COMPANIES ORDINANCE, 1984.

14

3.

4.

5.

6.

14.

15.

16.

17.

18.

10.

11.

12.

13.

8.

9.

Levy of 1% Special surcharge on imports excluding vegetables/pulses, edible oil/ghee, crude petroleum, furnace oil, HSD, medicines, fertilizers, imports under chapter 99, temporary imports etc.

Amnesty scheme for condonation of delays in submission of installation/ consumption certificates etc.

Amnesty from fines /penalties and surcharges, on payment of principal amount.

Downward revision of 5 yrs. capping to 3 yrs. for import of old/used cars/jeeps.

5 yrs. tariff plan for auto sector.

Reduction/elimination of duty rates on specified diesel generating sets.

Inputs used by the newspaper industry are being provided at concessionary rate.

Duty rates on equipments for broadcasting sector have been reduced to 5%.

Extention of incentives for expansion and up-gradation of existing hospitals.

Legislative changes have been suggested for simplification of law/ procedures.

Section 25 and 25A of the Customs Act have been amended to address the phenomenon of under invoicing.

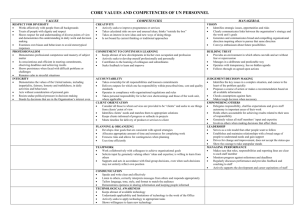

COMPANIES ORDINANCE, 1984.

1.

2.

7.

Certain amendments are made in the definitions, in order to include computer network, floppy, diskette, magnetic cartridge tape, CD-Rom or any other computer readable media, in law.

Transfer of registered office from one province to another or Islamabad capital territory does not tantamount to change in memorandum.

The period of AGM has been decreased from four months to three months.

A person holding more than 12.5% voting shares in a listed company may apply for requiring the company to hold fresh election of directors.

Listed companies shall have an independent share registrar.

Commission takes the powers to allow Investments in associated companies and undertakings. In case of default, fine limit is enhanced from one million to ten million rupees. The earlier exemption given by this section to banking companies, financial institutions, corporate brokerage houses etc.

is withdrawn.

The period for presentation of accounts has also been reduced to three months instead of four months.

8.

9.

10.

11.

12.

13.

The Commission or members holding not less that 20% voting rights in a company can hold a special audit of the company.

Private limited companies having paid up capital of more than 7.5 million rupees shall also send to the registrar a copy of audited financial statements, as in the case of listed companies.

All the reports required by the Commission under section 246 shall be audited by an auditor.

A lot of changes have been made to section 282 of the ordinance, which addresses specific interest of the NBFC’s.

Penalties have been enhanced manifold.

The Commission has been empowered to make regulations, issue directives, circulars and guidelines necessary to carry out the purposes of this Ordinance.

15

16

INCOME TAX ORDINANCE, 2001

Significant Amendments

Amalgamation

Sec. 2(1A)

The Finance Bill seeks to broaden the scope of term “amalgamation” by bringing in its folder the companies engaged in providing services and not being a trading company or companies.

Under the current scenario the amalgamation is the merger of one or more banking companies, non financial institutions, insurance companies, companies owing and managing industrial undertakings subject to the conditions mentioned therein.

Now the merger of one or more of companies engaged in providing services under the same terms and conditions shall constitute amalgamation.

The merger of one or more of trading company or companies does not fall within the ambit of term “Amalgamation” in view of the proposed amendment.

The merger of the companies specified in sub section (1A) shall be entitled to the incentive provided for merger of companies including services providing companies.

Eligible person

Sec. 2(19A)

The Bill seeks to amend the definition of eligible person by replacing the word “ has obtained “ with the word

“ holds” and inserting “or Computerized National Identity Card” after the word National Tax Number. After the proposed amendment the expression “eligible person” for the purpose of Voluntary Pension System Rules

2005 means, an individual Pakistani who holds: a.

b.

A valid National Tax Number (NTN); or

Computerized National Identity Card (CNIC) but does not include an individual who is entitled to benefit under any other Approved employment pension or annuity scheme.

The proposed amendment is remedial in nature and to rationalize the definition of eligible person.

Private Equity and Venture Capital Fund and Private Equity and Capital Fund Management Company

Sec. 2(45A), 2(45B), 18(4), 62,

The Bill propose to insert new sub section (45A) and (45B) to widening the scope of investment in Real Estate through Fund Management Companies having features similar to Modarba and Mutual Fund Companies.

Whereby the savings of the general public could be mobilized and invested in the collective investment schemes of Real Estate.

The Bill propose to define the expression “Private Equity and Venture Capital Fund” as a fund registered with the SECP under the Private Equity and Venture Capital Fund Rules, 2007 and the term “Private Equity and

Capital Fund Management Company” means a company licensed by SECP under the Private Equity and

Venture Capital Fund Rules 2007.

The Bill seeks to insert the expression “Private Equity and Venture Capital Fund” in sub section 4 of section

18 meaning thereby the amount distributed by Private Equity and Venture Capital Fund out of its income from profit on debt and received by a banking company or a non finance company shall be chargeable under the head “income from business’” and not under the head “income from other sources”.

The Bill proposes an amendment in clause 57 of Part I of Second schedule by virtue of which income derived

by Private Equity and Venture Capital Fund shall be exempt from tax, subject to distribution of 90% of its income among the unit holders.

The Bill also seeks to insert clause 99A in Part I of Second schedule whereby the profit and gain accruing to a person on sale of immovable property to a Real Estate Investment Trust upto June 30, 2010 shall be exempt from charge of tax.

The Bill also seeks to amend clause 101 in Part I of Second schedule whereby profit or gain derived by the

Private Equity and Venture Capital Fund upto 2014 is proposed to exempt from tax.

The Bill also seeks to amend clause 103 in Part I of Second schedule whereby any distribution received by the tax payer from a Private Equity and Venture Capital Fund out of capital gain of the said fund on which tax has already been paid is proposed to exempt from tax.

The Bill also propose to insert clause 5B in Part II of Second schedule whereby the tax in respect of capital gains derived by a person from the sale of shares or assets by a private limited company to Private Equity and Venture Capital Fund shall be charged at the reduced rate of ten per cent of such gains.

The Bill also seeks to amend clause 11, sub clause (xii) of Part IV of Second schedule whereby Private Equity and Venture Capital Fund shall be immune form application of minimum tax liability u/s 113.

The Bill also seeks to amend clause 33 of Part IV of Second schedule whereby the provisions of section

151(profit on debt) and section 233 (brokerage and commission) are not applicable to the person making such payments to the Private Equity and Venture Capital Fund.

The Bill also seeks to amend clause 47B of Part IV of Second schedule whereby the person making payment to the Private Equity and Venture Capital Fund on account of dividend, profit on debt or brokerage and commission is not required to deduct tax under section 150,151 and section 233 respectively.

Small company

Sec. 2(59A) a.

b.

c.

d.

The Bill seeks to rationalize the definition of Small company by imposing additional condition of having employees not more than 250 at any time during the year and also proposes to enhance the existing limit of

Rs. 200 million of annual turnover to Rs. 250 million p.a.

Pursuant to the aforesaid amendment the small company is a company registered under the Companies

Ordinance 1984, on or after the 1st day of July 2005 and fulfills the following conditions simultaneously: paid up capital plus undistributed reserves are not more than Rs. 25 million.

annual turnover does not exceed Rs. 250 million.

not formed by splitting up or the reconstitution of a company already in existence.

total employees are not more than 250 at any time during the year.

Income from business

Sec. 18

The Bill seeks to insert the expression “Private Equity and Venture Capital Fund” in sub section 4 of section

18 meaning thereby the amount distributed by Private Equity and Venture Capital Fund out of its income from profit on debt and received by a banking company or a non finance company shall be chargeable under the head “income from business’” and not under the head “income from other sources”.

