AP Gov Ch. 19 notes ALL COMPLETE

advertisement

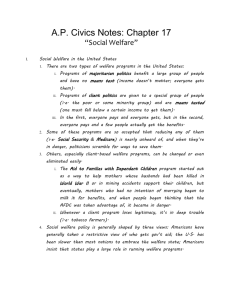

• • While both types of programs occasionally face controversy or opposition, the questions they raise are different. Majoritarian welfare programs are sometimes called “entitlement programs,” a term which highlights the difficulty politicians have in reforming them. The biggest problem facing majoritarian welfare programs is their cost: who will pay, and how much will they pay? Currently, both Medicare and Social Security are in danger of running out of funding as the “baby boom” generation reaches retirement age. • The biggest problem facing client-­‐oriented programs is their legitimacy: questions of who should benefit and how should they be served? If the beneficiaries of client-­‐based programs are not seen as legitimate, the programs may not survive (see “AFDC”). I. There are two main types of social welfare programs in the United States today: majoritarian (Social Security and Medicare, e.g.) and client (Medicaid, Food Stamps, TANF e.g.). • Social Welfare • Social Welfare in the United States Social welfare policy in the US is shaped by four factors that distinguish it from what exists in many other modern democracies: 1. Americans have a more restrictive view of who is entitled to (“deserves”?) government assistance 2. America was slower than other countries to embrace the “welfare state” (welfare state, concept of government in which the state plays a key role in the protection and promotion of the economic and social well being of its citizens. It is based on the principles of equality of opportunity, equitable distribution of wealth, and public responsibility for those unable to avail themselves of the minimal provisions for a good life—Encyclopedia Brittanica on-­‐line) 3. Insistence that the states play a significant role in running social welfare programs—and states often face significant budgetary challenges 4. Nongovernmental organizations (NGOs) play a large role in welfare (i.e., Red Cross, Salvation Army, Catholic Relief Services) • • • • Americans’ perceptions of who is ‘deserving’ of government assistance has changed over time. What has not changed is our distinction between need-­‐ based assistance (which we support) and “fair-­‐share” welfare policy (redistributionist welfare policy—which we oppose). Federalism is a distinguishing feature of the American political system and it plays a major role in America’s social welfare politics. Many states were experimenting with social welfare programs long before the federal government began similar programs during the New Deal. State social welfare programs contributed to the role of states as “laboratories of democracy” but also helped create the intergovernmental lobby. Another distinguishing characteristic of American social welfare policy is the degree to which nongovernmental organizations (NGOs) are involved. The federal government provides grants to large national nonprofits such as Big Brothers Big Sisters of America, the American Red Cross, and Catholic Charities. II. Majoritarian Social Welfare Programs: Social Security and Medicare • Modern entitlement programs to benefit the elderly and the unemployed were created under President Franklin Roosevelt during the 1930s as part of his “New Deal” to respond to the Great Depression. • Overcoming constitutional and ideological concerns, the Roosevelt administration and the Democratic Congress passed the Social Security Act in 1935. • The Social Security Act established an insurance program (“Social Security”) which provides unemployment insurance and retirement pensions, both paid for by workers through payroll deductions. • It also established an assistance program (“Welfare” or “AFDC”) which provided assistance to the disabled and to single mothers with dependent children. • The Social Security Act did not include a medical insurance component, as it was considered too controversial. Over the next several decades, Democrats continued to push for a national health care plan while Republicans (and the AMA) opposed it as “socialized medicine.” • Medicare was finally passed under President Lyndon Johnson in 1964. It not only established a medical assistance plan for retirees but also established Medicaid, providing medical assistance for the poor (those already qualifying for public assistance payments under Social Security). The bill passed with support from a majority of Democrats over the opposition of a majority of Republicans. • A national health insurance program remains elusive, however, and the recent controversies over “Obamacare” demonstrate how divisive the concept remains. III. Reforming Majoritarian Welfare Programs • Both Social Security and Medicare are in trouble. The amount of money being paid into these programs will soon not be enough to fund them at their current levels. This has put politicians in a serious bind: how to save these programs without significantly changing them. • The most obvious fix to Social Security would be some combination of the following: raise the eligibility age; increase Social Security taxes; and freeze Social Security benefits. Each of these has significant political risks, but they are increasingly being considered legitimate subjects for policy debate. • “Privatizing” Social Security, or even some portion of it, by allowing (or requiring) citizens to invest some or all of their Social Security taxes in the stock market was considered a viable reform in the early 2000s but is no longer a legitimate part of the policy debate. • Medicare is in trouble, not only because it costs so much money but also because it is not a very efficient means of delivering health coverage. Medicare encourages frequent doctor visits; allows doctors to overcharge the government (up to a point); and allows the government to determine how much it will pay doctors for most medical procedures. • Discussions continue about ways to reform Medicare, but no consensus has emerged. The recent “Ryan budget” (which passed the House but has no chance in the Senate) proposes replacing Medicare with a voucher system. This has drawn the wrath of many voters, particularly the elderly. President Obama has vowed to preserve Medicare as part of his healthcare reform agenda. Obama on Medicare (3 min.) IV. • • Client Welfare Programs: Aid to Families with Dependent Children Part of the Social Security Act of 1935 was the establishment of a program called Aid to Families with Dependent Children (AFDC). AFDC provided federal aid to states that were already providing this type of assistance. Over time, as is typical, Washington began attaching more and more conditions to how the states could run this program. They also began to create new benefits for those families receiving this assistance, including Food Stamps, the Earned Income Tax Credit, and other programs. • As time went along, public opinion began to turn against the AFDC program (as it cost more, placed more restrictions on the states, and provided increased benefits for recipients that many Americans felt were undeserving). • As the number of families with out-­‐of-­‐wedlock children in the program increased (as opposed to families where the husband had died or left after a divorce), public support for AFDC eroded to the point where, in 1996, the program was abolished (under President Clinton, a Democrat). • The program was replaced by a new block grant program, Temporary Assistance for Needy Families (TANF), which sets strict federal requirements about work and limits how long families may receive benefits. TWO KINDS OF WELFARE POLITICS Majoritarian Politics • Both Social Security (1935) and Medicare (1965) were passed over conservative arguments that they exceeded legitimate (and Constitutional) limits on governmental authority. • Because the benefits of these programs were perceived to exceed their costs, and because enough political elites (in these cases, liberal Democratic members of Congress) believed that they were legitimate, the programs were easily adopted. Client Politics • When AFDC was first enacted in 1935, it was noncontroversial. It was perceived to be a program designed primarily to benefit widows and to help them support their children until adulthood. • • As public perceptions about the beneficiaries of the program changed, however, it grew increasingly unpopular until it was abolished in favor of TANF. Medicare Part D, the prescription drug benefit that passed easily in 2003, has grown increasingly controversial as its costs have become apparent. In future years, if the ‘clients’ of this benefit (retired baby-­‐boomers) are perceived as costing the rest of the public too much (in other words, as costs of the program exceed its benefits), support for this program might disappear as well.