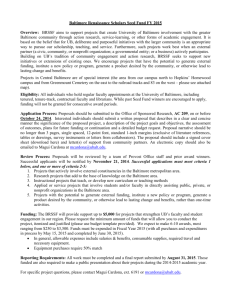

Year 2008 - Foundation Center

advertisement

N

.Form

Return of Private Foundation

990-PF

or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

Department of the Treasury

Internal Revenue Service

(.hprk all that annly

Use the IRS

and ending

P1 Initial return

n Final return

n Amended return

n Andress ch anne

Name of foundation

Number and street (or P O box number if ma i l is not delivered to street address )

or type .

See Specific

Instructions

52-6046691

Room/suite

410-377-6428

state, and ZIP code

BALTIMORE ,

MD

C If exemption application is pending , check here

D 1. Foreign organizations, check here

21204

Section 501(c)(3) exempt private foundation

H Check type of organization:

0 Section 4947 ( a )( 1 ) nonexem p t charitable trust 0 Other taxable p rivate foundation

Accrual

® Cash

I Fair market value of all assets at end of year J Accounting method:

= Other (specify)

(from Part 11, co/ (c), line 16)

6 4 2 8 2 7 . (Part 1, column (d) must be on cash basis)

Part I Analysis of Revenue and Expenses

(a) Revenue and

(b) Net investment

(The total of amounts in columns ( b), (c), and (d) may not

ex p enses p er books

income

necessarily equal the amounts in column (a))

1

Contributions, gifts, grants, etc., received

2

Check ^ ® d the foundation is not required to attach Sch B

Interest on savings and temporary

cash investments

3

g Telephone number

1110 ROLANDV[7E ROAD

City or town,

n Name channe

A Employer identification number

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

label

Otherwise , C /O BEVERLEY C. COMPTON , JR.

print

2008

Note The foundation may be able to use a copy of this return to satisfy state reporting requirements.

For calendar year 2008, or tax year beginning

n

OMB No 1545-0052

4 Dividends and Interest from securities

5a Gross rents

2

Forn oranizions meeting the g5% test,

c heck here and attach comp tat o

E If p rivate foundation status was terminated

under section 507(b)(1)(A), check here

F If the foundation is in a 60-month termination

under section 507(b )( 1 13), check here

PP.

( d) Disbursements

(c) Adjusted net

for charitable purposes

(cash basis only)

income

N/A

-

15 , 748.

STATEMENT 2

15 , 748.

b Net rental income or Qoss)

6a Net gain or (loss ) from sale of assets not on line 10

Gross sales price for all

b assets on l i ne Ba

y

NT 1

<54 , 046. >

528,523.

7

Capital gain net income (from Part IV, line 2)

8

9

Net short-term capital gain

Income modifications

0-

I

V

Q

C'

9

6

Gross sales less returns

1 Oa and allowances

b Less Cost of goods sold

11

12

13

c Gross profit or (loss)

Other income

Total Add lines 1 throu g h 11

<38 , 298. >

Compensation of officers, directors , trustees , etc

15 , 748.

0

0.

0.

654.

154.

0.

19 , 935.

16 , 435.

1 8 9 9.

20 , 589.

16 , 589.

14 Other employee salaries and wages

15 Pension plans, employee benefits

N

IUD) 16a Legal fees

w

b Accounting fees

W

c Other professional fees

> 17 Interest

2 18 Taxes

19

20

0

c

c

C-

3

< 21

c: 22

c 23 Other expenses

c

24

c.

I-

STMT 4

Total operating and administrative

expenses Add lines 13 through 23

0 25 Contributions, gifts, grants paid

L

C

26

C]

L

STMT 3

Depreciation and depletion

Occupancy

Travel, conferences, and meetings

Printing and publications

V

27

Total expenses and disbursements

Add lines 24 and 25

Subtract line 26 from line 12:

a Excess of revenue over expenses and disbursements

32 , 589.

13 , 899.

16 , 589.

-

< 7 0

8 8 7

b Net investment income (if negative, enter -0-)

c Adjusted net income (if negative enter -0-)

LHA For Privacy Act and Paperwork Reduction Act Notice , see the instructions .

823501

01-02-09

1 , 899.

12 , 000 .

12 , 000.

0

N/A

Form 990-PF (2008)

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

Fnrm 990-PF (2008)

Part II

1

2

3

4

5

6

7

C' / r)

Balance Sh ee ts

PR I MP 7,.V

C` _

Other notes and loans receivable

^

^

15

Other assets (describe ^

STMT

5 , 607.

51 , 336.

5 , 607.

51 , 336.

787 , 666.

725 , 234.

585 , 884.

853 , 064.

782 , 177.

642 , 827.

0.

0.

0.

0.

0.

0.

853 , 064.

782 , 177.

853 , 064.

782 , 177.

853 , 064. 1

782 , 177. 1

_

5

^

u)

16 Total assets to be com p leted b y all filers

17 Accounts payable and accrued expenses

18 Grants payable

19 Deferred revenue

-

20

Loans from officers , directors , trustees , and other disqualified persons

c^a

21

22

Mortgages and other notes payable

Other liabilities (describe ^

23 T otal liabilities (add lines 17 through 22)

Foundations that follow SFAS 117, check here

^ 0

and complete lines 24 through 26 and lines 30 and 31

24 Unrestricted

25 Temporarily restricted

m 26 Permanently restricted

Foundations that do not follow SFAS 117, check here

^

C

and

complete

lines

through

31

27

L

0

N 27 Capital stock, trust principal, or current funds

y 28 Paid-in or capital surplus, or land, bldg., and equipment fund

W

29 Retained earnings, accumulated income, endowment, or other funds

Z 30 Total net assets or fund balances

31

Total liabilities and net assets/fund balances

Part III

1

2

Page 2

End of year

(c) Fair Market Value

^

Less accumulated depreciation

Investments - mortgage loans

Investments - other

Land, buildings, and equipment basis ^

(b) Book Value

3 , 831.

61 , 567.

investments - land, buildings , and equipment basis

12

13

14

S 2 - F, (14 F Fi q 1

Beginning of year

(a) Book Value

Accounts receivable ^

Less, allowance for doubtful accounts ^

Pledges receivable ^

Less: allowance for doubtful accounts ^

Grants receivable

Receivables due from officers, directors, trustees, and other

disqualified persons

Less accumulated depreciation

J

,TP -

Cash - non-Interest-bearing

Savings and temporary cash investments

Less: allowance for doubtful accounts ^

8 Inventories for sale or use

9 Prepaid expenses and deferred charges

10a Investments - U.S. and state government obligations

b Investments - corporate stock

c Investments - corporate bonds

11

(YIMUTf M

andamounts inthedescnption

A ^chedschedules

column should betorend-ot -year amounts only

Analysis of Changes in Net Assets or Fund Balances

Total net assets or fund balances at beginning of year - Part II, column (a), line 30

(must agree with end-of-year figure reported on prior year's return)

Enter amount from Part I, line 27a

3 Other increases not included in line 2 (Itemize) ^

4 Add lines 1, 2, and 3

5 Decreases not included in line 2 (itemize) ^

6 Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b). line 30

1

853 064

2

3

4

<70

5

6

0

7 8 2 , 17 7

887 . >

0

782 , 177 .

Form 990-PF (2008)

823511

01-02-09

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

Form 990-PF (2008)

C / O BEVERLEY C. COMPTON , JR.

Capita l Gains a nd Losses for Tax on Investment Income

Part IV

(b How acquired

(a) List and describe the kind(s) of property sold (e.g., real estate,

2-story brick warehouse; or common stock, 200 shs. MLC Co.)

la UBS FINANCIAL SERVICES ,

b UBS FINANCIAL SERVICES ,

Page 3

52-6046691

(c) Date acquired

(mo., day, yr.)

D - Donation

P

P

INC.

INC.

(d) Date sold

(mo., day, yr.)

VARIOUS

VARIOUS

VARIOUS

VARIOUS

c

d

e

(e) Gross sales price

(f) Depreciation allowed

(or allowable)

322

259

271 835.

256 688.

a

b

(h) Gain or (loss)

(e) plus (f) minus (g)

(g) Cost or other basis

plus expense of sale

901.

668.

<51 , 066.

<2 , 980.

c

d

e

Comple te only for assets showing gain in column (h) and owned by the foundation on 12/31/69

(i) F.M.V. as of 12/31/69

(I) Gains (Col. (h) gain minus

col. (k), but not less than -0-) or

Losses (from col (h))

(k) Excess of col. (i)

over col. (I), if any

(j) Adjusted basis

as of 12/31/69

<51 066.

<2 980.

a

b

C

d

e

r If gain, also enter in Part I, line 7

2 Capital gain net income or (net capital loss)

3

Vl If (loss), enter -0- in Part I, line 7

1

)

Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):

If gain, also enter in Part I, line 8, column (c).

If (loss ) , enter -0- in Part I, line 8

2

<54

,

046.

N/A

3

Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

Part V

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940( d)(2) applies, leave this part blank.

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period9

If 'Yes,' the foundation does not qualify under section 4940 ( e). Do not complete this part.

1 Enter the appropriate amou nt in each co lumn for each year ; see instructions before making any entries.

Base period years

Calendar y ear ( or tax y ear be g inning in )

Adjusted qualifying distributions

2007

2006

2005

2004

2003

23

26

59

203

111

, 160.

, 078.

, 296.

244.

161.

Yes [2:1 No

d

Distribution ratio

(col (b) divided by col. (c))

Net value of nonchantable use assets

934

869

946

997

969

.024775

.029982

.062658

.203782

.114599

829.

801.

339.

359.

999.

2 Total of line 1, column (d)

2

. 435796

3 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by the number of years

the foundation has been in existence if less than 5 years

3

.

4 Enter the net value of noncharitable-use assets for 2008 from Part X, line 5

4

775 , 003.

087159

5

Multiply line 4 by line 3

5

67 , 548.

6

Enter 1% of net investment income (1% of Part I, line 27b)

6

0.

7

67 , 548.

8

13 , 899.

7 Add lines 5 and 6

B

Enter qualifying distributions from Part XII, line 4

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate.

See the Part VI instructions.

823521

01-02-09

Form 990-PF (2008)

Form 990-PF (2008)

Part VI

MUNICIPAL ART SOCIETY OF BALTIMORE

C / O BEVERLEY C. COMP TON, JR .

CITY

Page 4

52-6046691

Excise Tax Based on Investment Income (Section 4940(a), 4940 (b), 4940(e), or 4948 - see instructions)

la Exempt operating foundations described in section 4940(d)(2), check here ^ El and enter 'N/A' on line 1.

Date of ruling letter:

( attach copy of ruling letter if necessary - see instructions)

b Domestic foundations that meet the section 4940(e) requirements in Part V, check here ^ 0 and enter 1%

of Part I, line 27b

c All other domestic foundations enter 2% of line 27b. Exempt foreign organizations enter 4% of Part I, line 12, col. (b)

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-)

3 Add lines 1 and 2

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-)

5 Tax based on investment income Subtract line 4 from line 3. If zero or less, enter -06 Credits/Payments:

a 2008 estimated tax payments and 2007 overpayment credited to 2008

6a

2 , 368.

b Exempt foreign organizations - tax withheld at source

6b

c Tax paid with application for extension of time to file (Form 8868)

6c

d Backup withholding erroneously withheld

6d

7 Total credits and payments Add lines 6a through 6d

8 Enter any penalty for underpayment of estimated tax. Check here = if Form 2220 is attached

9 Tax due . If the total of lines 5 and 8 is more than line 7, enter amount owed

^

10 Overpayment If line 7 is more than the total of lines 5 and 8, enter the amount overpaid

^

11 Enter the amount of line 10 to be: Credited to 2009 estimated tax 00,

2 3 6 8 , Refunded Pj^

1

0.

2

0.

0.

3

4

5

0.

0.

7

2 , 368.

8

9

2 , 368.

10

11

0.

Part VII-A - I Statements Regarding Activities

1a During the tax year, did the foundation attempt to influence any national, state, or local legislation or did it participate or intervene in

any political campaign?

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see instructions for definition)

If the answer is "Yes" to 1 a or 1b, attach a detailed description of the activities and copies of any materials published o r

distributed by the foundation in connection with the activities

c Did the foundation file Form 1120 -POL for this year's

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year:

(1) On the foundation. ^ $

0. (2) On foundation managers ^ $

0.

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed on foundation

managers. ^ $

0.

2 Has the foundation engaged in any activities that have not previously been reported to the IRS?

If "Yes, " attach a detailed description of the activities

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of incorporation, or

bylaws, or other similar instruments? If "Yes,"attach a conformed copy of the changes

4a Did the foundation have unrelated business gross income of $1,000 or more during the year?

b If 'Yes,' has it filed a tax return on Form 990 -T for this year?

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year?

If "Yes, " attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either.

• By language in the governing instrument, or

• By state legislation that effectively amends the governing instrument so that no mandatory directions that conflict with the state law

remain in the governing instrument?

7

Did the foundation have at least $5,000 in assets at any time during the year?

If "Yes, " complete Part ll, col (c), and Part XV.

N/A

la

X

lb

X

is

X

2

X

3

X

4a

X

4b

5

X

6

7

X

X

Ba Enter the states to which the foundation reports or with which it is registered (see instructions) ^

MD

b If the answer is 'Yes* to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General (or designate)

of each state as required by General Instruction G' If "No, " attach explanation

9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942(1)(3) or 4942(j)(5) for calendar

year 2008 or the taxable year beginning in 2008 (see instructions for Part XIV)? If "Yes, " complete Part XIV

0 Did any oersons become substantial contributors durino the tax year' If'•Yes " attach n ached ilo 1,f nn the,. -- N

X

Form 990-PF (2008)

823531

01-02-09

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

For m 990-PF ( 2008)

C / O BEVERLEY C.

COMPTON ,

Page 5

52-6046691

JR.

Part VII-A Statements Regarding Activities (continued)

11

12

13

At any time during the year, did the foundation, directly or indirectly, own a controlled entity within the meaning of

section 512(b)(13)7 If'Yes,'attach schedule (see instructions)

Did the foundation acquire a direct or indirect interest in any applicable insurance contract before

Telephone no. ^ ( 410)

COMPTON

Located at ^ 1110 ROLANDVUE ROAD,

BALTIMORE,

X

X

377-6428

ZIP+4 ^ 212 0 4

MD

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 - Check here

and enter the amount of tax-exem p t interest received or accrued durin g the year

X

12

13

August 17 , 20089

Did the foundation comply with the public inspection requirements for its annual returns and exemption application?

Website address ^ N/A

14 The books are in care of ^ BEVERLEY C.

15

11

^

^

15

N/A

Part VII- B Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column , unless an exception applies.

la During the year did the foundation (either directly or indirectly):

(1) Engage in the sale or exchange, or leasing of property with a disqualified person?

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from)

a disqualified person?

(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person?

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person?

(5) Transfer any income or assets to a disqualified person (or make any of either available

Yes

0 Yes ® No

Yes ® No

No

Yes

No

Yes

Yes ® No

for the benefit or use of a disqualified person)?

(6) Agree to pay money or property to a government official? ( Exception Check "No'

if the foundation agreed to make a grant to or to employ the official for a period after

Yes ® No

termination of government service, if terminating within 90 days.)

b If any answer is Yes to la(1)-(6), did any of the acts fail to qualify under the exceptions described in Regulations

N/A

section 53 4941(d)-3 or in a current notice regarding disaster assistance (see page 20 of the instructions)?

^0

Organizations relying on a current notice regarding disaster assistance check here

c Did the foundation engage in a prior year in any of the acts described in la, other than excepted acts, that were not corrected

before the first day of the tax year beginning in 20087

2 Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a private operating foundation

defined in section 4942(1)(3) or 4942(f)(5))*

a At the end of tax year 2008, did the foundation have any undistributed income (lines 6d and 6e. Part XIII) for tax year(s) beginning

Yes

before 20089

It'Yes," list the years ^

b Are there any years listed in 2a for which the foundation is not applying the provisiorrs of section 4942(a)(2) (relating to incorrect

valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2) to all years listed, answer "No" and attach

statement - see instructions.)

No

lb

1c

X

No

N/A

2b

c If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

3a Did the foundation hold more than a 2% direct or indirect interest in any business enterprise at any time

during the year?

0 Yes ® No

b ItYes,' did it have excess business holdings in 2008 as a result of (1) any purchase by the foundation or disqualified persons after

May 26, 1969; (2) the lapse of the 5-year period (or longer period approved by the Commissioner under section 4943(c)(7)) to dispose

of holdings acquired by gift or bequest; or (3) the lapse of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C,

N/A

Form 4720, to determine if the foundation had excess business holdings in 2008.)

4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes?

b Did the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable purpose that

had not been removed from ieooardv before the first day of the tax year beginning in 20089

3b

4a

X

4b

X

Form 990-PF (2008)

823541

01-02-09

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

-60466

Part i/II-B Statements Regarding Activities for Which Form 4720 May Be Required (continued)

5a During the year did the foundation pay or incur any amount to:

(1) Carry on propaganda, or otherwise attempt to influence legislation ( section 4945 (e))?

(2) Influence the outcome of any specific public election (see section 4955); or to carry on , directly or indirectly,

any voter registration drive ?

(3) Provide a grant to an individual for travel, study , or other similar purposes?

(4) Provide a grant to an organization other than a charitable, etc ., organization described in section

509(a )(1), (2), or (3), or section 4940 (d)(2)9

(5) Provide for any purpose other than religious , charitable, scientific, literary, or educational purposes, or for

0 Yes ® No

Yes ® No

Yes ® No

Yes ® No

Yes ® No

the prevention of cruelty to children or animals?

b If any answer is "Yes" to 5a ( 1)-(5), did any of the transactions fail to qualify under the exceptions described in Regulations

section 53.4945 or in a current notice regarding disaster assistance ( see instructions)?

Organizations relying on a current notice regarding disaster assistance check here

c If the answer is "Yes" to question 5a(4), does the foundation claim exemption from the tax because it maintained

N/A

expenditure responsibility for the grant?

If "Yes, " attach the statement required by Regulations section 53 4945-5(d).

6a Did the foundation, during the year, receive any funds, directly or indirectly , to pay premiums on

a personal benefit contract?

b Did the foundation, during the year, pay premiums, directly or indirectly , on a personal benefit contract?

If you answered "Yes" to 6b, also file Form 8870

7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction?

b If yes , did the foundation receive an y p roceeds or have any net income attributable to the transaction?

Part

a VIII

1

5b

N/A

^0

Yes

No

Yes

No

6b

Yes ® No

N /A

X

7b

Information About Officers , Directors, Trustees , Foundation Managers, Highly

Paid Employees, and Contractors

List all officers. directors. trustees. fo undatio n managers and their compensation.

(a) Name and address

(b) Title, and average

hours per week devoted

to position

_f C.- h-F-f_-rl -1--c lnfher than fhnea •nelurIer1 nn lino 11

(a) Name and address of each employee paid more than $50,000

If nnne

(b) Title, and average

hours per week

devoted to position

(e)Expense

account, other

allowances

m

(d)Con

p dyee nben efi t

and deterred

compensation

0.

0.

SEE STATEMENT 6

13

(c) Compensation

( If not paid,

enter - 0 -)

0.

enter "NI INF"

to

(d) Contnbutions

e

(c) Compensation

emp and d eterred

compensation

(e) Expense

account, other

allowances

NO EMPLOYEES

Total number of other employees paid over $50.000

823551

01-02-09

0

^ 1

Form 990-PF (2008)

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

Form 990-PF (2008)

52-6046691

C/O BEVERLEY C. COMPTON, JR.

Information About Officers , Directors , Trustees , Foundation Managers , Highly

Part VIII

Paid Employees , and Contractors (continued)

3 Five highest-paid independent contractors for professional services. If none, enter "NONE."

(a) Name and address of each person paid more than $50,000

1

List the foundation's four largest direct charitable activities during the tax year. Include relevant statistical information such as the

number of organizations and other beneficiaries served, conferences convened, research papers produced, etc.

1

I (c) C ompensation

(b) Type of service

Total number of others receivin g over $50 ,000 for p rofessional services

Part IX-A Summary of Direct Charitable Activities

Page 7

^

U

Expenses

N/A

2

3

4

Part IX- B Summary of Program - Related Investments

Describe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2.

Amount

N/A

1

2

All other program-related investments. See instructions.

3

Total. Add lines 1 throu g h 3

0

Form 990-PF (2008)

823551

01-02-09

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

Form 99b-PF ( 2008 )

Part X

1

a

b

c

d

e

2

3

4

5

6

C/O

BEVERLEY

C.

COMPTON,

JR.

Minimum Investment Return (All domestic foundations must complete this part Foreign foundations , see instructions)

Fair market value of assets not used (or held for use) directly in carrying out charitable, etc., purposes:

Average monthly fair market value of securities

Average of monthly cash balances

Fair market value of all other assets

Total (add lines la, b, and c)

Reduction claimed for blockage or other factors reported on lines la and

le

1c (attach detailed explanation)

to

line

1

assets

Acquisition indebtedness applicable

Subtract line 2 from line 1d

Cash deemed held for charitable activities. Enter 1 1/2% of line 3 (for greater amount, see instructions)

Net value of noncharitable - use assets . Subtract line 4 from line 3. Enter here and on Part V, line 4

Minimum investment return Enter 5% of line 5

Part XI

1

2a

b

c

3

4

5

6

7

Page 8

52- 6046691

1a

1b

1c

1d

5 , 607.

