1 Deriving demand function

advertisement

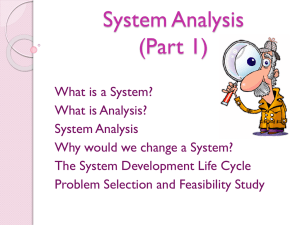

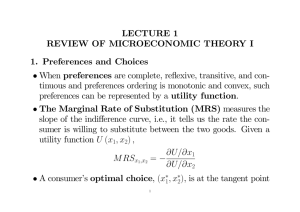

Economics II: Micro Exercise session 2 1 Fall 2009 VŠE Deriving demand function Assume that consumer’s utility function is of Cobb-Douglass form: (1) U (x; y) = x y To solve the consumer’s optimisation problem it is necessary to maximise (1) subject to her budget constraint: px x + py y (2) m To solve the problem Lagrange Theorem will be used to rewrite the constrained optimisation problem into a non-constrained form: max L (x; y; ) = x y + (m px x (3) py y) The …rst order (necessary) conditions will result in: 1 x x y = px (4) = py (5) m = px x + py y (6) y 1 Combining (4) and (5) will result in: (7) py y = px x which, combined with (6) will give: (m (8) px x) = px x and …nally, after some rearrangements becomes: m x= + px (9) This is the demand function for the good x. When the price of the good x; px , is …xed then (9) is the Engel curve for the good x: It is easy to see that this was an example of homothetic preferences: It is enough to check the income elasticity to be equal to unity: "xm = m @x = x @m m / @ m / @m m ( + )p ( + )p 1 = ( + )p ( + )p =1 Re-writing (9) as: px = m x (10) + gives the Inverse Demand function! 1.1 Quasi-linear preferences Remark 1 Quasi-linear utilities have the form u (x1 ; x2 ) = x1 + v (x2 )! Suppose the agent is maximising the following utility function: p U (x; y) = x + y (11) subject to standard budget constraint (2). Assuming that a rational agent will spend all her money on purchasing the goods (more rigorous alternative is to set up Lagrangian function), the optimisation problem will beocome: max y py p y+ y px m px (12) The …rst order (necessary) condition after rearranagements reads: px 2py y= 2 (13) This is the demand function for the good y. It is independent on the income level, i.e. the agent is going to consume exactly the same amount of the good y as long as the prices remain constant. On the other hand the agent is spending all her ‘leftover’money on purchasing good x: From (2) and (13) the demand function is: x= m px px 4py (14) which is of the usual form: x = x (px ; py ; m) : Q: Are x and y substitutes or compliments? 2 2.1 Exercises True/False Claim 1 If the Engel curve for a good is upward sloping, the demand curve for that good must be downward sloping. 2 TRUE: Upward sloping Engel curve Slutsky Normal good (negative income e¤ect ) downward sloping demand curve Claim 2 If the demand function is q = 3m p (m is the income, p is the price), then the absolute value of the price elasticity of demand decreases as price increases. @q q 3m = 1q 3m FALSE: The elasticity is: dp @p = pq 1: Thus has p = q = p2 constant elasticity equal to unity. Note: Any utility function of the form q = Ap" has constant elasticity equal to ": Claim 3 An increase in the price of Gi¤en good makes the consumers better o¤. FALSE: Increase in price of any good makes the consumer poorer and thus worse o¤. (A graphical representation may be helpful!) Claim 4 The demand function q = 1000 10p. If the price goes from 10 to 20, the absolute value of the elasticity of demand increases. TRUE: The elasticity of demand is: " = 1 20 1 1 1 9 ; "p=20 = 10 1000 200 = 4: 4 > 9 10 pq : "p=10 = 10 100010 100 = Claim 5 In case of perfect complements, decrease in price will result in negative total e¤ect equal to the substitution e¤ect. FALSE: In case of perfect compliments there is no substitution e¤ect, and the total e¤ect is equal to the income e¤ect. Claim 6 When all other determinants are held …xed, the demand for a Gi¤en good always falls when income is increased. TRUE: To prove the claim we need to show that Gi¤en good is always an inferior good. We are going to use the version of Slutsky equation that we had in class and ilustrated in Figure 3 (Note: the …gure is illustrative and does not explain Gi¤en good). Thus: x = xs + xm Slutsky x = Xold Xnew total e¤ect s x = Xold Xintm substitution e. xm = Xintm Xnew income e. 3 Figure 3 Xold Xnew Xintm BC(po,mo) BC(pn,mi) BC(pn,mn) Total effect Substitution effect Income effect As we can see, the …gure illustrates a case when the price of the good went down, viz. p = po pn > 0 and we can rewrite the Slutsky equation as xs + p x = p xm p and check for the signs. We know that substition e¤ect is always negative. We also know that for the Gi¤en good the total e¤ect is positive. Thus the income e¤ect should be positive: xm sgn =1 (15) p In order to prove the claim we need to show that sgn xm m = 1 or (same as) xm < 0 m that is the demand falls when income increases. Thus we need to see that sgn [ m] = 1 sgn [ p] 4 (16) From the budget constraint we know that when the price goes down, the agent ‘gets’richer, i.e. p = po pn > 0 =) mn mo > 0 as the shift of the budget constraint is paralel to right. Thus we have m = mo (17) mn < 0 Again from (15) and (17) directly follows (16). Q.E.D. Claim 7 If the goods are substitutes, then an increase in the price of one of them will reduce the demand for the other. False: According to the de…nition! 2.2 Problems Problem 1 Demand functions for beer is given: qb = m 30pb + 20pc where m is the income; pb and pc are the prices of beer and cake, respectively; qb is the demanded quantity. 1. is beer a substitute or compliment for cake? (A: @qb @pc = 20 > 0 =) substitute) 2. assume income is 100, and cake costs 1, what is the demand function? (A: qb = 120 30pb ) 1 30 qb ) 3. write the inverse demand function. (A: pb = 4 4. at what price would 30 beers be bought? (A: pb = 4 1 30 30 = 3) 5. Draw the inverse demand. (Hint: It’s a linear function) 6. Draw the inverse demand when pc = 2: (Hint: It’s parallel to the above, but higher.) Problem 2 Suppose the demand function is q = (p + a) ; a > 0; 1. Find the price elasticity of demand. A: p @q q @p = p q (p + a) 1 = p (p+a) (p + a) 1 = p p+a 2. Find the price level for which the elasticity is equal to -1? A: p p+a = 1:p= a +1 5 < 1: