Display

Sector Report / Display

August 16, 2011

Large AMOLED gets a cost edge over

LCD

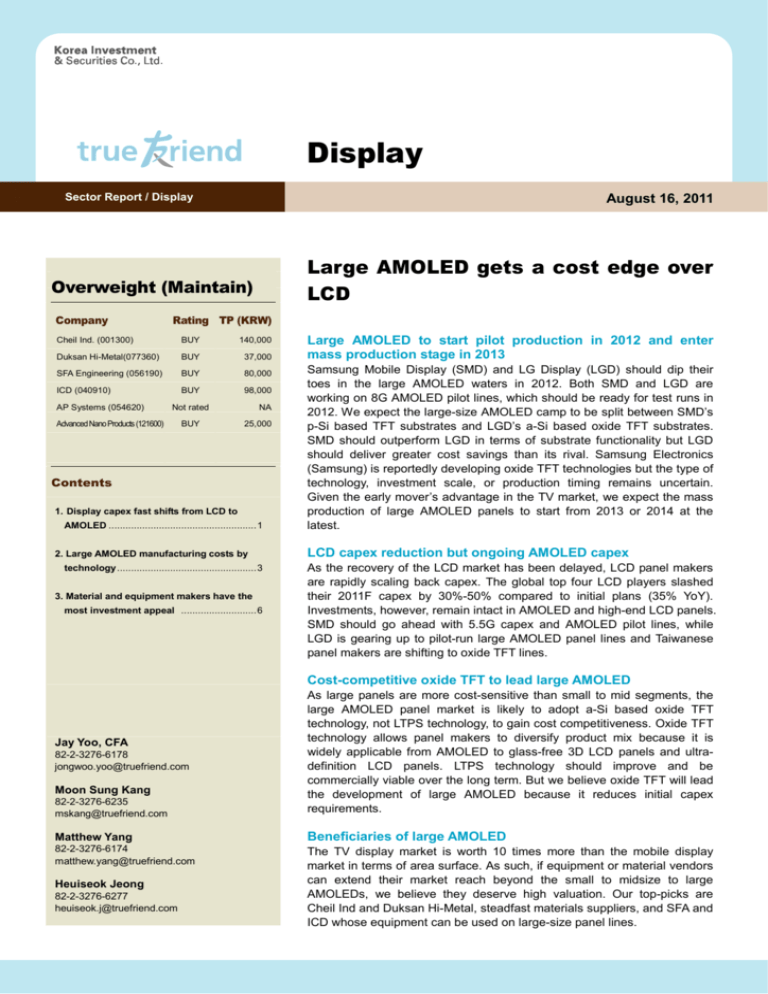

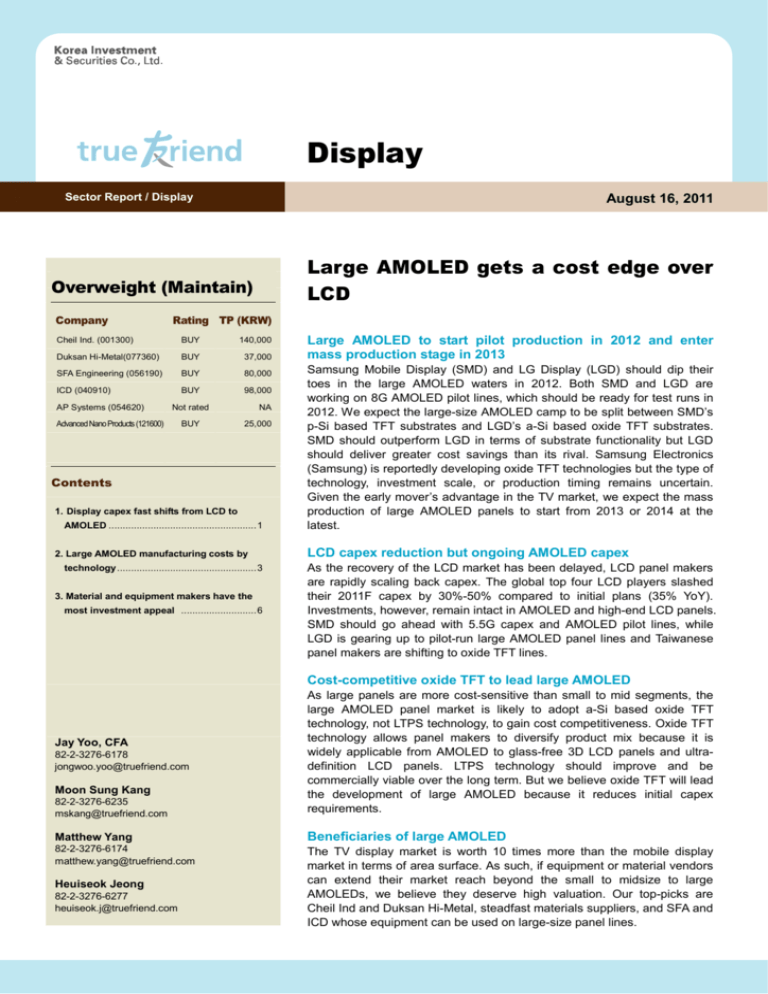

Overweight (Maintain)

Company

Rating TP (KRW)

Cheil Ind. (001300)

BUY

140,000

Duksan Hi-Metal(077360)

BUY

37,000

SFA Engineering (056190)

BUY

80,000

BUY

98,000

ICD (040910)

AP Systems (054620)

Not rated

Advanced Nano Products (121600)

BUY

NA

25,000

Contents

1. Display capex fast shifts from LCD to

AMOLED .....................................................1

2. Large AMOLED manufacturing costs by

technology ..................................................3

3. Material and equipment makers have the

most investment appeal ...........................6

Large AMOLED to start pilot production in 2012 and enter

mass production stage in 2013

Samsung Mobile Display (SMD) and LG Display (LGD) should dip their

toes in the large AMOLED waters in 2012. Both SMD and LGD are

working on 8G AMOLED pilot lines, which should be ready for test runs in

2012. We expect the large-size AMOLED camp to be split between SMD’s

p-Si based TFT substrates and LGD’s a-Si based oxide TFT substrates.

SMD should outperform LGD in terms of substrate functionality but LGD

should deliver greater cost savings than its rival. Samsung Electronics

(Samsung) is reportedly developing oxide TFT technologies but the type of

technology, investment scale, or production timing remains uncertain.

Given the early mover’s advantage in the TV market, we expect the mass

production of large AMOLED panels to start from 2013 or 2014 at the

latest.

LCD capex reduction but ongoing AMOLED capex

As the recovery of the LCD market has been delayed, LCD panel makers

are rapidly scaling back capex. The global top four LCD players slashed

their 2011F capex by 30%-50% compared to initial plans (35% YoY).

Investments, however, remain intact in AMOLED and high-end LCD panels.

SMD should go ahead with 5.5G capex and AMOLED pilot lines, while

LGD is gearing up to pilot-run large AMOLED panel lines and Taiwanese

panel makers are shifting to oxide TFT lines.

Cost-competitive oxide TFT to lead large AMOLED

82-2-3276-6235

mskang@truefriend.com

As large panels are more cost-sensitive than small to mid segments, the

large AMOLED panel market is likely to adopt a-Si based oxide TFT

technology, not LTPS technology, to gain cost competitiveness. Oxide TFT

technology allows panel makers to diversify product mix because it is

widely applicable from AMOLED to glass-free 3D LCD panels and ultradefinition LCD panels. LTPS technology should improve and be

commercially viable over the long term. But we believe oxide TFT will lead

the development of large AMOLED because it reduces initial capex

requirements.

Matthew Yang

Beneficiaries of large AMOLED

82-2-3276-6174

matthew.yang@truefriend.com

The TV display market is worth 10 times more than the mobile display

market in terms of area surface. As such, if equipment or material vendors

can extend their market reach beyond the small to midsize to large

AMOLEDs, we believe they deserve high valuation. Our top-picks are

Cheil Ind and Duksan Hi-Metal, steadfast materials suppliers, and SFA and

ICD whose equipment can be used on large-size panel lines.

Jay Yoo, CFA

82-2-3276-6178

jongwoo.yoo@truefriend.com

Moon Sung Kang

Heuiseok Jeong

82-2-3276-6277

heuiseok.j@truefriend.com

Sector report focus

What is the report about?

