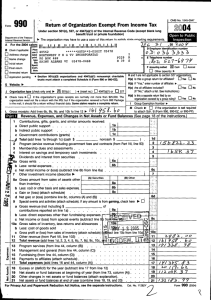

99f~ Return of Organization Exempt From

advertisement

, 99f~

i ~

Return of Organization Exempt From Income Tax

'

Under section 601(c), 527, a 4947(a)(1) of the Internal Revenue Code (except black lung

Interned R^b""° Service

W

A For the 2002 calendar y ear.

B Check d applicable

PU~

F jAddreas change

Name cha nge

an

SpKft

c~

cy) O Final return

0

- IRS

1"

~ or

~

print

D initial return

Application pending

The organization may have M use a copy of this return to satisfy staff reporting requirements

tax year beginnin g

C Name of organ'aUon

DUNSEITH COMMUNITY BETTERMENT CLUB

°r

M^^~ °b ~ (a P O Em M r~ull h not dell weE b meat address

p0 BOX 238

City a twvn

State or camtry

DUNSEITH

ZIP " 4

ssaze

ND

t

ORGANIZATION TYPE (croctonpone)III

cnscJc hens

P. E] if the org.[.twn~

apantratbn need not Ills a return with the I

mall, M should file a return wilhoul financial

sir

m receipts are normally ml more than $25.0W The

tart U the ppanmatlan received a Form ON Paclops In the

SOME STATES REQUIRE ACOMPLETE RETURN

111.

H(e)

bt~hapmupreWmbralRllabsl

!yD)

M'Yee; errtm number d efllllalas

N(c)

Are dl effiIMw Included?

X(E)

h this a ssparab reNm filed by en

M

18

19

20

Excess or (defiat) for the year (subtract line 17 from line 12)

Net asset or fund balances at beginning of year (from tine 73, column (A))

Other changes m net assets or fund balances (attach explanation)

For Paperwork Reduction Act Notice. am the separate Instructions.

imtbn

Yes E No

Check W UH the organization Is NOT required

b etch Seh B (Form 990. 980

.Q . w 990-PF)

Program services (from tine 44, column (B))

Management and general (from 6ne 44, column (C))

Fundratsing (from tine 44, column (D))

Payments to affiliates (attach schedule)

a

Yes ~ NO

D Yes ~ No

covered M e pinup Willis?

13

14

15

18

9

b

c

d

L-J

m moo: mmdh a [W See Instructions)

b

c

10 a

b

c

1'1

a

b

c

d

2

3

4

5

8a

b

c

7

8a

O8

(Krp

I D Other c.pecitn .

and Changes in Net Assets or Fund Balances (Seepage 17 of the instructions )

Contributions, gifts, grants, and similar amounts received

A

1a

Direct public support

1b

Indeed public support

Government confibubons (grants)

1c

TOTAL (add lines 1 e through 1 c) (cash i

nonpsh

$

)

Program service revenue including government fees and contracts (from Pert VII, line 93)

Membership dues and assessments

Interest on sarongs and temporary cash investments

Dividends and interest from securroes

Ba

Gross rents

77,68

Less rental

Ms

~~Ep

Bb

83,61

Net rental into a or I

e8bj~ One 6a)

Other mvestrne

come (describe

Gross amount

sa~~{ ~s~s a~

y

A Secunhes

B

~

8a

than inventory r

8b

Less cost or o r

ryes

tan or (lose) (

ch

'

Bc

Net gain or (loss comane tine Bc, columns (A) and (B))

Special event end achwbea (attach schedule)

Gross revenue (not Including

of

$

contributions reported on line Is)

1 9a l

Less direct expenses other than fundraising expenses

9b

NM income or (lose) from special every (subtract fine 9b from line 9a)

Gross sales of inventory, less returns and allowances

7oa

Less cost of goods sold

tOb

Gross profit or (loss) from sales of inventory (attach schedule) (subtract line 10b from line 10a)

Other revenue (from Pert VII, line 103)

1

o g

F IYZOUmInp erowa

Hand I ass nal applicable b saclbn 527000~~~~iii niaibns

- 9ecnon6of(cx3) organizations uWaw7(aM7)raneaemptcherhabla

Wets must attach a completed Schedule A (Form 880 or 880+Z/.

so

JIG Web site:

2

benefit trust a private foundation)