786

805 .

0.

2

3

4

0 .

786 , 805 .

11

802 .

775 , 003 .

5

6

Distributable Amount (see instructions) (Section 4942( j)(3) and ( j)(5) private operating foundations and certain

foreign organizations check here No. C and do not complete this part)

Minimum investment return from Part X, line 6

2a

Tax on investment income for 2008 from Part VI, line 5

2b

Income tax for 2008. (This does not include the tax from Part VI.)

Add lines 2a and 2b

Distributable amount before adjustments. Subtract line 2c from line 1

Recoveries of amounts treated as qualifying distributions

Add lines 3 and 4

Deduction from distributable amount (see instructions)

Distributable amount as adjusted. Subtract line 6 from line 5. Enter here and on Part XIII, line 1

, 198.

781

38.750 .

0.

0.

0.

7

38 ,750.

is

ib

2

-

13 , 899.

Part XII Qualifying Distributions (see instructions)

1

a

b

2

3

a

b

4

5

6

Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes:

Expenses, contributions, gifts, etc. - total from Part I, column (d), line 26

Program-related investments - total from Part IX-B

Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc., purposes

Amounts set aside for specific charitable projects that satisfy the:

Suitability test (prior IRS approval required)

Cash distribution test (attach the required schedule)

Qualifying distributions . Add lines la through 3b. Enter here and on Part V, line 8, and Part XIII, line 4

Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment

0.

3a

3b

4

13

income. Enter 1% of Part I, line 27b

5

Adjusted qualifying distributions Subtract line 5 from line 4

6

Note The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation q ualifie s for the section

4940(e) reduction of tax in those years.

,

899.

0.

13

,

899.

Form 990-P F (2008)

823571

01-02-09

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

Form 990-PF (2008)

Part XIII

C/O BEVERLEY C.

COMPTON,

(c)

2007

(b)

Years prior to 2007

(d)

2008

Distributable amount for 2008 from Part XI,

line?

2

Page 9

52-6046691

Undistributed Income (see instructions)

(a)

Corpus

t

JR.

38 , 750.

Undistributed income , if any, as of the end of 2007

0.

a Enter amount for 2007 only

b Total for prior years:

0.

3

Excess distributions ca rryover, if any, to 2008:

a From 2003

b From 2004

62 , 739.

155 , 240.

c From 2005

14 , 740.

d From 2006

e From 2007

f Total of lines 3a throu gh e

4 Qualifying distributions for 2008 from

Part XI I,line

232 719.

13 , 899.

a Applied to 2007, but not more than line 2a

b Applied to undistributed income of prior

years (Election required - see instructions)

c Treated as distributions out of corpus

(Election required - see instructions)

d Applied to 2008 distributable amount

e Remaining amount distributed out of corpus

5

Excess distributions carryover applied to 2008

(if an amount appears in column ( d), the same amount

must be shown in column (a))

6

Enter the net total of each column as

indicated below:

a Corpus Add lines 3f , 4c, and 4e Subtract line 5

0.

0.

0.

13 , 899.

0.

24

,

851.

207

,

868.

b Prior years' undistributed income. Subtract

line 4b from line 2b

c Enter the amount of prior years'

undistributed income for which a notice of

deficiency has been issued, or on which

24

,

851.

0.

the section 4942(a) tax has been previously

assessed

0

d Subtract line 6c from line 6b Taxable

amount - see instructions

0 .

e Undistributed income for 2007. Subtract line

4a from line 2a Taxable amount - see instr.

f Undistributed income for 2008. Subtract

lines 4d and 5 from line 1. This amount must

be distributed in 2009

7 Amounts treated as distributions out of

corpus to satisfy requirements imposed by

section 170(b)(1)(F) or 4942(g)(3)

8 Excess distributions carryover from 2003

not applied on line 5 or line 7

9

10

Excess distributions carryover to 2009

Subtract lines 7 and 8 from line 6a

Analysis of line 9,

a Excess from 2004

155 , 240.

from 2005

from 2006

from 2007

from 2008

14 , 740.

b Excess

c Excess

d Excess

e Excess

0

0

0

37 , 888.

169 , 980.

Form 990-PF (2008)

823581

01-02-09

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

Form 990-PF (2008)

C/O BEVERLEY C. COMPTON, JR.

I Part XIV I Private Operating Foundations (see instructions and Part VII-A, question 9)

1 a If the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2008, enter the date of the ruling

lo.

b Check box to indicate whether the foundation is a p rivate operating foundation described in section

Prior 3 years

Tax year

2 a Enter the lesser of the adjusted net

2007

(c) 2006

2008

(b)

(a)

income from Part I or the minimum

52-6046691

Page 10

N/A

4942(j)(3) or

(d) 2005

U 4942(1)(5

(e) Total

investment return from Part X for

each year listed

b 85% of line 2a

c Qualifying distributions from Part XII,

line 4 for each year listed

d Amounts included in line 2c not

used directly for active conduct of

exempt activities

e Qualifying distributions made directly

for active conduct of exempt activities.