Sector highlights

• Analyze large AMOLED capex and market developments

• Examine Samsung Mobile Display’s and LG Display’s cost

structure and technologies and forecast their business directions

• Identify beneficiaries from the expansion of the large-size

AMOLED market and recommend investment strategies

1) Oxide TFT to lead the large AMOLED panel market

• AMOLED market winners should be those who can roll out

Key assumptions and valuation

LCD capex by major panel makers

2008 2009

LG Display

SEC’s LCD

AUO

CMI

Total

2,667

3,896

3,081

3,203

12,846

3,209

1,683

2,004

1,423

8,319

(USD mn)

2010 2011F 2012F

4,377

4,109

2,639

2,671

13,796

2,759

2,858

1,714

1,701

9,032

1,810

1,357

1,086

1,086

5,339

2010-2011F

growth

-37.0%

-30.4%

-35.0%

-36.3%

-34.5%

2011-2012F

growth

-34.4%

-52.5%

-36.7%

-36.1%

-40.9%

products at a faster pace and at a cheaper price than rivals.

• It is important to secure cost competitive in the TFT process,

which is a major cost factor to AMOLED production.

• The Oxide-TFT AMOLED method is 34% more cost effective

than p-Si AMOLED and 28% than LCD a-Si method.

• LG Display and Samsung Electronics are likely to covert its

LCD lines to oxide-TFT AMOLED method.

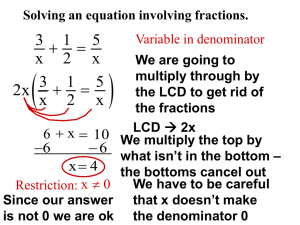

Cost analysis by AMOLED technology

(won/m2 per month)

Capex per unit area

600,000

Cash cost per unit area

Total cost per unit area

Source: Company data, Korea Investment & Securities

500,000

400,000

AMOLED capex by major panel makers

( USD mn)

300,000

2009

LG Display

SEC’s LCD

AUO

CMI

Total

257

257

2010

2011F

2012F

183

1,833

2,016

642

4,125

4,766

452

6,829

452

452

8,186

2010-2011F

growth

250.0%

125.0%

136.4%

2011-2012F

growth

-29.5%

65.6%

71.8%

200,000

100,000

0

TFT-LCD

ELA+FMM

ELA+LITI

Ox ide+FMM

Source: Company data, Korea Investment & Securities

Source: Market data, Korea Investment & Securities

Sensitivity & scenario analysis

2) Materials and equipment vendors look attractive if they

• Large AMOLED TV to debut in 2012 and enter the mass

production stage in 2014 at the latest

can serve large AMOLED

• Order momentum may differ by AMOLED equipment maker as

Area-based demand for mobile panels and TV panels

their clients may change process technologies to produce

large AMOLED panels.

• AMOLED material suppliers should be able to easily extend

(Km2)

90,000

their market reach beyond small AMOLED to include large

AMOLED.

• Large AMOLED equipment vendors deserve a PER of 15x,

75,000

60,000

11.8 fold increase

which is the level that LCD equipment vendors traded at

during the expansion of the large LCD panel market in 20042005.

• Materials suppliers’ high valuation levels are justifiable

45,000

30,000

15,000

0

Panel demand f or handset in terms of area

Panel demand f or LCD TV in terms of area

because large AMOLED panels need material input.

Source: Company data, Korea Investment & Securities

Peer comparison

Risks/opportunities

• AMOLED materials and equipment vendors are overvalued to

• AMOLED investments should accelerate when the LCD market recovers.

• If the global economic slowdown drags on, the AMOLED

market faces investment delays or retrenchment.

• Peer group PER band.

other players in the display value chain.

Display

1. Display capex fast shifts from LCD to AMOLED

Capex is rapidly shifting

from LCD to

large AMOLED; SMD

leads the transition

As the LCD panel market remains weak, major panel makers continue to scale

back their LCD capex. During the 2Q11 earnings season, the top five panel

producers, which represent 82% of global LCD panel production capacity,

announced their decision to cut annual LCD capex by 30-50% compared to the

initial plans set in early 2011. As such, LCD capex should decline 35% YoY in 2011

and the pace of capex cuts should accelerate in 2012. But, LCD capex

retrenchment should allow market leaders to spend more on large AMOLED.

Samsung Mobile Display (SMD), which is operating a 5.5G AMOLED line is

expected to start 8G investments in 2012. LG Display (LGD) is also looking toward

the mass production of 8G from 2013.

Korean and Taiwanese

panel makers are

passive investors in

China

Unlike Chinese counterparts, Korean and Taiwanese panel makers are passive

LCD investors in China. Major foreign makers were in a hurry to obtain capex

approval from the Chinese government in early 2010. But most of these capex

projects are being delayed due to chronic market oversupply. LGD was the first to

clear the regulatory hurdle but is still sitting on its capex plan. Pending the approval

process, LGD has already secured LCD production capacity domestically, which

makes it unnecessary to rush overseas capex. In contrast, Samsung Electronics

(Samsung) needs additional LCD capacity because the company has not invested

in domestic facilities. Nevertheless, Samsung is likely to chew over its Chinese

capex. Taiwanese panel makers also said they do not plan capex in China in the

near term.

LCD capex by major panel makers

(USD mn)

2008

2009

2010

2011F

2012F

LG Display

2,667

3,209

4,377

2,759

1,810

2010-2011F

growth

-37.0%

2011-2012F

growth

-34.4%

Samsung LCD

3,896

1,683

4,109

2,858

1,357

-30.4%

-52.5%

AUO

3,081

2,004

2,639

1,714

1,086

-35.0%

-36.7%

CMI

3,203

1,423

2,671

1,701

1,086

-36.3%

-36.1%

Total

12,846

8,319

13,796

9,032

5,339

-34.5%

-40.9%

Source: Company data, Korea Investment & Securities

Quarterly LCD capex

(USD mn)

5000

4000

3000

2000

Capex

retrenchment stage

1000

1Q05

4Q05

3Q06

2Q07

1Q08

4Q08

3Q09

2Q10

1Q11

4Q11F

Source: DisplaySearch, Korea Investment & Securities

1

Display

While LCD capex projects face delays and reductions, the large AMOLED panel

market sees a looming capex race among Korean display makers. As the 8G pilot

line is fully equipped, SMD, which leads the capex race, should be ready for trial

runs. SMD is expected to invest in a mass production line in 1H12 when the pilot

test is complete. LGD scaled back its investments in LCD and small AMOLED but

remains committed to large AMOLED. LGD plans pilot-production of 55” AMOLED

TV panels in 2H12. LGD plans to build 60K-capacity large AMOLED panel lines

from 2013 with a goal to start mass production in 2014. Taiwanese panel makers

have yet to unveil large AMOLED panel capex but are likely to take their cues from

SMD and LGD.

Korean display makers

in an AMOLED capex

race

Major panel makers’ AMOLED timeline

Note: A2 P3 is expected to exclude TFT-process

Source: Korea Investment & Securities

Who can roll out

AMOLED faster and at a

cheaper price?

The TV market plays by marketing and cost competitiveness, rather than

technology. As such, AMOLED market winners should be those who can roll out

products at a faster pace and at a cheaper price than rivals. We believe SMD and

Samsung will make a faster advance to the AMOLED market than their rivals.

However, SMD still does not have production lines dedicated to large panels. SMD

cannot switch its LCD line to AMOLED, which erodes its cost competitiveness and

requires changes in production technologies. Given SMD’s weak cost

competitiveness, there is a growing possibility for Samsung to enter the large

AMOLED panel business. Samsung can convert its LCD lines to oxide TFT

AMOLED panels just as LGD does. Samsung can sharpen its competitive edge

quickly when its oxide TFT meets SMD’s organic deposition technologies. LGD

faces growing concerns over the large panel business due to its suspension of

small AMOLED panel business. To compensate for its weaker financing capacity

compared to Samsung, LGD will enhance cost competitiveness through line

conversion from LCD to AMOLED.

Large AMOLED technologies adopted by SMD, Samsung, LGD

Samsung Electronics

TFT-Backplane process

Deposition process

Encapsulation process

Oxide TFT

SMS (same as SMD)

glass/metal type (same as SMD)

SMD

poly-Si TFT

SMS

glass/metal type

LG Display

Oxide TFT

White OLED

glass/metal type

2

Display

2. Large AMOLED manufacturing costs by technology

Oxide TFT technology is

optimal for large

AMOLED panels

We view oxide TFT technology as the most optimal for large AMOLED panel

production. Although the oxide TFT AMOLED panel is technologically inferior to

LPTS AMOLED, it could be the best choice in terms of cost competitiveness, which

is crucial for the large panels used in TVs. In contrast to LTPS, oxide TFT

technology is compatible with the process and equipment of existing LCD-use TFT

lines, which sharply reduces the initial capex burden for AMOLED panel makers.

The technology has not been applied for mass production and thus the production

yield remains uncertain. However, many panel makers are now preparing for mass

production by applying oxide TFT technology to existing LCD lines and will soon

start the pilot test. In addition to AMOLED panels, high-end glassless 3D and ultradefinition LCD panels can be built on the oxide TFT technology. As such, the oxide

TFT technology will allow panel makers to diversify product lineups.

