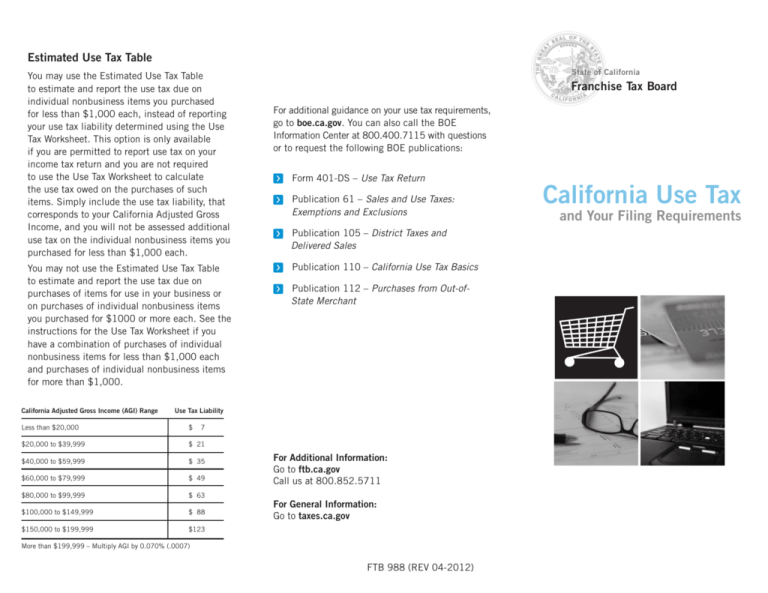

FTB 988 - California Use Tax and Your Filing Requirements

advertisement

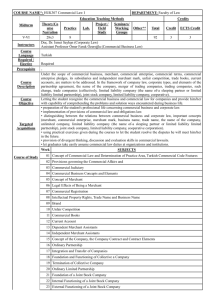

Estimated Use Tax Table You may use the Estimated Use Tax Table to estimate and report the use tax due on individual nonbusiness items you purchased for less than $1,000 each, instead of reporting your use tax liability determined using the Use Tax Worksheet. This option is only available if you are permitted to report use tax on your income tax return and you are not required to use the Use Tax Worksheet to calculate the use tax owed on the purchases of such items. Simply include the use tax liability, that corresponds to your California Adjusted Gross Income, and you will not be assessed additional use tax on the individual nonbusiness items you purchased for less than $1,000 each. You may not use the Estimated Use Tax Table to estimate and report the use tax due on purchases of items for use in your business or on purchases of individual nonbusiness items you purchased for $1000 or more each. See the instructions for the Use Tax Worksheet if you have a combination of purchases of individual nonbusiness items for less than $1,000 each and purchases of individual nonbusiness items for more than $1,000. California Adjusted Gross Income (AGI) Range State of California Franchise Tax Board For additional guidance on your use tax requirements, go to boe.ca.gov. You can also call the BOE Information Center at 800.400.7115 with questions or to request the following BOE publications: Form 401-DS – Use Tax Return Publication 61 – Sales and Use Taxes: Exemptions and Exclusions Publication 105 – District Taxes and Delivered Sales Publication 110 – California Use Tax Basics Publication 112 – Purchases from Out-ofState Merchant Use Tax Liability Less than $20,000 $ 7 $20,000 to $39,999 $ 21 $40,000 to $59,999 $ 35 $60,000 to $79,999 $ 49 $80,000 to $99,999 $ 63 $100,000 to $149,999 $ 88 $150,000 to $199,999 $123 For Additional Information: Go to ftb.ca.gov Call us at 800.852.5711 For General Information: Go to taxes.ca.gov More than $199,999 – Multiply AGI by 0.070% (.0007) FTB 988 (REV 04-2012) California Use Tax and Your Filing Requirements California Use Tax and Your Filing Requirements You just found a great online deal for a state-of-theart computer or a big-screen television. Maybe you purchased a mail-order book or phone-ordered a new dining table. For all of these purchases, you may owe California use tax if you purchased from an outof-state merchant, who did not collect the proper tax amount. You must pay California use tax when you purchase out-of-state items by telephone, Internet, mail, or in person and both of the following apply: The seller does not collect California sales or use tax. You use, give away, store, or consume the item in this state. The California State Board of Equalization (BOE) administers many different tax and fee programs. The best known is the sales and use tax program. Sales tax applies to purchases made within the state of California. The sales tax counterpart, use tax, applies to purchases made outside the state of California. Sales tax is generally due on the sale of tangible personal property and collected by merchants in California at the point of sale. Merchants then remit the sales tax collections directly to BOE. Use tax is sometimes called sales tax, but it is a separate tax generally due on the purchase of tangible personal property from merchants outside of California. If you purchase an item, from an out-of-state merchant, that you use, consume, or store in California, then you owe use tax. If the out-of-state merchant charges you the correct amount of sales or use tax on your purchase, then you fulfilled your use tax requirement. Out-of-state companies that are “engaged in business” in California must register with BOE and collect sales or use tax on their retail sales of personal property to California customers. However, if the merchant did not collect sales or use tax on your purchase, then you must compute and pay the proper amount of use tax. In an effort to assist you with your use tax reporting requirements, the Franchise Tax Board (FTB) included a use tax line on FTB Forms 540A, 540 2EZ, and 540, California Resident Income Tax Returns. This gives you the option to report your use tax liability on your individual income tax return for outof-state purchases. In addition, the form instructions include a Use Tax Worksheet and use tax rates to help you compute the proper use tax liability. New for 2011, you may use the Estimated Use Tax Table to estimate and report the use tax due on individual, nonbusiness items you purchased for less than $1,000 each. Your other available option is to file BOE-401-DS, Use Tax Return with BOE. How do you compute your use tax liability? For your item purchased from an out-of-state merchant, multiply the cost by the applicable use tax rate. The use tax rate and the sales tax rate are the same. Determine if the out-of-state merchant collected any sales or use tax and subtract this amount from the amount of use tax due. Example 1 (Out-of-state purchase with no use tax collected by merchant) Big-screen televison purchase Cost Sales/Use Tax Rate (Los Angeles) $1,000 *.0875 Total Use Tax Liability $87.50 Example 2 (Out-of-state purchase with use tax collected by merchant) Big-screen television purchase Cost Sales/Use Tax Rate (Los Angeles) $1,000 *.0875 Total Use Tax Liability $87.50 Sales/Use Tax Collected by Merchant $72.50 Total Use Tax Liability $15.00 In example 1, a taxpayer purchased the big-screen television from an out-of-state merchant who did not collect use tax. The taxpayer would report an $87.50 use tax liability on FTB Form 540, California Resident Income Tax Return. In example 2, a taxpayer purchased the big-screen television from an out-of-state merchant who collected a portion of the sales or use tax. The taxpayer would report a $15 use tax liability, the difference between the amount collected and the amount due on FTB Form 540, California Resident Income Tax Return. * We used a sample tax rate in our examples. To find your city and county sales and use tax rates, go to boe.ca.gov and search for city and county tax rates.