Additional Materials

advertisement

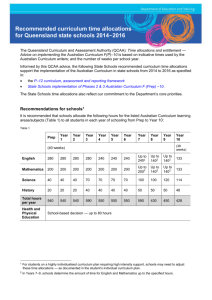

PRICKLIEST PROVISIONS IN A PARTNERSHIP AGREEMENT: ALLOCATIONS APPROACHES TO ALLOCATIONS IN PARTNERSHIP AGREEMENTS AND THEIR IMPLICATIONS Jennifer H. Alexander Deloitte Tax LLP Washington, DC Noel P. Brock West Virginia University Jim Tod KPMG LLP San Francisco, CA Basic Allocation Concepts 2 Overview of Operating Partnership Agreements - Distributive Share Section 704(a) – determined by partnership agreement Section 704(b) – determined in accordance with partner’s interest in a partnership (“PIP”) if: The partnership agreement does not provide partners’ distributive shares, or Allocations in the partnership agreement lack substantial economic effect (“SEE”) 3 Partnership Agreement Provisions Allocations and Distributions o Allocation Driven Upon liquidation, distributions are made to the partners based on their capital account balances Referred to as “allocation driven” because the allocations determine the capital accounts, which ultimately determine the economics Sometimes referred to as “layer cake” allocations because there is often a waterfall – with multiple layers – in the allocation provisions o Distribution Driven Distributions are not based on capital accounts Referred to as “distribution driven” because the allocations do not drive the economics Therefore, partnership items must be allocated in such a way that they track the economics – i.e., the distributions drive the allocations 4 Partnership Agreement Provisions Allocations and Distributions o Examples of Allocation Driven Agreements Safe Harbor Agreements o Agreements satisfying the test for “economic effect” o Agreements satisfying the “alternate test for economic effect” Non-Safe Harbor Agreements That Liquidate by Capital Accounts o Agreements that allocate income and loss on a non-section 704(b) basis – for example, agreements that allocate GAAP income and loss, or both realized and unrealized income and loss, determined on a FMV basis o Examples of Distribution Driven Agreements Targeted allocation agreements Any other agreement that does not provide for liquidation by capital accounts 5 Layered and Targeted Allocations – The Formulae Layered allocations compute ending capital under the following formula: beginning capital + - contributions distributions + - income loss = ending capital Targeted allocations plug income under the following formula: target ending capital - beginning capital + - income contributions distributions = or loss 6 Allocations and Distributions - Pros and Cons Allocation Driven (Safe Harbor) Advantages o Safe harbor, Treas. Reg. § 1.704-1(b)(2) o Fractions rule, § 514(c)(9)(E) o Allocations of nonrecourse deductions, Treas. Reg. § 1.704-2(b)(1) o Allocations of nonrecourse liabilities, Treas. Reg. § 1.752-2(a) Disadvantages o Complex to draft properly o If wrong, interferes with deal economics o Distribution Driven o Advantages o Easier to understand the economic deal o Easier to draft properly Disadvantages o May produce unexpected tax results leaving allocations to accountants to determine with knowledge that they are often wrong o Allocations may be challenged 7 Substantiality & Economic Effect Economic Effect Safe harbor - Treas. Reg. § 1.704-1(b)(2)(ii)(b) Maintenance of capital accounts under Treas. Reg. § 1.704-1(b)(2)(iv) Liquidation of partner’s interest in accordance with positive capital account balances Deficit Restoration Obligation (“DRO”) or Qualified Income Offset (“QIO”) Economic Effect Equivalence Treas. Reg. § 1.704-1(b)(2)(ii)(i) Allocations are deemed to have economic effect if, at the end of each year, a liquidation would produce the same economic effect as if the safe harbor had been satisfied, regardless of the economic performance of the partnership 8 Substantiality & Economic Effect Substantiality Must be a reasonable possibility that the allocation will affect substantially the dollar amounts to be received from the partnership, independent of tax consequences. An allocation is not substantial if: Overall tax effect for any partner is substantially diminished over the life of the partnership There are shifting tax consequences There transitory allocations 9 Partner’s Interest in the Partnership (“PIP”) If allocation fails to satisfy SEE safe harbor, partners’ distributive shares of partnership items determined in accordance with PIP. PIP signifies the manner in which the partners have agreed to share the economic benefit or burden (if any) corresponding to the item being allocated. Reg. § 1.704-1(b)(3). Takes into account all the facts and circumstances relating to the economic arrangement of the partners Factors include: Relative contributions to the partnership Interest in economic profits and losses Interest in cash flow and other non-liquidating distributions Rights of partners to distributions of capital on liquidation 10 Targeted Allocations– Illustrative Examples 11 Targeted Allocations with a Preferred Return – Example 1A Facts: X, Y, and Z each contribute $100 to LLC LLC liquidates based on the following distribution provisions: First to X until X receives a return of its contributed capital Second to X, a 10% simple return on X’s unreturned capital Third to Y and Z, their unreturned capital Fourth 1/3 each to X, Y, and Z LLC had the following items of income/loss for the year: Gross Revenue of $100 Expenses of $150 Unrealized Asset Appreciation of $90 12 Targeted Allocations – Sample Language Except as otherwise provided in [THE REGULATORY ALLOCATIONS PROVISION], and after adjusting for all capital contributions and distributions made during such tax year, Net Income and Net Loss (and, if necessary, individual items of gross income or loss) shall be allocated annually (and at such other times in which it is necessary to allocate Net Income or Net Loss), the Company shall allocate all of its Net Profit and Net Loss for such tax year in a manner such that, after such allocations have been made, the balance of each Member’s Capital Account shall, to the extent possible, be equal to an amount that would be distributed to such Member if (a) the Company were to sell the assets of the Company for their Book Values, (b) all Company liabilities were satisfied (limited with respect to each nonrecourse liability to the Book Values of the assets securing such liability), (c) the Company were to distribute the proceeds of sale pursuant to [THE DISTRIBUTION PROVISION] and (d) the Company were to dissolve pursuant to [THE LIQUIDATION PROVISION], minus the sum of (1) such Member’s share of Minimum Gain or Member Minimum Gain, and (2) the amount, if any, that such Member is obligated (or deemed obligated) to contribute, in its capacity as a Member, to the Company; computed immediately prior to the hypothetical sale of assets. 13 Targeted Allocations – Sample Language (cont.) o The LLC Agreement’s definition of “Net Income” and “Net Loss” reads as follows: “Net Income” and “Net Loss” means, for purposes of this Agreement, for each Fiscal Year or other period, an amount equal to the Company’s taxable income or loss for such year or period, determined in accordance with Code § 703(a) (for this purpose, all items of income, gain, loss, or deduction required to be stated separately pursuant to Code § 703(a)(1) shall be included in taxable income or loss), [...] 14 Targeted Allocations with a Preferred Return – Example 1A Step 1. Determine Beginning Capital Step 2. Determine Contributions/Distributions Step 3. Adjusted Capital Step 4. Determine Aggregate Capital Step 5. Determine Ending Capital First – Return X Capital Second – Return X 10% Return Third – Return Y and Z Capital Fourth – Return Remainder Pro-Rata Total Ending Capital Step 6. Allocate Income to Match Ending (subtract Step 3 from Step 5) X Y Z Total 100 100 100 300 0 0 0 0 100 100 100 300 250 100 10 0 110 70 0 70 70 0 100 10 140 0 70 250 10 (30) (30) (50) 15 Targeted Allocations with a Preferred Return – Example 1B Facts: Same facts as Example 1A, except: LLC Agreement calls for allocations of “Net Income or Net Loss” and does not include “(and, if necessary, individual items of gross income or loss)” 16 Targeted Allocations with a Preferred Return – Example 1B Step 1. Determine Beginning Capital Step 2. Determine Contributions/Distributions Step 3. Adjusted Capital Step 4. Determine Aggregate Capital Step 5. Determine Ending Capital First – Return X Capital Second – Return X 10% Return Third – Return Y and Z Capital Fourth – Return Remainder Pro-Rata Total Ending Capital Step 6. X Y Z Total 100 100 100 300 0 0 0 0 100 100 100 300 250 100 10 0 110 70 0 70 70 0 100 10 140 0 70 250 Allocate Income ? ? ? ? 