Evolution of small and midsized AMOLED panel

technology

Source: Industry data, Korea Investment & Securities

Oxide TFT AMOLED

manufacturing costs

34% less than LTPS

AMOLED or 28% less

than LCD panel

Evolution of large AMOLED panel technology

Source: Industry data, Korea Investment & Securities

Manufacturing of AMOLED panels on the existing LCD TFT line using the oxide

TFT technology will cost 34% less than LTPS AMOLED panels or 28% less than

LCD panels. AMOLED panels’ parts cost 40% less than those for LCD panels but,

to remain competitive in terms of total costs, the capex burden needs to be

contained. The area capex for excimer laser annealing (ELA)-based LTPS

AMOLED panels is four times greater than LCDs’. As it offsets cost reduction on

the parts front, the LTPS AMOLED’s total manufacturing costs surpass LCD

panels’ in the end. In contrast, capex increase is limited for oxide TFT AMOLED

panel production and thus its total costs should be 20% less than LCD panels’. As

such, we believe the oxide TFT technology, which uses the existing LCD TFT line,

will be adopted for large AMOLED panel production in the initial phase.

8G TFT technology by company

Company

SMD

Samsung

Electronics

LG Display

Technology

Mobility Uniformity Stability

Advanced

100cm2/Vs

ELA

SGC 10~40cm2/Vs

High

Oxide TFT

9cm2/Vs

High

Oxide TFT

9cm2/Vs

High

Low Very high

No. of

Temperature

masks

Cost

Technological

complexity

7~10

Low

High

High

High

4~6

High

Low

Low

High

4~5

Low

Low

Low

High

4~5

Low

Low

Low

Source: Company data, Korea Investment & Securities

3

Display

Unit costs by technology

Panel size (mm)

AMOLED 8G

(Oxide+FMM)

2,200x2,500

AMOLED 8G

(ELA+FMM)

2,200x2,500

AMOLED 8G

(ELA+LITI)

2,200x2,500

4

10

11

3

120

120

120

120

Capex (W trn)

Capacity (1,000 sheets per month)

Total capacity for 5yrs by area (1,000m2)

2

Capex per area (KRW/m per month)

Unit cash cost (KRW/m2 per month)

2

Total cost per area (KRW/m per month)

LCD 8G line

2,200x2,500

39,600

39,600

39,600

39,600

95,833

252,525

282,828

75,758

204,545

204,545

204,545

340,909

300,379

457,071

487,374

416,667

Note: Assuming useful life of five years

Source: Industry data, Korea Investment & Securities

Cost analysis: per area

AMOLED 8G

(Oxide+FMM)

95,833

LCD 8G line

Capex per area (KRW/m2 per month)

75,758

Capex per area (KRW/m2 per month)

TFT backplane process

40,152

TFT backplane process

CF & cell/module process

35,606

Deposition (evaporation) & encapsulation

20,076

75,758

Cash cost per area (KRW/m2 per month)

340,909

Cash cost per area (KRW/m2 per month)

204,545

Total cost per area (KRW/m2 per month)

416,667

Total cost per area (KRW/m2 per month)

300,379

Note: Key assumptions: 1) LCD cash cost per area: 4.5 times capex per area, 2) OLED line cash cost: 60% of LCD line, 3) Oxide OLED line can use the existing LCD line and thus

its TFT backplane process costs 50% less than its LCD counterpart

Source: Industry data, Korea Investment & Securities

Cost analysis: per area

AMOLED 8G

(ELA+FMM)

252,525

Capex per area (KRW/m2 per month

TFT backplane process

176,768

AMOLED 8G

(ELA+LITI)

282,828

Capex per area (KRW/m2 per month)

TFT backplane process

176,768

Deposition (evaporation) & encapsulation

75,758

Deposition (LITI) & encapsulation

Cash cost per area (KRW/m2 per month)

204,545

Cash cost per area (KRW/m2 per month)

204,545

106,061

Total cost per area (KRW/m2 per month)

457,071

Total cost per area (KRW/m2 per month)

487,374

Note: Key assumptions: 1) OLED line cash cost: 60% of LCD line, 2) LITI deposition: 40% greater than FMM method, 2) LITI deposition method costs 40% more in the deposition

process than the FMM method

Source: Industry data, Korea Investment & Securities

8G AMOLED (oxide) costs vs. 8G LCD

75,758

AMOLED 8G

(Oxide+FMM)

95,833

Cash cost per area (KRW/m2 per month)

340,909

204,545

-40.0%

Total cost per area (KRW/m2 per month)

416,667

300,379

-27.9%

AMOLED 8G

(ELA+FMM)

252,525

AMOLED 8G

(Oxide+FMM)

95,833

Cost reduction

or increase

-62.1%

176,768

20,076

-88.6%

75,758

75,758

0.0%

Cash cost per area (KRW/m2 per month)

204,545

204,545

0.0%

Total cost per area (KRW/m2 per month)

457,071

300,379

-34.3%

LCD 8G line

Capex per area (KRW/m2 per month)

Cost reduction

or increase

26.5%

Source: Industry data, Korea Investment & Securities

Oxide-based 8G AMOLED vs. ELA-based 8G AMOLED

Capex per area (KRW/m2 per month)

TFT backplane process

Deposition & encapsulation

Source: Industry data, Korea Investment & Securities

4

Display

AMOLED (oxide) costs vs. LCD

(won/m2 per month)

Capex per area

600,000

Total cost per area

Total cost per area

500,000

400,000

300,000

200,000

100,000

0

TFT-LCD

ELA+FMM

ELA+LITI

Oxide+FMM

Source: Industry data, Korea Investment & Securities

Panel makers should

speed up large

AMOLED panel

production to shore up

profitability

LCD panel makers’ profitability has continued to fall hit by slowing LCD TV

shipment growth. Their profitability moves up and down as the industry cycle

changes. Panel makers’ operating margin reached 20% in 2H07, the first upcycle

since they entered the full-scale production of LCD panels used in TVs. The

upcycle revisited the industry in 1H10 but the panel producers’ operating margin

averaged 10%, a sharp decline from the past. To shore up the operating margin,

panel makers are considering starting production of large AMOLED panels earlier

than scheduled as it is more cost competitive than LCD panel production. We

believe there will be intense competition to build presence in the market before the

rivals square off because profitability tends to be higher while the market is still

burgeoning.

Global panel makers’ OP margin

40%

30%

20%

10%

0%

1Q03

4Q03

3Q04

2Q05

1Q06

4Q06

3Q07

2Q08

1Q09

4Q09

3Q10

2Q11

-10%

-20%

-30%

Note: Global panel makers refer to Samsung Electronics (LCD business), LG Display, AUO and CMI.

Source: Company data, Korea Investment & Securities

5

Display

3. Material and equipment makers have the most

investment appeal

Material suppliers are

the most appealing

Material suppliers are the most appealing among AMOLED-related companies as

they can continue to benefit from the production of both small and large AMOLED

panels. Although there are differences between the materials used in small and

large AMOLED panels, it does not mean material suppliers have to drastically alter

their product mix. Thus, major material suppliers should continue to supply

products used in the production of small and large panels and their supply volume

should grow rapidly as well when the production area expands. In addition,

companies that can supply indium gallium zinc oxide (IGZO) required for oxideTFT processing should be able to benefit from the growth of the large AMOLED

panel industry.

Even if all handsets

were to adopt AMOLED

panels, demand for TV

panels would still be 12times more than that for

mobile panels

The TV panel market is appealing because its area-based demand is at least 12times bigger than that of the mobile display market. At present, AMOLED panels

have less than 5% share in the handset display market. Even if all handsets were

to adopt AMOLED panels (4-inch), the mobile display market’s area-based

demand would still be less than the 8% total demand for LCD TV panels that are

expected to sell in 2011. While mobile displays are more expensive than large

displays in terms of costs per unit area and prices, the TV panel market has much

stronger growth potential.

Area-based demand for mobile panels and TV panels

(Km2)

90,000

75,000

60,000

11.8 fold increase

45,000

30,000

15,000

0

Panel demand f or handset in terms of area

Panel demand f or LCD TV in terms of area

Source: DisplaySearch, Korea Investment & Securities

Material suppliers’

ability to satisfy

demand for both small

and large panels may

justify their high

valuation

6

As the TV panel market is enormous, the companies that can supply equipment or

materials used in the production of large AMOLED displays will have a wide

window of opportunity to achieve growth. In particular, as new technologies are

required for the production of large panels, the firms that can supply processing

equipment that satisfies such demand will be afforded fresh opportunities. As for

material suppliers, they are able to supply products for small and large panels

without drastically altering their product mix, which justifies their higher valuation

compared to equipment makers. At present, DS Hi-Metal’s stock trades at a PER

of 25x and 15x 2011F and 2012F EPS, respectively. But when we consider the

large panel market’s area-based demand for materials can grow more than 10times bigger than that of the mobile market, DS Hi-Metal’s high valuation is fully

justified.

Display

DS Hi-Metal’s PER band

Cheil Ind.’s PER band

(KRW)

(KRW)

70,000

160,000

x 48.0

60,000

x 18.0

140,000

x 15.0

x 36.0

50,000

120,000

100,000

40,000

x 24.0

80,000

x 12.0

60,000

x 9.0

30,000

20,000

x 15.0

10,000

40,000

x 6.0

20,000

0

Oct-05

Jul-06

Apr-07

Jan-08

Oct-08

Jul-09

Apr-10

0

Jan-03

Jan-11

Source: Company data, Korea Investment & Securities

May-04

Sep-05

Jan-07

May-08

Sep-09

Jan-11

Source: Company data, Korea Investment & Securities

SFA’s PER band

AP System’s PER band

(KRW)

(KRW)

18,000

90,000

x 17.0

x 12.0

16,000

80,000

70,000

x 9.0

14,000

60,000

12,000

50,000

10,000

x 13.0

x 9.0

8,000

40,000

x 6.0

6,000

30,000

x 4.0

20,000

x 5.0

4,000

2,000

10,000

0

Jan-03

May-04

Sep-05

Jan-07

May-08

Sep-09

0

Jan-03

Jan-11

Source: Company data, Korea Investment & Securities

May-04

Sep-05

Jan-07

May-08

Sep-09

Jan-11

Source: Company data, Korea Investment & Securities

SNU’s PER band

Display equipment makers’ PER band

(KRW)

(won bn)

40,000

3,500

x15.0

3,000

35,000

2,500

30,000

x 17.0

25,000

x 14.0

x12.0

2,000

20,000

x 11.0

x9.0

1,500

1,000

x6.0

500

15,000

0

10,000

x 8.0

-500

5,000

0

Jan-05

-1,000

Jan-06

Jan-07

Jan-08

Jan-09

Source: Company data, Korea Investment & Securities

Jan-10

Jan-11

-1,500

Dec-01

Mar-03

Jun-04

Sep-05

Dec-06

Mar-08

Jun-09

Sep-10

Note: Display equipment makers are SFA, DMS, KC Tech, Jusung Engineering, Top

Engineering

Source: Company data, Korea Investment & Securities

7

Display

Among equipment

makers, those with

steady order flows are

the most attractive

The technology switch at panel makers presents both opportunities and risks to

equipment suppliers. SMD’s technological changes at 5.5G fabs where capacity

additions are taking place have shed a positive light on some, but not all. SMD

plans to adopt the LITI (laser-induced thermal imaging) deposition method on its

5.5G P3 lines in parallel with the conventional fine-metal mask (FMM) method.

This offers fewer chances of orders for FMM-based equipment makers such as

SFA and SNU Precision but more opportunities for AP Systems, a supplier of laser

deposition equipment that is key to the LITI process. SFA has the potential to

offset the negative effect as it also produces equipment necessary for the LITI

process. Like this, technological changes made by panel makers will continue to

be a mixed bag of pros and cons for vendors. If the technology norm shifts from

LTPS to oxide TFT in the TFT backplane process with the heaviest capex burden

across the entire AMOLED panel process, the equipment order momentum should

vary from company to company.

Producers of oxide TFT

process equipment

merit attention given the

high applicability to

larger panels

Among equipment vendors, we draw attention to producers of the oxide TFT

process equipment as the process is likely to go mainstream in the large AMOLED

panel market. The necessity of the new processes in addition to the TFT-LCD

substrate manufacturing underlines the need for new equipment such as highdensity plasma etchers or heat treatment equipment. Accordingly, suppliers of

such equipment are worthy of attention.

LCD equipment makers’

PER peaked at 15x in

2004

LCD equipment makers’ PER rose to 15x during 2004-2005 when capex to

produce 40-inch or larger LCD TV panels was underway. We believe the PER of

vendors for large AMOLED panels has the potential to reach the same level as

capex for large AMOLED TV panels should start from 2012 and this will, in turn,

give a boost to equipment makers. As such, we applied a PER of 15x to SFA and

ICD that serve large panel makers.

AMOLED technology by generation and process

5.5G (1,500X1,300) A2 P3

5.5G (1,500X1,300) A3

8G V1

1) 24K (P1)+40K (P2)

5.5G (1,500X1,300) A2 P1-P2

32K

100K

8K

2) ELA (two-scan)

ELA (two-scan)

ELA (one-scan)

Advanced ELA

SGC

A-SPC

FMM (horizontal, cut a mother glass LITI (cut mother glass into 4 units,

into 4 units)

for red, green materials)

FMM (horizontal, cut a mother glass

into 4 units for blue and other

materials)

Glass-type

4) Glass-type

3)

Thin-film-type

LITI (mother glass, for red, green

materials)

FMM (vertical, mother glass for blue

and other materials)

Metal-type

Glass-type

Thin-film-type

Metal-type

Note: 1) capacity per month, 2) TFT backplane process, 3) deposition process, 4) encapsulation process

Source: Industry data, Korea Investment & Securities

8

Oxide (IGZO)

SMS (horizontal, cut a mother glass

into 6 units)

Display

Oxide flow chart (backplane manufacturing)

Source: Korea Investment & Securities

LTPS flow chart (backplane manufacturing)

Source: Korea Investment & Securities

9

Display

AMOLED supply chain

Product

Company type

Company

Domestic

Domestic

DS Hi-Metal, Doosan Corp. Electro-Materials, Cheil Ind.

NSC (Japan)*, Idemitsu Kosan (Japan), Hodogaya (Japan), Merck (Germany), Toyo Ink (Japan), Kodak

(US)

LG Chem., DS Hi-Metal

Foreign

NSC(Japan)*, Idemitsu Kosan (Japan), Hodogaya (Japan)

AMOLED material

HTL

Foreign

HIL

ETL

EIL

EML (red)

Domestic

LG Chem., Cheil Ind.

Foreign

NSC (Japan)*, Idemitsu Kosan (Japan), Merck (Germany), Toyo Ink (Japan), DuPont (US)

Domestic

LG Chem

Foreign

NSC (Japan)*, Cerac (US)*, DuPont (US)

Domestic

Dow Chemical*

Foreign

NSC (Japan)*, Idemitsu Kosan (Japan), Merck (Germany), Kodak (US), DuPont (US)

EML (green)

Domestic

Doosan Corp. Electro-Materials

Foreign

NSC (Japan)*, Idemitsu Kosan (Japan), Eray (Taiwan)*

EML (blue)

Domestic

SFC*, Dongwoo Fine-Chem*, Daejoo Electronic Materials

Foreign

Idemistus Kosan (Japan), Merck (Germany), Kodak (US), DuPont (US)

ITO

Shadow mask

Domestic

Advanced Nano Products

Foreign

-

Domestic

-

Foreign

DNP (Japan), Mitani (Japan)*

Desiccant

Domestic

-

Foreign

Dynic (Japan)*, Gore-tex (US)*, Saes Getters (Italy)

Sealants

Domestic

-

Encapsulant

Foreign

Nagase (Japan), Kyoritsu (Japan)*

Domestic

Nanonix*

Foreign

Donor film for laser evaporation Domestic

NSG (Japan)*

Cheil Ind.

Foreign

Kodak (US)

Domestic

AP System

AMOLED equipment makers

ELA

Foreign

-

FMM deposition

Domestic

SFA, SNU, Avaco, Dong A Eltek, Jusung Engineering, Top Engineering

Foreign

Tokki (Japan)*, Hitachi (Japan)*, ULVAC (Japan)

Laser deposition

Domestic

AP System

Foreign

-

Encapsulation

Domestic

AP System, SFA, SNU, LTS, Avaco, Jusung Engineering

Foreign

Miwa MFG (Japan)*, Vitex (US)*, Lantechnical (Japan)*

Etchers

Domestic

ICD

Foreign

Y.A.C. (Japan)*

Sputtering equipment

Domestic

Avaco

Foreign

ULVAC (Japan)

Domestic

Cheil Ind.

AMOLED material makers

AMOLED polarizer

Foreign

Shenzen Sunnypol Optoelecronic (China), Optimax (Taiwan)

AMOLED donor film

Domestic

Cheil Ind.

Foreign

Kodak (US)

AMOLED driver-IC

Domestic

LDT, Clover Hitech, Silicon Works, Nepes

Foreign

-

AMOLED bezel

Domestic

Sangsin EDP

Foreign

-

Note: Non-listed companies are marked with *

Source: Industry data, Korea Investment & Securities

10

Company

Cheil Ind. (001300)

......................................................................................................................................................................

