Accounting Chapter 24 • Generally accepted accounting principles

advertisement

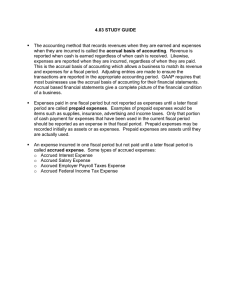

Accounting Chapter 24 • • • • • • Generally accepted accounting principles (GAAP) require that revenue and expenses be recorded in the accounting period in which revenue is earned and expenses incurred. Adjusting entries are made at the end of the fiscal period for revenues and expenses resulting from notes payable and notes receivable Accrued Revenue: revenue earned in one fiscal period but not received until a later fiscal period Adjusting entry for accrued revenue increase a revenue account and a receivable account The income statement will then report all revenue earned for the period even though some of the revenue has not been recorded yet The balance sheet will report all the assets, including the accrued revenue receivable Section 1 • • • • • • • • • • • • Accrued Interest Income: interest earned but not received yet Work Sheet o Debit Interest Receivable in the adjustment columns for the amount of interest due for the time period that has passed o Credit Interest Income for the same amount and label with a small letter in a () Record the Adjusting Entry to the General Journal using the same accounts Then post this transaction to the General Ledger accounts Debit in Interest Receivable is the accrued interest income earned but not yet collected at the end of the fiscal period Interest Receivable will show up on the balance sheet as a current asset Interest Income will be on the income statement as other revenue On December 31 Interest Income is closed into Income Summary as a part of regular closing entry for income statement accounts with credit balances Reversing Entry: an entry made at the beginning of one fiscal period to reverse an adjusting entry made in the previous fiscal period Reversing entries are the exact opposite of an adjusting entry An entry is made at the beginning of a new fiscal period to reverse the Interest Receivable adjusting entry that was made at the end of the previous fiscal period Reversing an adjusting entry for accrued Interest Income o Write Reversing Entries in General Journal o o • Debit Interest Income Credit Interest Receivable Collecting a note receivable issued in a previous fiscal period – record in CR journal • Notes Receivable credit in general columns for principal amount • Interest Income credit for full interest amount • Cash debit total amount received • Post the amounts in the General Columns of Cash Receipts journal to ledger accounts Section 24-2 • • • • • • • • • • • • • • Accrued Expenses: expenses incurred in one fiscal period but not paid until a later fiscal period The adjusting entry increases an expense account and increases a payable account Accrued Interest Expense: interest incurred but not yet paid. Plan the adjustment on the worksheet and then journalize to General Journal and post to ledgers. Debit Interest Expense and credit Interest Payable New balance of Interest Expense is the total amount of interest expense incurred during the fiscal period. Interest Payable balance indicated the interest owed on December 31 that will be paid the next fiscal year Interest Payable account balance will show as a current liability on the Balance Sheet Interest Expense balance will show on the Income Statement as an other expense On December 31, Interest Expense is closed as part of regular closing activities – credit Interest Expense and debit Income Summary On January 1, need to reverse the adjusting entry – do the exact opposite of the adjusting entry regarding Interest Expense The reversing entry creates a credit balance in the Interest Expense – this is the opposite of the normal balance The reversing entry to Interest Payable reduces the balance to zero. Paying a Note Payable signed in a previous fiscal period • Debit Notes Payable in the General debit column of Cash Payments journal for the principal of the note • Debit Interest Expense in General debit column of CP journal • Credit Cash for the full amount received. • Post the amounts in the General columns of the CP journal to ledgers