Codes of professional ethics

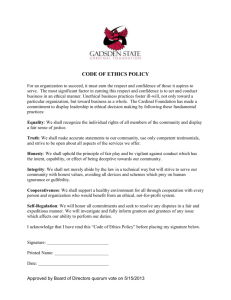

advertisement

chapter 14 Codes of professional ethics Contents Introduction Examination context Topic List 1 Professional ethics 2 IFAC Code 3 ICAEW Code 4 APB Ethical Standards Summary and Self-test Answers to Self-test Answer to Interactive question 251 Assurance Introduction Learning objectives ` Be aware of the key ethical codes to which ICAEW members are subject and the sources that influence them ` Understand the difference between principles and rules based systems ` Understand why ethics are important to accountants ` Know the key features of IFAC and ICAEW Codes ` Know the fundamental principles of IFAC and ICAEW Codes Tick off Specific syllabus references for this chapter are : 4a, b, c, d, e. Practical significance Professional ethics is of critical importance to accounting professionals. Remember in Chapter 1 where we set out that one reason people seek assurance from accountants is that they are independent, impartial people? That is due to their code of ethics. Ethical issues are important for all accountants, from trainees to partners. Stop and think What ethical issues might arise for trainees that are less likely to arise for partners? And vice versa? Working context If a trainee in practice is at a client carrying out assurance work, he could be faced with ethical decisions, such as if client staff are trying to influence him as to the appropriateness of a particular accounting policy, in which case he should refer the matter to his assurance senior. Syllabus links You will build on the principles of professional ethics you learn here in your Audit and Assurance paper. 252 CODES OF PROFESSIONAL ETHICS 14 Examination context Exam requirements Ethics is 20% of the syllabus, and therefore in the sample paper, there were ten questions on ethics. These were a combination of questions about general ethical concepts and principles, which we shall look at in this chapter, and more detailed ethical threats and safeguards, which we shall look at in the next two chapters. In the assessment, candidates may be required to: ` State the role of ethical codes and their importance to the profession ` Recognise the differences between a rules based ethical code and one based upon a set of principles ` Identify the key features of the system of professional ethics adopted by IFAC and ICAEW ` Identify the fundamental principles underlying the IFAC and the ICAEW Code of Ethics 253 Assurance 1 Professional ethics Section overview 1.1 ` Accountants require an ethical code because they hold positions of trust, and people rely on them. ` Accountants work in the public interest, which extends beyond clients to people associated with those clients and the general community. ` ICAEW members are subject to ICAEW guidance (influenced by IFAC guidance) and APB standards. ` Guidance tends to be issued in the form of principles rather than hard and fast rules. Need for ethics Professional accountants have a responsibility to consider the public interest and maintain the reputation of the accounting profession. Personal self-interest must not prevail over these duties. The IFAC and ICAEW Codes of Ethics help accountants to meet these obligations by setting out ethical guidance to be followed. Acting in the public interest involves having regard to the legitimate interests of clients, government, financial institutions, employees, investors, the business and financial community and others who rely upon the objectivity and integrity of the accounting profession to support the propriety and orderly functioning of commerce. In summary, then, the key reason accountants need to have an ethical code is that people rely on them and their expertise. It is important to note that this reliance extends beyond clients to the general community. Accountants deal with a range of issues on behalf of clients. They often have access to confidential and sensitive information. Auditors (and other assurance providers) claim to give an independent view. It is therefore critical that accountants (particularly those giving assurance) are independent. Compliance with a shared set of ethical guidelines gives protection to accountants as well, as they cannot be accused of behaving differently from (that is, less well than) other accountants. 1.2 Sources of ethical guidance ICAEW members (and trainees) and employees of member firms are subject to the ICAEW Code of Ethics. This is influenced by the guidance of IFAC (the International Federation of Accountants, of which ICAEW is a member). You should be aware of this body as it is the same body that issues International Standards on Auditing, which we have been studying in this Study Manual. UK auditors are also subject to the APB's Ethical Standards. The APB is the Auditing Practices Board in the UK, which also issues auditing standards (adopted from IFAC, which creates them). 1.3 Rules or principles–based guidance? The ethical guidance we shall look at tends to be in the form of a principles-based framework. It contains some rules (as we shall see in the next chapter), but in the main it is flexible guidance. It can be seen as being a framework of principles rather than a set of rules. There are a number of advantages of a framework of principles over a system of ethical rules, which are outlined in the following table. 254 Factor Explanation Active consideration and demonstration of conclusions A framework of principles places the onus on the accountant to actively consider independence for every given situation, rather than just agreeing a checklist of forbidden items. It also requires him to demonstrate that a responsible conclusion has been reached about ethical issues. CODES OF PROFESSIONAL ETHICS Factor Explanation Broad interpretation of ethical situations A principles-based framework prevents auditors interpreting legalistic requirements narrowly to get around ethical requirements. There is an element to which rules engender deception whereas principles encourage compliance. Individual situations covered A principles-based framework allows for the variations that are found in individual situations. Each situation is likely to be different. Flexible to changing situation A principles-based framework can accommodate a rapidly changing environment, such as the one that assurance providers are involved in. Can incorporate prohibitions However, a principle-based framework can contain certain prohibitions where these are necessary. 