12

Duksan Hi-Metal (077360) ................................................................................................................................................... 15

SFA Engineering (056190) .................................................................................................................................................. 18

ICD (040910) ........................................................................................................................................................................................ 21

AP Systems (054620) ................................................................................................................................................................ 24

Advanced Nano Products (121600) ......................................................................................................................... 25

Display

Cheil Ind. (001300)

BUY (Maintain), TP: W140,000 (Maintain)

Hopeful 4Q11

Potential dominant supplier of large AMOLED materials to Samsung: Cheil

Ind. (Cheil) should become a dominant supplier of large AMOLED materials to

Samsung. Although development and production of materials for large AMOLED

panels are behind schedule, we remain confident that the company will ultimately

secure a dominant supply share at Samsung. A bright spot is that the company

has started developing films suitable for the LITI (laser-induced thermal imaging)

method in line with the adoption of the LITI technique. Accordingly, its product

portfolio of AMOLED materials is growing more diverse. As Cheil’s forte lies in

large panels rather than mobile panels, panel makers’ ongoing shift to large

AMOLED panel production hints at more business opportunities going forward.

AMOLED materials supply to kick off in Sep upon the completion of mass

production lines: The last phase of Cheil’s AMOLED material development is

testing the prototypes produced at the mass production lines set for completion in

Sep. After Sep, products such as electron transport layer (ETL), pixel defining layer

(PDL) and hole transport layer (HTL) should come on stream, in that order.

Moreover, as the supply dates fall within a similar timeframe as SMD’s ramp-up of

the 5.5G P2 and P3 lines and V1 (8G pilot) lines, shipments should fast increase

after decisions are made to supply the products. In 2012, Cheil will also supply one

or two new AMOLED materials, polarizer and donor films, which should complete

the product mix of 7-8 AMOLED materials.

TV polarizer film business to normalize: We believe the TV polarizer film

business will normalize because its production yield improved to the normal level

at end-2Q11 and shipment volumes are expected to increase. It is also positive

that Cheil’s organization has stabilized with the completion of the post-merger

integration process after taking over its subsidiary Ace Digitech. Although new

product development and market share growth have been slower than our

expectations due to the lackluster LCD market, top-line growth should gain

momentum in 2H11 or 2012. We estimate polarizer film sales at W660bn in 2011F

but the figure should jump to W1.2trn in 2012F. The bottom line is unlikely to turn

profitable in 2011 but the operating margin should climb to 8% in 2012F.

Maintain BUY and TP of W140,000: The stock lost 19% since early Aug due to

disappointing earnings and the stock market crash. The stock trades at the 2011F

PER of 15x and 2012F PER of 11x, the lowest level since Oct 2009. The supply of

new AMOLED materials has been delayed but the start is a matter of when, not if.

We believe the recent correction offers a long-awaited entry point. We maintain

BUY and our TP of W140,000 (target PE 18x the 2011F-2012F average EPS). The

stock has 44% upside. OP should skyrocket 101% QoQ in 3Q11F. Despite

lingering uncertainties over the global economy and the demand side, we believe

Cheil looks more attractive than other IT plays because of its high earnings stability.

August 12, 2011 / W97,500 won / Mkt cap: USD4,520.2mn, KRW4,520.2bn

Yr to

Sales

OP

EBT

NP

PBR

ROE

Dec

(W bn)

(W bn)

(W bn)

(W bn)

(won)

(YoY)

(W bn)

(x)

(x)

(x)

(%)

2009A

4,261

264

155

127

2,654

(18.5)

395

21.3

8.0

1.4

7.1

2010A

5,019

334

314

259

5,395

103.3

468

20.6

12.3

2.0

10.9

Heuiseok Jeong

2011F

5,982

384

369

316

6,448

19.5

540

15.1

9.4

1.7

10.9

82-2-3276-6277

2012F

7,124

573

558

463

9,172

42.2

767

10.6

6.6

1.5

14.3

heuiseok.j@truefriend.com

2013F

8,549

691

686

569 11,269

22.9

915

8.7

5.6

1.5

16.4

Jay Yoo, CFA

82-2-3276-6178

jongwoo.yoo@truefriend.com

12

EPS % chg.

EBITDA

P/E EV/EBITDA

Display

Quarterly earnings estimates

(W bn, %)

2008

2009

1Q10

2Q10

3Q10

4Q10

2010

1Q11

2Q11P

3Q11F

4Q11F

2011F

2012F

3,728

4,261

1,164

1,309

1,234

1,311

5,019

1,400

1,481

1,519

1,583

5,982

7,124

815

1,209

321

367

370

351

1,410

382

402

470

488

1,742

2,649

Chemicals

1,774

1,827

519

592

568

551

2,231

621

650

694

675

2,641

2,904

Fashion

1,139

1,142

311

325

273

390

1,298

377

397

355

420

1,547

1,571

CGS

2,610

3,018

820

922

880

913

3,534

998

1,105

1,137

1,183

4,424

5,202

% of sales

70.0

70.8

70.4

70.4

71.3

69.6

70.4

71.3

74.7

74.9

74.7

74.0

73.0

SG&A

878

980

267

285

258

341

1150

299

313

256

306

1174

1,349

% of sales

23.5

23.0

22.9

21.7

20.9

26.0

22.9

21.3

21.1

16.9

19.4

19.6

18.9

Operating profit

240

264

77

103

97

57

334

103

63

126

93

384

573

Electronic materials

95

95

30

41

42

19

131

36

27

81

42

186

290

Chemicals

91

124

23

49

43

27

142

35

23

31

30

119

189

Fashion

47

52

25

13

12

13

63

29

11

14

21

75

94

Operating margin (%)

6.4

6.2

6.7

7.9

7.8

4.4

6.7

7.3

4.2

8.3

5.9

6.4

8.0

Sales

Electronic materials

Electronic materials

11.7

7.8

9.4

11.1

11.2

5.3

9.3

9.5

6.6

17.2

8.6

10.7

11.0

Chemicals

5.1

6.8

4.5

8.2

7.6

4.8

6.3

5.7

3.5

4.5

4.5

4.5

6.5

Fashion

4.1

4.6

7.9

3.9

4.4

3.4

4.8

7.6

2.8

4.0

5.0

4.8

6.0

EBT

191

155

80

101

79

54

314

110

55

118

86

369

558

EBT margin (%)

5.1

3.6

6.9

7.7

6.4

4.1

6.3

7.8

3.7

7.8

5.4

6.2

7.8

Net profit

157

127

66

83

65

45

259

92

55

98

71

316

463

Net margin (%)

4.2

3.0

5.7

6.3

5.3

3.4

5.2

6.6

3.7

6.5

4.5

5.3

6.5

Note: K-GAAP stand-alone until 2010 and K-IFRS consolidated from 2011.

Source: Company data, Korea Investment & Securities

13

Display

Balance Sheet

Fiscal year ending Dec. (W bn)

Current assets

Income Statement

2009A 2010A

2011F

2012F 2013F

1,146

1,200

1,360

1,620

1,944

80

18

22

26

31

Accounts receivable

444

461

479

570

684

Inventory

488

562

670

798

958

Cash & cash equivalent

Fixed assets

1,972

2,815

3,312

3,951

4,649

Investments

812

1,573

1,730

2,061

2,473

Tangible assets

988

1,104

1,417

1,694

1,941

Intangible assets

Fiscal year ending Dec. (W bn)

2011F

2012F

2013F

Sales

2009A 2010A

4,261

5,019

5,982

7,124

8,549

Gross profit

1,244

1,484

1,558

1,922

2,306

SG&A expense

980

1,150

1,174

1,349

1,616

Operating profit

264

334

384

573

691

Non-op. profit

179

176

80

80

83

6

2

1

1

1

113

74

15

59

59

Equity gains

26

42

42

42

42

Non-op. expense

287

196

95

95

88

41

27

27

27

20

116

75

15

60

60

17

20

5

6

6

155

314

369

558

686

28

56

53

95

117

0

0

0

0

0

Interest income

61

29

35

42

50

3,119

4,015

4,672

5,570

6,593

607

809

1,125

1,521

2,409

292

344

410

488

586

Short-term borrowing

50

0

0

0

0

Current portion of LT debt

62

191

191

191

191

Interest expense

Long-term debt

542

444

510

588

685

FX losses

Debentures

292

100

100

100

100

90

3

3

3

3

1,149

1,253

1,634

2,109

3,093

Paid-in capital

250

250

262

262

262

Capital surplus

431

429

417

417

417

Capital adjustments

(55)

(51)

(51)

(51)

(51)

Retained earnings

926

1,149

1,425

1,850

2,379

Net profit

127

259

316

463

569

Shareholders' equity

1,970

2,761

3,038

3,462

3,499

EBITDA

395

468

540

767

915

2012F

2013F

Total assets

Current liabilities

Accounts payable

Long-term borrowings

Total liabilities

Cash Flow

Fiscal year ending Dec. (W bn)

C/F from operating

FX gains

Equity losses

Earnings before tax

Income taxes

Profit from discontinued

Key Financial Data

2009A

2010A

2011F

2012F

2013F

Fiscal year ending Dec.

