Syllabus - Haas School of Business

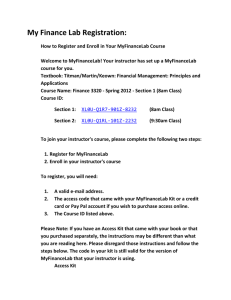

advertisement

Syllabus EWMBA 203 Core Finance Spring 2012 instructor: office: email: office hours: Professor Brett Green F653 bgreen@haas.berkeley.edu By appointment class time: Section 31A (Oski): Saturdays 9am-1pm, Cheit 220 Section 32A (Axe): Saturdays 2-6pm, Cheit 220 gsi: office: email: office hours: Donatella Taurasi F501 donatella_taurasi@haas.berkeley.edu Sundays 11:30am-1:30pm (in F501), Thursdays 7– 9 p.m. (by phone, 510.982.6396) overview: This is an introductory MBA course in finance, which is designed to introduce students to the concepts and techniques necessary to analyze and implement optimal investment decisions by firms. Students learn how to value projects and assets given forecasts of future cash flows. Topics include basic discounting techniques, stock and bond valuation, capital budgeting under certainty and uncertainty, portfolio choice, asset pricing models and (time-permitting) efficient market hypotheses and derivatives. This course will combine the theoretical underpinnings of finance with some “real world” examples. Students do not need a background in finance to succeed in this course, but should know all material covered in the Finance workshop. The Finance workshop material can be downloaded from: b-space under Resources=>Finance Workshop December 2011. required text: Corporate Finance, 2nd Edition, Jonathan Berk and Peter DeMarzo, 2010 (with access to MyFinanceLab). MyFinanceLab is an online resource developed by the publishers of the textbook. It allows you to access relevant sections of the textbook as well as work though review problems online. Students purchasing the textbook will be provided with an access code. When you register for access you will need to enter the following Course ID: green20701. Instructions for registering and accessing MyFinanceLab are posted on b-space under Resources=>Textbook Material. HBS cases, available from Study.Net. Syllabus for EWMBA 203 – Spring 2012 page 1 also required: Students are required to bring either a laptop with Microsoft Excel or a financial calculator (HP12C is recommended but not required) to each class. Access to a computer with Microsoft Excel for completing problem sets and exams is also required. homepage: Most of the materials for the course can be found on bspace.berkeley.edu. We will use MyFinanceLab (accessible at www.pearsonmylab.com) for quizzes and optional practice problems. Study.Net will be used solely for the HBS cases. readings: You are expected to do the assigned readings before each class. Time does not allow all topics to be covered in detail in the class room. Therefore, the readings are necessary. You are responsible for all material covered in assigned readings, whether or not we have time to cover it in class. Reading ahead is expected as it will aid your understanding of material presented in class. Re-reading after class is encouraged as it will help solidify the concepts just presented. supplementary readings: In addition to the textbook readings, I will post supplementary readings on b-space. These are primarily news articles that relate material from class to real-world applications. The supplementary readings are optional, but I encourage you to read the news articles whenever possible. We will discuss most of these articles in class (time permitting). Students are expected to contribute to this discussion. attendance: Attendance is mandatory. Please attend all classes and do not arrive late. preparation: The course has been designed so that the median student will spend 10-12 hours per week studying finance outside of class. Those of you with a strong background in finance will spend less time and find most of the material straightforward. Those of you with little or no background in finance will spend more time and find some of the material quite difficult. Time should be spent (in order of importance) doing problem sets and quizzes, reviewing lecture notes, doing practice problems, reading the textbook and reading news articles. I will occasionally cold-call individuals to facilitate discussion. grades: Your overall course grade will be based on: assignments, quizzes, a midterm exam and a final exam according to the following: Problem Sets: Quizzes: Midterm: Final exam: Total 15% 10 25 50 100 % The dean’s office mandates the following grade distribution: 15% A; 20% A-; 30% B+; 20% B; and 15% B- or below. Participation in the class will not be explicitly graded, but I will keep track of who is making valuable contributions to the class over the course of the quarter. This information will be used in determining grades in borderline cases. problem sets: The best way to learn the material is to do a large number of problems. There will be a total of 6 problem sets. Students should work on problem sets in groups of 2-3 people, hand in one set of solutions per group. Groups will be formed during the first week of class (you may choose your own group). Late problem sets will not be accepted. Problem sets are posted on b-space under the assignments tab. Solutions will be posted immediately after the class in which the problem set is due. Several of the problem sets will consist of analyzing HBS cases. I cannot post solutions for the HBS cases, rather we will work through them together during the class in which they are due. I will provide a handout for each case to guide our discussion but you should keep a copy of your solutions accessible. Be prepared to actively discuss the cases in class. In this class (as in the business world) you are expected to explain how you reached your conclusions. Your homework solutions should explain how you got to your answer as well as the answers Syllabus for EWMBA 203 – Spring 2012 page 2 themselves I don’t need to see the entire