Department d the Treasury

U~

OMB No 154SOD47

7

I

319 ,024

Form 880 (2002)

CI

/

~J

V

.~ end (e) apantrntbm

Statement of

al «penlmtnm must compble column (P) columns (M, (G), and (~ are reqw'ee for aecuon 501(c)(

Functional Expenses and section aen(e)(1) nonmamq charitable trusts do optimal r« anus sae pop si arms Instructions)

Program

DO not include amounts reported on One

~p~ Total

(B)

~~ ~`~°"°a°oral

"""~ (D) Fundrefalnp

services

°"d o°^

8b, 8b, 9b, 10b, w 18 0/ PER /

Grants and allocations (attach schedule)

31 , 021

31021

(cash

$

31,021 noncash $

) 22

23

Specific assistance to individuals (attach schedule)

21

Benefits paid to or for members (attach schedule)

25

Compensation of officers, directors, etc

28

16,732,i

18 732

Other salaries and wages

27

Pension plan contributions

28

Other employee benefits

4 004

29

4 . 0134

Payroll taxes

30

fundraising

fees

Professional

37

Accounting fees

32

Legal fees

33

9 , 987

9 . 987

Supplies

34

784

784

Telephone

57

35

57

Postage and shipping

38

7,

800

7

,

800

Occupancy

37

Equipment rental and maintenance

38

Printing and publications

39

Travel

40

Conferences, conventions, and meetings

41

Interest

457

42

457

Depreciation, depletion, etc (attach schedule)

a

43a

Other expenses not covered above (demlze)

41 504

43b

41 , 504

b SEE STATEMENT

c

43d

d

iiw

e

43f

f

'

22

23

24

25

28

27

28

28

30

31

32

33

34

35

38

37

38

39

40

41

42

43

44

-

TOTAu FurrcnKNOu owv+ses (.ad aw n muwan u) onwN¢Anars

COMMETvicoo1-uhvas(BI-R,CARRY THESE TOTALS roLn+esiais

q,y

112,348

31,021

81,325

JOINT COSTS Check w[-]if you are following SOP 9&2

t E]Yes E:]No

Are any Joint costs hen a combined educa6anal campaign and fundralsinp edr.Aahon reported In (B) Program services?

, (I1) the amount allocated m Program servk:es

E

If 'Yes,' enter (I) the aggregate amount of these joint caste

$

S

III MIB 81IIWf1I2110C8SEd W Mananement and general

and

the amount allocated to FUI1dI8

p

Statement of Program Service Aeeompliehmertls (Seepage 24 of the instructions )

Expenses

What is the organization's primary exempt purpose7l~

RFWnd for 501(c)C3) and

All organizitlons must describe their attempt purpose achievements m a clear end taxies manner Slate the number

(4) orp arid 4947(d)(1)

win, eon opeonm for

a clients served, publications Issued, eEe Discuss achievements that era not measurable (Section 507 (e)(3) end (4)

organizations and 4947(a)(1) nonexempt charitable trusts must also inter the amount of grants and allocations to others )

a THE CHARITABLE EXEMPT PURPOSE OF THE ORGANIZATION IS ACHIEVED BY PROVIDING FUNDING

A WIDE VARIETY OF PROGRAMS THROUGHOUT THE COMMUNITY INCLUDING DONATIONS TO

VARIOUS YOUTH ORGANIZATIONS . SENIOR CITIZENS AND PEOPLE OF LOW INCOME AND OTHER

SERVICE

Form 990 (2002)

Form 890(2002)

DUNSEITH COMMUNITY BETTERMENT C45-0348714

Page 3

Balance Sheet (See page 24 of the instructions )

Note :

Where required, attached schedules end amounts within the description

column should be for end-of-year amounts only

45

48

40 , 632

61 , 094

Cash - non-interest-bearing

Sarongs and temporary cash investments

47 a Accounts receivable

b Less allowance for doubtful accounts

47a

47b

m

p

52

53

54

55

58

57

58

Pledges receivable

48a

Less allowance for doubtful accounts

48b

Grants receivable

Recervables from officers, directors, trustees, and key employees

(attach schedule)

a Other notes and loans receivable (attach

57a

schedule)

57b

b Less allowance for doubtful accounts

Inventories for sale or use

Prepaid expenses and deferred charges

" C]Cost

E]FMV

Investments -securities (attech schedule)

a Investments-land, buildings, end

equipment basis

55a

493 , 981

b Less accumulated depreciation (attach

schedule)

