Econ 301: Topics in Microeconomics Answer Key to

Econ 301: Topics in Microeconomics

Sanjaya DeSilva, Bard College, Spring 2008

Answer Key to Second Homework Assignment

1. Good references are applications or extensions that use Becker or Gronau models as a primary reference. We will present three such references in class next Wed.

2. Informally, we see that C can be positive even when l = 0, and vice versa.

Whenever there is an additive (linear) component in the utility function, the two goods are substitutes. More formally, if the MRS is a finite negative number, we know that there is some substitutability between the two goods, i.e. when we give up one unit of C , we can restore the original utility level by acquiring some positive amount of l . The MRS is,

M RS = −

∂U

∂C

∂U

∂l

= −

1

3

1 + l

1 + C

(1)

Because both C and l are finite nonnegative numbers, the MRS is finite and negative. The two goods are substitutes.

Informally, we see that there is some complementarity between the two goods when there is a multiplicative component in the utility function (e.g. Cobb

Douglas function). Therefore, these two goods must be complements. More formally, if two goods are substitutes, the marginal utility from one good must be an increasing function of the quantity of other other good, i.e. when the amount of leisure increases, the marginal utility from consumption increases, and vice versa.

∂U

∂C

∂U

=

∂l

=

1

3

1

3

(1 + l )

(1 + C )

1

(2)

(3)

Note that both marginal utilities are an increasing function of the other good.

A more rigorous way to state this is to take the cross partial derivatives, and demonstrate that both cross partials are strictly positive.

∂

2

U

∂C∂l

∂

2

U

=

∂

=

∂

∂l∂C

∂U

∂C

∂l

∂U

∂C

∂l

=

1

3

> 0

=

1

3

> 0

3. The optimization problem can be written as max

C,l

1

3

( C + l + Cl ) subject to the following constraints;

(4)

(5)

(6)

P C ≤ wL + V l + L = T l ≥ 0

C ≥ 0

L ≥ 0

Note that the first constraint must hold with strict equality because the utility function is strictly increasing in both consumption and leisure, i.e.

U

1

> 0 , U

2

>

0.

When V = 0 and C = 0, it follows from the constraint that l = T and L = 0.

Similarly, when V > 0 and C > 0, L > 0. In words, if there is no nonearned income, the only way one could have positive consumption is by having a positive labor supply. Therefore, one of the last two constraints is redundant.

When V > 0 and C = 0, the budget constraint does not hold with strict equality because l = T +

V w

> T is not feasible. Another way to see this is to observe

2

(7)

(8)

(9)

(10)

(11)

that even when we allocate all time to leisure, l = T , we have a consumption level of

V

P

> 0. Therefore C = 0 is not a possible optima when V > 0.

Either way, we can ignore the nonnegativity constraint on C.

With this information, and incorporating the budget and time constraints to get the full income constraint, we can rewrite the constraints as follows,

P C + wl = wT + V l ≥ 0

T − l ≥ 0

We can now set up the Lagrangian function to maximize.

(12)

(13)

(14)

L ( C, l ) =

1

3

( C + l + Cl ) + λ

1

( wT + V − P C − wl ) + λ

2 l + λ

3

( T − l ) (15)

The FOCs are

1

(1 + l ) = λ

1

P

3

1

3

(1 + C ) = λ

1 w − λ

2

+ λ

3

P C + wl = wT + V l ≥ 0 l ≤ T

There are three possibilities.

(a) Interior solution when 0 < l < T : In this case, λ

2

= λ

3

= 0. Using this and the FOCs, we get the familiar conditions for an interior optimum.

1 + C

1 + l w

=

P

(16)

3

Inserting this in the full income budget constraint, we can solve for the optimum leisure and consumption levels.

C l

∗ a

∗ a

= w ( T − 1) + V + P

2 w w ( T + 1) + V − P

=

2 P

(b) Corner solution when l = 0: Now we can’t use the first two FOCs because λ

2

≥ 0, but we can get the solution trivially from the two binding constraints.

P C + wl = wT + V l = 0 leads to the following solutions

C b

∗

= l b

∗

= 0 wT + V

P

(c) Corner solution when l = T (or L = 0): We still can’t use the first two

FOCs because λ

3

≥ 0, but we can again use the two binding constraints trivially.

P C + wl = wT + V l = T leads to the following solutions

C c

∗ l

∗ c

= T

V

=

P

Labor force participation will be determined if, for given parameters w , P , T and V ,

U ( C a

∗

, l

∗ a

) > U ( C c

∗

, l c

∗

) (17)

4

The RHS of this expression is quite simple.

U ( C c

∗

, l

∗ c

) =

1

3

V

P

+ T +

V T

P

(18)

The LHS is a bit more complicated, and I will not do it here. The principle is simple, but the algebra seems a little too cumbersome!

There is an easier way to see this. The labor supply L

∗ can take three values.

L

∗ a

= T − w ( T − 1) + V + P

2 w

=

T + 1

2

−

V + P

2 W

L

∗ b

= 0

L

∗ c

= T

If the interior solution yields, L

∗ a

> T , L

∗

= L

∗ c

= T . If the interior solution yields, L

∗ a

< 0, L

∗

= L

∗ b

= 0. Therefore,

L

L

∗

∗

=

L

T

∗

= 0 if if

T + 1

2

V + P

>

2 W

V + P

−

2 W

T + 1

2

> T

T + 1 V + P

= − otherwise

2 2 W

4. When W is very small, V is very large or P is very large, this individual may quit the labor force. After she enters the labor force, her labor supply will increase if T or w increases, and will decrease if V or P increases.

