Securian Financial Group

Capital and Surplus-to-Liabilities Ratio

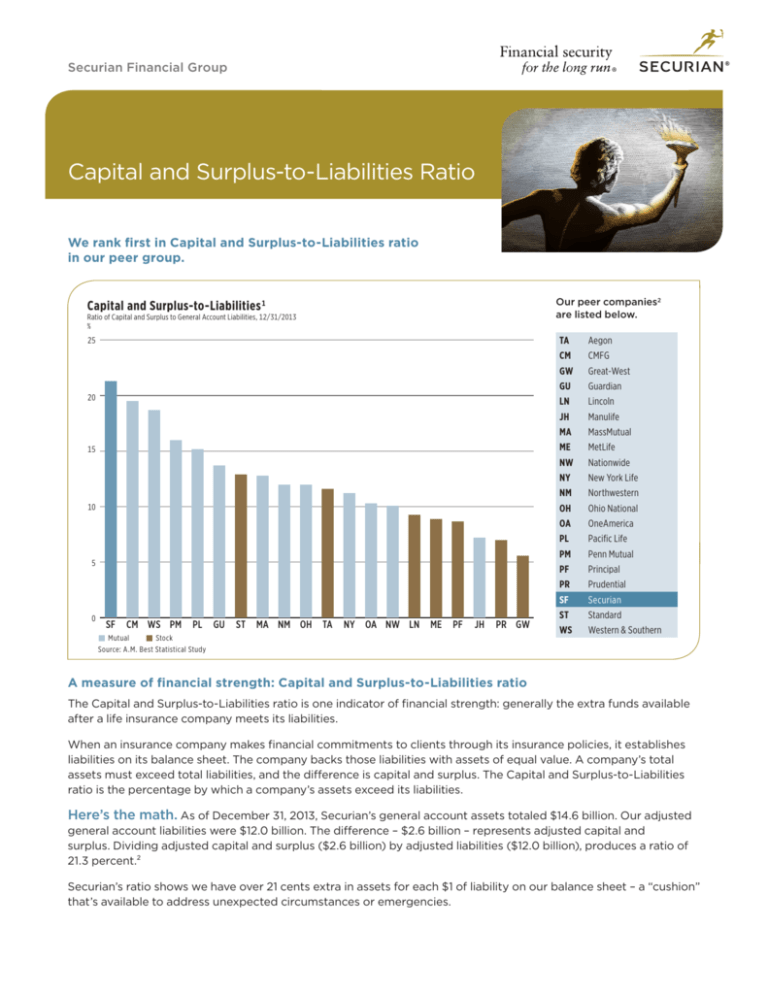

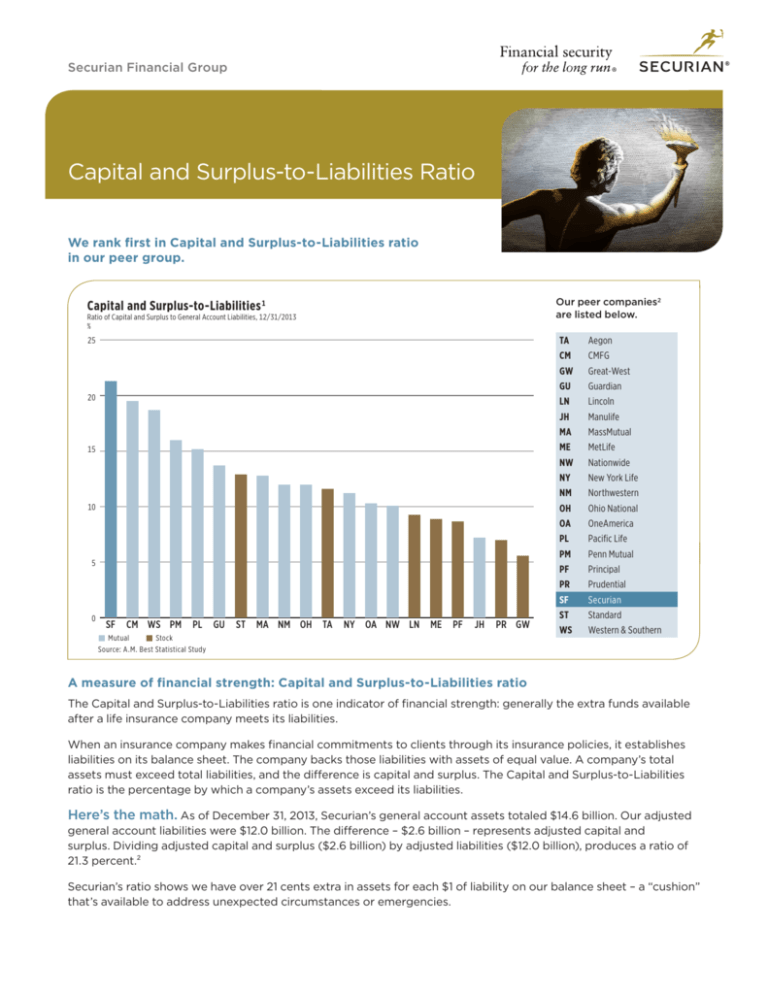

We rank first in Capital and Surplus-to-Liabilities ratio

in our peer group.