55b

122 , 453

Investments - other (attach schedule)

57a

a Land, buildings, and equipment basis

b Less accumulated deprecation (attach

schedule)

57b

)

Other assets (describe "

TOTAL ASSETS add lines 45 throug h 58 must equal line 74

Accounts payable and accrued expenses

Grants payable

Deferred revenue

Loans from officers, directors, trustees, and key employees (attach

schedule)

64 a Tax-exempt bond liabilities (attach schedule)

b Mortgages and other notes payable (attach schedule)

85

Other liabilities (describe "

50

7 , 500

1*

~t

51c

52

53

54

389 .425 55e

56

7 , 500

371 , 528

57c

58

498 . 651

59

80

81

82

83

84a

178 , 569 84b

85

)

TOTAL LIABILITIES add lines 80 throu g h 85

Organizations that follow SFAS 117, check here "

and complete lines

87 through 89 and lines 73 and 74

67

Unrestricted

88

Temporarily restricted

89

Permanently restricted

Organizations that do not follow SFAS 117, check her" XOand

complete lines 70 through 74

70

Capital stock, trust principal . or current funds

77

Paid-in or capital surplus, or land, budding, end equipment fund

72

Retained earnings, endowment, accumulated income, or other funds

73

TOTAL NET ASSETS OR FUND BALANCES (add lines 67 through 69 OR

lines 70 through 72,

column (A) MUST equal line 19, column (B) MUST equal line 21)

44 , 144

62 , 858

48c

49

59

80

81

82

83

88

45

48

47c

48 a

b

49

50

51

(g)

End a year

(A)

Beginning of year

178.569

88

486 , 030

4 , 142

162 . 864

167.006

67

88

89

70

71

72

319 , 02i

320,0823

319,024

320 .082

I

L

Forth 980 is available for public inspection end, for some people, serves as the primary or sole source of information about a

particular organization How the public perceives en organization in such cases may be determined by the information presented

on its return Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's

programs and accomplishments

Reconciliation of Revenue per Audited

Financial Statements with Revenue per

e

Total revenue, gains, and other support

per audaed financial statements

"

Amounts included on line a but not

b

on line 12, Form 890

(1) Net unrealized gains

on investments

$

(2) Donated services and

use of facilities

(3) Recoveries of prior

year grants

(4) Other (specify)

a

a

NA

/

b

~

(1)

(2)

$

/

(3)

i

S

Add amounts an lbws (1) through (4)

c

d

Reconciliation of Expenses per Audited

Financial Statements with Expenses per

Line a minus line b

Amounts included on line 12,

Form 990 but not on line a

(1) Investment expenses

not included on line

6b, Forth 990

(2) Other (specify)

(4)

"

b

"

c

Total expenses and losses per

audited financial statements

Amounts included on line a but not

on line 17, Forth 990

Donated sernces

and use of facilities

Prior year adjustments

reported on line 20,

Forth 990

$

Losses reported on

line 20, Form 990

$

Other (specify)

~

,(/,((~(/

S

Add amounts on [fries (1) through (4)

c

Lane a minus line b

/

d

Amounts included on line 17,

Forth 990 but not on line a

(1) Investment expenses

not included on line

Bb, Forth 980

$

,,~

(2) Other (specify)

1111.

Add amounts on lines (1) and (2)

Add amounts on lines (1) and (2)

" d

" d

a

Total

per

line

17,

Form

e

Total revenue per line 12, Form 990

expenses

990

line c plus line d

" e

line c plus line d

" e

and

Key

each

one

even

if

not

compensated,

see

'art. r=

List of Officers, Directors, Trustees,

Employees (List

pace 26 of the instructions )

(A) Name and address

ND

average

hours per I

I (B) TIUe

~end

~~

~ ~~

(C) Compensatbn I

(D) Contributions W

I

(E) Expense

pF NOT PAID,

employee benefit plans 8

account and other

ENTER ~ )

deferred compensation

allowances

PRESIDENT

ND

7$

Did any officer, director, trustee, or key employee receive aggregate compensation of mae than 5100,00D from your organization

and all related organizations, of which more than $10,000 was provided by the related organizations?

yes

lr-ves : attach schedule-see page 2e a u, . Instructions

NO

porn 990 (20p2)

Other Information

78

77

CLUB

(Seepage 27 of the instructions )

Yes

DM LM organization erpape In any ectlvXy not previously 'sported W the IRS? 7 Yse ; attach a Aeroibd dncAptlon U each Both*

Were any changes made in the organizing or governing documents but not reported to the IRS

78

77

If "Yes," attach a conformed copy of the changes

78 a Did the organtratbn have u nrelated badness prose income of $1,000 a more during the year wveled by this return?

