heitmann / Jan Henrik Voß / Maren Wendland pidun.ulrich@bcg.com / heitmann@strategie.tu-berlin.de / wendland@strategie.tu-berlin.de http://www.strategie.tu-berlin.de/ Commodity oligopolies are special competitive situations. They are very common in mature industries in which few large players compete (oligopoly) on the basis of non-differentiated products (commodities). Think of the paper, steel, cement or energy industry. But many other industries also show some (first) characteristics of commodity oligopolies because it is a natural tendency of an industry to commoditize and consolidate over time. Commodity oligopolies pose specific requirements on the competitive strategies of individual players. The classical strategies of differentiation cannot be applied. The remaining key strategic levers are price, capacity and production volume. In contrast to more fragmented industries, competitors in commodity oligopolies can and have to explicitly take the behavior of their individual peers into account, and think about how they can influence it. Game theory becomes an important strategic instrument. The course "Competitive Strategies in Commodity Oligopolies" will give an overview of the theoretical foundations and practical implications of competing in commodity oligopolies. It offers an introduction to oligopoly theory and game theory, covers the concept of coopetition and its applications, introduces the work of Robert Axelrod on the emergence of cooperation, and illustrates the potential of business model innovation to overcome stalemate competitive situations. Participants will be able to apply the learnings and train their managerial skills in an economic simulation game in which four teams compete over the course of an industry cycle of eight years and try to maximize the value of their respective companies. Case study presentations will complement the learning experience. 1 Required readings Only if all participants prepare themselves for the respective meetings and participate in the discussions, the goals of this course can be achieved. For this, we have put together a folder containing the basic literature and case studies, which give you an understanding of the subject matter. Important: The mandatory reading is part of the content which is relevant for the exam. All case studies are part of the mandatory reading (not only the one that you will be presenting). From experience, it is too late if you try to read all the literature at once and for the first time right before the exam. A folder with the literature will be provided in the secretariat (H 9167). You can borrow the folder and copy the relevant literature. Schedule and organization The course will take place in four block sessions on December 19th, January 16th, January 23rd and January 30th, 9:30 – 13:00 and 14:00 – 17:30 respectively, in the rooms HL 001 and H2036. However, the general introduction for this module will take place on October 14th at 4:15 p.m. in room H 0107. In our introductory session we will present the case study assignments for both courses. You have to choose three of them and fill out the form which is available on our website (the link to this form will be published in the news section after our introductory session) until October 17th at 11:59 p.m. We will then try to assign each of you to a group and case study of his or her choice, but please understand that some topics are very popular and the size of each student group is limited. So, eventually not everyone will get his or her priority. In the end you have to participate in one case study group, either in this or in Prof. zu Knyphausen-Aufseß’ course. We strongly encourage you to prepare for each session and to read the course material (in particular the case studies), even if you have no active part in the corresponding session. Without this you will not be able to comprehend everything that your fellow students present and you cannot participate in the subsequent discussion. This syllabus outlines the schedule of the whole course as well as the detailed organization of each meeting. Please check the syllabus on a regular basis to inform you on which part of the whole course we are working at the moment and how this part is related to former and further sections. Following this request will help you to develop an understanding of the structure and the content of our course. This course is taught in English in order to attract foreign students and to offer you an opportunity to practice your language skills. Introductory session to the chair’s teaching program Again, on October 14th at 4:15 p.m. in room H 0107, we offer a general introduction to our teaching program and answer questions regarding your study plans as far as they are related to our chair. We strongly recommend participating in this session, especially to receive the password for downloading course materials. 