Recent Trends in Financial Reporting

advertisement

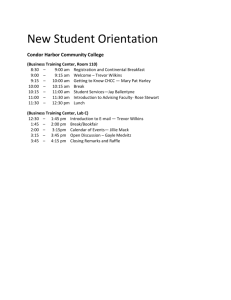

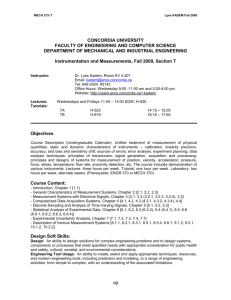

Recent Trends in Financial Reporting Implications for Governance and Risk Management Wednesday, May 27th, 2009 Organized by CIRANO 2020 University, 25th floor In collaboration with the Lawrence Bloomberg Chair in Accountancy John Molson School of Business, Concordia University To register Participants Michel Magnan, Fellow, CIRANO Professor and Lawrence Bloomberg Chair in Accountancy John Molson School of Business, Concordia University Daniel B. Thornton, Ph.D., FCA Professor and Chartered Accountants Professor School of Business, Queen’s University Professional Accounting Fellow, Securities and Exchange Commission (2000-2001) Trevor S. Harris, Ph.D., CA (S.A.) Professor and co-Director of the Center for Excellence in Accounting and Security Analysis Columbia Business School, Columbia University Managing Director and Vice-Chair, Morgan Stanley (2000-2008) David McAusland, BCL, LLB Corporate Director Executive Vice-President for Corporate Development at Alcan Aluminium (2000-2007) Sylvie Léger, CA Partner, National Office, KPMG Program 14 :00 – 14 :05 Welcoming remarks Bryan Campbell, Concordia University and CIRANO 14 :05 – 14 :15 Presentation of workshop program Michel Magnan, Lawrence Bloomberg Chair, Fellow CIRANO 14 :15 – 15:45 Recent Trends in Financial Reporting A Regulatory Perspective Daniel B. Thornton School of Business, Queen’s University A Trader’s Perspective Trevor S. Harris Columbia Business School, Columbia University An Accountant’s Perspective Sylvie Léger Partner, National Office, KPMG A Corporate Perspective David McAusland Corporate Director 15:45 – 16:00 Coffee Break 16:00 – 17:15 Round Table Discussion Michel Magnan (moderator) Daniel B. Thornton Trevor S. Harris Sylvie Léger David McAusland 17 :15 Cocktails Recent Trends in Financial Reporting: Implications for Governance and Risk Management Summary The advent of International Financial Reporting Standards (IFRS) and of Fair Value Accounting (FVA) has modified corporate financial reporting in some fundamental ways. First, moving away from an historical perspective that emphasized conservatism and reliability, financial statements now integrate numerous assessments, assumptions and projections about the future. Second, the measurement of many financial statement accounts is converging toward market values, which raises concerns about their volatility, predictability and usefulness for stakeholders beyond shareholders. In the context of the global financial crisis, the purpose of this workshop is to discuss the governance and risk management implications from these trends as both boards of directors and regulators grapple with the effectiveness of corporate risk management policies, executive compensation practices and the properties of reported earnings as a measure of a firm’s value, risk profile and prospects. In other words, is the traditional view of accounting as being backward-looking still appropriate? Which information underlying financial statements would be useful to directors in their oversight of a firm’s risk management policies? In their assessment of a firm’s risk profile? In the determination of executive compensation? What are the implications of recognizing gains or losses in financial statements that are not based upon a firm’s actual transactions? How can auditors help boards of directors in that regard? These are some of the questions to be debated at the workshop.