78a

79

Was there a liquidation . dissolution, termination, a substantial contraction during the year? If 'Yes." attach a statement

80 a Is the organization related (ether than by association with a statewide a natlomNds organization) through common

membership . 8ovemlnp bodies, trus0eesaMcere, e0e , W any other exempt a none xempt argentratbn9

b If Was,' enter the name of the organ¢etior~-

79

b If "Yes," has d filed a tax return on FORM 890-T for this year

78b

end check whether it Is

Uexempt OR

nonexempt

81 a Enter direct or indirect political expenditures See line 81 instructions

81a

b Did the organization file FORM 112aPOL for this year?

82 a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge

or at substantially less than fair rental value?

b If "Yes," you may indicate the value of these items here Do not include this amount

as revenue m Part I or as an expense in Pert II (See instructions in Part III )

1 8211;

83 a Did the organiza4on comply with the public inspection requirements for returns and exemption applications?

b Did the organization comply with the disclosure requirements relating to quid pro quo contributions?

84 a Did the organization solicit any contributions or gifts that were not tax deductible?

b If 'Yes," did the organization include with every solicitation an express statement that such contributions

or gifts were not tax deductible?

85

501(c)(4), (5), or (8) orgen¢ations a Were substantially all dues nondeductible by members?

b Did the organization make only in-house lobbying expenditures of $2,000 or less?

If "Yes" was answered to either 85a or 85b, DO NOT complete BSc through 85h below unless

o

the

organization received a waiver for proxy tax owed for the prior year

c Dues, assessments, end similar amounts from members

85e

d Section 182(e) lobbying and political expenditures

Aggregate nondeductible amount of section 8033(e)(1)(A) dues notices

85e

f Taxable amount of lobbying and political expenditures (line B5d less BSe)

85f

g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f1

h If section 8033(ex1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to

it reasonable estimate of dues allocable to nondeductible lobbying end polRical expenditures for the

following tax year?

88

501(c)(7) orgs Enter

a Initiation foes and capital contnbutions included on line 12

18681

b Gross receipts, inducted on line 12, for public use of club facilities

88b

87

501(c)(12) orgs Enter a Gross income horn members or shareholders

87a

b Gross income from other sources (Do not net amounts due or paid to other

sources against amounts due or received horn them )

87b

88

At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or

partnership, or an entity disregarded as separate from the organization under Regulations sections

301 7701-2 and 301 77017 If 'Yes," complete Part IX

89 a 501(c)(3) organizations Enter Amount of tax imposed on the organization during the year under

section 4911 "

, section 4812 "

, section 4955

b 501(c)(3) and 501(c)(4) orgs Did the organization engage in any section 4958 excess benefit transaction

dunng the year or did R become aware of an excess benefit transaction from a pnor year? If "Yes," attach

a statement explaining each transaction

c Enter Amount of tax imposed on the organization managers or disqualified persons during the year under

sections 4912, 4855, and 4958

d Enter Amount of tax on line 89c, above, reimbursed by the organization

"1 92

X

X

FAI

X

X

gyp

X

83E

83!

841

gqt

858

get

a

BSh

Section 4947(a)(1) nonexempt chantsble trusts filing Forth 990 m lieu of FORM 1041 - Check here

and enter the amount of tax-exempt interest received or accrued dunn9 the tax year

X

X

80a

80 a List the states with which a copy of this return is flied " NONE

b Number of employees employed in the pay period that includes March 12, 2002 (See instructions )