14 2 IFAC Code Section overview ` The IFAC Code contains a number of fundamental principles. ` It also gives guidance on the meaning of independence and the approach accountants should take to ethical questions. ` The IFAC Code sets out a number of general threats to independence and categories of safeguards. The IFAC Code contains a number of fundamental principles. It then goes on to outline key issues of ethics, such as independence, and highlight general and specific threats to independence and the safeguards that can be implemented to reduce those threats. A key issue to remember is that if it is impossible to reduce a threat to an acceptable level, the threat must be avoided (for example, by not accepting an engagement). 2.1 Fundamental principles The fundamental principles are: 2.2 ` Integrity. A professional accountant should be straightforward and honest in all professional and business relationships. ` Objectivity. A professional accountant should not allow bias, conflict of interest or undue influence of others to override professional or business judgements. ` Professional competence and due care. A professional accountant has a continuing duty to maintain professional knowledge and skill at the level required to ensure that a client or employer receives competent professional service based on current developments in practice, legislation and techniques. A professional accountant should act diligently and in accordance with applicable technical and professional standards when providing professional services. ` Confidentiality. A professional accountant should respect the confidentiality of information acquired as a result of professional and business relationships and should not disclose any such information to third parties without proper and specific authority unless there is a legal or professional right or duty to disclose. Confidential information acquired as a result of professional and business relationships should not be used for the personal advantage of the professional accountant or third parties. ` Professional behaviour. A professional accountant should comply with relevant laws and regulations and should avoid any action that discredits the profession. Independence IFAC Code It is in the public interest and, therefore, required by this Code of Ethics, that members of assurance teams, firms and when applicable, network firms be independent of assurance clients. 255 Assurance The Code discusses independence in the light of the wider term 'assurance engagements' rather than focusing solely on audits. The guidance states its purpose in a series of steps. It aims to help firms and members: Step 1 Identify threats to independence Step 2 Evaluate whether the threats are insignificant Step 3 If the threats are not insignificant, identify and apply safeguards to eliminate risk, or reduce it to an acceptable level. It also recognises that there may be occasions where no safeguard is available. In such a situation, it is only appropriate to ` ` Eliminate the interest or activities causing the threat Decline the engagement, or discontinue it Definitions Independence of mind: The state of mind that permits the expression of a conclusion without being affected by influences that compromise professional judgement, allowing an individual to act with integrity, and exercise objectivity and professional scepticism. Independence in appearance: The avoidance of facts and circumstances that are so significant that a reasonable and informed third party, having knowledge of all relevant information, including safeguards applied, would reasonably conclude a firm's, or a member of the assurance team's, integrity, objectivity or professional scepticism had been compromised. The degree of independence required is highest for an audit engagement, with less stringent requirements for non-audit engagements at an audit client, and engagements at non-audit clients. 2.3 Threats and safeguards The following general points are made in the Code. We shall look at more specific guidance in the following chapters. There are five general sources of threat identified by the revised Code. The APB's Ethical Standard 1 identifies a sixth threat (the management threat): ` Self-interest threat (for example, having a financial interest in a client) ` Self-review threat (for example, auditing financial statements prepared by the firm) ` Advocacy threat (for example, promoting the client's position by dealing in its shares) ` Familiarity threat (for example, an audit team member having family at the client) ` Intimidation threat (for example, threats of replacement due to disagreement) ` Management threat (for example, doing work that should be carried out by management, such as the design and implementation of IT systems) There are two general categories of safeguard identified by the Code: ` ` 256 Safeguards created by the profession, legislation or regulation Safeguards within the work environment CODES OF PROFESSIONAL ETHICS 14 Examples of safeguards created by the profession, legislation or regulation: ` Educational training and experience requirements for entry into the profession ` Continuing professional development requirements ` Corporate governance regulations ` Professional standards ` Professional or regulatory monitoring and disciplinary procedures ` External review by a legally empowered third party of the reports, returns, communication or information produced by a professional accountant Examples of safeguards in the work environment: ` Involving an additional professional accountant to review the work done or otherwise advise as necessary ` Consulting an independent third party, such as a committee of independent directors, a professional regulatory body or another professional accountant ` Rotating senior personnel ` Discussing ethical issues with those in charge of client governance ` Disclosing to those charged with governance the nature of services provided and extent of fees charged ` Involving another firm to perform or reperform part of the engagement The team and the firm should be independent 'during the period of the engagement'. The period of the engagement is from the commencement of work until the signing of the final report being produced. For a recurring audit, independence may only cease on termination of the contract between the parties. 