View - nau.edu

advertisement

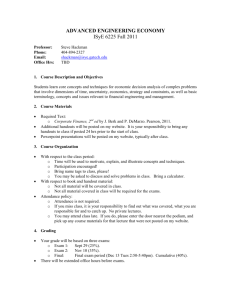

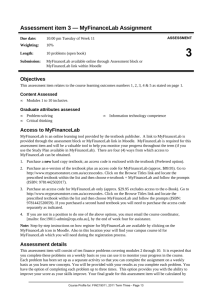

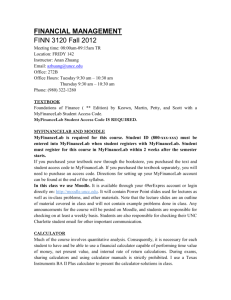

BBA 320 – Managerial Finance Fall 2013 GENERAL INFORMATION Semester: Fall 2013 Day / Time: N/A – WEB Course Room: Online Credit: 3 Credit Hours Professor: Office Hours: Phone: Email: Dr. Tanesha Morgan By appointment (225) 302-8244 tanesha.morgan@nau.edu THE BBA PROGRAM BBA Mission Statement: To provide excellent business management and related higher education for working adults throughout Arizona with and in-depth focus on core business competencies within a global context. BBA Vision Statement: To be a premier provider of Baldrige-Quality business management and related higher education with an emphasis on value and accessibility. BBA Learning Objectives: We will train our graduates to: (1) Think creatively and view data from multiple perspectives; (2) Communicate effectively in both verbal and written formats; (3) Work well in teams using effective interpersonal skills; (4) Discern ethical issues; (5) Solve problems and utilize decision-making tools and theories; (6) Design and implement effective strategies; (7) Analyze and utilize financial information. BBA Values: We value: Visionary and innovative leadership; Lifelong student, faculty & organizational learning; Ethical and socially responsible behavior; Creating and improving excellent quality & value – personal and societal; Diversity of people and ideas. 1 BBA 320 – Managerial Finance Fall 2013 COURSE PREREQUISITES Business Major Status or ACC 255, ACC 256, and MAT 119 and junior status for non-business majors. COURSE/CATALOG DESCRIPTION Survey of the major areas of financial operations in business and their relationship to other business functions; internal financial activities, sources of funds, and the firm’s involvement with money and capital markets; basic techniques of financial analysis and their application to financial decision making; development of an understanding of the financial system. COURSE STRUCTURE / APPROACH This is an online, independent study course. Communication between instructor and students or between students will take place in Blackboard. Connectivity to the Internet is the student’s responsibility. Personal communication between the instructor and students will primarily take place via email and the Discussion Board in Blackboard. Instruction will focus on your reading assignments, homework assignments, numerical and analytical problem solving, and case analysis and web-based exercises. A focus of the course is to improve the student’s analytical and written skills. Students will receive a customized study plan based on the MyFinanceLab tutorial. Students will get the help they need, when they need it, from the robust tutorial options in MyFinanceLab, which breaks the problems into steps and links the relevant reading materials. This is a structured course with time sensitive reading assignments, homework assignments, quizzes, cases, exercises, and exams. Homework assignments, quizzes, case analysis, web exercises, and exams are open book and open notes and may be taken anywhere and anytime prior to the scheduled deadline. The deadlines will be strictly adhered to. It is the student’s responsibility to meet the scheduled deadlines. If a deadline is missed without a reasonable excuse, you will receive a 0 for that assignment or assessment. There are no make-up assignment or assessments. Only very serious matters will be considered a reasonable excuse and must be cleared with me prior to the deadline of the assignment or assessment. Because this is a finance course, you will need a financial calculator to solve the numerical problems. You may use a financial calculator in all exams. Cell phone calculators are not acceptable and may not be used during exams. COURSE LEARNING OUTCOMES Upon successful completion of this course, students will be able to: Describe the institutional and tax environments in which firms operate. Assess the financial health of firms by examining their financial statements. Adjust the values of cash flows across time. Calculate returns and riskiness of returns for various assets. Describe the source of asset value and be able to calculate values for various financial assets. 2 Assess the value of potential investments in fixed assets and make correct decisions on whether or not to proceed with the investment. Describe the sources of capital available to firms and estimate the cost for various sources. Forecast financial statements into the future and determine future external financing needs. Describe the importance of working capital to the firm’s financial health, and its effect on the firm’s profitability and liquidity. Describe sources of short-term financing available to firms, and the relative advantages or disadvantages of each. Describe the tradeoff between minimizing cash balances and maintaining sufficient liquidity, and determine optimal cash balances for firms. Describe the tradeoff between levels of investment in accounts receivables and inventory, and the profitability and liquidity of