Federal and Provincial Government and local authority income

Sec. 49

The Bill seeks to insert a proviso after sub section 3 of section 49 by virtue of which the income of the following shall be brought under tax net:

17

18 a.

b.

Corporation, company, regulatory authority, a development authority or other body or institution established by or under a Federal law or a Provincial law or an existing law or a corporation, company or other body or institution set up, owned and controlled, either directly or indirectly, by the Federal Government or a Provincial Government.

The ultimate destination of such income is not a bar for the purpose of charge of tax in view of this amendment as laid down in Article 165A of the Constitution of the Islamic Republic of Pakistan.

Set off of losses of companies operating hotels

Sec. 56A

The Bill seeks to insert a new section 56A by virtue of which a company registered in Pakistan or Azad Jammu and Kashmir (AJK) and operating hotels in Pakistan or AJK shall be entitled to setoff losses sustained in

Pakistan or AJK in a tax year under the head “income from business” against the income of the company in

Pakistan or AJK as the case may be subject to section 56 and 57.

Set off of business loss consequent to amalgamation

Sec. 57A

The Bill seeks to substitute sub section 1 of section 57A, in pursuant to which assessed losses of the amalgamating company or companies for the tax year shall be set off against the business profit and gain of the amalgamated company and vice versa in the year of amalgamation. This provision shall not be applicable to brought forward and capital losses.

Where the loss could not be adjusted against the profit and gain for the tax year than the unadjusted losses shall be carry forward for adjustment upto a period of six year succeeding the year of amalgamation.

Group taxation

Sec. 59AA c.

d.

e.

f.

g.

a.

b.

The Bill seeks to insert a new section 59AA to introduce a new concept of group taxation, whereby the holding company and a wholly owned subsidiary company may be taxed as a one fiscal unit.

The taxation of consolidated income of a group as one fiscal unit is an option and not obligatory. Where such option is exercised the following requirement is to be met:

Consolidated group accounts as required under the Companies Ordinance, 1984 are required to be made.

Computation of consolidated income and tax payable thereon shall be made available for the purpose of taxation

Irrevocable option for taxation as one single unit shall be given by the companies in the group.

Company under the group shall be locally incorporated under the Companies Ordinance, 1984.

Relief under the group taxation will not be available for the losses prior to the formation of the group.

Accounts of the group company shall be prepared and audited by the Chartered Accountants as required under the Companies Ordinance, 1984.

The CBR is empowered to make rules regulating the group taxation.

The proposed amendment of group taxation is in consonance with International practices and also consistent with the concept that no one can make profit by selling goods to itself, thus the inter group purchase, sales, income, expenses, investments needs to be eliminated alongwith unrealized profits on stocks purchased from inter group so that real income of the group could be deduced for the purpose of taxation.

Group relief

Sec. 59B

Pursuant to the insertion made by the Bill a company being subsidiary of a holding company is entitled to surrender its assessed losses for the tax year other than capital losses and brought forward business and capital losses in favor of the holding company or between the subsidiary of the holding company.

a.

b.

c.

d.

e.

f.

g.

h.

The surrendered losses of the subsidiary could be claimed by the holding company or subsidiary company of the holding company for setoff against the business income in the tax year and following two tax years subject to the conditions listed below:

Continuation of ownership for the five year of the share capital of the subsidiary company to the extent of 55% in case of listed company and 75% in case of other company.

Group companies are not engaged in trading businesses,

Holding company being a Private ltd. company having 75% holding in the subsidiary company will get itself listed within three years from the year in which loss is claimed.

Group companies are locally incorporated companies incorporated under Companies Ordinance, 1984

The board of directors of the respective compniaes have accorded the approval to the loss surrendered and the loss claimed.

Continuation of same business during the aforesaid period of three years by the subsidiary company.

Group accounts are audited by the Chartered Accountants prescribed for listed companies under the

Companies Ordinance, 1984

The group company observes the code of corporate governance as provided under the Companies

Ordinance, 1984.

The assessed losses of the subsidiary cannot be surrendered for setoff against the income of the holding company for more than three tax years.

Surrendered losses by the subsidiary company not adjusted against the income of the holding company for the aforesaid three tax years shall be carry forward as unadjusted losses by the subsidiary company in accordance with section 57.

Where the share of subsidiary company is disposed off by the holding company during the five year to bring the ownership less than 55% or 75% as the case may be and in that case it is obligation on the part of holding company to offer amount of profit for taxation in the year of disposal on which tax have been saved due to setoff of loss by the subsidiary company.

Loss claiming company may transfer cash to the loss surrendering compnay equal to the amount of tax payable on the profit to be setoff against the acquired losses subject to the approval of board of directors. The transfer of cash under the circumstances shall not be treated as taxable event for both the companies.

Inter transfer of shares between the company and the shareholders shall not be treated as taxable event provided the transfer is to acquire the share capital for the purpose of forming the group and the approval of

SECP and SBP has been obtained. Sale and purchase from third party of shares will be a taxable event.

In case of a holding company being a public listed company must hold 55% or more shares in the subsidiary company and in case there is no listed company in the group then the holding company must hold 75% shareholding of the subsidiary company.

Investment in shares

Sec. 62

The Bill seeks to enhance the limit from Rs. 200,000 to Rs. 300,000 for availing the tax credit in respect of investment in shares.

Principles of taxation of associations of persons, Taxation of members of an association of persons

Sec. 92,93

The Bill seeks to amend section 92, whereby sub section 2,3,4 and 5 dealing with professional firms have been abolished.

Pursuant to the aforesaid amendment professional firms shall be treated at par with other AOP’s and shall be liable to tax accordingly.

Section 93 dealing with the taxation of members of the professional firm has been abolished consequent to the aforesaid amendment.

19

20

Disposal of business by individual/AOP to wholly-owned company.

Sec. 95,96, 97

The Bill seeks to omit the expression “at fair market value” for the purpose of acquisition of business by the wholly owned company form individual/ AOP and from another wholly owned company. This amendment is in line with the concept of group taxation.

Disposal of asset under a scheme of arrangement and reconstruction.

Sec. 97A

Pursuant to the insertion of new section 97A, regarding disposal of asset under the schemes of arrangement and reconstruction, no profit or loss could be treated as a taxable event between the companies under such schemes in view of section 282L and 284 to 287 of the Companies Ordinance, 1984 and 48 of the Banking

Ordinance, 1962 subject to the conditions stipulated in the newly inserted section.

Where the shares are issued, cancelled, exchanged or received as a result of scheme of arrangement or reconstruction against the aforesaid sections of the Companies Ordinance, 1984 and of the Banking Ordinance,

1962 and approved by the High Court, SBP or SECP on or after 1st day of July 2007, no loss or profit is set to arise on such transactions for the purpose of taxation.

Special provisions relating to banking business.

Sec.100A

The Bill seeks to insert section 100A in pursuant to which income, profit or gain of the banking company and tax thereto shall be computed in accordance with the newly inserted seventh schedule.

These provisions shall be applicable to the profits or gains of the banking company relevant to the tax year

2008 and onward.

Tax on Income of certain persons.

Sec.113A

By virtue of amendment in section 113A by the Bill the retailers shall not be entitled to claim any adjustment of withholding tax collected or deducted under any heads during the year.

The Bill also seeks to reduce the rate of tax form 0.75% to 0.50% of the turnover of a Retailer being individual or AOP whose turnover is upto Rs. 5 million for any tax year and he has opted for payment of such tax as a final tax.

Tax on Income of certain retailers.

Sec.113B

The Bill seeks to amend section 113B whereby existing rate of 1% of turnover which form part of single stage sales tax of 3% of turnover under the Sales tax special procedures Rules 2006 shall be omitted and the following new rates and turnover is substituted:

S.No

Amount of turnover

1.

