UNBC Chart of Accounts Dictionary

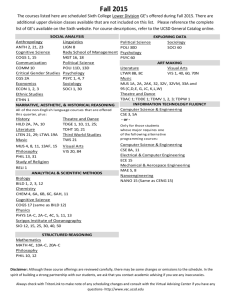

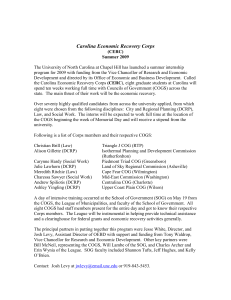

advertisement

UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Type of Entries Postage, Courier, Freight 7021 Postage Costs of stamps and other mailing charges. 7024 Freight In 7025 7026 Freight Out Freight Charges (Bookstore only) Freight on incoming purchases. (Bookstore only) Freight on returns. This account is used to track freight charges on incoming or outgoing packages (such as couriers). Office Supplies These accounts are used to record the purchase of items for general office consumption. 7001 Unallocated MasterCard Transactions 7038 7039 Enviro Deposit Supplies - Convenience Store 7041 Supplies - General 7042 Supplies - Paper 7043 7044 Supplies - Stationery Supplies - Printing 7045 Supplies - Archives 7046 Supplies - Computer/Printer/Fax 7047 7048 Supplies - Photocopier Usage Supplies - Field Education 7049 Archives - Media Reformatting 7050 Supplies - Accommodation Services 7255 Supplies - Library Clearing account for the procurement card for transactions that have not been reconciled by the cardholder. This account should always be zero, if balances are remaining the budget holder will be contacted by Finance. Cost of supplies used in the convenience store (plastic ware, paper cups, etc.) Cost of supplies used for administrative purposes. Cost of all paper excluding photocopier paper. Cost of letterhead, envelopes, etc. Expenses relating to the printing of forms, brochures and business cards. Expenses related to the preparation of materials for the archives. Cost of screen cleaner, toner, ribbons and other consumable computer and printer supplies, such as data cartridges, disks or tapes. NOT to be used to record the costs of fixing or upgrading computers or printers. Cost of photocopying. Costs associated with the preparation of materials and purchases of supplies for field education purposes. Expenses related to the reformatting of antiquated media Expenses related to the provision of accommodation in the residence buildings such as dish soap, hand soap, etc. Costs of purchasing supplies specific to library functions. Page 1 UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Vehicle Repair, Maintenance, Operation The following accounts are used to record expenses related to UNBC mobile equipment. Includes all licensed and unlicensed motorized vehicles (cars, trucks, vans, ATV's, boats, forklifts), non-motorized vehicles (trailers, campers, etc) and vehicle equipment (motors, etc). Type of Entries 7061 Vehicle Maintenance Costs associated with regular maintenance costs, like oil changes and tune-ups. 7062 7063 7064 7065 7066 Vehicle Fuel Vehicle Damage Vehicle Repair Bulk Diesel Fuel Propane Fuel Fuel expenses for fleet vehicles. Costs associated with body work. Costs associated with major repairs. Waste Management 7081 7082 7083 7084 7085 7086 The following accounts are used to record the removal of waste materials from the campus. Waste Removal - Biohazard Waste Removal - Chemical Waste Removal - Radioactive Waste Removal - Recycle Waste Removal - Regular Waste Removal - Gross Anatomy Health and Safety 7101 Safety Supplies Cost of health and safety items (eg. hard hats, respirators, first aid supplies). Cost of external safety inspections of equipment such as fire extinguishers. Cost of safety training courses (eg. first aid; fire safety). 7102 Equipment Inspection 7103 Safety Training 7104 7105 7106 7107 7108 7109 Emergency Medical Transportation First Aid Supplies - Oxygen Fire Extinguishers Emergency Response Planning Criminal Record Checks Supplies - Medical Page 2 Cost of extinguishers and recharges. UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Equipment Maintenance These accounts are used to record the expense of maintaining University owned equipment. 7121 Equipment Maintenance - Computer 7125 Equipment Maintenance - Photocopier 7127 Equipment Maintenance - Scientific 7128 Equipment Maintenance - Printers 7130 Equipment Maintenance - Fax Machines 7131 Equipment Maintenance - Miscellaneous 7132 Equipment Maintenance - Audio Visual 7133 Equipment Maintenance - Research Type of Entries Costs associated with the ongoing maintenance of computers. Include the costs of service calls and replacement parts. Do NOT include parts purchased to upgrade a system (such as a new motherboard, more RAM), these should be recorded as minor capital. Costs associated with the ongoing maintenance of photocopiers. Costs associated with the ongoing maintenance of scientific equipment such as autoclaves, microscopes, etc. Costs associated with the ongoing maintenance of printers and scanners. Costs associated with the ongoing maintenance of fax machines. Expenses related to the ongoing maintenance or repair of other equipment. Costs associated with the ongoing maintenance of audio visual equipment. Costs associated with the ongoing maintenance of equipment used in the field for research such as chainsaws, weapons, data loggers, GPS units. Travel - Non-employee These accounts are used to record the costs of travel expenses paid by UNBC for individuals who are not employees of the institution. 7151 Travel - Students/Speakers/Lecturers 7152 Field Education Travel 7153 Team Travel 7154 7569 Athletic Registration Fees Non-employee Travel Page 3 To record the cost of travel for speakers or lecturers and in cases where student travel is being paid for or sponsored by a programme. Travel costs associated with teaching students in the field such as van rental. Associated faculty travel costs should be recorded in account 7917. Travel costs associated with athletic team travel, players only. Tournament fees for athletic teams. To be used where a programme or department is paying for the travel of a third party to attend a meeting or conference on behalf of the University. UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Taxes, Duties, Licenses These accounts are used to record the costs of copyrights and other legalities. 7161 Licenses & Permits 7162 Software Licensing 7163 Copyrights 7164 B.C. Online Search Charges 7165 Grants-in-lieu 7166 Property Taxes Type of Entries Costs such as operating permits, building permits, gun licenses, etc. Used to record the costs of licensing software products for continued authorized use. Used to record the copyright fees related to photocopying. For use by Parking Services to record the costs of license plate searches. Used to record payment of the annual grant to the City of Prince George. To record annual property taxes. Advertisements & Promotions 7181 Advertising & Promotion 7182 Donations 7183 Contributions Costs of ads (newspaper, print media, radio, television) to promote University activities or programs. Costs associated with personnel recruitment advertising are to be recorded in account 7924. Donations to other non-profit ventures. Usually used by executive offices only. Contributions to conferences and meetings. Meetings & Events 7201 Meeting Expense Costs to be included here are room rentals and food service. Supplies and photocopy charges associated with material preparation for the meeting should NOT be included in this account. All additional costs associated with conducting special events such as room rental, food service, stage rental, band rental, public address systems. Printing, supplies and advertising charges should NOT be included in this account. 7203 Event Expense 7204 Honorariums To record honorariums paid to non-UNBC employees. This includes guest lecturers or speakers. Any travel allowances paid should be recorded in account 7151. 7205 Event Expense - Field Education Costs associated with teaching students in the field. Please note that travel costs for students should be recorded in account 7152 and travel costs for faculty should be recorded in account 7917. Page 4 UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Type of Entries Books, Publications, Subscriptions 7221 Interlibrary Loan Charges 7222 Printing & Publication Expense 7223 Blueprint & Photo Expense 7224 Subscriptions 7225 Books & Publications 7226 Audio Visual Aids/Teaching Materials 7227 University Memberships 7228 Electronic Acquisitions 7250 Bookbinding Expense Live Research Specimens 7231 7232 7239 Fee charged by the library for the use of the interlibrary loan service. Costs of preparing and printing ongoing University publications (eg. calendar). Cost of developing photographs and purchasing film and blueprint materials. Cost of subscribing to magazines and periodicals for general departmental use. Costs of purchasing reference books and other one time publications. Purchase of materials used to facilitate academic instruction (overheads, chalk). Non-professional university membership fees. Eg. A.U.C.C. membership fees where the "member" is the University (or a department of the University). Costs for electronic acquisitions in the library. Costs for thesis binding. These accounts are used to record the purchase and care of live specimens for use in research and teaching. Rodents Fish Research Animal Care Costs for care such as vet bills and nutrition. Materials & Supplies These accounts are for recording the purchase of consumables. 