Accounting 1 Chapter 2 Test/Quiz

advertisement

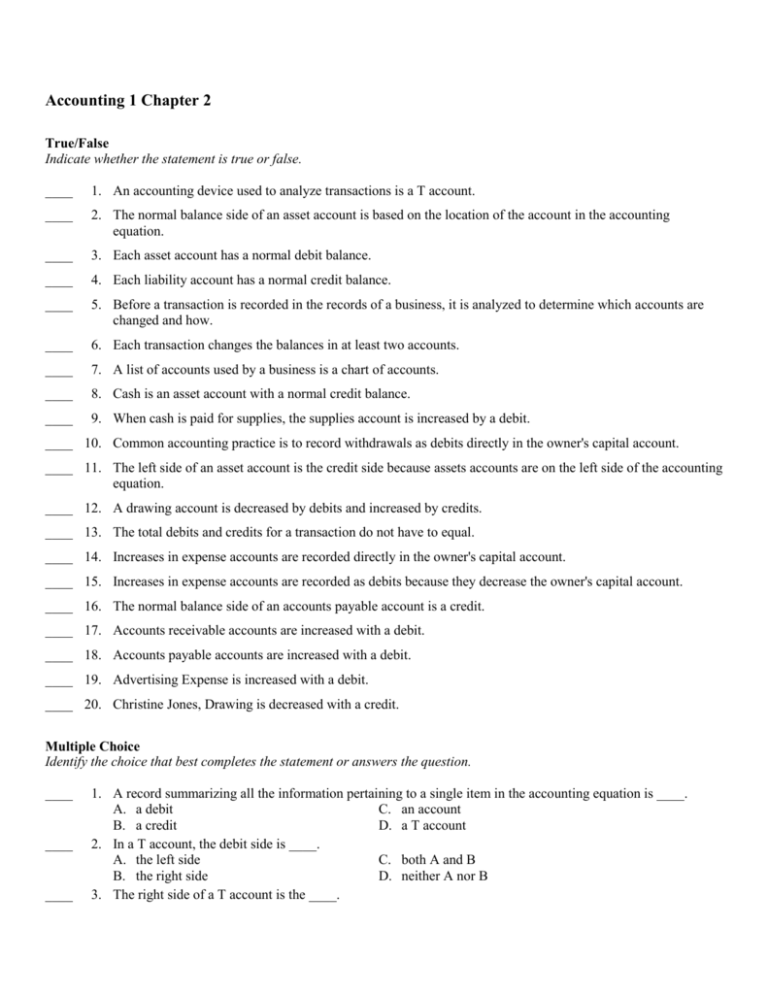

Accounting 1 Chapter 2 True/False Indicate whether the statement is true or false. ____ 1. An accounting device used to analyze transactions is a T account. ____ 2. The normal balance side of an asset account is based on the location of the account in the accounting equation. ____ 3. Each asset account has a normal debit balance. ____ 4. Each liability account has a normal credit balance. ____ 5. Before a transaction is recorded in the records of a business, it is analyzed to determine which accounts are changed and how. ____ 6. Each transaction changes the balances in at least two accounts. ____ 7. A list of accounts used by a business is a chart of accounts. ____ 8. Cash is an asset account with a normal credit balance. ____ 9. When cash is paid for supplies, the supplies account is increased by a debit. ____ 10. Common accounting practice is to record withdrawals as debits directly in the owner's capital account. ____ 11. The left side of an asset account is the credit side because assets accounts are on the left side of the accounting equation. ____ 12. A drawing account is decreased by debits and increased by credits. ____ 13. The total debits and credits for a transaction do not have to equal. ____ 14. Increases in expense accounts are recorded directly in the owner's capital account. ____ 15. Increases in expense accounts are recorded as debits because they decrease the owner's capital account. ____ 16. The normal balance side of an accounts payable account is a credit. ____ 17. Accounts receivable accounts are increased with a debit. ____ 18. Accounts payable accounts are increased with a debit. ____ 19. Advertising Expense is increased with a debit. ____ 20. Christine Jones, Drawing is decreased with a credit. Multiple Choice Identify the choice that best completes the statement or answers the question. ____ ____ ____ 1. A record summarizing all the information pertaining to a single item in the accounting equation is ____. A. a debit C. an account B. a credit D. a T account 2. In a T account, the debit side is ____. A. the left side C. both A and B B. the right side D. neither A nor B 3. The right side of a T account is the ____. ____ 4. ____ 5. ____ 6. ____ 7. ____ 8. ____ 9. ____ 10. ____ 11. ____ 12. ____ 13. ____ 14. ____ 15. ____ 16. ____ 17. ____ 18. A. debit side C. normal balance side B. credit side D. equity side If an amount is recorded on the side of a T account opposite the normal balance side, the account balance is ____. A. increased C. unaffected B. decreased D. correct The normal balance side of an asset account is the ____. A. debit side C. decrease side B. credit side D. right side When the owner invests cash in a business, the owner's capital account is ____. A. increased by a debit C. decreased by a debit B. increased by a credit D. decreased by a credit When a business buys an asset on one date and agrees to pay on a later date, the transaction is ____. A. delayed C. increased B. on account D. none of the above When a business pays cash on account, a liability account is ____. A. increased by a debit C. decreased by a debit B. increased by a credit D. decreased by a credit When a business receives revenue, Sales is ____. A. increased by a debit C. decreased by a debit B. increased by a credit D. decreased by a credit The amount paid for rent is recorded as a debit to ____. A. Miscellaneous Expense C. Supplies B. Rent Expense D. Cash The values of all things owned (assets) are on the accounting equation's ____. A. left side C. credit side B. right side D. none of the above An amount recorded on the left side of a T account is ____. A. a debit C. normal balance B. a credit D. none of the above The normal balance side of any liability account is ____. A. the debit side C. the left side B. the credit side D. none of the above Debits must equal credits ____. A. in a T account C. on the equation's right side B. in the equation's left side D. in all transactions Decreases in any liability account are shown on a T account's ____. A. debit side C. right side B. credit side D. none of the above Increases in a revenue account are shown on a T account's ____. A. debit side C. left side B. credit side D. none of the above The normal balance side of any revenue account is ____. A. the debit side C. the left side B. the credit side D. none of the above The normal balance side of any expense account is ____. A. the debit side C. the right side B. the credit side D. none of the above ____ 19. When $1,500.00 cash is received on account, ____. A. Sales is increased with a credit and Cash is increased with a credit B. Accounts Receivable is increased with a debit and Cash is increased with a credit C. Accounts Receivable is decreased with a credit and Cash is increased with a debit D. Accounts Receivable is decreased with a debit and Cash is increased with a debit ____ 20. A sale on account ____. A. increases an owner's equity account and increases an asset account B. increases a liability account and increases an asset account C. increases an owner's equity account and increases a liability account D. increases an owner's equity account and decreases a liability account Accounting 1 Chapter 2 Answer Section TRUE/FALSE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: T T T T T T T F T F F F F F T T T F T T PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 MULTIPLE CHOICE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: C A B B A B B C B B A A B D A B B A 19. ANS: C 20. ANS: A PTS: 1 PTS: 1