Competition Overview The McIntire Investment Institute (MII) invites

Competition Overview

The McIntire Investment Institute (MII) invites all

UVA undergraduate students to participate in the 2010

MII Undergraduate Stock Pitch Competition. The contest will consist of two separate sub-competitions, one for 1st and 2nd-year students and the other for 3rd and 4th-year students.

For specifics on the upperclassmen competition, please see the following three pages. For specifics on the underclassmen competition, please see this document’s final three pages. Feel free to contact Ryan Comisky at rjc6k@virginia.edu with any questions.

1

Upperclassmen Competition Prizes

The first place winner/s will be invited to a lunch with Bill Richards in a private dining room at the Four Seasons in New York City. Mr. Richards is the Senior Client

Relationship Manager for Hedge Funds at UBS Investment Bank. He has graciously offered to also invite several prominent hedge fund managers to the lunch.

Runner-up: $400

Third Place: $200

Upperclassmen Competition Process

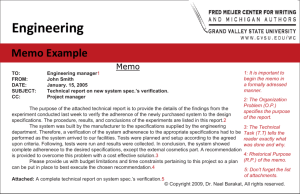

1.

Participants—either individually or in teams of two—will develop a value investing idea and submit a memo (description on the following page) in support of this idea. The investment idea may be a long or a short of a company with a market cap in excess of

$750 million. The investment should have a return potential of 50% to 100% over the next one to five years. Support for the investment idea should be based on fundamental analysis (not technical analysis). Judges will focus on the quality of the idea, research, and presentation. a.

Memo Submission Deadline: Thursday, Oct. 21 at 11:59 p.m.

E-mail a copy to

Ryan Comisky at rjc6k@virginia.edu.

2.

Faculty judges will review the memo submissions and select up to eight investment ideas to proceed to the final round. Final round participants will be notified no later than

Monday, Oct. 25 at 5:00 p.m.

3.

The final round will be conducted on Thursday, Oct. 28 in RBT 221 from 2:00 p.m. –

4:00 p.m. (immediately before the Value Investing Conference). Each participating individual or team will deliver a seven-minute PowerPoint presentation, followed by four minutes of Q&A from the panel of judges. These judges will announce the first, second, and third place finishers after a brief conclave.

2

Guidelines for Upperclassmen Memo and Evaluation

Memo (Template on following page)

3 pages maximum (2 page memo max + 1 page optional appendix)

Please strictly adhere to the template below

Appendix examples include: o Additional numerical support (ROIC, unit economics, cost structure, DCF, Sum of Parts, etc.) o Visual (company product vs. competitors) o Probability tree of outcomes (convey risk/reward) o Industry value chain, cost structure o Value Added Research log (comments from key conversations) o Other creative options

Guidelines for Evaluation

Research Quality/Depth o Understanding of company, industry, competitive advantages (or lack thereof), management, secular drivers o Quality (creativity, depth, breadth) of value added research

Conversations with key individuals that will help you to understand the opportunity

Memo/Idea o Attractiveness of opportunity (risk/reward, variant perception), must fit within 1-5 year time horizon

Think about risk/return as how much you can make in your upside vs. how much you can lose in your downside scenario (and the probabilities of each). It is important to quantify your research to understand the size of your variant perception and whether the potential return justifies the risk. o Strong understanding and conveyance of key points / drivers (and supportive research) o Simple and effective pitch

Financial analysis o Accurate financial model/valuation

Consider multiple of EBITDA or FCF/EPS, DCF, Sum of Parts, etc. o Strong understanding of key valuation drivers

Presentation o Strength of verbal pitch, how well you ―tell the story‖ o Ability to handle Q&A (often results from anticipating questions) o Creativity

3

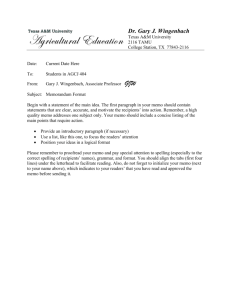

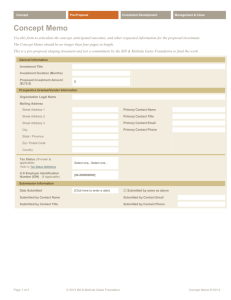

Company Name (Ticker)

Date :

Share Price (date)

Diluted Shares Outstanding (mm)

Market Capitalization ($US mm)

Total Cash ($ US mm)

Total Debt ($ US mm)

Minorities / Preferred

Enterprise Value ($US mm)