Our peer companies2

are listed below.

Capital and Surplus-to-Liabilities 1

Ratio of Capital and Surplus to General Account Liabilities, 12/31/2013

%

25

20

15

10

5

0

SF

CM WS PM

PL

GU

ST

MA NM OH

TA

NY OA NW LN

ME

PF

JH

PR GW

Mutual

Stock

Source: A.M. Best Statistical Study

TA

Aegon

CM

CMFG

GW

Great-West

GU

Guardian

LN

Lincoln

JH

Manulife

MA

MassMutual

ME

MetLife

NW

Nationwide

NY

New York Life

NM

Northwestern

OH

Ohio National

OA

OneAmerica

PL

Pacific Life

PM

Penn Mutual

PF

Principal

PR

Prudential

SF

Securian

ST

Standard

WS

Western & Southern

A measure of financial strength: Capital and Surplus-to-Liabilities ratio

The Capital and Surplus-to-Liabilities ratio is one indicator of financial strength: generally the extra funds available

after a life insurance company meets its liabilities.

When an insurance company makes financial commitments to clients through its insurance policies, it establishes

liabilities on its balance sheet. The company backs those liabilities with assets of equal value. A company’s total

assets must exceed total liabilities, and the difference is capital and surplus. The Capital and Surplus-to-Liabilities

ratio is the percentage by which a company’s assets exceed its liabilities.

Here’s the math. As of December 31, 2013, Securian’s general account assets totaled $14.6 billion. Our adjusted

general account liabilities were $12.0 billion. The difference – $2.6 billion – represents adjusted capital and

surplus. Dividing adjusted capital and surplus ($2.6 billion) by adjusted liabilities ($12.0 billion), produces a ratio of

21.3 percent.²

Securian’s ratio shows we have over 21 cents extra in assets for each $1 of liability on our balance sheet – a “cushion”

that’s available to address unexpected circumstances or emergencies.

Our life insurance company affiliates are highly rated by the major

independent rating agencies that analyze the financial soundness and

claims-paying ability of insurance companies. For more information

about the rating agencies and to see where our life insurance affiliate

ratings rank relative to other ratings, please visit our website at

securian.com/ratings.

Securian Financial Group’s current

member company ratings.

•A.M. Best: A+ (Superior),

second highest of 16 ratings

•Moody’s: Aa3 (Excellent),

fourth highest of 21 ratings

Peer companies are selected solely by Securian based on various

competitive criteria.

•Standard & Poor’s: A+

(Strong), fifth highest of

21 ratings

Securian Financial Group, Inc. is the holding company parent of a group

of companies that provide a broad range of financial services, including

Minnesota Life Insurance Company; American Modern Life Insurance

Company; Balboa Life Insurance Company; Balboa Life Insurance

Company of New York; Cherokee National Life Insurance Company;

Securian Life Insurance Company; and Southern Pioneer Life Insurance

Company. The guarantees of the life insurance affiliate general accounts

are backed by the financial strength and claims-paying ability of the

applicable life insurance company affiliate.

•Fitch: AA- (Very Strong),

fourth highest of 19 ratings

Ratings for financial strength and

claims-paying ability do not reflect the

performance of any registered securities

or variable subaccounts. All ratings

information as of April 2014. Ratings are

assigned to Securian Financial Group

life insurance affiliates Minnesota Life

Insurance Company and Securian Life

Insurance Company.

1

The Capital and Surplus-to-Liabilities ratio is derived from data provided by A.M. Best, and

is the combined adjusted capital and surplus of insurance companies within a common

insurance group divided by the combined adjusted liabilities of insurance companies within

a common insurance group. The calculation also may contain additional adjustments

to adjusted capital and surplus for the capital and surplus of downstream insurance

companies within the group. Capital surplus and liabilities are factors used by insurance

company rating agencies to assign ratings. Factors which may impact this ratio include

the type of business an insurance carrier writes or its product features and guarantees.

2

Peer companies were selected solely by Securian based on competitive criteria.

Since 1880, Securian Financial Group, Inc. and its affiliates have provided financial security for individuals and businesses in the form of

insurance, investments and retirement plans. Now one of the nation’s largest financial services providers, it is the holding company parent

of a group of companies that offer a broad range of financial services.

Securian Financial Group, Inc.

www.securian.com

Insurance products are issued by Minnesota Life Insurance Company in all states except New York. In New York, products are issued by Securian Life

Insurance Company, a New York authorized insurer. Both companies are headquartered in St. Paul, MN. Product availability and features may vary by state.

Each insurer is solely responsible for the financial obligations under the policies or contracts it issues. 400 Robert Street North, St. Paul, MN 55101-2098

©2011 Securian Financial Group, Inc. All rights reserved.

F70237 Rev 4-2014 DOFU 10-2011

A04092-1011