Accounting for Shipping and Handling Fees and Costs

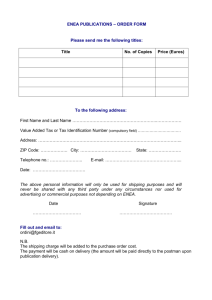

advertisement

EITF ABSTRACTS Issue No. 00-10 Title: Accounting for Shipping and Handling Fees and Costs Dates Discussed: May 17–18, 2000; July 19–20, 2000; September 20–21, 2000 References: FASB Concepts Statement No. 5, Recognition and Measurement in Financial Statements of Business Enterprises FASB Concepts Statement No. 6, Elements of Financial Statements AICPA Accounting Research Bulletin No. 43, Restatement and Revision of Accounting Research Bulletins APB Opinion No. 22, Disclosure of Accounting Policies SEC Staff Accounting Bulletin No. 101, Revenue Recognition in Financial Statements SEC Staff Accounting Bulletin No. 101B, Second Amendment: Revenue Recognition in Financial Statements ISSUE 1. Shipping and handling costs are incurred by most companies that sell goods; however, diversity in practice exists regarding the income statement classification of amounts charged to customers for shipping and handling, as well as for costs incurred related to shipping and handling. Many sellers charge customers for shipping and handling in amounts that exceed the related costs incurred. Some display the charges to customers as revenues and the costs as expenses, while others net the costs and revenues. This Issue addresses the income statement classification for shipping and handling fees and costs by companies that record revenue based on the gross amount billed to customers under Issue No. 99-19, "Reporting Revenue Gross as a Principal versus Net as an Agent." This Issue excludes from its scope shipping and handling fees billed and costs incurred by shipping companies or businesses that provide those services on an outsourcing basis. Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 1 2. The components of shipping and handling costs, and the determination of the amounts billed to customers for shipping and handling, may differ from company to company. Some companies define shipping and handling costs as only those costs incurred for a third-party shipper to transport products to the customer. Other companies include as shipping and handling costs a portion of internal costs, for example, salaries and overhead related to the activities to prepare goods for shipment. In addition, some companies charge customers only for amounts that are a direct reimbursement for shipping and, if discernible, direct incremental handling costs; however, many other companies charge customers for shipping and handling in amounts that are not a direct pass-through of costs. 3. For the purpose of this Issue, "shipping" is understood to be those costs that are incurred to physically move the product from the seller's place of business to the buyer's designated location. Shipping costs generally comprise payments to third-party shippers but may also be costs incurred directly by the seller. "Handling" is understood to be those costs incurred to store, move, and prepare the products for shipment. Generally, handling costs are incurred from the point the product is removed from finished goods inventory to the point the product is provided to the shipper and often include an allocation of internal overhead. 4. The issues are: Issue 1—How a seller of goods should classify in the income statement amounts billed to a customer for shipping and handling Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 2 Issue 2—How a seller of goods should classify in the income statement costs incurred for shipping and handling. Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 3 EITF DISCUSSION 5. The Task Force reached a consensus on Issue 1 that all amounts billed to a customer in a sale transaction related to shipping and handling, if any, represent revenues earned for the goods provided and should be classified as revenue. 6. The Task Force reached a consensus that on Issue 2 the classification of shipping and handling costs is an accounting policy decision that should be disclosed pursuant to Opinion 22. A company may adopt a policy of including shipping and handling costs in cost of sales. If shipping costs or handling costs are significant and are not included in cost of sales (that is, if those costs are accounted for together or separately on other income statement line items), a company should disclose both the amount(s) of such costs and the line item(s) on the income statement that include them. 7. The Task Force observed that there would be some diversity in the types of costs companies include in "shipping and handling," but decided not to provide additional guidance. The Task Force also reached a consensus that deducting shipping and handling costs from revenues (that is, netting any such costs against shipping and handling revenues) is inconsistent with the Task Force's consensus on Issue 1. 8. The SEC Observer stated that the SEC staff expects SEC registrants to evaluate the significance of shipping and handling costs for the purpose of applying the guidance of this Issue based on the significance of those costs to each line item on the income statement that includes them and on their significance in total to gross margin. 9. The Task Force reached a consensus that the consensuses on Issues 1 and 2 should be applied by SEC registrants no later than the required implementation date for SAB Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 4 101. According to SAB 101B, that implementation date is the fourth quarter of a registrant's fiscal year beginning after December 15, 1999. Accordingly, all registrants, including those that may already have adopted SAB 101, are required to apply the consensus guidance in this Issue in their financial statements for the fourth quarter of their fiscal year beginning after December 15, 1999. Nonregistrants should apply the consensus no later than in annual financial statements for the fiscal year beginning after December 15, 1999. Upon application of the consensus, comparative financial statements for prior periods should be reclassified to comply with the classification guidelines of this Issue. If it is impracticable to reclassify prior-period financial statements, disclosure should be made of both the reasons why reclassification was not made and the effect of the reclassification on the current period. 10. The SEC Observer noted that in Topic No. D-85, "Application of Certain Transition Provisions in SEC Staff Accounting Bulletin No. 101," the SEC staff has indicated that registrants should retroactively apply the guidance in SAB 101 regarding income statement classification to all periods presented in their next financial statements (whether interim or annual) filed with the Commission after January 20, 2000, if that information is available. The SEC Observer indicated that the same guidance applies to reclassification of shipping and handling revenues in this Issue. STATUS 11. No further EITF discussion is planned. Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 5