7241 7242 7243 Lab Supplies - Chemicals Lab Supplies - Coat Rentals Lab Supplies - Glassware/Consumables 7244 7245 Lab Supplies - Industrial Gases Lab Supplies - Other 7246 7247 GIS Lab Services Research Supplies 7248 7249 Fitness Centre Supplies Uniforms/Coveralls 7251 7252 7253 Linen Dendrology Lab Services External Lab Services 7254 7256 7257 Research Supplies - Data Laboratory Charges CATI Lab Services Chemicals only. Lab coat rental. Glassware (e.g. beakers) and other miscellaneous science supplies (e.g. tubing and pipettes). Gas cylinder rentals and fills. Miscellaneous lab supplies (filters, testing paper, etc) and stock purchased for use in the greenhouse. NOT to include purchases for goods best described as equipment. Supplies used in the field such as rope, shovels, tarps, flag tape, etc. Purchase of supplies for fitness centre. Costs of cleaning and repair for uniforms and coveralls. Cost of replacement for housing linens. Laboratory services from suppliers external to UNBC. Other internal laboratory charges. Page 5 UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code 7258 Description SSRL - Services Page 6 Type of Entries UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Planning & Development These accounts are used to record meeting costs and other expenses related to the following activities. 7261 7262 7263 Other Costs & Charges Type of Entries Course Development Programme Development Strategic Planning Such as 5 year capital plan, academic visioning initiative. These accounts are used by Accounting Services to record the costs of conducting business. 7271 7272 7273 Bank Service Charge Discounts Lost Bad Debt Expense Bank fees for providing general services. Vendor discounts not taken. Cost of uncollectable accounts receivable. 7274 Unrealized Gains/Losses 7275 Cash - Over/Short 7276 Overhead Charge/Recovery 7277 7278 Exchange Gain/Loss Insurance Unrealized gains or losses incurred on University investments in commercial paper. Cash discrepancies in petty cash funds and tills. Administration fees incurred by BCFCSN and other contract grant holders. Exchange difference on foreign currency. Costs of insuring University property and providing business coverage on personal vehicles. 7286 Gain/Loss on Asset Disposal Miscellaneous Expenses Other expenses categories. not included 7281 7282 7283 7284 Internet Service Provider Charges Laundry Interdepartmental Admin O/H Miscellaneous Expenses 7285 7287 Towing Expense Recognition and Remembrance Page 7 in other Cleaning of uniforms, towels, linens, etc. This account is available only for budgeting purposes. Please contact Finance for assistance in determining an appropriate account code. Costs for sending flowers, cards, gifts for guest speakers, etc. UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Minor Equipment Non-capital These accounts record the purchase of nonconsumable, non-capital assets. Assets recorded here will have an individual value of less than $1,000. 7311 7312 Furnishings Office Equipment 7313 7314 Computer Software Computer Equipment 7315 7316 Printers/Scanners Equipment - Other 7317 Research Equipment 7318 7319 Small Tools Audio Visual Equipment 7320 Communication Equipment 7321 Photography Equipment 7322 Scientific Equipment COGS Bookstore/Copy Services 7411 7412 7413 7414 7415 7416 7417 7418 7419 7420 7421 7422 7423 7525 7526 Type of Entries Items such as chairs and bookshelves. Items such as calculators, label makers and transcribers. Single use software. Items such as keyboards or mice, or upgrades such as RAM. Small printers and/or scanners. All equipment that does not fit in other categories. Do NOT include consumable items, please see accounts listed under "Materials and Supplies". Items such as chain saws, weapons, data loggers, GPS, etc used in the field for research. Do NOT include consumable items, please see accounts listed under "Materials and Supplies". Power tools and other small tools. Items such as speakers, microphones and projectors. Items such as telephones, pagers, blackberrys, radios. Items such as cameras, lenses, video equipment. Items such as burners, small refrigerators, etc. Do NOT include consumable items, please see accounts listed under "Materials and Supplies". These accounts are used by the Bookstore and Copy Services only to record the cost of goods sold. COGS - Text New COGS - Text Used COGS - Trade COGS - General Merchandise COGS - Services COGS - Inventory Obsolescence