Identity Theft Brochure

advertisement

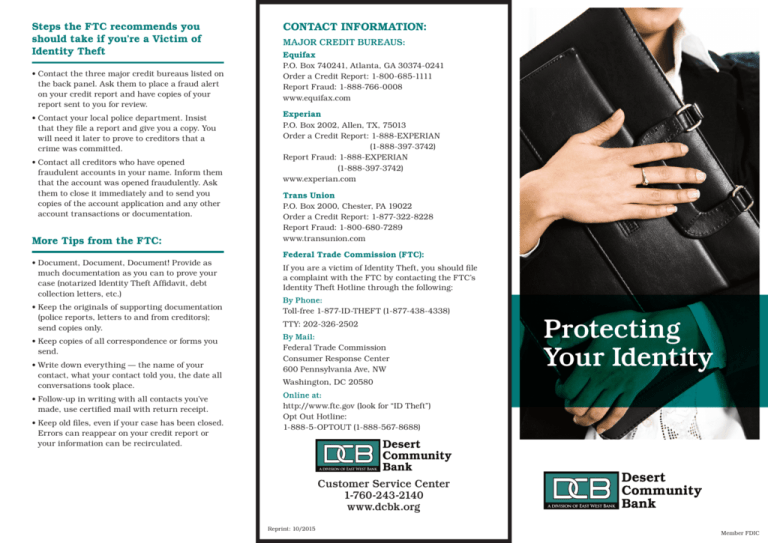

Steps the FTC recommends you should take if you’re a Victim of Identity Theft •C ontact the three major credit bureaus listed on the back panel. Ask them to place a fraud alert on your credit report and have copies of your report sent to you for review. • Contact your local police department. Insist that they file a report and give you a copy. You will need it later to prove to creditors that a crime was committed. • Contact all creditors who have opened fraudulent accounts in your name. Inform them that the account was opened fraudulently. Ask them to close it immediately and to send you copies of the account application and any other account transactions or documentation. More Tips from the FTC: • Document, Document, Document! Provide as much documentation as you can to prove your case (notarized Identity Theft Affidavit, debt collection letters, etc.) • Keep the originals of supporting documentation (police reports, letters to and from creditors); send copies only. • Keep copies of all correspondence or forms you send. • Write down everything — the name of your contact, what your contact told you, the date all conversations took place. • Follow-up in writing with all contacts you’ve made, use certified mail with return receipt. • Keep old files, even if your case has been closed. Errors can reappear on your credit report or your information can be recirculated. CONTACT INFORMATION: MAJOR CREDIT BUREAUS: Equifax P.O. Box 740241, Atlanta, GA 30374-0241 Order a Credit Report: 1-800-685-1111 Report Fraud: 1-888-766-0008 www.equifax.com Experian P.O. Box 2002, Allen, TX, 75013 Order a Credit Report: 1-888-EXPERIAN (1-888-397-3742) Report Fraud: 1-888-EXPERIAN (1-888-397-3742) www.experian.com Trans Union P.O. Box 2000, Chester, PA 19022 Order a Credit Report: 1-877-322-8228 Report Fraud: 1-800-680-7289 www.transunion.com Federal Trade Commission (FTC): If you are a victim of Identity Theft, you should file a complaint with the FTC by contacting the FTC’s Identity Theft Hotline through the following: By Phone: Toll-free 1-877-ID-THEFT (1-877-438-4338) TTY: 202-326-2502 By Mail: Federal Trade Commission Consumer Response Center 600 Pennsylvania Ave, NW Protecting Your Identity Washington, DC 20580 Online at: http://www.ftc.gov (look for “ID Theft”) Opt Out Hotline: 1-888-5-OPTOUT (1-888-567-8688) Customer Service Center 1-760-243-2140 www.dcbk.org Reprint: 10/2015 Member FDIC IDENTITY THEFT IS THE FASTEST GROWING CRIME IN AMERICA. OVER 900,000 NEW VICTIMS ARE AFFECTED EVERY YEAR. HERE IS HOW IT CAN AFFECT YOU: Precautions You can take NOW to Protect your Identity: How an identity thief can obtain your information: What an identity thief can use your information for: • Stealing your wallet, purse, or personal agenda or Cell Phone. • Stealing mail (incoming and outgoing) including credit card and bank statements, bills, new checks, and pre-approved credit offers. • Completing a “change of address” form in your name to divert your mail elsewhere. • Going through your trash bins or bins belonging to businesses. • F raudulently obtaining your credit report by posing as someone who may have a legal right to review it (employer, landlord). • Snooping through your home. • F inding personal information you share online or by hacking into your electronic files. • Sending you scam mail presented as correspondence from legitimate companies or government agencies. • Commit “business record theft” by stealing files belonging to offices you visit as a customer, employee, student, or patient. •T hey call your credit card issuer, pretending to be you, and request a change of address form. After stealing it out of your mailbox and returning it, they run of charges on your account, which will take you awhile to figure it out. •T hey open up new lines of credit in your name, using your date of birth and Social Security Number (SSN). Any delinquent accounts are filed under your SSN on your credit report. •T hey establish phone or wireless service in your name and use it freely. •T hey open a bank account in your name and write bad checks against it. •T hey file bankruptcy under your name to avoid paying debts they’ve incurred under your name or to avoid eviction. •T hey counterfeit checks or debit cards, and drain your bank accounts. •T hey buy cars by taking out auto loans in your name (done easily online). •T hey give your name to police during an arrest; if released from police custody, and this identity thief does not show up for their court date, the warrant for arrest is issued in your name. 1. C all the Opt Out number listed on the reverse side of this brochure to take your name off mailing lists for financial solicitations, including pre-approved credit offers. Things you should NEVER, NEVER Do: 1. N ever share personal information with anyone, including friends and relatives. 2. Never share financial information with anyone over the phone or in person (unless you initiate the call to a reputable company or advisor). 3. N ever carry financial documents, credit cards you don’t use, birth certificates, Social Security Number (SSN) with you unless absolutely necessary. 4. N ever leave your financial information such as credit cards or personal checks in plain view of others. 5. Never place personal, or financial information in your agenda or Cell Phone. 6. N ever imprint your SSN or Driver’s License number on your checks. 7. Never mail checks from or receive bills to your mailbox at home (unless it is a locked box). Use a post office drop box when mailing checks, or sign up for online banking. 2. Study your bills carefully and question any suspicious charges immediately. 3. I f you haven’t already, purchase a shredder. Use it to destroy credit card receipts, bills and any other financial material that could get into the wrong hands. Properly dispose of financial information, including financial solicitations that arrive by mail. 4. S ign your name on the back of your credit cards and debit cards in the blank provided for the Authorized Signature. 5. M emorize your PINs; do not write PINs on the card or carry them in your wallet. Do not share your PINs with anyone. 6. D estroy credit cards you no longer use by cutting the black strip on the back and destroying areas displaying your name, credit card number and expiration date. 7. Periodically check your credit report. Report any discrepancies immediately to the FTC and credit reporting agencies listed on the reverse side of this brochure. 8. W hen reordering checks, pick them up directly from your bank; do not have them mailed to your home. 9. R eport lost or stolen credit cards and checks to the issuer immediately. 10. D o not give out personal information on the phone, through the mail, or the Internet, unless you initiate the contact or are sure you know with whom you are dealing. Best Hometown Bank