3 ICAEW Code Section overview ` The ICAEW Code is relevant to professional accountants in all of their professional and business activities. ` The ICAEW Code incorporates the IFAC Code of Ethics, but also contains additional rules deemed appropriate by the ICAEW. The ICAEW Code states that 'professional accountants are expected to follow the guidance contained in the fundamental principles in all of their professional and business activities whether carried out with or without reward and in other circumstances where to fail to do so would bring discredit to the profession.' Therefore the Code may apply not only to the job of the professional accountant but also to the life of the professional accountant, particularly if he is involved in matters relevant to his profession, such as keeping the books for a private club of which he is a member. The Code also states that professional accountants are required to follow the spirit as well as the letter of the guidance. In other words, a specific matter being excluded from the guidance does not mean that the accountant does not have to think about it; rather he must determine if the spirit of the guidance would also apply to that situation. The ICAEW Code implements the IFAC Code above so that following it ensures compliance with the IFAC Code. 257 Assurance 4 APB Ethical Standards Section overview The APB has issued ethical standards with which UK auditors must comply when carrying out audits. The ethical standards were drafted with the IFAC Code of Ethics in mind. ` ` As noted above, the APB has issued ethical standards (ESs) with which UK auditors must comply when carrying out UK audits. They are as follows: ` ` ` ` ` ES 1: Integrity, Objectivity and Independence ES 2: Financial, Business, Employment and Personal Relationships ES 3: Long Association with the Audit Engagement ES 4: Fees, Remuneration and Evaluation Policies, Litigation, Gifts and Hospitality ES 5: Non-Audit Services Provided to Audit Clients There is also an ES with provisions available for smaller entities, which is not examinable. This offers exemptions and special rules to the auditors of smaller entities. These standards were developed with regard to the IFAC Code of Ethics and also the EC Recommendation on the independence of statutory audits. Interactive question: Ethical codes [Difficulty level: Exam standard] There are two main approaches to a code of professional ethics: a rules based ethical code and a code based on a set of principles. Indicate whether the following statements are true or false. (a) A code based on a set of principles rather than rules is more flexible in a rapidly changing environment. True False (b) ICAEW's Code of Ethics is principles based. True False (c) True False A code based on a set of rules requires accountants to evaluate and address threats to independence. See Answer at the end of this chapter. 258 CODES OF PROFESSIONAL ETHICS 14 Summary and Self-test Summary Accountants require an ethical code because they hold positions of trust and people rely on them A principles based system: – Allows flexibility – Allows broad interpretation – Encourages evaluation – Allows for individual situations – Can contain rules The IFAC Code is principles based. It contains a number of fundamental principles and then goes on to focus on the importance of independence, and threats of self-interest, self-review, advocacy, familiarity and intimidation The ICAEW Code is compulsory for members in their professional lives and where actions in their personal life would discredit the profession. It implements the IFAC Code The APB has issued ethical standards with which UK auditors must comply when carrying out UK audits. They also apply the principles of the IFAC Code Self-test Answer the following questions. 1 Which two of the following statements are correct? (a) Accountants must have ethical codes because people rely on accountants. Yes No (b) A set of ethical principles gives protection to accountants as it means they are all working to the same guidelines. Yes No (c) Rules based codes provide better protection to users of accountancy services because every potential situation arising is covered by them. Yes No 259 Assurance 2 Are the following statements true or false? (a) The principle of integrity can be defined as the accountant not allowing bias, conflict of interest or undue influence of others to override his choice of actions. True False (b) Accountants may use information obtained during the course of their professional work for personal use so long as they do not disclose it to others in breach of their duty of confidentiality. True False (c) Professional accountants should be technically up to date so as to give appropriate advice to clients. True False 3 The following are examples of which types of general threats to independence? (a) The financial statements of Dropdown Ltd have been prepared by Glazer Brothers, their audit firm. (b) Knowhow plc has intimated to the audit firm that if they do not receive an unqualified audit report for the year 20X6, they may put the audit out to tender. 4 The ICAEW Code implements the IFAC Code. True False 5 The APB Ethical Standards apply to UK audits and assurance work. True False Now, go back to the Learning Objectives in the Introduction. If you are satisfied you have achieved these objectives, please tick them off. 260 CODES OF PROFESSIONAL ETHICS 14 Answers to Self-test 1 (a) and (b) are correct; (c) is incorrect, as this would be true of a principles based system, not a rules based system. 2 (a) is false; this is a description of objectivity. (b) is false; accountants are not entitled to use confidential information for their own personal good. (c) is true. 3 (a) Self-review (b) Intimidation 4 True 5 False – they apply to UK audits only. 261 Assurance Answer to Interactive question Answer to Interactive question 1 (a) True – it is an advantage of the principles based approach (b) True – it implements the IFAC Code, which is principles based (c) 262 False – a rules based system tends to remove the need to evaluate, as accountants can just check whether certain rules are being met or not, rather than applying the principles to given situations.