Subtract line 2d from line 2c

3 Complete 3a, b, or c for the

alternative test relied upon:

a 'Assets" alternative test - enter:

(1) Value of all assets

(2) Value of assets qualifying

under section 4942(j)(3)(B)(i)

b 'Endowment" alternative test - enter

2/3 of minimum investment return

shown in Part X, line 6 for each year

listed

c 'Support" alternative test - enter:

(1) Total support other than gross

investment income (interest,

dividends, rents, payments on

securities loans (section

512(a)(5)), or royalties)

(2) Support from general public

and 5 or more exempt

organizations as provided in

section 4942(j)(3)(B)(nQ

(3) Largest amount of support from

an exempt organization

( 4 ) Gross investment income

Part XV

1

Supplementary Information (Complete this part o my if the foundation had S5.000 or more in assets

at any time during the year-see the instructions.)

Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any tax

year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or

other entity) of which the foundation has a 10% or greater interest

NONE

2 Information Regarding Contribution , Grant, Gift, Loan , Scholarship, etc., Programs:

Check here ^ 0 if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If

the foundation makes gifts, grants, etc. (see instructions) to individuals or organizations under other conditions, complete items 2a, b, c, and d

a The name, address, and telephone number of the person to whom applications should be addressed:

SEE STATEMENT 7

b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines*

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors:

823601 01-02-09

Form 990-PF (2008)

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

C/O BEVERLEY C. COMPTON, JR.

Form 990-PF (2008)

11

Information

r;rnnte and Gnntrihutinns Paid During the Year or Aooroved for Future Payment

Recipient

Name and address ( home or business)

It recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

Foundation

status of

recipient

Purpose of grant or

contribution

Amount

a Paid dung the year

MARYLAND INSTITUTE COLLEGE

OF ART, 1300 MT ROYAL

AVE., BALTIMORE, MD 21217

ONE

12,000.

^ 3a

TotaI

b

RAINGER

MARBURG &

ALTERS

SCHOLARSHIP

12 , 000.

Approved for future payment

NONE

Total

823511 01-02-09

0.

111- 3b 1

Form 990-PF (2008)

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

Form 990-PF (2008)

Part XVI-A

C/O BEVERLEY C.

COMPTON,

JR.

52-6046691

Page 12

Analysis of Income - Producing Activities

Enter f ross am ou nts unle s s otherwise indicated .

1 Pro gram service revenue:

a

b

c

d

Unrelat ed business income

(a)

Business

code

Exclu ded b y section 512 513 or 514

(b)

Amount

Exc?uso"

code

(e)

Related or exempt

function income

(d)

Amount

e

f

9 Fees and contracts from government agencies

2 Me mbership dues and assessments

3 Int Brest on savings and temporary cash

Inv estments

4 Div idends and interest from securities

5 Nett rental income or (loss) from real estate:

a Debt-financed property

b Not debt-financed property

6 Nett rental income or (loss) from personal

proo perty

7 Ot h er investment income

8 Gal n or (loss) from sales of assets other

tha n inventory

9 Nett income or (loss) from special events

10 Gr o ss profit or (loss) from sales of inventory

11 Ot h er revenue:

14

15 , 748.

-

<54 , 046. >

18

a

b

c

d

e

12 Su btotal Add columns (b), (d), and (e)

13 Total. Add line 12, columns (b), (d), and (e)

(See worksheet in line 13 instructions to verify calculations.)

Part XVI-B

823621

01-02-09

0. 1

1

<38 298 .

13

0.

<38 - , 298 . >

Relationship of Activities to the Accomplishment of Exempt Purposes

Form 990-PF (2008)

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

Form 990-PF (2008)

C/O BEVERLEY C. COMPTON, JR.

52-6046691

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Part XVII

Exempt Organizations

Paoe 13

Yes No

Did the organization directly or indirectly engage in any of the following with any other organization described in section 501(c) of

the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations?

a Transfers from the reporting foundation to a noncharitable exempt organization of

la ( l )

X

(1) Cash

1a ( 2 )

X

(2) Other assets

b Other transactions:

lb ( l )

X

(1) Sales of assets to a noncharitable exempt organization

lb ( 2 )

X

(2) Purchases of assets from a noncharitable exempt organization

lb ( 3 )

X

(3) Rental of facilities, equipment, or other assets

lb ( 4 )

X

(4) Reimbursement arrangements

lb ( 5)

X

(5) Loans or loan guarantees

lb ( 6 )

X

(6) Performance of services or membership or fundraising solicitations

1c

X

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees

d If the answer to any of the above is "Yes, complete the following schedule. Column (b) should always show the fair market value of the goods, ot her ass ets,

or services given by the reporting foundation. If the foundation received less than fair market value in any transaction or sharing arrangement, sh ow in

2a Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described

in section 501 ( c) of the Code ( other than section 501(c)(3 )) or in section 5277

er penalties of

U

d com

Si

fury, I decl

eclaration of pr

e th

arer o

as

t

e

m

tazp

is return , in

r-priduci

ng accompanying schedules and

based on all informah

ure of officer or tr stee

Preparer's

signature

p, y Firm ' s name (oryours

00

dself-employed ),

address and ZiP code

823622

01-02-09

MCGLADREY, INC.

1954 GREENSPRING DRIVE,

TIMONIUM

MARYLAND 2109

RSM

'

0 Yes

tatements, and to the best of my knowledge and belief, it is true , correct,

EXI No

52-6046691

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

GAIN OR

FORM 990-PF

(LOSS)

FROM SALE OF ASSETS

MANNER

ACQUIRED

(A)

DESCRIPTION OF PROPERTY

UBS FINANCIAL SERVICES,

PURCHASED

INC.