I 90b

91

The books are in care of " KIM BOGUSLAWSKI

Telephone no " 701 244-5491

Located at " DUNSEITH, ND

ZIP + 4

92

No

Form 990

X

Analysis of Income-Produclng Activities (Seer

Unrelated Ix

Note' inter gross amounts unless otherwise

(A)

indicated

Business code

93

Program service revenue

a GAMING

b

e

d

e

1 MedscareNtedicaid payments

g Fees and contracts from OovernmmM apendes

94

Membership dues and assessments

95

himnao~ ...+w" .~ae .~w .+~vmne

96

Dividends mid Into

from securities

97

Net rental Income or (loss) from real estate

531110

a debt-financed property

b riot debt-financed property

88

rot Mw i~ a ro.U ft. ~i cmosnr

99

Other Investment income

531310

100

Gal . ap,o) ,ms,a n 9m,b s,m,r

101

Net income « (loss) from special events

453220

102

Gross profit a (it=) from miss of i nventory

a

103

Other revenue

31 of the instructions

(B)

Amount

I

8

section

(C)

Excluslan code

513,x514

Amount

(D)

(E)

Related or exempt

function income

b

c

d

e

104

Subtotal (add columns (B) . (D), and (E))

105

TOTAL (add line 104, columns (B), (D), and (E))

Note : Line 105 plus line 1 d, Part l, should equal the amount on firm

Relationship of Activities to the Accomplishment of Exempt Purposes (See page 32 of the instructions )

LLro No

E~laln how each ecWlty, far which inoane to reported M column (E) of Part VII contributed Importantly to the accorriplishment

01 the aaanlraUOn's exempt purposes (olMr than by providing funds for such purposes)

Information Regarding Taxable Subsidiaries and Dian

wi

Name, address, and EIN of corporation,

partnership, w disregarded mitHY

Information Reg

Lei

Percentage Of

ownership i

d Entitles (Seepage 32 of the instructions )

(C)

Nature of activities

(D)

Total Income

Transfers Associated vnth Personal Benefit Contacts (See page 33 of the instructions

(a) Did the organization, during the year, too" em funds, directly or Indirectly, to pay premiums on a personal benefit contract?

(b) Did the organization, during the year, pay premiums, directly or i

Vote: h' Yes' to (b) file Form 8870 AND Form 4720 (see ins

Under penalties d perjury, I Eeclere that I have mmmined

.ad caoD~ela. DeeFa'atlon dthi. 10

and LdfftN Is true . cured

Please

Sign

Here

SpM

' Tw`P ~

1;

Pant

,q awro

Preperers I----Use Only ~ gyp,

(E)

End-of-year

assets

SCHEDULER

(Fotm 9Q0 or 990-EZ)

o"~man»r~un

hftroi aewnue seines

Name of the organization

Organization Exempt Under Section 501(c)(3)

(Except Private Foundation) and Section 501(e), 507(f), 501(k),

o,,8 No ,

501(n), or Section 4947(a)(1) Nonexempt Charitable Trust

Supplementary Information -(See separate instructions .)

200

MUST be completed by the above organizations and attached to their Form 890 w 990-EZ

-

DUNSEITH COMMUNITY BETTERMENT CLUB

2

Employer iaenNecauon number

4x0348714

Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees

(See page 1 of the instructions List each one If there are none, enter "None ")

(a) Name and address of each

employee pant more than $50,000

(b) Title and everape

hour per week

deviled to positbn

(d) Contributions W

(c) Compensation

employee benefit plans 8

deterred compensation

(e) Expense account

and other

allowances

number of other employees paid

Compensation of the Five Highest Paid Independent Contractors for Professional Services

(See page 2 of the instructions List each one (whether individuals or firms) If there are none, enter "None ")

(a) Name and address of each Independent contractor paid mom than $50,000

(b) Type of service

(o) Compensation

Total number of others receiving over

(FrrA)

For Paperwork Reduction Ad Notice, seethe Instructions for Form 990 end Form B80fZ.

Schedule A (Form 090 or 880-EZ) 2002

Schedule A Forth 890ar990

.E2 2002

DUNSEITH COMMUNITY BETTERMENT CLUB

Statements About Activities

45-0348714

p as 2

(See page 2 of the instructions )

During the year, has the organization attempted to influence national, state, or local legislation, including any

attempt to influence public opinion on a legislative matter or referendum? If "Yes," enter the total expenses paid

or Incurred in connection with the lobbying activities

$

(Must equal amounts on line 38,

Part VI-l, or line i of Part VI-B )

Organizations that made an election under section 501(h) by filing Form 5788 must complete Part VI-A Other

organizations checking "Yes.' must complete Part VI-B AND attach a statement giving a detailed description of

the lobbying activities

2

During the year, has the organization, either directly or indirectly, engaged in any of the following acts with any

substantial contributors, trustees, directors, officers, creators, key employees, or members of their families, or

with any taxable organization with which any such person is affiliated as an officer, director, trustee, majority

owner, or principal beneficiary? (K the answer to any question s "Yes," attach a detailed statement explaining the

transactions

a Sale, exchange, or leasing of property!