2 Course materials The charts, which will be used in the meetings, will be posted online in our virtual course, at www.isis.tu-berlin.de, on a weekly basis before the actual meeting. The access is password protected. You will receive the password during the general introduction. Presentation of case studies As stated above, the group assignment will be handled using the web form. Your presentation should take 30 minutes. Furthermore, you have to prepare a discussion, which should take place after your presentation and in which you argue with the auditorium about specific aspects of your case study (15 minutes). There is a deadline for sending in your presentations. You have to send your presentation to our assistants three days before the presentation at the latest! Attention: Don’t forget to include a guideline chart in your slide set. This is important so that your fellow students can prepare sufficiently for the exam later on. We will provide you with some basic literature, which should serve as a starting point for the preparation of your case study. Nevertheless, you have to search for additional sources and information on your own. This is part of your task. The grade for your presentation will depend on its content (65% of the presentation grade: How well do you understand the case? How well do you answer the questions? How do you use all available sources of information? How consistent and clear is your line of argumentation? How original are your ideas?) and on the presentation itself (35% of the presentation grade: How well do you structure your presentation? How good is your timing? How well do you use different presentation techniques? How clear and convincing do you speak? How do you react to questions?). Important: The better you prepare your presentation and the subsequent discussion, the more you (and your fellow students) can learn and the easier will be the preparation for the exam. Interactivity/Feedback We encourage your participation in the course as far as possible in the seminar. To ensure the communication won’t be one-sided, we ask you to articulate all your questions and ideas openly in class. Furthermore, we are at your disposal for all kinds of questions and requests per email. Please also make use of our forum on ISIS as a communication platform. At the end of the course you will have the possibility to officially evaluate the course (as long as the course has been chosen to be evaluated by the evaluation team of our faculty) – of course we have and want to improve ourselves. Registration You have to register for the class at the latest by the end of the first week of lectures in the virtual course (ISIS). Only this way, we can communicate with you per e-mail and inform you about shortterm changes. 3 Students of “Industrial Engineering and Management“ also have to register officially. This course is part of the module “Strategic Management“ for master students. During the first six weeks of the semester, you have to register this module at the examination office or via QISPOS for receiving the acknowledgement as so called “prüfungsäquivalente Studienleistung”. For diploma students this course is part of the module “Strategic Management“ within their first or second “BWL”subject, which also has to be registered as “prüfungsäquivalente Studienleistung” at the examination office Students of “Innovation Management and Entrepreneurship” have to register via QISPOS. In case you have further questions about the registration, please contact Mr. Mrozewski (matthias.mrozewski@tu-berlin.de). This course is part of study stream 3 within the IME master program. Students of other fields who only need a certificate or “Schein” respectively (i.e. ERASMUSstudents, students of other universities) also need to register for the written exam. Please use the ISIS system to register within the first six weeks of the semester. Otherwise, you can’t participate in the final exam. Credits and module-exam Please note that you will be graded for the entire module “Strategic Management”. The portfolio examination consists of the following elements, adding up to a maximum of 100 credits. The grading follows the joint conversion key of the School of Economics and Management (decision of the school's council dated May 28, 2014 - FKR VII-4/8-28.05.2014) 70 points will be based on two tests, which will both take 45 minutes each. One of these tests is about the SMOC course (offered in December and February), the other one is about the CSCO course (offered in February and May). The first test date is on December 11th, 2014, starting at 12 p.m. in room H 0107 and possibly also in room H 0106. This test is about the SMOC course. The second test date is on February 12th, 2015, starting at 12 p.m. in room H 0107 and possibly also in room H0106. On this date you can write the SMOC and/or the CSCO test. Another test date for CSCO in May or June has yet to be announced. We will formulate the exam in English and in German and allow you to use bilingual dictionaries (German <-> English) and answer the questions in either of the two languages. The remaining 30 points for