Car Sharing: The Motivations of Industry

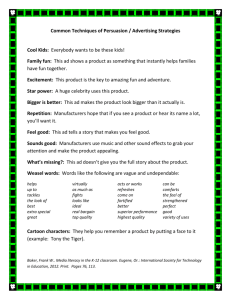

advertisement