Alternative Risk-based Levies in the Pension Protection Fund for

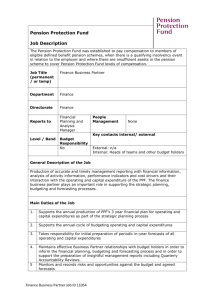

advertisement