the module will be based on the case study which you have to present in one of the two courses. Students passing the module earn 6 ECTS credits. Throughout the semester we will support you and especially at the end of each course you will have the opportunity to pose questions regarding the written exam – we want you to pass the exam. If you still fail to pass the whole module (this is not the same as failing a single test or in the case study presentation), we will give you the opportunity to repeat the module in the next winter term. 4 Overview of the course: Lecture 1: Theories of oligopolistic competition Date: Friday, 19.12.2014, 09:30-11:00 Room: HL 001 Introduction to the course: Learning objectives, overview of lectures, topics covered Required readings, case studies, proof of performance, support Content lecture 1: Market mechanism in perfectly competitive markets Market mechanism in monopolistically competitive markets Equilibrium in an oligopolistic market Cournot model of oligopolistic competition First mover advantage: Stackelberg model Price competition with homogeneous products: Bertrand model Price competition with differentiated products Competition vs. collusion Mandatory readings: R.S. Pindyck, D.L. Rubinfeld: Microeconomics, 8th edition, Pearson 2012, Chapter 8.1-8.4 (p.279292), Chapter 12.1-12.4 (p.451-472) Lecture 2: Case study "Southwest Airlines" Date: Friday, 19.12.2014, 11:30-13:00 Room: HL 001 Lead questions for the presenting student group (please also use other, more recent sources): How do you assess the attractiveness of the U.S. airline industry (using Porter's Five Forces framework)? Describe Southwest Airline's strategy. What are key strategic choices? What is unique? How easy would it be to imitate this strategy? Is the strategy sustainable? What threats are on the horizon? What should Southwest Airlines do in order to stay successful? Mandatory readings (for all participants, not only the presenting group) Case study "Southwest Airlines" (Thunderbird Global School of Management, 2013) 5 Lecture 3: Typology of strategies in commodity oligopolies Date: Friday, 19.12.2014, 14:00-15:30 Room: HL 001 Content lecture 3: Characteristics of commodity oligopolies Evasion strategy: Changing the rules of the game Hardball strategy: Discipline through deterrence Cooperative strategy: Growing the pie Mandatory readings: R.M. Grant: Contemporary Strategy Analysis, 8th edition, Wiley 2013, Chapter 10 (p.277-291) Lecture 4: Case study "Cola wars continue: Coke and Pepsi in 2010" Date: Friday, 19.12.2014, 16:00-17:30 Room: HL 001 Lead questions for the presenting student group (please also use other, more recent sources): How would you describe the development of competition in the US and global soft drinks market over the last 100 years? Which competitive strategies and instruments did Coke and Pepsi employ during the cola wars? What are new challenges for Coke and Pepsi at the beginning of the 21st century? Which strategies do Coke and Pepsi follow to cope with these new challenges? Whose strategy will be more successful? Who will win the next round of the cola wars? Mandatory readings (for all participants, not only the presenting group) Case study " Cola wars continue: Coke and Pepsi in 2010" (Harvard Business School, 2011) Lecture 5: Introduction to game theory Date: Friday, 16.01.2015, 09:30-11:00 Room: HL 001 Content lecture 5: Cooperative vs. noncooperative games Constant sum games vs. nonconstant sum games Dominant strategies, Nash equilibrium, Pareto efficiency Mixed strategies, maximin strategies Prisoner's dilemma, battle of the sexes, hawk-dove game, Montmort game Sequential games and the extensive form 6 Threats, commitments and credibility Entry deterrence Price competition in a duopoly Mandatory readings: R.S. Pindyck, D.L. Rubinfeld: Microeconomics, 8th edition, Pearson 2012, Chapter 13.1-13.7 (p.487-516) Lecture 6: Case study "Tetra Pak versus Greatview: The battle beyond China" Date: Friday, 16.01.2015, 11:30-13:00 Room: HL 001 Lead questions for the presenting student group (please also use other, more recent sources): How would you describe the aseptic packaging industry and the positioning and development of the two competitors Tetra Pak and Greatview? Which strategies did Greatview use to attack Tetra Pak in China? Which strategies did Tetra Pak use to defend its market position? How do you evaluate these different strategies? What is the impact of the Chinese antitrust law on competition? Which arguments can Greatview and Tetra Pak use in their favor with respect to this antitrust law? What are potential competitive strategies for Tetra Pak in Europe? Please identify and evaluate options and derive a recommendation. What are potential competitive strategies for Greatview in Europe? Please identify and evaluate options and derive a recommendation. Mandatory readings (for all participants, not only the presenting group) Case study " Tetra Pak versus Greatview: The battle beyond China" (Asia Case Research Centre, 2013) Lecture 7: The emergence of cooperation Date: Friday, 16.01.2015, 14:00-15:30 Room: HL 001 Content lecture 7: Repeated prisoner's dilemma Axelrod's first and second computer tournament Characteristics of successful strategies The evolution of cooperation in a world of egoists Conclusions for companies and policy makers Mandatory readings: 7 R. Axelrod: Effective choice in the Prisoner’s Dilemma, Journal of Conflict Resolution 1980, 24 (1), p. 3-25 R. Axelrod: More effective choice in the Prisoner’s Dilemma, Journal of Conflict Resolution 1980, 24 (3), p.379-403 Lecture 8: Case study "OPEC: The economics of a cartel" Date: Friday, 16.01.2015, 16:00-17:30 Room: HL 001 Lead questions for the presenting student group (please also use other, more recent sources): What is the origin of the OPEC and how did it evolve over time? How does the OPEC function as a cartel? Which mechanisms exist for influencing the oil price? What has been the impact of the OPEC on the oil price? How did this influence change over time and what did it depend upon? What are the advantages and disadvantages for an individual country of being part of the OPEC cartel? What have been competitive strategies of the different members of the OPEC? Which conflicts exist and how do members deal with them? What will be the future of the OPEC from your point of view? Mandatory readings (for all participants, not only the presenting group) Case study " OPEC: The economics of a cartel (A-C)" (IBSCDC, 2008) Lecture 9/10: Commopoly Game (I) Date: Friday, 23.01.2015, 09:30-13:00 Room: H2036 Content lecture 9/10: Introduction to the commopoly game Eight rounds of commopoly in four teams (please bring a pocket calculator) Joint analysis of the game, conclusions Mandatory readings: None Lecture 11/12: Commopoly Game (II) Date: Friday, 23.01.2015, 14:00-17:30 8 Room: H2036 Content lecture 11/12: Second game of eight rounds of commopoly (please bring a pocket calculator) Application of the learnings from game theory and the emergence of cooperation Joint analysis of the game, comparison between the two games, conclusions Mandatory readings: None Lecture 13: Coopetition Date: Friday, 30.01.2015, 09:30-11:00 Room: HL 001 Content lecture 13: The concept of coopetition: business as war and piece Beyond Porter: the Value Net The PARTS framework: Players, Added values, Rules, Tactics, Scope Mandatory readings: A.M. Brandenburger, B.J. Nalebuff: The Right Game: Use Game Theory to Shape Strategy, Harvard Business Review 1995, Jul-Aug, p. 57-71 G. Stalk, R. Lachenauer: Hardball: Five Killer Strategies for Trouncing the Competition, Harvard Business Review 2004, April, p.62-71 Lecture 14: Case study "Maersk Line and the future of container shipping" Date: Friday, 30.01.2015, 11:30-13:00 Room: HL 001 Lead questions for the presenting student group (please also use other, more recent sources): How do you assess the attractiveness of the container shipping industry (using Porter's Five Forces framework)? To which extent is container shipping a commodity oligopoly? What are key success factors? How did the price war in container shipping happen? What can Maersk Line do to restore the profitability of the industry? What is Maersk Line's strategy? How successful will it be? Mandatory readings (for all participants, not only the presenting group) Case study "Maersk Line and the future of container shipping" (Harvard Business School, 2012) 9 Lecture 15: Case study "Lafarge-Holcim deal: A merger of equals" Date: Friday, 30.01.2015, 14:00-15:30 Room: HL 001 Lead questions for the presenting student group (please also use other, more recent sources): How would you describe the global cement industry? To which extent is it a commodity oligopoly? What are key success factors? How does the competitive landscape look like? How are Lafarge and Holcim positioned? What is the rationale for the planned merger from the two companies' perspectives? What are potential risks? How do you assess the antitrust issues regarding the deal? What should be the arguments of the regulators and of the two companies? How do you assess the impact of the suggested merger on the competitive landscape and the future competitive dynamics in the cement industry? Mandatory readings (for all participants, not only the presenting group) Case study "Lafarge-Holcim deal: A merger of equals" (Amity Research Centers, 2014) Lecture 16: Business model innovation Date: Friday, 30.01.2015, 16:00-17:30 Room: HL 001 Content lecture 16: What is a business model? How is business model innovation different from other types of innovation? Blue ocean strategies A framework for analyzing business model innovation Examples for different types of successful business model innovation Mandatory readings: W.C. Kim, R. Mauborgne: Blue Ocean Strategy, Harvard Business Review 2004, Oct, p.173-181 Z. Lindgardt, M. Reeves, G. Stalk, M.S. Deimler: Business Model Innovation: When the Game Gets Tough, Change the Game, The Boston Consulting Group 2009 10