17 Various Approaches X Gross Allocation Approach: Y Z Total 10 (30) (30) (50) 10 (30) (30) (50) 10? (30)? (30)? (50) 0 (25) (25) (50) 10 (30) (30) (50) 0 (25) (25) (50) (25) (12.5) (12.5) (50) Net Allocation Approach: o Guaranteed Payment o Capital Shift o Taxable o Non-Taxable PIP using Section 704(b) Value: PIP accounting for Built-in-Gain: PIP using Fair Market Value: 18 Targeted Allocations with a Preferred Return – Guaranteed Payment X Y Z Total Step 1. Step 2. Determine Beginning Capital Determine Contributions/Distributions 100 0 100 0 100 0 300 0 Step 3. Adjusted Capital 100 100 100 300 Step 4. Determine Aggregate Capital Step 5. Determine Ending Capital First – Return X Capital Second – Return X 10% Return Third – Return Y and Z Capital Fourth – Return Remainder Pro-Rata Total Ending Capital Step 6. Step 7. Beginning Capital Guaranteed Payment (OI/OD) Allocate Income to Match Ending Ending Capital 250 100 100 10 70 70 10 140 0 0 0 0 110 70 70 250 100 10 100 (5) (25) 100 (5) (25) (50) 70 70 240? 100? 19 Targeted Allocations with a Preferred Return – Taxable Capital Shift X Y Z Total Step 1. Step 2. Determine Beginning Capital Determine Contributions/Distributions 100 0 100 0 100 0 300 0 Step 3. Adjusted Capital 100 100 100 300 Step 4. Determine Aggregate Capital Step 5. Determine Ending Capital First – Return X Capital Second – Return X 10% Return Third – Return Y and Z Capital Fourth – Return Remainder Pro-Rata Total Ending Capital Step 6. Step 7. Step 8. Beginning Capital Capital Shift 250 100 100 10 70 70 10 140 0 0 0 0 110 70 70 250 100 10 100 (5) (25) 100 (5) (25) (50) 250 Allocate Income to Match Ending Ending Capital 110 70 70 Taxable Income/Deduction 10? (5)? (5)? 20 Targeted Allocations with a Preferred Return – Non-Taxable Capital Shift X Y Z Total Step 1. Step 2. Determine Beginning Capital Determine Contributions/Distributions 100 0 100 0 100 0 300 0 Step 3. Adjusted Capital 100 100 100 300 Step 4. Determine Aggregate Capital Step 5. Determine Ending Capital First – Return X Capital Second – Return X 10% Return Third – Return Y and Z Capital Fourth – Return Remainder Pro-Rata Total Ending Capital Step 6. Step 7. Step 8. Beginning Capital Capital Shift Allocate Income to Match Ending Ending Capital Taxable Income/Deduction 250 100 100 10 70 70 10 140 0 0 0 0 110 70 70 250 100 10 100 (5) (25) 100 (5) (25) (50) 110 70 70 250 0 0 0 21 Targeted Allocations with a Preferred Return – PIP Using 704(b) X Y Z Total Step 1. Step 2. Determine Beginning Capital Determine Contributions/Distributions 100 0 100 0 100 0 300 0 Step 3. Adjusted Capital 100 100 100 300 Step 4. Determine Aggregate Capital Step 5. Determine Ending Capital First – Return X Capital Second – Return X 10% Return Third – Return Y and Z Capital Fourth – Return Remainder Pro-Rata Total Ending Capital Step 7. Beginning Capital Allocate Gross Items to Match Ending Ending Capital 250 100 100 10 70 70 10 140 0 0 0 0 110 70 70 250 100 100 100 10 (30) 70 (30) 70 110 (50) 250 22 Targeted Allocations with a Preferred Return – PIP Accounting for BIG X Y Z Total Step 1. Step 2. Determine Beginning Capital Determine Contributions/Distributions 100 0 100 0 100 0 300 0 Step 3. Adjusted Capital 100 100 100 300 Step 4. Determine Aggregate Capital Step 5. Determine Ending Capital First – Return X Capital Second – Return X 10% Return Third – Return Y and Z Capital Fourth – Return Remainder Pro-Rata Total Ending Capital Step 6. Step 7. Beginning Capital Allocate Income Ending Capital