COGS - Inventory Loss COGS - Restocking Fee COGS - Freight In Text COGS - Freight Out Text COGS - Freight Out Web COGS - Paper COGS - Image Charges COGS - Regalia Rental - Service COGS - Regalia Rental - Maintenance Page 8 UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description COGS - Central Stores These accounts are used by Central Stores only to record the cost of goods sold: 7431 7432 7433 7434 7435 COGS - Letterhead COGS - Toner COGS - Student Labs COGS - Postage COGS - Business Reply These accounts are used by COGS Telecommunications Telecommunications only to record the cost of goods sold: 7438 7439 7441 7442 7443 7444 7445 7446 7447 7448 7449 COGS - Laboratory 7450 COGS - Calling Cards COGS - Toll Free Service COGS - Mobile Communications COGS - Telephone Rental & Service COGS - Telephone/Fax Long Distance COGS - Moves/Adds/Changes COGS - PRI/Trunk Lines COGS - Audioconferencing COGS - Videoconferencing COGS - Facsimile Rental & Service COGS - Regional BRI These accounts are used by the Labs only to record the cost of goods sold: COGS - Lab Supplies C.O.G.S. - Conference These accounts are used by Conference Services and the Fitness Centre only to record / Fitness the cost of goods sold. 7424 7466 7467 7468 7469 7471 7472 7473 7474 7475 7476 7477 7478 7479 7480 7481 7482 7483 7484 7485 7486 COGS - Event Insurance COGS - NSC Concession COGS - Facilities Rental COGS - Booth Rental COGS - Equipment Rental COGS - A/V Rental COGS - A/V Repair COGS - A/V Production COGS - Food/Liquor COGS - Personnel COGS - Janitor Services COGS - Copy Services COGS - Parking Services COGS - Building Maintenance COGS - General Merchandise COGS - Laundry COGS - Cleaning Supplies COGS - SOCAN Fees COGS - Conference Management COGS - Client Disbursements COGS - Course Fees Page 9 Type of Entries UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Type of Entries Occupancy Rental, Lease, Maintenance 7511 7512 Occupancy Lease Maintenance Chargeback 7513 Gymnasium Rental Equipment Rental Rental charges for off-campus facilities. Departmental chargeback to allocate the cost of maintaining University facilities. Rental charges for off-campus gym. These accounts record the cost of short term rentals of equipment from external sources. 7279 Rental Vehicle Damage Costs levied to repair damage to rented vehicles, including insurance deductible. Costs of renting equipment such as photocopiers, radios, welders, etc. To record the costs associated with short term rentals of desktop or laptop computers or printers. Costs of renting audio visual equipment. Costs of renting pagers. Costs of renting vehicles for purposes of research travel. 7521 Equipment Rental - Other 7522 Computer Rental 7523 7524 7824 Audio Visual Rental Pager Rental Research Vehicle Rental Fees These accounts record all non-professional fees charged by external parties. 7561 Consulting Fees 7562 7563 Management Fees Pension Plan Administration 7564 Employee Assistance Program 7565 Evaluations 7566 Nisga'a - Programme Delivery 7567 7568 Co-op Subsidy Principal Wages 7570 Third Party Teaching Contracts 7571 Fees - Research Subjects 7572 Regional Campus Agreements 7573 Research Awards 7574 Course Director Fees - NMP To record the fees charged for services rendered by third parties. Expenses should be recorded in account 7585. Page 10 Fees paid for investment and custodial services on the pension plan. Expenditures related to providing the services in the E.A.P. Fees paid to consultants for fair market assessments of donated items. All expenditures incurred in the delivery of the First Nations programme - Nass Valley. Wages of the principal of a research grant. This account is to be used only by researchers who collect a wage from their grant. To record the payment to third parties (not individuals) for academic instruction services. Fees paid to research subjects for their participation. To record the costs associated with UNBC space requirements at the regional colleges. To record research awards to non-UNBC personnel. Student awards are to be recorded in account 7828. Used to record course director fees in the Northern Medical Program. UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code 7575 Description Clinical Faculty Payments 7576 Practicum Supervision - Fees 7577 Practicum Supervision - Expenses 7578 Referees and Officials 7585 Consulting Expenses 7588 Funding Agreements Professional Fees Used to record payments to clinical faculty in the Northern Medical Program. Used to record the fees paid to practicum supervisors. Used to record the expenses reimbursed to practicum supervisors. Used to record the costs of providing referees and other officials for home games. Used to record the expenses reimbursed to contractors. Used by Research Accounting for encumbrance purposes only. These accounts record fees charged for professional services. 