2009A

2010A

2011F

per share data (won)

457

448

602

773

1,340

EPS

2,654

5,395

6,448

9,172

11,269

Net profits

127

259

316

463

569

BPS

39,287

55,682

58,257

66,216

66,774

Depreciation

112

126

150

187

217

DPS

750

750

750

750

750

SPS

Amortization

19

8

6

7

8

Net incr. in W/C

72

(11)

149

131

559

Others

C/F from investing

127

66

(18)

(170)

(274)

(619)

(15)

(13)

(800) (1,383)

Growth (%)

Sales growth

14.3

17.8

19.2

19.1

20.0

OP growth

9.9

26.7

15.0

49.2

20.5

NP growth

(19.4)

103.7

22.0

46.8

22.9

EPS growth

(18.5)

103.3

19.5

42.2

22.9

11.7

18.6

15.4

42.1

19.3

OP margin

6.2

6.7

6.4

8.0

8.1

NP margin

3.0

5.2

5.3

6.5

6.7

EBITDA margin

9.3

9.3

9.0

10.8

10.7

ROA

4.3

7.3

7.3

9.0

9.4

ROE

7.1

10.9

10.9

14.3

16.4

Dividend yield

1.3

0.7

0.8

0.8

0.8

EBITDA growth

Capex

Decr. in fixed assets

(124)

(248)

(470)

(470)

(470)

7

1

1

1

1

Net incr. in current assets

(8)

16

(0)

(0)

(0)

Incr. in investment

(9)

(21)

(118)

(293)

(867)

Others

C/F from financing

(36)

(22)

(32)

(38)

(47)

(224)

(235)

20

31

48

Incr. in equity

0

0

0

0

0

Incr. in debts

(189)

(200)

(0)

(1)

(1)

85,222 104,656 122,165 141,013 169,216

Profitability (%)

Stability

Net debt (W bn)

403

274

270

266

260

Int. coverage (x)

6.4

12.5

14.5

21.6

34.6

25.1

10.6

9.6

8.5

8.4

D/E ratio (%)

Valuation (x)

Dividends

Others

Increase in cash

14

(36)

1

64

(36)

1

(61)

(36)

57

3

(39)

71

4

(39)

PER

21.3

20.6

15.1

10.6

8.7

89

PBR

1.4

2.0

1.7

1.5

1.5

PSR

0.7

1.1

0.8

0.7

0.6

EV/EBITDA

8.0

12.3

9.4

6.6

5.6

5

Display

Duksan Hi-Metal (077360) BUY (Maintain), TP: W37,000 (Maintain)

OLED materials to keep thriving backed by larger AMOLED

Ample upside despite demanding valuation: Duksan Hi-Metal (Duksan)

currently trades at a high 2011F PE 25x, which we view as tenable on the back of

strong growth potential for its AMOLED materials business. We have an upbeat

outlook due to the following. 1) As AMOLED panels get larger, the materials market

will fast expand. 2) Given rivals’ delayed entry to the HTL (hole transport layers)

market, Duksan should be able to hold on to its large share at Samsung Mobile

Display (SMD) after 2011. We peg the 2011F EPS at W1,056, up 116% YoY, and

expect a decent rise of 67% for 2012F. We maintain BUY and a TP of W37,000

that equals a target PE 25x the 2011-2012F average EPS W1,412 (2012F

earnings growth potential priced in). We applied the current PE 25x as the target

multiple given the company’s good earnings visibility.

Larger AMOLED spurs materials market growth: As AMOLED formats get

larger, we expect the OLED materials market to grow rapidly as well. An 8G

AMOLED substrate requires OLED materials 2.8-fold more than a 5.5G substrate.

As AMOLED panel makers make full-fledged investment in 8G lines from 2012, the

HTL market’s growth would get into high gear at the same time. In particular,

Duksan can offer a steady supply of OLED materials regardless of possible

technology changes to the deposition process at 5.5G and 8G lines. Unlike

AMOLED equipment vendors whose orders momentum can slow with the

technology shift, materials suppliers including Duksan face limited risk to sales.

Large presence at SMD to remain intact: Duksan is an exclusive supplier of HTL

to SMD. There is concern that it will face a threat from emerging rivals but we

believe chances of its vendor share shrinking are remote. SMD’s 5.5G phase 2 line

ready to be operational in 2H11 will use the same materials as phase 1 and thus

chances are good that it will continue to use Duksan’s products. It is difficult for a

manufacturer to change a supplier of materials used at the current production line.

Given this, Duksan being equipped with the most stable mass-production lines

should keep the upper hand over rivals. The company’s vendor share could shrink

from the current level when large-size AMOLED panels are made at the phase 3

line as major rivals will pose competitive threats at that time. However, its supply

volume would expand thanks to larger panels. We estimate OLED materials sales

to jump 119% YoY to W74.1bn in 2011F and gain 114% YoY to W158.3bn in 2012F.

August 12, 2011 / W26,700 won / Mkt cap: USD727.7mn, KRW727.7bn

Yr to

Sales

OP

EBT

NP

PBR

ROE

Jay Yoo, CFA

Dec

(W bn)

(W bn)

(W bn)

(W bn)

(won)

(YoY)

(W bn)

(x)

(x)

(x)

(%)

82-2-3276-6178

jongwoo.yoo@truefriend.com

2009A

32

5

6

5

251

NM

8

52.0

35.4

5.1

8.7

2010A

72

13

13

10

489

94.8

22

41.5

22.6

6.7

12.4

2011F

125

33

34

31

1,055

115.7

43

25.3

17.7

6.7

28.4

2012F

213

56

57

52

1,766

67.4

67

15.1

11.0

4.7

34.4

2013F

261

66

67

61

2,084

18.0

78

12.8

9.1

3.5

29.5

Heuiseok Jeong

82-2-3276-6277

heuiseok.j@truefriend.com

EPS % chg.

EBITDA

P/E EV/EBITDA

15

Display

OLED materials sales

(won bn)

Ramp-up of A2

P3 and A3

50

Ramp-up of A2

P2

40

Ramp-up of A2 P1 at

8G line

30

20

10

0

1Q10

3Q10

1Q11

3Q11F

1Q12F

3Q12F

Source: Company data, Korea Investment & Securities

Quarterly earnings estimates

(W bn)

2009

2010

1Q11

2Q11F

3Q11F

4Q11F

2011F

1Q12F

2Q12F

3Q12F

4Q12F

2012F

Sales

32.1

72.5

23.3

29.9

34.3

37.9

125.3

46.0

53.0

53.5

60.1

212.6

OLED

18.1

33.9

10.7

16.9

21.3

25.2

74.1

33.3

39.7

39.4

45.9

158.3

Semiconductor materials

25.7

38.6

12.6

13.0

13.1

12.6

51.3

12.7

13.4

14.1

14.2

54.3

COGS

19.7

42.7

14.8

18.2

20.8

23.1

76.9

28.0

32.4

32.9

37.3

130.7

61.3%

59.0%

63.5%

61.1%

60.7%

60.8%

61.3%

60.9%

61.2%

61.5%

62.1%

61.5%

4.7

13.1

5.6

8.0

9.4

10.3

33.3

12.4

14.2

14.1

15.5

56.3

14.6%

18.1%

24.3%

26.9%

27.3%

27.2%

26.6%

27.0%

26.7%

26.4%

25.9%

26.5%

(% of sales)

OP

OP margin (%)

EBT

EBT margin (%)

NP

NP margin (%)

5.7

12.5

5.8

8.1

9.5

10.4

33.8

12.5

14.3

14.2

15.6

56.6

17.7%

17.3%

24.9%

27.3%

27.6%

27.4%

27.0%

27.2%

26.9%

26.6%

26.0%

26.6%

4.7

10.1

5.3

7.5

8.7

9.5

31.0

11.5

13.1

13.0

14.3

51.9

14.7%

14.0%

22.9%

25.0%

25.3%

25.2%

24.7%

24.9%

24.7%

24.4%

23.8%

24.4%

Note: 1) Accounting changes from K-GAAP to K-IFRS as of 2011. 2) OLED sales figures until 2009 are based on Ludis prior to the merger with Duksan Hi-Metal.