52 Week Range ($US)

% of 52-Week High

Avg Daily Value (3 months) as a % of Market Cap

Thesis / Key Points

X (brief sentence)

Analysts :

52

523

22

309

10

820

2.62 - 10.83

93%

567,346

0.11%

Revenue ($US mm) y/y growth

EBITDA

Margin y/y growth

EPS y/y growth

FCF y/y growth

EV / EBITDA

P / E

FCF Yield

2007 2008 2009E 2010E 2011E 2012E

2,138 1927.8 1877.6 1836.1 1817.7 1826.6

-5% -10% -3% -2% -1% 0%

(17)

-1%

(20)

-1%

12

1%

(11)

-1%

(38)

-2%

(45)

-2%

113% 18% 160% -192% -245% -18%

(0.79) (0.58) (0.16) (0.48) (0.82) (0.90)

-93% 27% 72% -198% -72% -9%

7

-94%

(77)

-

(55)

1200% -29%

(87)

58%

(112)

29%

(112)

0%

68.4x

N/A

5.6%

-74.6x

N/A

5.6%

-21.6x

N/A

5.6%

-18.2x

N/A

5.6%

Misperception

Most Compelling VAR Points

How It Plays Out

Risks / What Signs Would Indicate We Are Wrong?

X (Brief sentence)

Signposts / Follow-Up

X (what to look for going forward, short phrases fine)

Company Description

[Ticker] is . . .

Underclassmen Competition Prizes

First Place: $800

Runner-up: $400

Underclassmen Competition Process

1.

Groups of three or four underclassmen will develop a value investing idea and submit a one-page memo (description on following page) in support of this idea. The investment idea may be a long or a short of a company with a market cap in excess of $750 million.

The investment should have a return potential of 50% to 100% over the next one to five years. Support for the investment idea should be based on fundamental analysis (not technical analysis). Judges will focus on the quality of the idea, research, and presentation. a.

Memo Submission Deadline: Saturday, Oct. 30 at 11:59 a.m.

E-mail a copy to

Ryan Comisky at rjc6k@virginia.edu.

2.

Faculty judges will select up to five teams to proceed to the final round based on the memo submissions. Final round participants will be notified no later than Tuesday, Nov.

2 at 5:00 p.m.

3.

Final round teams will be e-mailed a list of six publicly-traded companies on the morning of Friday, Nov. 5. Each team will have precisely five hours to identify the most attractive long or short investment among these stocks, to research that company, to develop thesis points buttressing the investment idea, and to fill in a relatively simple PowerPoint template. Rouss/Robertson group study rooms will be provided to facilitate the teamwork. Teammates are free to come and go as their schedules permit during this fivehour period.

4.

The final round will be conducted from 4:00 p.m. – 6:00 p.m. on Nov. 4 th

in Rouss 410.

Each team will deliver a seven-minute PowerPoint presentation, followed by four minutes of Q&A from the panel of judges. These judges will announce a winner and a runner-up after a brief conclave.

1

Guidelines for Underclassmen Memo and Evaluation

Memo (Template on following page)

1 page maximum

Please strictly adhere to the template below

Guidelines for Evaluation

Research Quality/Depth o Understanding of company, industry, competitive advantages (or lack thereof), management, secular drivers o Creativity, depth, and breadth of research

First Round Memo/Final Round Idea o Attractiveness of opportunity (risk/reward, variant perception), must fit within 1-5 year time horizon

Think about risk/return as how much you can make in your upside vs. how much you can lose in your downside scenario (and the probabilities of each) o Strong understanding and conveyance of key points/drivers (and supportive research) o Succinct, readable presentation (no fluff or verbiage)

Final Round Presentation o Strength of verbal pitch, how well you “tell the story” o Ability to handle Q&A (often results from anticipating questions) o Creativity

2

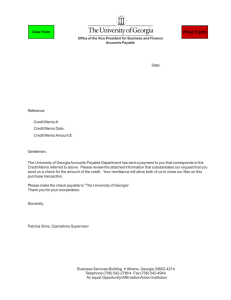

Company Name (Stock Exchange: Ticker Symbol)

Analyst: Your Name E-mail Address: Date:

Date

Business Description

Blah blah blah

Thesis Points

Blah blah blah

Risks/What Signs Would Indicate We Are Wrong?

Blah blah blah

Important Data Points and Trends to Monitor as We Re-Evaluate the Thesis

Blah blah blah

Page 1 of 1 <Insert Company Name> Memo