7581 Accounting / Auditing Fees 7582 Collection Fees 7583 7584 7586 7587 7589 Legal Fees Process Server Program Reviews Legal Settlements Internal Staff Support Services Facility Repairs, Maintenance Type of Entries Fees paid to external accounting firms for accounting advice and auditing. Fees paid to external parties for outstanding debt collection. Fees paid to external reviewers. Fees charged to the NSC. These accounts record the cost of on-going maintenance and repairs to University occupied buildings. 7611 7612 7613 7614 7615 7616 7617 Warehouse Maintenance Mechanical Maintenance Electrical Maintenance Structural Maintenance Building Controls Maintenance Elevator Maintenance Emergency Repair Mechanical 7618 Emergency Repair Electrical 7619 Emergency Repair Structural 7620 7621 7622 7623 7624 7625 Janitorial Services Security Services Parking Lot / Road Maintenance Snow Removal Key / Locksmith Costs General Building Repairs 7626 Operating Costs 7627 7628 7629 Signage Locker Maintenance Moving Expenses 7633 Renovations and Alterations Regularly scheduled maintenance. Regularly scheduled maintenance. Regularly scheduled maintenance. Regularly scheduled maintenance. Regularly scheduled maintenance. Regularly scheduled maintenance. To record separately the costs emergency repairs. To record separately the costs emergency repairs. To record separately the costs emergency repairs. of of of To record costs of repairs to the building, such as drywall, painting, carpet replacement. To record the ongoing maintenance costs for the buildings. To record all costs of moving offices and other functional space within the University. To record costs of non-capital renovations to space. Page 11 UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Grounds / Greenhouse Stock These accounts record the cost of maintaining University grounds and vegetation. These accounts should not be used to record the cost of greenhouse supplies or stock purchased for use in teaching or research (see account #7245). 7631 Groundskeeping 7632 Nursery & Greenhouse Stock Utilities Type of Entries Cost of equipment, supplies and contractor. These accounts record the costs of utilities in University occupied buildings. 7661 Hydro Charges for electrical power consumption. 7662 7663 7664 7665 Water / Sewer Natural Gas Television Services Carbon Offset Credits Charges for water and sewer service. Charges for natural gas consumption. Phone, Fax & Telecomm. These accounts record the cost of providing telecommunication services. 7681 Telephone Rental & Service Charges for the monthly rental of phones. 7682 7683 7684 7685 7686 7687 Telephone & Fax Long Distance Toll Free Service Videoconferencing Audioconferencing Facsimile Rental & Service Internet Access Charges for long distance calling. Charges for use of toll free lines. Charges for videoconferencing. Charges for audioconferencing. Charges for facsimile rental and service. Charges paid to internet service providers. 7688 Mobile Telecommunications 7689 Telephone - Moves/Adds/Changes 7690 Telephone - PRI/Trunk Lines 7691 Telephone - Regional BRI 7692 Telephone - Business Line Rental / Usage Charges for mobile phones, blackberrys and radios. Charges for moves, adds and changes to internal service lines. Charges for the rental of telephone trunk lines (main campus). Charges for the rental of the regional telephone lines (conference lines for regional campuses). Charges for the rental of the business line (main lines to the regional campuses and the regional and local fire panels). Interest, Insurance & These accounts are used by Accounting Services only to record interest charges on Other Charges debt. 7711 7712 Debt Servicing Principal 7810 7815 Interest Expense Short Term Interest Expense Long Term These accounts are used by Accounting Services only to record the principal payments made on long term debt. Sinking Fund Payments Capital Lease Payments Page 12 UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Scholarships, Fellowships & Bursaries These accounts are used by Student Services only to record payments made to University students. 