the firm. Describe how international trade creates additional risks and opportunities for firms. Students should be able to assess the effect of varying exchange rates on financial statements, cash flows from fixed assets, credit decisions, and pricing strategies. READINGS AND COURSE MATERIALS Required Text – Principles of Managerial Finance, Brief, 6th edition by Lawrence J. Gitman; and MyFinanceLab Student Access Code Card. The ISBN for the textbook is ISBN: 9780136119456. The student access Code Card can be purchased online at http://www.myfinancelab.com. Recommended Tool – Companion Website to accompany Principles of Managerial Finance, Brief, fifth edition at www.prenhall.com/gitman Required Tool - A financial calculator is required. Optional Software – Free PowerPoint Viewer to allow you to read the powerpoint slides that may be used as outlines for the textbook chapters. The viewer may be downloaded at http://office.microsoft.com/en-us/powerpoint/HA100966951033.aspx Additional articles and reading materials as assigned. EVALUATION TOOLS Evaluations of student performance will be conducted by the means of assessment. The means of assessment consist of ten homework assignments, ten quizzes, three cases and web-based exercises, and four exams. The learning outcomes will be achieved if the student passes the course requirements with a grade of C or higher based on the grading scale below. Course Requirements: 1. Homework Assignments (15 points each) ................................................................... 150 points. 2. Quizzes (25 points each) ............................................................................................. 250 points. 3. CHAPTER CASES and CRITICAL THINKING PROBLEMS (50 points each) ...... 150 points. 4. Exams (150 points each) ............................................................................................. 450 points. Total 1,000 points. Grading Procedures: 900 - 1,000 points ........................................................................................................................... A 800 - 899 points ............................................................................................................................... B 700 - 699 points ............................................................................................................................... C 600 - 699 points ............................................................................................................................... D <600 points ...................................................................................................................................... F COURSE OUTLINE* Please see the course schedule that is posted in the classroom. 3 Email Communication and Grading Turn Around Expectations Please feel free to contact me, preferably by email, with any questions or concerns you may have. Because of the nature of the course, I receive many similar emails asking how to solve problems or apply a formula. These inquiries are similar to someone asking a question in a traditional classroom. Emails of this kind are more appropriately addressed to the entire class and should be posted on the online discussion board. Posting substantive questions on the discussion board and providing substantive responses will receive extra credit. I will monitor the discussions to make sure answers given are correct and will provide the answers where needed in the discussion board. Any emails of this type, I will post to the discussion board unless you explicitly state that the email should remain confidential. I will not post confidential emails or emails regarding grades, assignments, etc. I will check emails Monday – Friday and respond to emails no later than 2 working days or 48 hours (not counting weekends, holidays, or scheduled breaks). Assignments, quizzes, exams will be graded as soon as possible but no later than one week, Monday through Friday, and the following weekend after the assignment or assessment is due (not counting holidays or scheduled breaks). For example, if a writing assignment is due on Sunday, you will receive the grade and feedback no later than a week from the next Monday (8 days). Many assessments (exams and quizzes) are graded when the assessment is taken. You will know your grade when you finish the assessment. However, the completed assessment will not be available for your review until after the assessment deadline has passed. COURSE POLICIES Assignments submitted as a requirement for some other class may not be submitted for an assignment in this BBA class. All assignments must be original work of the student or properly referenced and must be specific work for this class. All work is to be submitted in the appropriate professional style and format. Standard oral and written English is always used in the NAU classroom. All assignments must be turned in on the due dates specified in the syllabus. Late work will not be accepted unless there are extreme circumstances that are unexpected and unavoidable. Students are responsible for making sure they have assignments and handouts (which are available in Blackboard™ and MyFinanceLab) and turn in assignments on time through Blackboard™ and MyFinanceLab. This is an online course. Computer literacy is assumed and connectivity is the student’s responsibility. Have a back-up plan for accomplishing course requirements. Take quizzes and exams early so computer or connectivity issues do not pose problems with meeting course requirements. Exams, quizzes, homework, web cases and exercises, and exams may not be made up unless arrangements to do so are made in advance or the reason is extreme, unexpected, and unavoidable. Proper tone and attitude in all on-line discussions is required to maintain the professional atmosphere that reflects higher education. This class will be a success for you and others if you take the responsibility for your own learning and then make sure that you share your learning and experiences with the other participants in the class. This is your unique opportunity to display, practice, assess and improve your own learning and leadership. “Attendance” in the online classroom is a minimum of three logins per week. The logins must occur on separate dates. Get in the habit of checking frequently and viewing 4 announcements for new information and reminders. While it may be occasionally necessary for a student to “miss class” due to personal extenuating circumstances or professional obligations, these events do not relieve students from course responsibilities. Students are expected to notify the instructor if they will be absent from the class for more than three or four days. A university education aims to expand student understanding and awareness. Thus it necessarily involves engagement with a wide range of information, ideas and creative representations. In this course of college studies, students can expect to encounter—and critically appraise—materials that may differ from and perhaps challenge familiar understandings, ideas, and beliefs. Students are encouraged to discuss these matters with faculty. MYFINANCELAB MyFinanceLab opens the door to a powerful Web-based diagnostic testing and tutorial system designed for this course. MyFinanceLab allows you to take practice tests correlated to the textbook and receive a customized study plan based on your results. The assignment problems in MyFinanceLab, based on selected end-of chapter problems in the book, have algorithmically generated values. Thus, the numbers in your homework will differ from those of your classmates, and there is an unlimited opportunity for practice and testing. You can get the help you need, when you need it, from the robust tutorial options, including “View an Example” and “Help me Solve This,” which breaks down the problem into steps and links to the relevant textbook page. The MyFinanceLab web address is http://www.myfinancelab.com/. How to Register and Enroll in Your MyFinanceLab Course Welcome to MyFinanceLab! I have set up a MyFinanceLab course for you. To join the course, please complete the following two steps: 1. REGISTER for MyFinanceLab, and, 2. ENROLL in your instructor's course To Register for MyFinanceLab To register, you will need a student access code and a course ID. If you don't have an access kit, you can purchase access online at http://www.myfinancelab.com. You will have the choice to purchase access with or without a full etext. Once enrolled in your professor's course, you will also have the option to purchase a discounted version of your text. Textbook: Gitman: Principles of Managerial Finance, Brief 6th Edition Course Name: BBA320 - Fall 2013 Course ID: morgan57272 Steps to Register: 1. Go to http://www.myfinancelab.com and click the Student button, in the Register section. 2. Enter the course ID, morgan57272 and click Next. 3. Choose to register an access code (came with your new book) or purchase access if you don’t have an access kit/code. 4. Click the button to proceed to registration. 5. Follow the instructions to create your account. 6. Click the link to login. You’ll be directed to http://www.myfinancelab.comwhere you can enter the user name and password you just created. Click the login button. 7. The first time you enter the site you’ll be asked to enter your course ID. Enter your course ID, morgan57272 8. Be sure to click on the Browser Check link on the Announcements page or in the upper right of the screen the first time you login and anytime you use a new computer. This wizard will walk you through the installation of the software you will need to use the MyFinanceLab resources (such as 5 Flash). Note: the software may already be installed in the school lab, so in that case check first with your lab administrator. To log into MyFinanceLab 1. Go to http://www.myfinancelab.com 2. Enter the user name and password you just created, and click Log In (or hit the enter key). If you purchased access, visit the Textbook Resources inside your Instructor’s Course for additional purchase options. Note: If you are taking two MyFinanceLab courses simultaneously you will need two separate login accounts. Need Help? For assistance, please visit http://www.myfinancelab.com/support. HOMEWORK