Hypothetical Allocation of MTM Gain Hypothetical Ending Capital 340 100 100 10 100 100 10 200 10 10 10 30 120 110 110 340 100 100 100 (25) 75 100 (25) 75 (50) 250 20 35 35 120 110 110 90 340 23 Targeted Allocations with a Preferred Return – PIP Using FMV X Y Z Total Step 1. Step 2. Determine Beginning Capital Determine Contributions/Distributions 100 0 100 0 100 0 300 0 Step 3. Adjusted Capital 100 100 100 300 Step 4. Determine Aggregate Capital Step 5. Determine Ending Capital First – Return X Capital Second – Return X 10% Return Third – Return Y and Z Capital Fourth – Return Remainder Pro-Rata Total Ending Capital Step 6. Step 7. Beginning Capital Allocate Income Ending Capital Hypothetical Allocation of MTM Gain Hypothetical Ending Capital 340 100 100 10 100 100 10 200 10 10 10 30 120 110 110 340 100 (12.5) 87.5 100 (12.5) 87.5 (50) 250 45 22.5 22.5 120 110 110 100 (25) 75 90 340 24 Who is the “Preparer” of Partnership Allocations? 25 Preparer of Allocations for Tax Purposes Section 6694 – Tax Return Preparer Penalties Penalizes income tax return preparers for understatements of taxpayer’s liability which result from negligent disregard of rules and regulations by the return preparer or from willful attempts by the return preparer to understate the tax due. One purpose of the return preparer penalty rules was to ensure that the person who makes the decisions and calculations involved in preparing a particular return will be considered the preparer of that return, even if that person “does not actually place the figures on the lines of the taxpayer’s final tax return.” H.R. Rep. No. 94-658, 2d Sess. 275, reprinted in 1976 U.S.C.C.A.N. 3171. Treas. Reg. § 1.6694-2(e)(6) – one of the relevant factors to be considered in determining whether the penalty will be imposed is whether the preparer “reasonably relied in good faith on generally accepted administrative or industry practice in taking the position that resulted in the understatement.” 26 Preparer of Allocations for Tax Purposes Section 7701(a)(36)(A) “Tax Return Preparer” “means any person who prepares for compensation, or who employs one or more persons to prepare for compensation, any return of tax imposed by this title or any claim for refund of tax imposed by this title. For purposes of the preceding sentence, the preparation of a substantial portion of a return or a claim for refund shall be treated as if it were the preparation of such return or claim for refund.” (Emphasis added) Elements: Prepares for compensation (or employs others to prepare); and Return of tax imposed by this title (or claim for refund). (For this purpose preparation of a substantial portion of a return or claim for refund constitutes preparation of a return.) 27 Preparer of Allocations for Tax Purposes Section 7701(a)(36)(B) Exceptions A person shall not be a “tax return preparer” merely because such person— Furnishes typing, reproducing, or other mechanical assistance, Prepares a return or claim for refund of the employer by whom s/he is regularly and continuously employed, Prepares as a fiduciary a return or claim for refund for any person, Prepares a claim for refund a taxpayer in response to any notice of deficiency issued to such taxpayer or in response to any waiver of restriction after the commencement of an audit of such taxpayer or another taxpayer if a determination in such audit of such other taxpayer directly or indirectly affects the tax liability of such taxpayer. 28 Preparer of Allocations for Tax Purposes Treas. Reg. § 301.7701-15(a) “Tax Return Preparer” “A tax return preparer is any person who prepares for compensation, or who employs one or more persons to prepare for compensation, all or a substantial portion of any return of tax or any claim for refund of tax under the Internal Revenue Code (Code).” (Emphasis added) 29 Preparer of Allocations for Tax Purposes Treas. Reg. § 301.7701-15(b)(1) “Signing Tax Return Preparer” “[T]he individual tax return preparer who has the primary responsibility for the overall substantive accuracy of the preparation of such return or claim for refund.” 