7821 Student Assistance 7822 Scholarships & Bursaries 7823 Regional Tuition Scholarship 7825 Student Grants 7826 Scholarship - Senior / Other 7827 Tuition Waivers - Students 7828 Research Grants - Students 7829 Interest Only Waiver Travel Type of Entries Used to record student assistance payments. Used to record the payment of scholarships and bursaries. Used to record grant given to employees taking courses at regional college campuses. Used to record reimbursed travel expenses, conference fees or for grants/allowances given to students. Used to record tuition waiver for senior citizens. Used to record waivers of tuition for students. Used to record research grants given to students. Used to record the waiver of fees for students with interest only status. These accounts record the cost of travel by University employees only. Please note that the use of any of these codes must be accompanied by the unique LOCN code assigned to the employee. 7909 Travel - Liaison To record the travel costs of the University Liaison officers or others travelling in that capacity. To record the costs of travelling to the regional offices for meetings or other business. To record the costs of travelling to conferences. 7911 Travel - Regional 7912 Travel - Conference 7913 7914 Travel - Field Trips Travel - Fundraising 7915 Travel - Meeting 7916 Travel - Research 7917 Travel - Field Education 7918 Travel - Professional Development 7919 Travel - Course Delivery 7938 Travel - Coaching Staff 7939 Travel - Recruitment Page 13 To record the costs of taking trips where the purpose is for fundraising or campaign promotion. To record the costs of travelling to meetings outside of the regions. To record costs associated with field research. To record the travel costs of University employees accompanying students on field trips (airfare, accommodation or meals). To record the costs of travelling to seminars and training courses for the purpose of professional development. To record the costs of faculty members travelling to regional campuses to teach. To record the costs of travel for coaching staff. To record the costs of travel associated with direct recruitment of students and athletes. UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code 7943 Description Travel - Local Type of Entries To record the costs of local travel. Page 14 UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Recruitment These accounts record the costs associated with interviewing and hiring employees. These accounts are used by Human Resources only. 7921 Candidate Travel 7922 Relocation Expense 7923 Relocation Expense - T4A 7924 Recruitment Advertising 7925 Internal Promotion Labour Relations All costs of bringing applicants to an interview. Any relocation expenses reimbursed to an employee or paid directly to a moving company. Please note that the use of this code must be accompanied by the unique LOCN code assigned to the employee. Any relocation assistance (lump sum) paid out to an employee. Please note that the use of this code must be accompanied by the unique LOCN code assigned to the employee. All expenses related to recruiting faculty and staff. All expenses related to human resource communication initiatives targeted to existing personnel. These accounts record the costs associated with negotiating and administering collective agreements. 7927 7928 Negotiations Arbitration 7929 7950 Collective Agreements Other Agreement Costs Professional Development Type of Entries Includes cost of travel and meetings. Includes cost of professional arbitrator, travel and meetings. Costs of printing. These accounts are used to record the education and training of employees. Please note that the use of any of these codes must be accompanied by the unique LOCN code assigned to the employee. 7931 Award Program President's Award for Service Excellence and Creative Initiatives. Cost of attending a conference. Professional development fees for nonfaculty employees. Faculty professional development allowance as defined in the faculty handbook (includes course fees and memberships). Professional membership fees of nonfaculty employees. Costs of courses and training programmes for all employees. 7932 7933 Conference Fees P.D. - Staff 7934 P.D. - Faculty 7935 Professional Memberships 7936 Training / Courses 7937 7940 7941 7942 Accreditation Teaching & Excellence Award Merit Awards Recruitment and Retention Awards Page 15 Used for budgeting only. Used for budgeting only. Used for budgeting only. UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Other Description Type of Entries These accounts are used by the Finance Department only. 7997 7999 External Cost Recovery Contingency 8999 9701 Amortization Fund Deductions This account purposes only. Page 16 is used for budgeting UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Capital Furniture These accounts record the purchase of capital assets. Assets of a capital nature have a unit value in excess of $1,000. 