Source: Company data, Korea Investment & Securities

16

Display

Balance Sheet

Fiscal year ending Dec. (W bn)

Current assets

Income Statement

2009A 2010A

2011F

2012F 2013F

26

22

47

90

136

14

5

19

43

76

Accounts receivable

4

7

12

21

26

Inventory

4

7

12

20

26

Fixed assets

Cash & cash equivalent

66

90

103

121

135

Investments

15

16

19

22

25

Tangible assets

18

44

52

60

69

Intangible assets

30

27

29

33

35

Total assets

92

112

150

211

271

Current liabilities

16

11

13

19

15

Accounts payable

1

3

4

8

10

Short-term borrowing

6

2

0

0

0

Current portion of LT debt

0

3

5

8

5

Long-term debt

6

7

12

15

18

Debentures

3

1

1

2

2

Long-term borrowings

2

6

10

12

14

21

18

25

34

33

Total liabilities

Fiscal year ending Dec. (W bn)

2011F

2012F

2013F

Sales

2009A 2010A

32

72

125

213

261

Gross profit

12

30

48

82

97

SG&A expense

8

17

15

26

31

Operating profit

5

13

33

56

66

Non-op. profit

5

2

2

2

2

Interest income

1

0

0

0

1

FX gains

1

0

0

0

1

Equity gains

2

0

0

0

0

Non-op. expense

4

2

1

1

1

Interest expense

2

1

0

0

0

FX losses

0

1

0

0

0

Equity losses

0

0

0

0

0

Earnings before tax

6

13

34

57

67

Income taxes

1

2

3

5

6

Profit from discontinued

0

0

0

0

0

Paid-in capital

5

6

6

6

6

Capital surplus

68

76

76

76

76

(20)

(18)

(18)

(18)

(18)

Retained earnings

21

31

62

114

175

Net profit

5

10

31

52

61

Shareholders' equity

70

93

125

177

238

EBITDA

8

22

43

67

78

Capital adjustments

Cash Flow

Fiscal year ending Dec. (W bn)

C/F from operating

Key Financial Data

2009A

2010A

2011F

2012F

2013F

Fiscal year ending Dec.

2009A

2010A

2011F

2012F

2013F

per share data (won)

10

10

30

47

59

EPS

251

489

1,055

1,766

2,084

Net profits

5

10

31

52

61

BPS

2,558

3,048

3,993

5,628

7,639

Depreciation

1

2

3

4

4

DPS

0

0

0

0

0

SPS

1,702

3,494

4,264

7,233

8,864

Sales growth

41.8

125.5

73.0

69.6

22.5

OP growth

(4.4)

179.2

154.1

68.7

17.5

NP growth

NM

114.0

205.6

67.4

18.0

EPS growth

NM

94.8

115.7

67.4

18.0

37.1

164.3

98.4

56.0

16.4

OP margin

14.6

18.1

26.6

26.5

25.4

NP margin

14.7

14.0

24.7

24.4

23.5

25.5

29.9

34.3

31.6

30.0

Amortization

2

6

6

7

8

Net incr. in W/C

4

(12)

(10)

(16)

(14)

Others

C/F from investing

(2)

4

(0)

0

(0)

(10)

(28)

(22)

(28)

(26)

Growth (%)

EBITDA growth

Capex

Decr. in fixed assets

Net incr. in current assets

Incr. in investment

Others

C/F from financing

(7)

(28)

(11)

(12)

(13)

0

0

0

0

0

Profitability (%)

(3)

3

(0)

(0)

(0)

EBITDA margin

1

1

(2)

(3)

(1)

ROA

6.1

10.0

23.7

28.8

25.4

ROE

8.7

12.4

28.4

34.4

29.5

Dividend yield

0.0

0.0

0.0

0.0

0.0

(0)

(4)

(9)

(13)

(11)

0

9

6

5

(0)

Incr. in equity

0

6

0

0

0

Incr. in debts

(12)

2

6

5

(0)

Stability

Net debt (W bn)

(7)

6

(3)

(22)

(56)

Int. coverage (x)

3.1

19.1

114.1

153.6

184.1

15.8

11.8

12.7

11.8

8.5

D/E ratio (%)

Valuation (x)

Dividends

Others

Increase in cash

0

12

0

0

0

(9)

0

0

14

0

0

24

0

PER

52.0

41.5

25.3

15.1

12.8

0

PBR

5.1

6.7

6.7

4.7

3.5

PSR

7.7

5.8

6.3

3.7

3.0

35.4

22.6

17.7

11.0

9.1

33

EV/EBITDA

17

Display

SFA Engineering (056190) BUY (Maintain), TP: W80,000 (Maintain)

Large AMOLED capex projects need SFA

Changes in TFT backplane and deposition technology to have limited effect:

SFA Engineering’s (SFA) wide product mix gives the equipment maker a sharper

competitive edge over domestic rivals. Moreover, SFA is capable of adapting to the

technological changes that occur when panel makers shift their capex from LCD to

AMOLED or when the production of small and midsize panels expands to include

large panels. In 2011, SFA’s overall new orders for equipment are expected to

reach W834.2bn, of which LCD-related equipment should be a mere W200bn.

Given that SFA’s AMOLED-related equipment orders already amount to W400bn,

the company boasts strong product competitiveness.

To supply deposition equipment to A3 line: In 2H11, SFA will likely receive new

orders worth W200bn from SMD, which is expanding the deposition process for its

A2 lines. In addition to the existing orders for logistic systems, the company should

supply new equipment required for the newly implemented laser-induced thermal

imaging (LITI) method. SFA was preparing to supply vertical deposition equipment

for 5.5G lines but technological changes have delayed their application in A3 lines.

Instead, SFA is now supplying blank deposition equipment and donor handlers,

which minimizes the effect caused by the supply delay of vertical deposition

equipment. At present, SFA is making plans to supply vertical deposition

equipment for the FMM method used in A3 lines in 2012.

Equipment for 8G oxide-TFT and deposition methods: SFA is also preparing

equipment for the oxide-TFT method when it is adopted for 8G AMOLEDs. As for

front-end equipment, the company already has experience with supplying plasmaenhanced chemical vapor deposition (PECVD) equipment and it is currently

developing equipment for the oxide deposition process. In addition to the vertical

deposition equipment for the FMM method currently in development, SFA is

developing equipment for the SMS method that could be applied to 8G AMOLEDs.

Although it is premature to say whether every piece of equipment will be

successfully developed and supplied, the company faces limited risk from failing to

supply equipment due to its a wide product mix.

Maintain BUY and TP of W80,000: We maintain BUY and our TP of W80,000 on

SFA, which has been shifting its sales portion from LCD to AMOLED equipment

and from logistics systems to front-end equipment. We derived the TP by applying

the AMOLED equipment suppliers’ target PE of 15x the 2011F and 2012F average

EPS. SFA should see its overall new orders for equipment used in AMOLED panel

production jump from the mid-40% level in 2011 to more than 70% in 2012 when

new orders flow in from SMD’s A3 lines and 8G lines. Even if Samsung Electronics

starts investing in the oxide-TFT method for 8G AMOLEDs, it would not greatly

affect SFA’s equipment orders.

August 12, 2011 / W55,500 won / Mkt cap: USD923.9mn, KRW923.9bn

Yr to

Sales

OP

EBT

NP

Dec

(W bn)

(W bn)

(W bn)

(W bn)

(won)

(YoY)

(W bn)

(x)

(x)

(x)

(%)

2008A

431

54

69

50

5,570

20.7

58

9.9

6.5

2.1

23.4

2009A

307

15

25

18

2,038

(63.4)

20

16.4

9.9

1.2

8.0

2010A

423

38

50

39

2,192

7.6

42

22.4

16.1

3.1

16.0

Heuiseok Jeong

2011F

790

103

106

85

4,731

115.8

108

11.7

7.5

2.8

28.1

82-2-3276-6277

2012F

975

136

139

111

6,206

31.2

141

8.9

5.5

2.2

28.5

Jay Yoo, CFA

82-2-3276-6178

jongwoo.yoo@truefriend.com

heuiseok.j@truefriend.com

18

EPS % chg.