5. Here, the maximization problem is max

C,l,L

C

α l

β

L

γ

(19) subject to the following constraints;

5

P C ≤ wL l + L = T l ≥ 0

C ≥ 0

L ≥ 0

Because the preferences are well-behaved, i.e. monotonically increasing, twice differentiable, concave and Inada conditions are satisfied, we can treat the budget constraint with strict equality, and ignore the nonnegativity constraints, i.e.

all nonnegativity constraints are non-binding because there is always a full interior solution. Note that unlike in our previous model, we won’t have a corner where L

∗

= 0 because she likes to work, and work is a complement to leisure and consumption.

Therefore, the constraint simplifies to

P C + wl = wT (25)

Note also that we can rewrite the utility function in terms of two choice variables, C and l because L is completely determined by the choice of l .

The Lagrangian function to maximize over C and l is,

C

α l

β

( T − l )

γ

+ λ ( wT − P C − wl ) (26)

The FOCs follow the familiar pattern for an interior solution,

αC

α − 1 l

β

( T − l )

γ

= λP

βC

α l

β − 1

( T − l )

γ

− γC

α l

β

( T − l )

γ − 1

= λw

Note that the LHS of the second FOC was obtained via the product rule because l appears twice in that expression.

6

(20)

(21)

(22)

(23)

(24)

Dividing the second FOC by the first FOC, we get

βC

αl

γC

−

α ( T − l ) w

=

P

(27)

For T − l , we can substitute,

P C w from the constraint. With further simplifications, we get

C =

α + γ

β w l

P

(28)

Substituting for C in the budget constraint, we get the optimal solutions for C and l .

C

∗

= l

∗

=

α + γ

α + β + γ wT

β

α + β + γ wT

We can see from the expression for l

∗ that as the individual’s preference for work γ increases, he reduces the time spent for leisure, and increases the time spent at work. Therefore, his consumption level also increases. We can see this directly if we take the partial derivative of C

∗ with respect to γ .

∂C

∗

∂γ

β

= wT

[ α + β + γ ]

2

> 0 (29)

6. Using Becker’s simple model, and assuming well-behaved preferences, we can write the optimization problem as max

R,T

U ( R, T ) subject to the following constraint;

(30)

π

R

R + π

T

T = wT + V

7

(31)

where the ”price” or opportunity cost of reading, π

R and watching TV π

T are defined as follows

π

R

= P

R b

R

+ wc

R

π

T

= P

T b

T

+ wc

T where P

R is the price of books, P

T is the price of the TV and cable or satellite services (note: because the TV is a durable, its price should be adjusted to obtain the price attributable to watching one TV show), w is the wage or opportunity cost of time, b

R is the goods intensity of reading, b

T is the goods intensity of watching TV, c

R is the time intensity of reading, and c

T is the time intensity of watching TV.

The conditions for the interior optimum is

π

R

R + π

T

∂U

∂R

π

R

∂U

∂T

=

π

T

T = wT + V

Reading is an activity that is generally more time intensive and less good intensive than watching TV, i.e.

b

R

< b

T

, c

R

> c

T

.

When our wages goes up, there is an income and substitution effect. Due to the income effect, we increase our consumption of both reading and watching

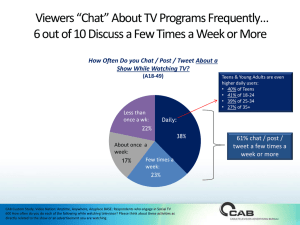

TV. We see this from the fact that the budget constraint shift out. However, the relative price of reading will also increase because reading is more time intensive than watching TV. This leads us to substitute away from reading towards watching TV. If the substitution effect dominates the income effect, as it would for most low to middle income people, we will watch TV more and read less as our wage increases.

If our nonearned income increases, there will be an increase in both activities due to an income effect. This doesn’t explain the reduction in reading.

8

The price of a TV or cable etc.has decreased more rapidly than the price of a book (Why? This is probably because providing TV programs have a large fixed cost but a very low marginal cost compared to books. It is also because globalization has reduced the price of TVs much more than the price of printed books). Therefore, the relative price of reading has increased, inducing us to read less and watch TV more.

Finally, the technology of watching TV has improved much more than the technology of reading books. Specifically, the time intensity of watching TV has fallen with the availability of a larger number of channels, better quality pictures

(big screen HDTVs etc.) commercial-free cable channels, DVRs and TIVOs etc, allowing us to get more bang for the every minute we spend watching TV. In other words, to get the same satisfaction from watching TV that we got from watching an hour of TV twenty years ago, we probably need to watch only half hour now. The technology of readings hasn’t changed much. This would lead to the relative price of watching TV to decrease, and therefore, to less reading and more watching TV. There are some technologies like audio books or e-books that have perhaps helped to restore this imbalance somewhat. Audio books allow us to multi-task while reading just like we can multi-task while watching

TV, effectively reducing the time intensity of the activity.

9