spreadsheet of cash flows, but I do need to see the formulas that you used to get to your answer and an explanation of why the formula is correct. You can copy cells from the spreadsheet as long as you provide an explanation and label any rows or columns referenced. If you feel it is necessary, you can print out the spreadsheet and attach it provided you supplement it with an explanation of how it was generated Please note that neither the TAs nor I will answer questions about how to do problem sets prior to their due date. Please discuss all such questions only within your group. If your group feels that the question is ambiguous, try to make reasonable assumptions and state them clearly. quizzes: There will be a total of 6 quizzes. The quizzes should be accessed through MyFinanceLab. Each quiz must be done individually and be completed by Thursday at 8AM on the week that it is assigned. Quizzes are designed to take 45-60 minutes for a student that is comfortable with the material. There is no limit as to how much time you are allowed to spend on the quiz. Some students may prefer to learn the material while working through the quiz. In this case, the quizzes will take longer to complete. The lowest quiz score will be dropped for each student. exams: There is both a midterm exam and a final exam in this course. The final exam is scheduled by the University for Saturday, March 10. The exam will take place from 2-6pm for both cohorts (the final exam for Operations is from 9am-1pm for both cohorts). All students must take the exam at this time – no exceptions. The midterm will be a take home exam. The midterm will be available on b-space starting at 11:30AM on February 19 (immediately following the review session) and due at the beginning of class in week 5 (Febraury 26). Note that there will be no quiz or problem set during this week. regrade policy: If you feel that there was an error made in grading your exam, you can submit your exam to the GSI along with a written explanation of the grading error for a regrade. In this case, the entire exam will be regraded and therefore your score may go up or down. All scores from regraded exams are final. additional problems: For students looking for additional practice of the topics covered in the course, I have provided a list of practice questions from each chapter (see course outline below). These problems are optional and are not to be handed in. They are also available through MyFinanceLab. ethics and etiquette: Students who take this class are bound by the Haas code of ethics. For reference please see: http://www.haas.berkeley.edu/MBA/academics/academic/code-of-conduct.html. Nothing less than strict adherence will be accepted. For problem sets, students may work together in small groups of no more than three. In the case of quizzes and exams, each student is still responsible for submitting, understanding, and being able to complete his or her own. We ask students to refrain from behavior that has been shown to interfere with a positive classroom experience. Please do not use laptops or cell/smart phones during lecture periods miscellaneous: Please bring your name plate to class and have it displayed throughout the semester. Familiarity with Excel is recommended. There are teaching notes titled “Use of Financial Functions in Excel” and “Use of Statistical Functions in Excel” on the course website under Supplementary Readings=>Teaching Notes on Excel. Syllabus for EWMBA 203 – Spring 2012 page 3 course outline: January 21 Below is a rough outline for the material we will cover in this course. All chapters refer to Berk and DeMarzo. Some topics may run over to the next lecture. Consequently, we may fall behind the listed schedule a bit at some points. If time permits, we will cover efficient market hypotheses (likely) and derivatives pricing (unlikely). Depending on the material covered, assignments may change during the semester. Any changes will be announced on b-space. topic: due: readings: teaching notes: Introduction to Finance; The Time Value of Money Problem Set 1 Chapters 3 and 4 Use of Financial Functions in Excel January 22 GSI session 10-11:30am January 26 Quiz 1 due at 8am (available on MyFinanceLab.com) January 28 topic: due: readings: Interest Rates; Bond valuation; Problem Set 2 Chapter 5, Chapter 8 January 29 GSI session, 10-11:30am February 2 Quiz 2 due at 8am (available on MyFinanceLab.com) February 4 topic: due: readings: Capital Budgeting; NPV and other decision rules Problem Set 3 Chapter 6 and 7, Chapter 2 (optional) February 5 GSI session 10-11:30am February 9 Quiz 3 due at 8am (available on MyFinanceLab.com) February 11 topic: due: readings: teaching note: Stock Valuation; Introduction to Risk Problem Set 4 Chapter 9, Chapter 10.1-10.6 Use of Statistical Functions in Excel Midterm Exam Distributed (covers material through Stock Valuation) February 12 GSI session 10-11:30am February 15 No quiz this week. February 18 topic: due: readings: Optimal Portfolio Choice and the CAPM; Midterm Exam Due Chapter 10.7-10.8, Chapter 11, Chapter 12.1.12.3, Chapter 13.7-13.9 February 19 GSI session 10-11:30am February 23 Quiz 4 due at 8am Syllabus for EWMBA 203 – Spring 2012 (week 1) (week 2) (week 3) (week 4) (week 5) page 4 February 25 topic: due: readings: Estimating Cost of Capital; Capital Budgeting under Uncertainty Problem set 5 Chapter 12.4-12.6, Chapter 14 February 26 GSI session 4-5:30pm March 1 Quiz 5 due at 8am March 3 topic: due: readings: Capital Budgeting under Uncertainty (cont); Market Efficiency Problem set 6 Chapter 13.1-13.6 March 4 GSI session 10-11:30am March 8 Quiz 6 due at 8am March 10 Final Exam: 2-6pm (week 6) (week7) Note: The final exam is cumulative, but emphasis will be placed on the material that was not covered on the midterm. Syllabus for EWMBA 203 – Spring 2012 page 5