Yes

No

T ~

X

7

b Lending of money or other extension of credit?

2a

2b

c Furnishing of goods, services, or facilities?

I 2c I

X

I

X

d Payment of compensation (or payment or reimbursement of expenses d more than $1,000)9

2d

X

e Transfer of any part of its income or assets?

2e

X

3

4

X

X

3

Does the organization make grand for scholarships, fellowships, student loans, etc 7 (See NOTE below )

4

Do you have a section 403(b) annuity plan for your employees?

Note: Attach a statement to explain how the organization determines that individuals or organizations receiving grants

or loans hom d m furtherance of its charitable programs 'qualify' to receive payments

Reason for Non-Private Foundation Status

(See pages 3 through 5 of the instructions )

The or an¢ahon is not a private foundation because it is (Please check only ONE applicable box)

5

]A church, convention of churches, or association of churches Section 170(bx1)(A)(p

8

7

8

9

F ]A school Section 170(b)(1)(A)(n) (Also complete Part V )

DA hospital or e cooperative hospital saints organization Section 170(b)(1)(A)(ni)

RA Federal, state, or local government or governmental unR Section 170(bu1)(A)(v)

F-1A medical research organization operated in conjunction with a hospital Section 170(b)(1)(A)(m) ENTER THE HOSPITAL'S

NAME, CITY, AND STATE

10 [-]An organization operated for the benefit of a college or unnersdy owned or operated by a governmental unit Section

170(b)(1)(A)(rv) (Also complete we SUPPORT SCHEDULE m Pert IV-A)

11 a[--] An organization that normally receives a substantial part of it support from a governmental unit or from the general

public Section 170(b)('I)(A)(h) (Also complete the SUPPORT SCHEDULE in Part IV-A)

11 b DA community trust Section 170(b)(1)(A)(w) (Also complete the SUPPORT SCHEDULE m Part IV-A)

12

13

ZM organization that normally receives (7) MORE THAN 33 7/396 of ft support from eaAribuhons, menbnship fees, end prose recapb from

activities related to Its charitable, etc , functions -subbed to certain mxeptbm, end (2) NO MORE THAN 331/3% W Ns support horn gross

Investment Income and unrelated buslnasa taxable Income (less section 571 fix) horn businesses acquired by the organization after June 30,

1975 See section 509(a)(2) (Also complete the SUPPORT SCHEDULE In Pert IV-A )

DAn organization that is not controlled by any disqualfied persons (other than foundation managers) and supports

organ¢eGons deathbed in (1) fines 5 through 12 above, or (2) section 501(c)(4), (5), or (8), d they meet the test of section

(a) Name(s) of supported organization(s)

14

(b) Line number

from above

UAn organization organized end operated W test far public safety Section 509(a)(4) (See page 5 of the instructions )

Schedule A (Forth 990 or 880£2) 2002

~o-vatio~Y

rage

UUrvati i n L.UmmUm i r OM i i CrtmCn i ~wo

arm 990 a 890

.EZ) 2002

Support Schedule (Complete only A you checked a box online 10, 11, or 12 ) USE CASH METHOD OF ACCOUNTING

NOEe : You may use the worksheet m the insduclions for converting from the accrual to the cash method

Gifts, grams, and contributions received (Do

Gross receipts from admissions, merchandise

sold or services performed, or furnishing of

fealnles In any eUlvlly that Is related to the

18

Groan Income from Interest, dividends,

amounts received from payments on securities

bans (section 572(a)(5)), rents, royalties, and

unrelated business taxable income (less

section 517 taxes) from businesses acquired

19

Net Income from unrelated business

Tax revenues levied for the organization's

benefit and either paid to d w offended on

21

me value of services a facilities famished w

the organization try a governmental unit

without charge Do not include the value of

services or facilities generally furnished to the

22

Other Income Attach a schedule Do riot

ORGANIZATIONS DESCRIBED ON LINES 10 OR 11 a Enter 2% 01 amount In cdumn (e), Ime 24

b Prepare a list far your recalls to show the name of and amount contributed by each person loth" than a governmental

unit or publicly supported organization) whose total gifts for 1998 through 2001 exceeded the amount sham In line 26a

