Judicial System

advertisement

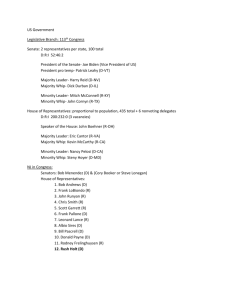

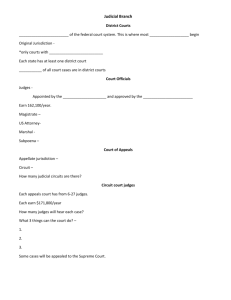

Tax Research: Understanding Sources of Tax Law (Why my IRC beats your Rev Proc!) Understanding the Federal Courts There are three levels of Federal courts that hear tax cases. At the bottom of the hierarchy, there are several trial courts, including the Tax Court, the U.S. Court of Federal Claims, District Courts and Bankruptcy Courts. Trial court cases are appealed to the U.S. Courts of Appeals. The highest court and final level of appeal is the Supreme Court of the United States. Federal Tax Cases U.S. Tax Court U.S. Court of Appeals U.S. District Court and Bankruptcy Courts Court of Federal Claims Trial Courts U.S. Supreme Court U.S. Court of Appeals for the Federal Circuit Appellate Courts High Court Trial Courts U.S. Tax Court. Most tax cases are litigated in Tax Court. The Tax Court is a court of nationwide jurisdiction. Although the Tax Court is physically located in Washington, D.C., the judges travel nationwide to conduct trials in various designated cities. The 19 Tax Court judges are appointment by the President of the United States. The Tax Court judges have special expertise in federal tax laws. U.S. Court of Federal Claims. The U.S. Court of Federal Claims is a special trial court that has nationwide jurisdiction over certain types of cases, including claims for money damages against the United States. Tax cases make up a substantial subset of the cases decided by this court. Approximately one-fourth of the cases before the U.S. Court of Federal Claims involve tax refund suits. Tax cases before this court are often large, complex and technical claims by national and multi-national companies. U.S. District Courts. Federal District Courts have jurisdiction to hear nearly all categories of federal cases, including both civil and criminal matters, within their geographic areas. Jury trials are available. Bankruptcy Courts. Bankruptcy courts are separate units of the district courts. Federal courts have exclusive jurisdiction over bankruptcy cases. Thus, a bankruptcy case cannot be filed in a state court. Bankruptcy courts have jurisdiction to decide tax issues that arise in a bankruptcy proceeding. Bankruptcy court decisions are appealed the U.S. District Court. Appellate Courts U.S. Court of Appeals. The losing party in a decision by a trial court in the federal system normally is entitled to appeal the decision to a federal court of appeals. There are 94 federal judicial districts, which are organized into 12 regional circuits, outlined below. Each circuit has a court of appeals. Each regional circuit court of appeals hears appeals from the district courts located within its circuit, as well as appeals from decisions of federal administrative agencies. First Circuit – Maine, Massachusetts, New Hampshire, Rhode Island, Puerto Rico Second Circuit – Connecticut, New York, Vermont Third Circuit – Delaware, New Jersey, Pennsylvania, Virgin Islands Fourth Circuit – Maryland, North Carolina, South Carolina, Virginia, West Virginia Fifth Circuit – Louisiana, Mississippi, Texas Sixth Circuit – Kentucky, Michigan, Ohio, Tennessee Seventh Circuit – Illinois, Indiana, Wisconsin Eighth Circuit – Arkansas, Iowa, Minnesota, Missouri, Nebraska, North Dakota, South Dakota Ninth Circuit – Alaska, Arizona, California, Guam, Hawaii, Idaho, Montana, Nevada, Oregon, Washington Tenth Circuit – Colorado, Kansas, New Mexico, Oklahoma, Utah, Wyoming Eleventh Circuit – Alabama, Florida, Georgia D.C. Circuit – District of Columbia Tax Research: Understanding Sources of Tax Law (Why my IRC beats your Rev Proc!) 2 Court of Appeals for the Federal Circuit. The Court of Appeals for the Federal Circuit has nationwide jurisdiction to hear appeals in specialized cases, such as those decided by the U.S. Court of Federal Claims (as well as cases involving patent and copyright laws and cases decided by the Court of International Trade). Appeals of Tax Court cases. Tax Court cases are appealed to the appropriate U.S. Court of Appeals where the taxpayer resides. Thus, a Tax Court cases decided against a taxpayer in Texas would be appealed to the U.S. Court of Appeals for the Fifth Circuit. Highest Court Supreme Court of the United States. The U.S. Supreme Court consists of nine justices (a Chief Justice and eight associate justices). The Supreme Court is rarely required to hear a case; instead, parties petition the court, and the justices decide whether to hear a case. Each year, the court receives thousands of petitions. Cases before the U.S. Supreme Court usually involve important questions about the U.S. Constitution or federal law. The court does not decide many tax cases; if there is a constitutional issue concerning a tax or if there is a split in the Circuits on a particular tax matter, the Supreme Court is far more likely to accept the case. Tax Research: Understanding Sources of Tax Law (Why my IRC beats your Rev Proc!) 3 Choice of Forum for Litigation of Tax Issues The following table describes the trial courts that hear tax disputes. Must pay disputed amount, then request refund from IRS, in order to file tax case? Jury Trial Available? Tax Court Most federal tax cases are litigated in Tax Court. Judges are tax specialists. Jurisdiction not limited to any specific geographical region. No No U.S. District Court No minimum amount for tax disputes but costs and complexity of a federal District Court case often limit tax actions to large cases. Judges are generalists, not tax specialists. Jurisdiction is based on geographic area. Yes Yes U.S. Court of Federal Claims Large, complex tax claims (generally for national and multi-national companies). Judges are generalists, not tax specialists. Jurisdiction not limited to any specific geographical region. Yes No Resolves a wide variety of tax issues concerning taxpayers who are in a pending bankruptcy case. No No Court Bankruptcy Court Types of Cases Heard Tax Research: Understanding Sources of Tax Law (Why my IRC beats your Rev Proc!) 4 When a taxpayer in a dispute with the IRS receives a notice of deficiency (“90-Day Letter”), the taxpayer may file a petition in the Tax Court without paying the tax. The Tax Court is the only forum