Where turnover exceeds Rs.5,000,000 but does not exceed Rs.10,000,000

Rate of tax

Rs.25,000 plus 0.5% of the turnover exceeding Rs.5,000,000

2.

Where turnover exceeds Rs.10,000,000 Rs. 50,000 plus 0.75% of the turnover exceeding Rs.10,000,000.

The bill also proposes that the retailer shall not be entitled to claim any adjustment of withholding tax collected or deducted under any head during the year.

Return of income.

Sec.114

The Bill seeks to amend sub section 2 of section 114 whereby the Board is empowered to make Rules relating to electronic filing of returns, documents etc.

Wealth statement.

Sec.116

The Bill seeks to make amendment in section 116 and impose an additional condition that where the declared income of a person for the current tax year exceeds Rs. 500,000/-. He is required to file wealth statement with return. Earlier there were two conditions for filing of wealth statement ie., a.

b.

where the last declared income is Rs. 500,000/- or more or where the last assessed income is Rs. 500,000/- or more

Earlier the person was not required to file the wealth statement where his last declared or assessed income was less than Rs. 500,000/- and current year declared income was Rs. 500,000/- or more.

Appointment of the Appellate Tribunal

Sec.130

The Bill seeks to make amendment in sub section 4 of section 130 in pursuant to which Commissioners and

CIT Appeals are eligible for appointment as Accountant members of ITAT.

Advance tax paid by the taxpayer

Sec.147

The Bill seeks to broaden the scope of advance tax and propose to insert new sub section 4AA and 6A in the said section.

In pursuant to insertion of sub section 4AA the working of payment of advance tax shall be made keeping in view the minimum tax liability in terms of section 113 of the Income Tax Ordinance, 2001

Consequent to the insertion of sub section 6A, advance tax shall be payable by the company in the absence of last assessed income. In other words the tax shall be payable in the first year of operation. The amount of advance ax shall be estimated quarterly on the basis of accounting profit of the company.

The amount of advance tax so computed shall be paid keeping in view the minimum tax liability under section

113 as provided in newly inserted sub section 4AA and also making the adjustment of amount of tax already paid.

Imports

Sec.148

The Bill seeks to substitute sub section 2 of section 148, whereby the CBR is empowered to specify the goods or classes of goods or person or classes of persons importing such goods or classes of goods on which sub section 1 dealing with collection of tax on import shall not be applicable.

The bill also seeks to omit sub section 3 and sub section 4 of section 148 by virtue of which the manufacturers importing raw material for own use were entitled to lower rate exemption certificate facility upto 75%.

Similarly manufacturers liable to advance tax were entitled to exemption certificates in respect of collection of tax on imported raw material now it has been withdrawn. However, sub section 4A has been substituted in pursuant to which all the persons except the person covered under PTR are entitled to exemption certificate facility. Provided the Commissioner is satisfied that the taxpayer is not likely to pay any tax other than tax u/s

113 (minimum tax). The Commissioner shall issue exemption certificate from tax collectable u/s 148 upon receipt of application in writing from the person requiring such certificate.

21

22 d.

e.

f.

g.

a.

b.

c.

h.

i.

The Bill also seeks to amend clause (c) of sub section 7 of section 148 and replace the word “car” with “motor vehicles” which are precluded from the final tax regime.

The Bill also seeks to insert clause (d) in sub section 7 of section 148 in pursuant of which large import house shall also fall outside the ambit of final tax regime provided the following conditions are fulfilled.

have paid-up capital of exceeding Rs.100 million; have imports exceeding Rs.500 million during the tax year; own total assets exceeding Rs.100 million at the close of the tax year; is single object company; maintain computerized records of imports and sale of goods; maintain a system for issuance of 100% cash receipts on sales; present accounts for tax audit every year; is registered with Sales Tax Department; and made sales to only Sales Tax registered persons a.

b.

c.