8105 8110 Capital Furniture - Office Capital Furniture - Library 8115 8120 8125 Capital Furniture - Laboratory Capital Furniture - Classroom Capital Furniture - Meeting Rooms 8130 8135 Capital Furniture - Common Areas Capital Furniture - Residences 8140 Capital Furniture - Other Capital Equipment Type of Entries Items such as desks or filing cabinets. Items for the general library such as carrels and bookshelves. Items for the laboratory like lab stools. Tables, chairs, lecterns for classrooms. Tables, chairs, whiteboards, etc. for meeting rooms. Couches, etc. placed in lounge areas. All furniture purchased for the residences. All furniture items that don't fit in the categories above. These accounts record the purchase of capital assets. Assets of a capital nature have a unit value in excess of $1,000. 8205 Capital Equipment - Office 8210 Capital Equipment - Library 8215 Capital Equipment - Scientific 8220 Capital Equipment - Computer Includes monitors, desktops and laptops. 8225 Capital Equipment - Audio Visual 8230 Capital Equipment - Telecommunications Includes overhead projectors, TV's, VCR's and equipment purchased for the dynacom system. Includes telephones and all equipment purchased for the telephone system. 8235 8240 Capital Equipment - Fax Machines Capital Equipment - Printers/Scanners 8245 Capital Equipment - Mobile 8250 Capital Equipment - Kitchen/Servery 8255 Capital Equipment - Other 8275 8280 8285 Capital Equipment - Daycare Capital Equipment - Parking Capital Equipment - Photography Page 17 Items such as paper shredders or transcribers. Items such as microfiche readers and other library specific equipment. Equipment used in laboratories and field research such as microscopes, autoclaves, generators and analysis equipment. Includes all desktop and network printers and/or scanners that meet the capital criteria. For the purchase of all licensed and unlicensed motorized vehicles (trucks, cars, vans, ATV's boats, forklifts, etc), nonmotorized vehicles (trailers, campers, etc) and vehicle equipment (motors, etc). All equipment purchased for use in the kitchen (such as ovens, microwaves, dishwashers, mixers, etc). To be used for equipment that does not fit into the categories above (fitness centre or facilities equipment for example). Includes large cameras, lenses. still cameras, digital UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Other Capital 8260 8265 8270 Capital - Library Books Capital - Periodicals/Continuations Capital - Collections Land These accounts record the fair market value of purchased or donated land. 8700 Land Building & Construction 8811 8812 8813 8814 8815 8816 8817 8818 8819 8820 8821 8822 8823 8824 8825 8826 8827 8828 These accounts are used to record work-inprogress expenditures related to the capital construction project only. Sub Architect Architect Fees Site Services Planning and Design Building and Construction Insurance and Permits Landscaping Project Management Project Management Disbursements Architect Disbursements Mechanical Upgrades and Renovations Electrical Upgrades and Renovations Architectural Upgrades and Renovations Millwork/Cabinetry/Hardware Consultant Fees Consultant Disbursements Betterments Legal Fees Page 18 Type of Entries UNBC Chart of Accounts Dictionary - Coding Guide EXPENDITURES Account Code Description Transfers These accounts are used to record transfer between University funds. 9101 9102 9103 9104 9105 9106 9107 9108 9109 9110 9111 9112 Transfer to General Operating Transfer to Sponsored Research Transfer to Specific Purpose Transfer to Ancillary Transfer to Capital Transfer to Appropriated Transfer to Carryforward Transfer to P.D. Reserves Transfer to Endowment Transfer to Faculty Start Up Transfer to Internal Research Funds Transfer to NMP 9201 9202 9203 9204 9205 9206 9207 9208 9209 9210 9211 9212 Transfer from General Operating Transfer from Sponsored Research Transfer from Specific Purpose Transfer from Ancillary Transfer from Capital Transfer from Appropriated Transfer from Carryforward Transfer from P.D. Reserves Transfer from Endowment Transfer from Faculty Start Up Transfer from Internal Research Funds Transfer from NMP Page 19 Type of Entries

![[Name of Business]](http://s2.studylib.net/store/data/005439490_1-eb485795b6ab94ac46e88cc0426770e1-300x300.png)