in which a taxpayer can dispute tax deficiencies without first paying the tax. Jury trials are not available in Tax Court. Alternatively, the taxpayer may pay the tax and file a refund claim. If the IRS denies the refund claim, or does not respond within six months, the taxpayer can file a suit in the Federal District Court or the U.S. Court of Federal Claims. (Certain types of cases, such as those involving some employment tax issues or manufacturers’ excise taxes, can be heard only by these courts.) A jury trial is only available in federal District Court. Simplified Small Tax Case Procedure. If the dispute is $50,000 or less for any one tax year, the taxpayer has the option of having the case heard under the Tax Court’s simplified small tax case procedures. Generally, small tax cases are less formal and are resolved faster. However, decisions are not appealable. The illustration below highlights some of the general considerations in selection of a forum to litigate tax issues. Pay Tax Deficiency ? File Refund Claim Y O Denied, or no response in 6 months Jury Trial Available? Y U.S. District Court O N Approved Amount at issue is $50,000 or less? Y N Tax Court Tax Court— option of simplified Small Tax Case procedure N U.S. Court of Federal Claims General Considerations in Choosing a Forum to Litigate Tax Issues Weight of Authority There are several factors that affect the strength of a court decision. The main factors are outlined below. Tax Research: Understanding Sources of Tax Law (Why my IRC beats your Rev Proc!) 5 Rank of the court. Generally, the higher level of court, the more weight of authority. At the trial court level, the Tax Court is generally considered to have more technical expertise on tax matters than other trial courts. In the U.S. legal system, lower courts must follow finding of law made by higher courts that is within the appeals path of cases the court hears. Thus, a District Court in New York must follow the findings of law established by The Court of Appeals for the 2nd Circuit and the U.S. Supreme Court. This concept is called “precedence” or “binding precedence” in the judicial system. Hierarchy of Federal Court System High Court Appellate Courts Trial Courts U.S. Supreme Court U.S. Court of Appeals U.S. Tax Court Federal Court Level U.S. Supreme Court U.S. Court of Appeals U.S. Court of Appeals for the Federal Circuit U.S. District Court Court of Federal Claims Weight of Authority Highest court in the federal judiciary. Highest authority. Binding on all Federal courts. Case decided by 9 justices. A decision by the U.S. Court of Appeals carries a higher authority than a decision by a trial court. A case decided by a particular Circuit Court of Appeals is only binding on the District Courts within that circuit. High persuasive value in other Federal Circuits. Cases are heard and decided by a panel of 3 Appellate Court judges. Tax Research: Understanding Sources of Tax Law (Why my IRC beats your Rev Proc!) 6 Federal Court Level Weight of Authority A trial court decision generally carries less authority than an appellate court decision. The Tax Court is generally considered to have more technical expertise on tax matters than other trial courts. A Tax Court regular U.S. Tax Court - Regular Decisions decision is issued when the Tax Court believes the case involves a sufficiently important legal issue or principle (new or unusual point of law). A Tax Court decision can be cited as legal authority. A Memorandum Opinion addresses cases where the law is settled or factually driven (does not involve a novel U.S. Tax Court - Memorandum Decisions legal issue). A Memorandum Opinion has less authority than a regular Tax Court decision but can be cited as legal authority. Similar authority as Tax Court. Precedential value in the U.S. Court of Federal Claims Court of Federal Claims or in the Court of Appeals for the Federal Circuit. Not binding on any courts but often cited as persuasive U.S. District Court authority. U.S. Tax Court - Small Case Procedures No precedential value (but can be persuasive if directly Summary Decisions on point). Jurisdictional issues regarding where taxpayer lives. Court cases with similar facts and issues may have been decided differently in other circuits. For example, an Eleventh Circuit Court of Appeals decision would provide precedent for cases appealable in the Elenenth Circuit (in Alabama, Georgia and Florida). The decision could also be used as persuasive authority in another circuit, but would not provide binding precedent in other circuits or in the Supreme Court. Status on appeal. Cases that were affirmed on appeal generally carry more weight than cases that were overruled on appeal. An Appellate Court decision where the U.S. Supreme Court declined to review the case (writ of certiorari was denied) carries more weight than an Appellate Court decision that was not appealed. Whether the decision was unanimous or split. A unanimous decision of the court carries more weight than a split decision. The number of concurring and dissenting judges may affect the weight of authority. Furthermore, an Appellate Court decision heard by all circuit court judges (en blanc) carries more weight than a decision decide by the normal 3-judge Appellate panel. Tax Research: Understanding Sources of Tax Law (Why my IRC beats your Rev Proc!) 7 Split in the Circuits. When one court of Appeals decides a case one way and another court rules differently in a case with similar facts and circumstances, the decision of both may carry less weight as there is not uniformity in the law. Authority of the judges. The authority or respect of the judges who decided the case, and the soundness of the reasoning expressed in the opinion, may affect the weight of authority. How other courts viewed the decision. Using a citation index (“Citator”) is an important step in evaluating how an opinion compares with other decisions on the same issue. A Citator provides the judicial history of a case and a record of citations listing later decisions in which that case has been discussed and cited. A strong decision would be one with a long history of favorable evaluation by other courts. Tax Research: Understanding Sources of Tax Law (Why my IRC beats your Rev Proc!) 8