The bill also seeks to amend the definition of value of goods given in sub section 9 of section 148. The value of goods for the purpose of collection of tax on import stage is the value determined under section 25 of the

Custom Act and increased by the custom duty, federal excise duty and sales tax payable on import of such goods.

The rate of collection at the import stage has been reduced from 6% to 5%.

The bill also seeks to insert clause 13 in part II of second schedule by virtue of which reduced rate of withholding tax of 1% is prescribed to be collected on the import of capital goods and raw material other than polyester filament yarn exclusively for its own use by a manufacturer registered with sales tax department.

The bill also seeks to amend clause 56 of part IV of second schedule by virtue of which the import of the following items are exempt form collection of tax at import stage.

d.

Capital goods and raw material imported by manufacturer exporter registered with Sales Tax Department as a manufacturer.

Petroleum (E&P) companies covered under SRO.678(I)2004 dated 07.08.2004 except motor vehicles imported by such companies.

Companies importing high speed diesel oil, light diesel oil, high octane blending component or motor spirit, furnace oil, JP-1, MTBE, kerosene oil, crude oil for refining and chemical use in refining thereof in respect of such goods; and

The re-importation of re-usable containers for re-export qualifying for customs-duty and sales tax exemption on temporary import under the Customs Notification No. S.R.O. 344(I)/95 dated the 25th day of April, 1995

Salary

Sec.149

The bill seeks to amend section 149 to remove the anomalies of non adjustment of withholding tax in any other head and non considering tax credits available in the law. In pursuant to the amendment, adjustment of tax withheld under any other head and tax credit admissible under section 61, 62, 63 and 64 shall be admissible and available to the employee.

The bill also seeks to amend sub section 1 of section 149 by virtue of which the adjustment of the following items shall be made with respect to deduction of tax on the salary of the employee by the employer: a.

b.

c.

tax withheld from the employee under this Ordinance during the tax year; any excess deduction or deficiency arising out of any previous deduction; or failure to make deduction during the year

These amendments are beneficial to the employee and have been made on the persistent demand of the employees and seem to be sensible and equitable.

Payment to non resident

Sec.152

The bill seeks to amend sub section 2 of section 152 dealing with withholding of tax on payment to non residents by inserting the reference of sub section 1A and thus excluding the payment on account of construction contracts to non residents mentioned in sub section 1A form the purview of sub section 2 as it has separately been dealt.

Payments for goods and services

Sec.153

The bill seeks to abolish sub section 1A of section 153 which was inserted through Finance Act, 2006 in pursuant to this sub section exporters or export house were required to deduct tax on the payment to resident or non resident having permanent establishment on account of services of stitching, dying, printing, embroidery etc, at the time of making payments relating to exports.

The bill also seeks to insert in sub section 5 a new clause (bb) by virtue of which sub section 1 of section 153 dealing of tax deduction on goods and services shall also not apply to cotton ginners who deposit the amount equal to the amount of tax deductible on the payments made to him and furnish evidence to the withholding agent.

The bill also seeks to insert a proviso in sub section 6 of section 153 by virtue of which tax deducted on the payment received on account of following shall not fall within the ambit of final tax regime.

a.

b.

advertisement services, by owners of newspapers and magazines; sale of goods and execution of contracts by a public company listed on a registered stock exchange in Pakistan.

The Bill also seeks to insert a new sub section 6B by virtue of which payment on account of sale of goods form which tax is deductible shall fall within the final tax regime in respect of individual and AOP however this sub section shall be applicable for the tax year 2007.

The bill seeks to omit sub section 8A inserted by the Finance Act, 2006 regarding deduction of 2% over and above the regular rate on payment made to person not disclosing his CNIC or NTN.

The bill seeks to reorganize the rate of advance tax to be deducted from the payment on account of services.

The services have been classified into two kinds given below alongwith rate of tax deduction: a.

b.

Transport services @ 2% of the gross amount payable.