DO NOT FILE THIS LIST WITH YOUR RETURN Enter the Mtal a( ail these mess amounts

c Total support for section 509(P)(1) M& Enter line 24, column (a)

19

d Add Amounts from column (a) for lines

is

26b

22

e Public support (fine 26e minus line 2Bd flog

ORGANIZATIONS DESCRIBED ON LINE 12 a For amounts Included in lines 15, 78, and 77 that were received from a"disqualified

pawn," prepare s IM for your records b show the name of, end total amounts received In each year from, each 'disqualified person

DO NOT FILE THIS LIST WITH YOUR RETURN Enter we sum of each amounts for each year

(2000)

(1998)

(2001)

(19M)

b For any amount included In line 17 Nat was received from each person (other than "disqualified persons'), prepare a list for your records to

show the name of, end amount received for each yew . that was more than the LARGER of (1) the amount on line 25 (or the year w (2) E5,000

(Irroiude In the list organl¢atlons described In lines S through 11, as well as individuals ) DO NOT FILE THIS LIST WITH YOUR RETURN After

computing the difference between the amount received arid the larger amount dacrlbad In (1) a (2), enter the sum of these differences (the

excess amounts) for each year

(2000

(2000)

(1999)

(1998)

75

16

C Add Amounts from column (e) for lines

27c

2 , 436 , 544

21

77

2 , 436,544 20

27d

27b

total

d Add LJne 27a trial

and line

27e

24 38 544

e Public support pine 27c total minus line 27d total)

27f

2 , 45

2290

Trial support for section 509(a)(2) test Enter amount from line 23, column (e)

~

27

99 36%

9 PUBLIC SUPPORT PERCENTAGE (LINE 27E (NUMERATOR) DMDED BY LINE Z'7F (DENOMINATOR))

0 84°i6

h INVESTMENT INCOME PERCENTAGE LINE 18 COLUMN E NUMERATOR DIVIDED BY LINE 27F DENOMINATOR 27h

arty

unusual

grants

during

1998

through

2001,

prepare

a

28

UNUSUAL GRANTS For an organization described In line 10, 71, a 12 that received

list for your racade to show, for each year, the name o1 the contributor, the date and amount of the grant, and a brief description of to

nature of the grant DO NOT FILE THIS LIST WITH YOUR RETURN Do not include these arents in line 15

Schedule A (Form 990 or BOO-EZ) 2002

ROOM

29

30

31

32

Private School Questionnaire (Seepage 7 of the instructions )

(To be completed ONLY by schools that checked the box on line 6 in Part IV)

Does the organization have a racially nondiscriminatory policy toward students by statement in its

charter, bylaws, other governing instrument, or in a resolution of its governing body?

Does the organization include a statement of its racially nondiscriminatory policy toward students m all

its brochures, catalogues, and other written communications with the public dealing with student

admissions, programs, and scholarships?

Has the organization publicized its racially nondiscriminatory policy through newspaper or broadest

media during the period of solicitation for students, or during the registration period if it has no solicitation

program, in a way that makes the policy known to all parts of the general community it serves?

If "Yes," please describe. if "No," please explain (If you need more space, attach e separate statement )

Does the organization maintain the following

a Records indicating the racial composition of the student body, faculty, end administrative staff?

b Records documenting that scholarships and other financial assistance ere awarded on a racially

nondiscriminatory basis?

c Copies of all catalogues, brochures, announcements, and abler written communications to the public

dealing with student admissions, programs, and scholarships?

d Copies of all material used by the organization or on its behalf to solicit contributions?

If you answered 'No' W airy of the above, please explain (If you raced more space, attach a separate staberrent

33

Does the organization discriminate by race in any way with respect to

a Students' rights or privileges?

b Admissions policies?

c Employment of faculty or administrative staff?

d Scholarships or other financial assistance?

a Educational policies?

f Use of facilities?

g Athletic programs?

h Other extracurricular activities?

If you arrwered'Yes' to any M the above, please epWln (if you need more span, attach a separate statement

34 a Does the organization receive any financial aid or assistance horn a governmental agency?

b Has the organization's right to such aid ever been revoked or suspended?