The homework assignments are located in MyFinanceLab. You must submit the homework assignment in MyFinanceLab by the scheduled deadline as listed in the course outline. The homework assignments are not timed, open book, open notes, and may be taken at any location. There are 10 homework assignments. One homework assignment is worth 15 points. In total, the 10 homework assignments are worth 150 points or 15% of your grade. The option is available to submit the homework assignments prior to the scheduled deadline. Once a homework assignment is made available, you may submit it anytime (and resubmit it as many times as you like) prior to the deadline. It is possible to go faster than the suggested schedule in the course outline or work ahead on the homework assignments. Please see MyFinanceLab and the course outline when homework assignments are available (open) and when they are due (close). QUIZZES The quizzes are located in MyFinanceLab. You must attempt a quiz in MyFinanceLab by the scheduled deadline as listed in the course outline. The quizzes are timed, open book, open notes and may be taken at any location. The quizzes consist of multiple-choice questions. There are 10 quizzes. One quiz is worth 25 points. In total, the 10 quizzes are worth 250 points or 25% of your grade. The option is available to take quizzes prior to the scheduled deadline. Once a quiz is made available, you may attempt it only once and it must be completed prior to the scheduled deadline. It is possible to go faster than the suggested schedule in the course outline or work ahead on the quizzes. Please see MyFinanceLab and the course outline when quizzes are available (open) and when they are due (close). CHAPTER CASES and CRITICAL THINKING PROBLEMS The chapter cases and critical thinking problems are located in MyFinanceLab. After you log in, from the menu on the left select “Chapter Resourses.” This will take you to a page where you will find 1 chapter case and 1 critical thinking problem per chapter. The assignment is that from the chapters in a learning module you must choose 1 chapter case and 1 critical thinking problem. The chapter case and critical thinking problem may not be from the same chapter. For example, learning module 1 consists of chapters 1-3. You will pick a chapter case from either chapter 1, 2, or 3. Let’s assume you pick the chapter 2 case. Now you must pick a critical thinking problem 6 from either chapter 1 or 3. You may not pick the critical thinking problem from chapter 2. The chapter case and critical thinking problem must be from different chapters. Follow the instructions and answer the questions in the case or critical thinking problem. Be careful! It is not enough to answer the questions/prompts in the case analysis. Carefully consider the “Case Analysis Rubric” below when doing the case analysis. A case analysis is not merely restating the facts of the case but requires some analysis as pointed out in the rubric. Incorporate the questions/prompts in the case analysis. For the critical thinking problem it suffices to answer the questions/prompts and follow the instructions. These should be emailed to the professor through Blackboard by the due date provided in the course schedule. There are 3 cases & critical thinking problem assignments, one per learning module, except for the final learning module. One assignment is worth 50 points. In total the 3 assignments are worth 150 points or 15% of your grade. Case Analysis Rubric TRAIT Issues Unacceptable Does not recognize a problem or mentions problems that are not based on facts of the case Acceptable Recognizes one or more key problems in the case. Perspectives Does not recognize the perspectives of any characters in the case Knowledge Simply repeats facts listed in case and does not discuss the relevance of these facts Actions No action proposed or proposes infeasible action(s) No positive and negative consequences are identified Considers the perspectives of individuals who are related to the problems Considers facts from the case and cites related knowledge from theoretical or empirical research More than one reasonable action proposed. Positive and negative consequences for each action are discussed Consequenc es Exemplary Recognizes multiple problems in the case. Indicates some issues are more important than others and explains why Clearly describes the unique perspectives of multiple key characters. Discusses facts of the case in relation to empirical and theoretical research and add knowledge from personal experience Proposed actions seem to deal with the most important issues Consequences are tied to the issues deemed most important. EXAMS The exams are located in MyFinanceLab. At the end of every learning module an exam is due testing on the materials covered in the chapters of that learning module. The exams are located in MyFinanceLab and must be attempted by the scheduled deadline as listed in the course outline. The exams are timed, open book, open notes and may be taken at any location. The exams consist of multiple-choice questions. 