Other services @ 6% of the gross amount.

The bill seeks to grant immunity from withholding tax under sub section 1 of section 153 to the payment received by Permanent Establishment of Non-resident Petroleum Exploration and Production (E&P) Companies on account of supply of petroleum products imported by the same person under the Govt. of Pakistan deregulation policy of POL products.

The bill seeks to grant exemption from the withholding tax under sub section 1 of section 153 to the payment received by the travel agent on account of sale of travel ticket provided that he had paid withholding tax on his commission income.

The bill seeks to insert a new clause 57A in part IV of second schedule by virtue of which large import house shall be exempt from the operation of withholding tax in terms of section 153 and will immune from the application of section 169 regarding final tax regime.

The above exemption is subject tot the condition that such large import houses have fulfilled all the conditions laid down in section 148.

23

24

Tax collected or deducted as final tax

Sec. 169

The Bill seeks to amend sub section 3 of section 169 by virtue of which inter-corporate dividend within group companies as referred in section 59B shall stand excluded from the purview of final tax regime.

National Tax Number Certificate

Sec. 181

The bill seeks to insert a proviso in sub section 3 of section 181, whereby the Board is empowered to allow use of Computerized National Identity Card in place of National Tax Number in the case of individuals for tax purposes.

Purchase of motor car

Sec. 231B

The bill seeks to broaden the withholding tax regime and brining in the persons purchasing motor cars within withholding tax bracket.

Every manufacturer or authorized dealer of motor cars is obliged to collect tax from the purchaser at the time of sale at the rate of 5% of the gross purchase price of the motor car.

The above provisions shall not apply in case of purchase made by the Federal Govt., Provincial Govt., a foreign diplomat or diplomatic mission in Pakistan.

CNG stations

Sec. 234A

The bill seeks to fix rate of tax collection @ 6% of the gas consumption charges to be collected by the person supplying gas to the CNG station in the same manner as gas collection charges are charged. The tax so collected shall be the final tax liability of the CNG station.

Electricity consumptions

Sec. 235

The bill seeks to insert sub section 4 in section 235 by virtue of which tax collected on the amount of electricity bills shall be minimum tax on the income of the person other than a company.

There shall be no refund of tax so collected unless the tax so collected is in excess of amount of tax chargeable under the Ordinance in case of a company.

Transition of Federal Board of Revenue

Sec. 239A

The bill seeks to insert a new section 239A in pursuant to which any reference to the Central Board of Revenue, wherever occurring, in this Ordinance and the rules made thereunder and Notifications, Orders, or any other instrument issued thereunder shall be construed as a reference to the Federal Board of Revenue on the commencement of the Federal Board of Revenue Act, 2007.

Amendments in First Schedule

Part I

Tax for retailers – Sec 113A

The Bill seeks to reduce the rate of tax form 0.75% to 0.50% of the turnover of a Retailer being individual or

AOP whose turnover is upto Rs. 5 million for any tax year and he has opted for payment of such tax as a final tax.

Tax for companies

The Bill seeks to remove rate disparity in corporate sector and introduce a uniform tax rate of 35% for all companies for the tax year 2007 and onward

Tax rate on Dividend – Sec. 5

The Bill seeks to remove rate disparity in case of a dividend received by a public company or an insurance company or any other resident company which were at 5% and in case of any other person, rate of tax on dividend was 10%.

Now the Bill prescribe uniform rate of 10% of the gross amount of dividend received by any person.

Part II

Part III

Rat of advance tax on import – Sec. 148

The rate of advance tax to be collected by the Collector of Customs under section 148 has been reduced from

6% to 5% of the value of the goods including polyester filament yarn.

Rat of advance tax for payment of goods or services – Sec. 153

The Bil seeks to reorganize the rate of advance tax to be deducted from the payment on account of services.

The services have been classified into two kinds given below alongwith rate of tax deduction: a.

b.

Transport services @ 2% of the gross amount payable.