(D)

EXPENSE OF

SALE

(C)

COST OR

OTHER BASIS

(B)

GROSS

SALES PRICE

322,901.

271,835.

VARIOUS

(E)

1

DATE SOLD

VARIOUS

(F)

DEPREC.

GAIN OR LOSS

<51,066.>

0.

MANNER

DATE

INC.

(D)

EXPENSE OF

SALE

(C)

COST OR

OTHER BASIS

(B)

GROSS

SALES PRICE

DATE

ACQUIRED

0.

(A)

DESCRIPTION OF PROPERTY

UBS FINANCIAL SERVICES,

STATEMENT

259,668.

256,688.

(E)

(F)

DEPREC.

GAIN OR LOSS

0.

0.

<2,980

0.

CAPITAL GAINS DIVIDENDS FROM PART IV

TOTAL TO FORM 990-PF,

FORM 990-PF

PART I,

STATEMENT

DIVIDENDS AND INTEREST FROM SECURITIES

GROSS AMOUNT

SOURCE

UBS FINANCIAL SERVICES INC.

TOTAL TO FM 990 -PF,

<54,046.>

LINE 6A

PART I,

LN 4

CAPITAL GAINS

DIVIDENDS

2

COLUMN (A)

AMOUNT

15,748.

0.

15,748.

15,748.

0.

15,748.

STATEMENT(S)

1,

2

52-6046691

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

DESCRIPTION

(A)

(B)

EXPENSES

PER BOOKS

NET INVESTMENT INCOME

FOREIGN TAXES

EXCISE TAX

TO FORM 990-PF,

STATEMENT

TAXES

FORM 990-PF

PG 1,

LN 18

(C)

ADJUSTED

NET INCOME

154.

0.

0.

0.

654.

154.

0.

(A)

EXPENSES

PER BOOKS

DESCRIPTION

(D)

CHARITABLE

PURPOSES

154.

500.

STATEMENT

OTHER EXPENSES

FORM 990-PF

3

(B)

NET INVESTMENT INCOME

(C)

ADJUSTED

NET INCOME

4

(D)

CHARITABLE

PURPOSES

INVESTMENT MANAGEMENT FEES

INSURANCE FEES

AGENCY FEES

PROFESSIONAL FEES

14,536.

14,536.

0.

1,426.

175.

3,798.

0.

0.

1,899.

0.

0.

1,899.

TO FORM 990-PF, PG 1, LN 23

19,935.

16,435.

1,899.

BOOK VALUE

DESCRIPTION

UBS FINANCIAL SERVICES - STOCKS

TOTAL TO FORM 990-PF,

STATEMENT

CORPORATE STOCK

FORM 990-PF

PART II,

LINE 10B

5

FAIR MARKET

VALUE

725,234.

585,884.

725,234.

585,884.

STATEMENT(S)

3,

4,

5

52-6046691

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

PART VIII - LIST OF OFFICERS, DIRECTORS

TRUSTEES AND FOUNDATION MANAGERS

FORM 990-PF

TITLE AND

AVRG HRS/WK

NAME AND ADDRESS

COMPTON,

BEVERLEY C.

JR

PETER C.

ANNE L.

0.00

MD

0.

0.

0.00

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

21212

CULMAN

SECRETARY

2300 LEGG MASON BLDG

0.00

MD 21201

KATHERINE HARDIMAN

8 BOWEN MILL RD.

BALTIMORE, MD 21212

TREASURER

0.00

GREGORY BARNHILL

BOARD MEMBER

10801 STEVENSON RD.

STEVENSON,

0.

VICE PRESIDENT

DOO

BALTIMORE,

EMPLOYEE

BEN PLAN EXPENSE

CONTRIB ACCOUNT

COMPENSATION

MD 21204

6600 YORK RD.

BALTIMORE,

6

PRESIDENT

1110 ROLANDVUE RD.

BALTIMORE,

STATEMENT

0.00

MD

CONSTANCE CAPLAN

BOARD MEMBER

701 CATHEDRAL ST.

0.00

0.

0.

0.

WILLIAM B. GILMORE, II

1110 ROLANDVUE RD.

BALTIMORE, MD 21204

BOARD MEMBER

0.00

0.

0.

0.

DAVID A. ASHTON

1110 ROLANDVUE RD.

BALTIMORE, MD 21204

BOARD MEMBER

0.00

0.

0.

0.

MARGARET COOK

BOARD MEMBER

0.

0.

0.

0.

0.

0.

BALTIMORE,

MD 21201

0.00

1110 ROLANDVUE RD.

BALTIMORE,

MD 21204

TOTALS INCLUDED ON 990-PF,

PAGE 6,

PART VIII

STATEMENT(S)

6

52-6046691

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

FORM 990-PF

GRANT APPLICATION SUBMISSION INFORMATION

PART XV, LINES 2A THROUGH 2D

STATEMENT

7

NAME AND ADDRESS OF PERSON TO WHOM APPLICATIONS SHOULD BE SUBMITTED

MUNICIPAL ART SOCIETY OF BALTIMORE CITY C/O BEVERLEY C.

1110 ROLANDVUE RD

BALTIMORE, MD 21204

COMPTON,JR.