H you answered "Yes" to either 34a or b, please explain using en attached statement

35

Does the organization certify that it has complied with the applicable requirements of sections 4 01 through

4 OS of Rev Proc 7550 . 1975-2 C B 587. covering racial nondiscrimination? If "No," attach an exolanatioi

Schedule A (Forth 990 or 990 .EZ) 2002

Lobbying Expenditures by Electing Public Charities (see page 9 of the instructions )

(To be completed ONLY by an eligible organization that filed Form 5788)

"

Check

a[:]if the organization belongs to en affiliated group Check b[ :]ii you checked "a" and "limited control" provisions apply

Limits; on Lobbying Expenditures

Affiliated group

totals

term "expenditures' means amounts paid a Intuited )

38

37

38

39

40

41

42

43

44

Total lobbying expenditures to influence public opinion (grassroMs lobbying)

Total lobbying expenditures to influence a legislative body (direct lobbying)

Total lobbying expenditures (add lines 38 and 37)

Other exempt purpose expenditures

Total exempt purpose expenditures (add lines 38 and 39)

Lobbying nontaxable amount Enter the amount from the following table The lobbying nontaxable amount is If the amount on line 40 Is Not over SSOO,ODO

20% of the amount on line 40

over $5W 000 nun not war $1,000,000

$100,000 qua Is% or the excess over

$175,000 plus 10% of the excess over $511.)0=0,

Over $7,000,000 bid not over $1,500,000

$225,000 plus 5% of the excess over $1,500,000

Over $1,500,000 but not over 517,OOD,OOD

$7,000,000

Over S17,OOO,ODO

Grassroots nontaxable amount (enter 25% of line 41)

Subtract line 42 from line 38 Enter- if line 42 is more than line 38

Subtract line 41 from line 38 Enter-0- if line 47 is more than line 38

To be oompietee

for ALL electing

.. . .._

38

on either Gne 43 or line 44. you must h1e Form

4-Year Averaging Period Under Section 507(h)

(Some organizations that made a section 501(h) election do not have to complete all of the five columns below

Lobbying Expenditures During 4-Year Averaging Period

(d)

999

Calendar year (or

I

(e)

Total

of line

48

Lobbying Activity by Nonelecting Public Charities

(For reporting only by organizations that did not complete Part VI-A) (See page 11 of the instructions )

the year, did the organization attempt to

state or local

any

attempt to influence public opinion on a legislative matter or referendum, through the use of

a Volunteers

b Paid staff or management (Include compensation in expenses reported on lines c through h )

c Media advertisements

d Mailings to members, legislators, or the public

e Publications, or published or broadcast statements

f Grants to other organizations for lobbying purposes

g Direct contact with legislators, their staffs, government officials, or a legislative body

h Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other means

I Total lobbying expenditures (Add hoes c through h )

If "Yes" to any of the above, also attach a statement giving a detailed description of the lobbying activities

Schedule A (Forth 990 or B90-EZ) 2002

51

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

(See pegs 12 of the instructions )

Exempt Organizations

Did the reporting organization directly or indirectly engage m any of the following with any other organization described in section

501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations?

a Transfers from the reporting organization to a nonchantable exempt organization of

Yes No

(1) Cash

Other assets

570(i1) a II

v

b Other transactions

(I) Sales or exchanges of assets with a noncharitable exempt organization

V,

b( i)

(u) Purchases of assets from a noncharttable exempt organization

L~'

b( il )

(III) Rental of facilities, equipment, or other assets

b( ill)

(iv) Reimbursement arrangements

b(Iv)

(v) Loans or loan guarantees

bv

r

(vi) Performance of services or membership or fundraising solicitations

-vi

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees

d If the answer to any of the above is "Yes," complete the following schedule Column (b) should always show the fair market value

of the goods, other assets, or services given by the reporting organization If the organization received less than fair market value

Lineeno

I

Amount

I

Name

(d)

transitions, and sharing arningemente

a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations

described m section 501(c) of the Code (other than section 501(c)(3)) or in section 5277

(a)

Name of oigenIzaUon

[] Yes

~ No

k1

Description of relatimship

Schedule A (Form 990 a 880fZ) 2002

DUNSEITH COMMUNITY BETTERMENT

EIN 45-0348714

FORM 990

LINE 43

GAMING TAXES

LICENSES

COMMISSIONS

ADVERTISING

INSURANCE

REPAIRS

TAXES

UTILITIES

29,833

150

8,387

882

500

1,504

781

1,487

41,504