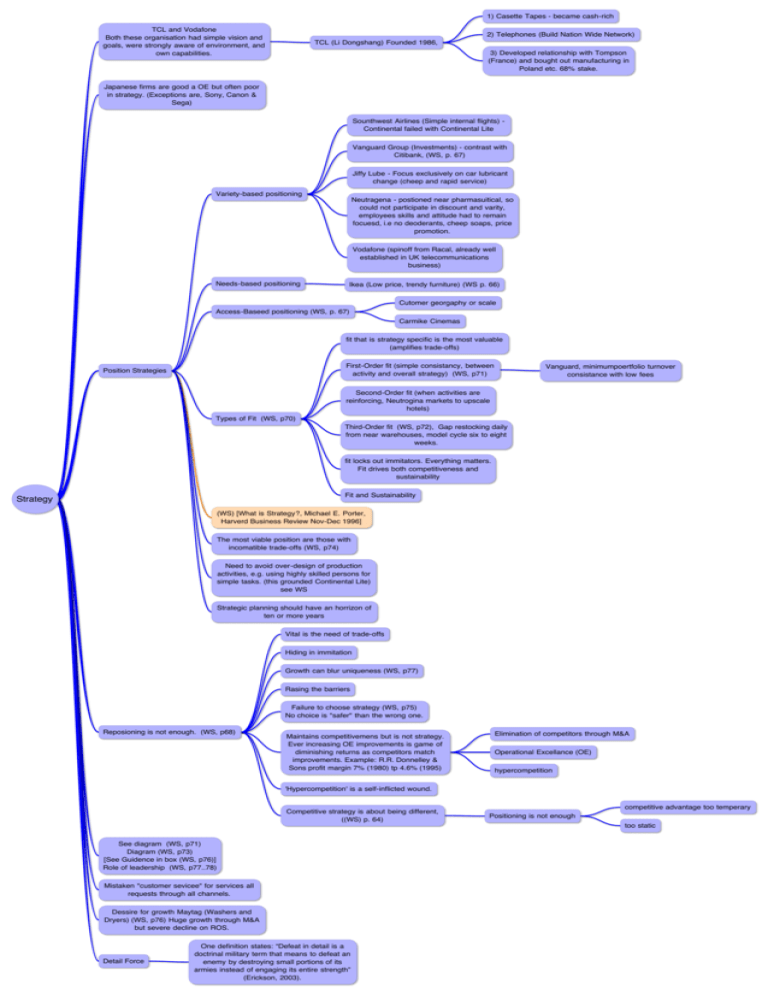

Strategy

advertisement

1) Casette Tapes - became cash-rich TCL and Vodafone Both these organisation had simple vision and goals, were strongly aware of environment, and own capabilities. 2) Telephones (Build Nation Wide Network) TCL (Li Dongshang) Founded 1986, 3) Developed relationship with Tompson (France) and bought out manufacturing in Poland etc. 68% stake. Japanese firms are good a OE but often poor in strategy. (Exceptions are, Sony, Canon & Sega) Sounthwest Airlines (Simple internal flights) Continental failed with Continental Lite Vanguard Group (Investments) - contrast with Citibank, (WS, p. 67) Jiffy Lube - Focus exclusively on car lubricant change (cheep and rapid service) Variety-based positioning Neutragena - postioned near pharmasuitical, so could not participate in discount and varity, employees skills and attitude had to remain focuesd, i.e no deoderants, cheep soaps, price promotion. Vodafone (spinoff from Racal, already well established in UK telecommunications business) Needs-based positioning Ikea (Low price, trendy furniture) (WS p. 66) Cutomer georgaphy or scale Access-Baseed positioning (WS, p. 67) Carmike Cinemas fit that is strategy specific is the most valuable (amplifies trade-offs) First-Order fit (simple consistancy, between activity and overall strategy) (WS, p71) Position Strategies Vanguard, minimumpoertfolio turnover consistance with low fees Second-Order fit (when activities are reinforcing, Neutrogina markets to upscale hotels) Types of Fit (WS, p70) Third-Order fit (WS, p72), Gap restocking daily from near warehouses, model cycle six to eight weeks. fit locks out immitators. Everything matters. Fit drives both competitiveness and sustainability Fit and Sustainability Strategy (WS) [What is Strategy?, Michael E. Porter, Harverd Business Review Nov-Dec 1996] The most viable position are those with incomatible trade-offs (WS, p74) Need to avoid over-design of production activities, e.g. using highly skilled persons for simple tasks. (this grounded Continental Lite) see WS Strategic planning should have an horrizon of ten or more years Vital is the need of trade-offs Hiding in immitation Growth can blur uniqueness (WS, p77) Rasing the barriers Failure to choose strategy (WS, p75) No choice is "safer" than the wrong one. Reposioning is not enough. (WS, p68) Maintains competitivemens but is not strategy. Ever increasing OE improvements is game of diminishing returns as competitors match improvements. Example: R.R. Donnelley & Sons profit margin 7% (1980) tp 4.6% (1995) Elimination of competitors through M&A Operational Excellance (OE) hypercompetition 'Hypercompetition' is a self-inflicted wound. Competitive strategy is about being different, ((WS) p. 64) See diagram (WS, p71) Diagram (WS, p73) [See Guidence in box (WS, p76)] Role of leadership (WS, p77..78) Mistaken "customer sevicee" for services all requests through all channels. Dessire for growth Maytag (Washers and Dryers) (WS, p76) Huge growth through M&A but severe decline on ROS. Detail Force One definition states: “Defeat in detail is a doctrinal military term that means to defeat an enemy by destroying small portions of its armies instead of engaging its entire strength” (Erickson, 2003). competitive advantage too temperary Positioning is not enough too static