30 Preparer of Allocations for Tax Purposes Treas. Reg. § 301.7701-15(b)(2) “Nonsigning Tax Return Preparer” “[A]ny tax return preparer who is not a signing tax return preparer but who prepares all or a substantial portion of a return or claim for refund . . . with respect to events that have occurred at the time the advice is rendered.” Is the drafter of a partnership agreement a nonsigning preparer of the partnership tax return? Is the answer different if the allocations are safe-harbor (layercake) versus targeted? 31 Preparer of Allocations for Tax Purposes Treas. Reg. § 301.7701-15(b)(2) “Nonsigning Tax Return Preparer” Factors to help identify nonsigning tax return preparer: Time spent on the advice given after events have occurred. Time spent prior to events occurring relevant if (1) facts and circumstances show the position(s) giving rise to an understatement is (are) primarily attributable to the advice, (2) the advice was substantially given before events occurred primarily to avoid treating the person giving the advice as a tax return preparer, and (3) the advice given before events occurred was confirmed after events had occurred for purposes of preparing a tax return.” (Emphasis added) 32 Preparer of Allocations for Tax Purposes Treas. Reg. § 301.7701-15(b)(2) “Nonsigning Tax Return Preparer” Examples: Example 1 – an attorney in a law firm providing legal advice to a corporate taxpayer regarding a completed corporate transaction is considered a nonsigning tax return preparer. Example 2 – an attorney in a law firm providing legal advice to a corporate taxpayer regarding the tax consequences of a contemplated transaction, but who does not render any advice after the transaction is completed, is not considered a tax return preparer. Example 3 – facts are the same as Example 2, except that the attorney provides supplemental legal advice to the corporate taxpayer on a phone call after the transaction is completed. The time spent on the supplemental advice represents less than 5% of the aggregate amount of time the attorney spent providing tax advice. Not considered a tax return preparer. 33 Preparer of Allocations for Tax Purposes Treas. Reg. § 301.7701-15(b)(3)(i) “Substantial Portion” “A person who renders tax advice on a position that is directly relevant to the determination of the existence, characterization, or amount of an entry on a return or a claim for a refund will be regarded as having prepared that entry.” “Whether a schedule, entry, or other portion of a return . . . is a substantial portion is determined based upon whether the person knows or reasonably should know that the tax attributable to the schedule, entry, or other portion of a return . . . is a substantial portion of the tax required to be shown on the return or claim for refund.” (Emphasis added) “A single entry may constitute a substantial portion of the tax required to be shown on a return.” 34 Preparer of Allocations for Tax Purposes Treas. Reg. § 301.7701-15(b)(3)(ii) “Substantial Portion” De minimis exceptions: A schedule, entry or other portion of a return or claim for refund is NOT considered to be a substantial portion if the schedule, entry, or other portion of the return or claim for refund involves amounts of gross income, amounts of deductions, or amounts on the basis of which credits are determined that are— Less than $10,000; OR Less than $400,000 AND ALSO less than 20 percent of the gross income as shown on the return or claim for refund. Partnership allocations impact 100% of income as shown on the return. 35 Preparer of Allocations for Tax Purposes Treas. Reg. § 301.7701-15(b)(3)(iii) “Substantial Portion” - Preparer of Partner Returns? A tax return preparer with respect to one return may be considered to be a tax return preparer with respect to another return if the entry(ies) on the first return are directly reflected on the other return and constitute a substantial portion of the other return. Example – the sole preparer of a partnership return of income is considered a tax return preparer of a partner’s return if the entry(ies) on the partnership return reportable on the partner’s return constitute a substantial portion of the partner’s return. 