Other services @ 6% of the gross amount.

Tax on exports

The Bill seeks to remove disparity in withholding tax rates on export of different categories which varies from

0.75% to 1.50% of the proceeds of export.

Now the Bill seeks to fix uniform withholding tax rate on export of 1% of the proceeds of export of all sorts of exports.

Withholding tax on CNG – 234A

The Bill seeks to fix rate of tax collection @ 6% of the gas consumption charges to be collected by the person supplying gas to the CNG station which shall be final tax liability of the CNG station.

Part IV

Rat of tax on purchase of motor car – Sec. 231B

The Bil seeks to broaden the withholding tax regime and bringing persons purchasing motor cars within withholding tax bracket..

Every manufacturere or authorized dealer of motor cars are obliged to collect tax from the purchaser at the time of sale at the rate of 5% of the gross purchase price of the motor car.

25

26

Amendments in Second Schedule

PART I – Exemptions from total income

Private Equity and Venture Capital Fund - Clause 57

The Bill seeks to grant the exemption to the income derived by the Private Equity and Venture Capital Fund approved by SECP, provided not less than 90% of its income is distributed among the unit holders for a tax year.

Micro Finance Banks - Clause 66

The Bill seeks to grant exemption to the income derived by Micro Finance Banks for a period of five years starting from 1 st

day of July 2007. It was a persistent demand of banks engaged in micro financing for raising the living standard and uplifting the economic and social conditions of the low income groups.

The aforesaid exemption is subject to the condition that such banks shall not declare and pay dividend to their shareholders and all their profits and gains shall be utilized for the micro financing operations only.

Income of Mutual Fund and Investment Company - Clause 99

The Bill seeks to amend the clause 99, whereby the income, except income arising from continuous funding derived by Mutual Fund and Investment Company shall be exempt subject to the conditions mentioned therein.

Profit or gain on sale of immovable property to REIT – Clause 99A

The bill seeks to insert a new clause by virtue of which profit or gain accruing to a person on sale of immovable property to REIT shall be exempt from tax upto June 30, 2010.

Profit and gain of Private Equity and Venture Capital Fund – Clause 101

The Bill seeks to grant exemption to the profit and gain derived by Private Equity and Venture Capital Fund upto June 30, 2014.

Distribution received out of capital gain from Private Equity and Venture Capital Fund – Clause 103

The Bill seeks to amend clause 103 by virtue of which any distribution received by a taxpayer out of capital gain of Private Equity and Venture Capital Fund shall be exempt.

Capital gains – clause 110

The Bill seeks to extend the period of exemption to capital gains for a further one year upto June 30, 2008.

Thus the capital gains arising from the sale of Modarba certificates or any instrument of a redeemable capital or share of a pubic company and voucher of PTCL upto tax year ending on June 30, 2008 shall be exempt.

Corporatization of existing Stock Exchanges – Clause 110A

The Bill seeks to promote corporatization of existing stock exchanges therefore has granted exemptions to the gains arising on the transfer of capital asset of existing stock exchanges to the new corporatized stock exchange in the course of corporatization of existing stock exchanges.

Corporatization of member of stock exchange – Clause 110B

The bill also seeks to grant exemption to any gain on transfer of capital asset being a membership right held by a member of existing stock exchanges for acquiring shares and trading or clearing rights by such member in the new corporatized stock exchange in the course of corporatization of existing stock exchanges.

Hydel power projects in AJK or Pakistan – Clause 132

The bill seeks to insert a proviso to clause 132, whereby the companies registered in Pakistan or AJK owing and managing a Hydel power project setup in AJK or Pakistan shall be entitled to exemption under this clause.

Conversion of membership right of stock exchange into corporate entity – Clause 133A

The bill seeks to enhance the period of exemption for a period of one year form June 30, 2007 to June 30,

2008 to the income derived from transfer of membership rights, or share of stock exchange in Pakistan along with room of a stock exchange to a Company.