EBITDA

P/E EV/EBITDA

PBR

ROE

Display

Quarterly earnings estimates

(W bn)

2008

2009

1Q10

2Q10

3Q10

4Q10

2010

1Q11

2Q12F

3Q11F

4Q11F

2011F

430.8

307.1

48.8

91.8

98.9

183.5

423.0

134.1

204.9

213.5

237.3

789.8

40.4

(28.7)

3.9

45.8

32.5

49.8

37.8

174.8

123.2

115.9

29.3

86.7

355.1

270.4

41.0

77.2

85.2

149.4

352.8

109.0

170.0

175.3

192.2

646.5

Operating profit

53.5

15.2

1.5

7.1

5.6

23.6

37.8

17.3

25.0

27.2

33.6

103.1

OP margin (%)

12.4

4.9

3.0

7.7

5.7

12.9

8.9

12.9

12.2

12.7

14.2

13.1

Non-OP gains

14.9

9.9

3.1

0.0

3.9

5.3

12.3

0.7

0.8

0.8

0.8

3.1

EBT

68.5

25.1

4.5

7.1

9.5

28.9

50.0

18.1

25.8

28.0

34.4

106.2

Net profit

49.8

18.0

3.5

5.5

7.4

22.9

39.4

14.4

20.6

22.4

27.5

84.9

Sales

Growth (% YoY)

COGS

11.6

5.9

7.2

6.0

7.5

12.5

9.3

10.7

10.1

10.5

11.6

10.8

New orders

Net margin (%)

409.5

254.4

143.0

197.0

240.7

158.4

743.4

114.2

210.0

240.0

270.0

834.2

Backlog

228.7

176.0

270.2

379.3

521.5

496.4

496.4

235.4

240.5

267.0

299.7

540.8

Note: Figures up to FY2010 based on K-GAAP; Figures from FY2011 and onward based on K-IFRS

Source: Company data, Korea Investment & Securities

19

Display

Balance Sheet

Fiscal year ending Dec. (W bn)

Current assets

Income Statement

2008A 2009A 2010A

2011F 2012F

2011F

2012F

431

307

423

790

975

Gross profit

76

37

70

143

180

85

SG&A expense

22

22

32

42

44

Operating profit

54

15

38

103

136

Non-op. profit

274

167

494

361

445

Cash & cash equivalent

36

26

66

63

78

Accounts receivable

46

38

86

99

122

Inventory

109

27

216

69

Fixed assets

143

143

136

161

184

Investments

43

44

33

42

52

Tangible assets

90

91

94

104

113

Intangible assets

0

0

1

0

0

Total assets

417

310

630

521

629

Current liabilities

178

69

357

150

148

41

30

104

78

96

Short-term borrowing

0

0

0

0

0

Current portion of LT debt

0

0

0

0

0

Long-term debt

16

12

9

31

38

Debentures

0

0

0

0

0

Long-term borrowings

0

0

0

0

0

194

81

366

181

187

Accounts payable

Total liabilities

Fiscal year ending Dec. (W bn)

Sales

2008A 2009A 2010A

22

15

17

4

4

Interest income

8

5

7

9

9

FX gains

6

1

1

1

1

Equity gains

2

3

3

3

3

Non-op. expense

7

5

5

1

1

Interest expense

0

0

0

0

0

FX losses

1

3

3

3

3

Equity losses

1

2

2

2

2

Earnings before tax

69

25

50

106

139

Income taxes

19

7

11

21

28

0

0

0

0

0

Paid-in capital

5

5

9

9

9

Capital surplus

25

25

20

20

20

Capital adjustments

(17)

(17)

(17)

(17)

(17)

Retained earnings

210

216

252

328

430

Net profit

50

18

39

85

111

Shareholders' equity

223

228

264

340

442

EBITDA

58

20

42

108

141

2011F

2012F

Cash Flow

Fiscal year ending Dec. (W bn)

C/F from operating

Net profits

Depreciation

Amortization

Net incr. in W/C

Others

C/F from investing

Capex

Decr. in fixed assets

Key Financial Data

2008A

2009A

2010A

2011F

2012F

2008A

2009A

2010A

per share data (won)

(3)

85

29

76

EPS

5,570

2,038

2,192

4,731

6,206

50

18

39

85

111

BPS

26,302

26,916

15,615

19,877

25,583

4

5

5

5

5

DPS

1,400

400

500

500

500

SPS

47,291

33,707

23,559

43,991

54,304

Sales growth

40.4

(28.7)

37.7

86.7

23.4

OP growth

21.4

(71.6)

148.6

173.0

32.0

NP growth

18.4

(63.8)

118.3

115.8

31.2

EPS growth

20.7

(63.4)

7.6

115.8

31.2

EBITDA growth

21.0

(65.9)

115.0

154.0

30.7

OP margin

12.4

4.9

8.9

13.1

14.0

NP margin

11.6

5.9

9.3

10.8

11.4

EBITDA margin

13.5

6.4

10.0

13.7

14.5

ROA

12.5

5.0

8.4

14.8

19.4

ROE

23.4

8.0

16.0

28.1

28.5

4.2

1.2

1.0

0.9

0.9

Net debt (W bn)

(110)

(91)

(179)

(169)

(208)

Int. coverage (x)

NM

NM

NM

NM

NM

D/E ratio (%)

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

(25)

(26)

33

(87)

(50)

1

0

8

26

10

27

6

(46)

(22)

(52)

(12)

(5)

(8)

(15)

(15)

0

0

0

0

0

46

12

(30)

8

(25)

Incr. in investment

(5)

(1)

(4)

(8)

(9)

C/F from financing

Fiscal year ending Dec.

31

Net incr. in current assets

Others

Profit from discontinued

(2)

(0)

(3)

(6)

(3)

(30)

(12)

1

(10)

(10)

Incr. in equity

0

0

0

0

0

Incr. in debts

0

0

0

(1)

(1)

Growth (%)

Profitability (%)

Dividend yield

Stability

Valuation (x)

Dividends

Others

Increase in cash

20

(13)

(17)

28

(12)

0

(10)

(4)

4

40

(9)

0

(3)

(9)

PER

5.9

16.4

22.4

11.7

8.9

0

PBR

1.3

1.2

3.1

2.8

2.2

PSR

0.7

1.0

2.1

1.3

1.0

EV/EBITDA

3.0

9.9

16.1

7.5

5.5

15

Display

ICD (040910)

BUY (Maintain), TP: W98,000 (Maintain)

8G oxide-TFT needs HDP etchers

Supplying HDP etchers to SMD’s 5.5G: The 2011F sales should hit W156.8bn

and the operating margin jump to 23.6% with the sharp increase in high-density

plasma (HDP) etcher sales. Japan’s TEL and YAC met most of SMD’s equipment

demand until 4.5G but ICD supplies more than 90% of the equipment for the 5.5G

line. We expect ICD to retain its dominant supply share at SMD as it will be difficult

for rivals to match ICD’s large-area plasma source technology in the short-term.

We estimate ICD’s HDP etcher sales to jump from W7.4bn in 2010 to a whopping

W120.7bn in 2011F.

Supply to A3 line to boost 2012F sales and OP 83% and 84%, respectively:

We estimate 2012F sales at W286.4bn and OP at W68bn. Our decent YoY growth

outlook is attributed to the start of SMD’s order placements for its 5.5G A3 lines in

early 2012. The A3 lines have a monthly capacity of 100Kcps, 56% greater than

64Kcps at the current A2 lines and this will fuel ICD’s equipment supply growth.

Additional orders momentum when 8G oxide-TFT technique is adopted: We

expect the oxide-TFT method to become the trendsetter in the 8G technology

evolution as it costs 28% and 34% less than the current TFT-LCD and AMOLED

excimer-laser annealing (ELA) and fine-metal mask (FMM) methods, respectively.

Despite the technology shift, we believe ICD can continue to supply HDP etchers

as oxides have more than 68% greater bond energy than hydrogenate amorphous

silicone (a-Si:H) and thus, oxides require a more elaborate etching process. We

estimate ICD’s HDP etcher sales to jump 26% YoY to W314.9bn in 2013F. We

believe related sales will likely exceed our estimate when capex projects for 8G

mass-production lines get underway from 2H12F in full force.

Maintain BUY and TP of W98,000: We maintain BUY and a 12M TP of W98,000

using 15x 2012F EPS. We applied the peak multiple LCD equipment makers

received in 2004-2005 when LCD capex was aggressive. We considered: 1)

potential benefits from greater AMOLED capex given its sales structure being

skewed toward the panels (89% of total in 2011F, a sector-high), 2) strong sales

growth in 2011F (+342% YoY) and 2012F (+83% YoY) on its HDP etcher sales to

SMD’s 5.5G production line, and 3) further orders backlog growth with the adoption

of the oxide-TFT method for 8G AMOLED. Our price target implies 40% upside.

August 12, 2011 / W69,000 won / Mkt cap: USD539.8mn, KRW539.8bn

Yr to

Sales

OP

EBT

NP

Matthew Yang

Dec

(W bn)

(W bn)

(W bn)

(W bn)

(won)

EPS % chg.

(YoY)

EBITDA

(W bn)

P/E EV/EBITDA

(x)

(x)

PBR

(x)

ROE

(%)

82-2-3276-6174

2009A

8

(0)

(1)

(1)

(178)

0.0

1

0.0

12.0

0.0

(11.7)

matthew.yang@truefriend.com

2010A

35

4

3

3

504

0.0

6

0.0

1.5

0.0

29.6

Jay Yoo, CFA

2011F

157

37

36

28

3,668

627.8

40

19.1

13.1

5.9

54.9

82-2-3276-6178

jongwoo.yoo@truefriend.com

2012F

286

68

66

50

6,526

77.9

70

10.7

7.5

3.8

43.0

2013F

344

72

71

54

6,938

6.3

74