36 Preparer of Allocations for Tax Purposes Who is the Preparer of Partnership Allocations? The drafter of the allocations? The person who follows the agreement and puts the numbers on the form(s)? Both? Is the answer different for Safe-harbor versus Targeted Allocations? Does drafting partnership safe-harbor allocations constitute the “preparation” of the allocations? Does drafting partnership targeted allocations constitute the “preparation” of the allocations? If the answers are different for safe-harbor versus targeted allocations, what does that tell us about targeted allocations? Are targeted allocation provisions really allocations or are they simply a directive to someone to draft/prepare allocations? 37 Preparer of Allocations for Tax Purposes Who is the Preparer of Partnership Allocations? United States v. Pugh, 717 F. Supp. 2d 271 (E.D. NY 2010) – holding as a preparer someone who did not actually sign the tax return, but who rendered advice on a position that appeared in the tax return. Rev. Rul. 81-270, 1981-2 C.B. 250 and GCM 38746 (June 5, 1981) – GP who prepared partnership return for compensation held subject to preparer penalty where limited partner found to have a substantial understatement arising from GP’s negligence or intentional disregard of the rules and regulations in preparing entries on Schedule K-1. (GP did not prepare the limited partner’s return.) 38 Preparer of Allocations for Tax Purposes Who is the Preparer of Partnership Allocations? Adler v. US, 9 F.3d 617 (7th Cir. 1993), rev’g F. Supp. 579 (N.D. Ill. 1992) – suggesting accountants who prepared a partnership return may be “preparers” of each partner’s return if the income or loss reported to each partner constitutes a “substantial portion” of a partner’s tax return and remanding for further consideration by the District Court. Adler v. US, No. 88 C 10051 (1989) (on remand from 7th Circuit) – accountants who prepared a partnership tax return were “preparers” of a substantial portion of the partners’ tax returns and, therefore, presumably were “preparers” of the individual partners’ tax returns. Goulding v. US, 957 F.2d 1420 (7th Cir. 1992) – an attorney who prepared a partnership’s return was held to be the preparer of each partner’s return. 39 Contributors to This Presentation Deloitte Tax LLP – Washington National Tax, Passthroughs Noel P. Brock – West Virginia University Jim Tod, KPMG LLP 40 APPENDIX The Difference between Layered and Targeted Allocations Layered Allocations What are they? Establish an ordering (or layers) for allocating partnership profit and losses after considering regulatory allocations. Generally, profits are allocated first to offset prior years’ losses that eliminated the partners’ contributed capital and undistributed profits that were reflected in their capital accounts at the time such losses were allocated, and finally to reflect the manner in which the profits would be distributed if the partnership had cash available to distribute. Losses are generally allocated in the reverse order of profits. Liquidating distributions generally will be made in accordance with positive capital account balances. Allocating profits to “fill-up” waterfall layers Layered Allocations Common Issues/Considerations Often the waterfall provisions are in the distribution section of the agreement. There may be a different ways of sharing profits versus sharing losses. The allocations may be tied to target capital accounts even though they are layered allocations. Targeted Allocations What are they? Specifies how cash will be distributed from operations and in liquidation of the partnership. Allocates profit/loss so that at the end of the taxable year, each partner’s capital account is equal to the amount that would be distributed to that partner in liquidation if all partnership assets were sold at their section 