7 Score There are 4 exams, one exam per learning module. One exam is worth 150 points. In total the 4 exams are worth 450 points or 45% of your grade. The exam with the lowest score will be dropped. Only the 3 exams with the highest scores will count towards your grade. The exams must be taken during the last week of the learning module. Please see MyFinanceLab and the course outline when exams are available (open) and when they are due (close). EXTRA CREDIT: There are three opportunities to earn extra credit in this course. The first extra-credit opportunity is the pre-quiz, due the first week of class (please see the class schedule for the due date because the pre-quiz cannot be taken after it closes). The pre-quiz consists of true/false and multiple choice questions covering the material in the syllabus. The second opportunity is to post an introduction on the discussion board in Blackboard prior to the deadline and to post a comment to one of your classmates on the discussion board in Blackboard prior to the deadline. In the introduction, introduce yourself to the class and state what your expectations are. In the comment, respond to at least one post of your classmates. The third extra-credit opportunity is based on your participation in the discussion board in Blackboard. As stated above in the course policy, this class will be a success for you and others if you take the responsibility for your own learning and then make sure that you share your learning and experiences with the other participants in the class. This is your unique opportunity to display, practice, assess and improve your own learning and leadership. To facilitate this learning, extra credit will be awarded to those students who ask substantive questions covering the material and to those students who provide substantive answers on the discussion board in Blackboard. The amount of extra credit varies with the depth of the questions asked and answered provided. Because this is a finance course, there will be many of you who have “mechanical” questions of how to calculate a certain answer or what the steps are in solving a problem. Although MyFinanceLab is very helpful, some of you will still have questions. Instead of sending the instructor an email, post that question on the discussion board for extra credit. Those who provide the answer will also receive extra credit. The instructor will monitor the answers and discussions to make sure the correct answers are being given. If you send a “mechanical” type question in an email to the instructor, that question will be posted by the instructor on the discussion board. This process facilitates the learning and sharing learning experience in this class. 8 Class Schedule Week Week 1 Week 2 Date 28-Aug - 1-Sep 2-Sep - Topic Welcome to the Course & Course Introduction Readings Syllabus MyFinanceLab BlackBoard DB The Role and Environment of 8-Sep Managerial Finance Chapter 1 8-Sep in MyFinanceLab. Homework and Quiz 2 opens 9-Sep and closes 15-Sep in MyFinanceLab. Homework and Quiz 3 opens 16-Sep and closes 22-Sep Exam 1 opens 23-Sep and closes 29-Sep Case and Critical Thinking Prob 1 - Submit before 29-Sep in MyFinanceLab. in MyFinanceLab. in BlackBoard. Chapter 4 Homework and Quiz 4 opens 6-Oct in MyFinanceLab. Chapter 5, 6 Chapter 7 Chapters 4-7 Homework and Quiz 5 opens 7-Oct and closes Homework and Quiz 6 opens 14-Oct and closes Exam 2 opens 21-Oct and closes Case and Critical Thinking Prob 2 - Submit before Homework and Quiz 7 opens 28-Oct and closes Homework and Quiz 8 opens 4-Nov and closes Exam 3 opens 11-Nov and closes Case and Critical Thinking Prob 3 - Submit before 13-Oct 20-Oct 27-Oct 27-Oct 3-Nov 10-Nov 17-Nov 17-Nov in MyFinanceLab. in MyFinanceLab. in MyFinanceLab. in BlackBoard. in MyFinanceLab. in MyFinanceLab. in MyFinanceLab. in BlackBoard. 1-Dec in MyFinanceLab. 8-Dec 11-Dec in MyFinanceLab. in MyFinanceLab. Week 4 Week 5 Week 6 30-Sep - Week 7 Week 8 Week 9 7-Oct 14-Oct 21-Oct - Week 10 Week 11 Week 12 28-Oct 3-Nov Risk and Return 4-Nov - 10-Nov The Cost of Capital 11-Nov - 17-Nov Chapter 8 Chapter 9 Chapters 8-9 Capital Budgeting 24-Nov Techniques Chapter 10 Capital Budgeting Cash Flows and Risk Week 14 25-Nov 1-Dec Refinements Chapter 11 Homework and Quiz 9 opens Leverage and Capital Structure & Week 15 2-Dec 8-Dec Payout Policy Chapter 12, 13 Homework and Quiz 10 opens Week 16 9-Dec - 11-Dec Chapter 10-13 Exam 4 opens *The schedule and assignments are subject to change at the discretion of the instructor or the university. Week 13 in BlackBoard. 2-Sep and closes 9-Sep - Cash Flow and 6-Oct Financial Planning Time Value of Money & Interest Rates and Bond 13-Oct Valuation 20-Oct Stock Valuation 27-Oct Activities 28-Aug and closes 1-Sep 30-Aug in BlackBoard. 1-Sep in BlackBoard. Homework and Quiz 1 opens The Financial 15-Sep Market Environment Chapter 2 Financial Statements and 16-Sep - 22-Sep Ratio Analysis Chapter 3 23-Sep - 29-Sep Chapters 1-3 Week 3 Pre Quiz opens DB Intro due by DB comment due by 30-Sep and closes 18-Nov - NAU POLICY STATEMENTS: Please review the following policy statements established by the University. 9 25-Nov and closes 2-Dec and closes 9-Dec and closes