704(b) book value, less the partner’s share of minimum gain. They are distribution driven allocations that have the following characteristics: Liquidation in accordance with the distribution provisions “Plug” income so that capital accounts equal what a partner would receive upon a hypothetical liquidation if the assets of the partnership were sold for their section 704(b) value Targeted Allocations Common Issues/Considerations Targeted allocations won’t satisfy the substantial economic effect safe harbor because they don’t liquidate in accordance with capital account balances. If drafted properly, should be respected under the economic equivalence test or else are consistent with PIP Use of Qualified Income Offset provisions Impact of current tax distributions Impact on statutory allocations Impact of revaluation events Targeted allocations may create taxable capital shifts Layered and Targeted Allocations – The Formulae Layered allocations compute ending capital under the following formula: beginning capital + - contributions distributions + - income loss = ending capital Targeted allocations plug income under the following formula: target ending capital - beginning capital + - income contributions distributions = or loss Layered and Targeted Allocations – Classic 80/20 Example o LP contributes $200 and GP contributes $0 to partnership o Partnership buys two securities (1 and 2) for $100 each o All distributions are made to LP until it gets its $200 back o Then, distributions are made 80% to LP and 20% to GP o In Year 2, the partnership sells 1 for $200 (gain of $100) o Partnership distributes the $200 of proceeds to LP Layered Allocation Provision Section 1. Allocations. (a) Net Income. Net Income for any period will be allocated: (i) First, 100% to the LP until the total Net Income allocated under this Section 1(a)(i) equals the total Net Loss allocated under Section 1(b)(ii), and (ii) (b) Second, 80% to the LP and 20% to the GP. Net Loss. Net Loss for any period will be allocated: (i) First, 80% to the LP and 20% to the GP until the total Net Loss allocated under this Section 1(b)(i) equals the total Net Income allocated under Section 1(a)(ii), and (ii) Second, 100% to the LP. Layered Allocations – Capital Accounts LP Contribution Gain Distribution Total GP Book Tax 200 200 80 80 (200) (200) 80 80 Contribution Gain Distribution Total Book Tax 0 0 20 20 0 0 20 20 Sample Target Allocation Provision Language “Except as otherwise provided in this Article, Profits and Losses (or items thereof) for any Fiscal Period shall be allocated among the Members in such manner that, as of the end of such Fiscal Period, the respective Capital Accounts of the Members shall be equal to the respective amounts that would be distributed to them, determined as if the Company were to (i) liquidate the assets of the Company for an amount equal to their Gross Asset Value and (ii) distribute the proceeds of liquidation pursuant to Section 10.3.” Not all agreements have the “or items thereof” language Puts pressure on guaranteed payment determination Might make allocation fail economic effect equivalence and fall into PIP Targeted Allocations Targeted allocations are computed under a 6-step process: Step 1. Determine beginning capital for each partner Step 2. Allocate contributions and distributions by partner Step 3. Add Steps 1 and 2 to determine adjusted capital account for each partner Step 4. Determine aggregate ending capital Step 5. Allocate aggregate ending capital to the partners in accordance with the distribution provisions Step 6. Subtract Step 3 from Step 5 to determine income for each partner Targeted Allocation – Capital Accounts Step 1. Determine Beg. Capital Step 2. Determine Contrib. and Dist. Step 3. Adjusted Capital LP GP Total 200 0 200 (200) 0 (200) 0 0 Step 4. Determine Aggregate End. Capital 0 100 Step 5. Allocate Ending Capital 1st – Return Cap. to LP 2nd – Return remainder 80/20 Total Ending Cap. 0 80 80 0 20 20 0 100 100 Step 6. Taxable Income by Partner (subtract Step 3 from Step 5) 80 20 100 • • •