TELEPHONE NUMBER

(410)

377-6428

FORM AND CONTENT OF APPLICATIONS

LETTER OF REQUEST;

PLEDGE

ANY SUBMISSION DEADLINES

REQUESTS ARE ACCEPTED AT ANY TIME

RESTRICTIONS AND LIMITATIONS ON AWARDS

GRANT REQUESTS ARE LIMITED TO DONEES WITHIN BALTIMORE CITY

STATEMENT(S)

7

Page

Account Number JW 03670 63

10 of

13

UBS Financial Services Inc.

Your Financial Advisor or Contact

BUTTARAZZI,PATRICK J

2008 Consolidated Form 1099

410-576-3200/800-622-0073

P070 51622-X16

2008 Realized Gain/Loss Summary

(Includes sale proceeds not reported on Form 1099-B)

This Realized Gain/Loss Summary is not a tax reporting document and has not been submitted to the IRS If your sale amount matches the amount on Form 1099-B. which is reported to the IRS, it is marked as such Please rely

on the confirmations previously provided to you as your official activity record

Estimated 2008 Gain/Loss for transactions with trade dates through 12/31/08 has been incorporated into this statement Realized gain/loss is based on the sales amount less the cost basis Please note that gain or loss

recognized on the sale or redemption of certain Structured Products may be ordinary, and not capital, gain or loss Please check with your tax advisor Note that the Original Cost Basis column is only populated for

transactions of securities that have had their basis reduced due to premium amortization or increased due to O1D accretion

The cost basis of the oldest security lot (first-in, first-out or FIFO method of accounting) is assigned to a sale to calculate Gam/Loss unless you identified a specific lot (a "versus purchase" or "VSP" order) when you

placed your sell order An asterisk (') indicates a UBS Financial Services adjustment to cost basis The number "1"indicates cost basis information has been provided by a source other than UBS Financial Services

Gam/Loss may not have been adjusted for all capital changes Gain/Loss values that may be subject to Wash Sale provisions are not indicated here "Earnings" in the Purchase Date column indicates the position sold was

acquired on vanous dates through dividend reinvestment and that the Gam/Loss has been aggregated

Cost basis for coupon tax-exempt municipal secunties (including securities subject to AMT) has been adjusted for mandatory amortization of bond premium The O10 amount reported on your Form 1099-OID is not adjusted for

Market Discount, Acquisition Premium, or Bond Premium Therefore, the amortization and accretion adjustments used here may not be consistent with the Form 1099-OID amount because the reporting requirements are different

Gam/Loss from short sale closings are reported as short-term regardless of the holding penod of property used to close the short position Clients should consult their tax advisors as to whether exceptions may apply in

their particular case to change this classification The possible application of the "Constructive Sale" provisions (Sec 1259) for short-against-the box transactions is not considered Clients should discuss the possible

application of these provisions with their tax advisor

Net

Losses

Gam/Loss

Purchase

Gains

Sale

Short-term Gain/Loss

Long-term Gain/Loss.

Sub Total:

$

$

Total:

322,901 09

259,668 26

582,569 . 35

$

582,569 .35

$

$

17,061 00

36,469 83

53,530 .83

$

53, 530.83

$

$

271,835 46

256,688 28

528 ,523.74

$

528,523.74

$

$

-68,12663

-39,449 81

-107,576.44

$

-107,576.44

$

$

-51,06563

-2,979 98

-54,045.61

Short-Term Gain/Loss

This section includes securities held for less than one year, and option contracts that are not reported on Form 1099-B

Quantity/

Date

Onginal Cost Purchase date

Security Description

Face value

Basis

Activity Type

Date Acquired

Sold

Sale Amount

AIRGAS INC

Trade

300 000

03/03/08

05/14/08

17,793 45

14,386 85

3,406 60

Y

APACHE CORP

Trade

200 000

07/16/07

06/12/08

27,608 59

17,355 2 5

10,253 34

V

BANK OF AMER CORP

Trade

500 000

10/29/07

06/23/08

13,569 67

24,215 25

-10,645 58

V

BE AEROSPACE INC

Trade

300 000

06/18/08

07/01/08

6,67671

8,53205

-1,85534

Y

CATERPILLAR INC

Trade

Trade

Trade

150 000

150 000

100 000

07/09107

07/09/07

09/27/07

01/03108

06/05/08

06/05/08

10,515 08

12,155 78

8,10385

11,909 13

11,909 13

7,732.25

-1,39405

246 65

371 60

V

V

V

Continued on page 11

Cost or Other

Basis

Gam/Loss

2008 1099 / JW 03670 63

Remarks

Matches

1099- B

Account Number JW0367063

Page

11 of

13

UBS Financial Services Inc.

Your Financial Advisor or Contact

BUTTARAZZI,PATRICK J

2008 Consolidated Form 1099

410-576-3200/800-622-0073

P07L151623-X16

Short-Term Gain/Loss - continued

This section includes securities held for less than one year, and option contracts that are not reported on Form 1099-B

Quantity/

Original Cost Purchase date

Date

Security Description

Activity Type

Face value

Basis

Date Acquired

Sold

Sale Amount

CNH GLOBAL N V NEW

Trade

500 000

01/25/08

05/12/08

21,841 12

24,043 25

-2,202 13

Y

CORNING INC

Trade

600 000

06/12/08

11/18/08

4,95072

16,227 15

-11,27643

Y

DELL INC

Trade

400 000

07/16/07

02/08/08

7,67729

11,543 25

-3,86596

Y

HEWLETT PACKARD CO

Trade

200 000

07/16/07

05/12/08

9,865 93

9,453 25

412 68

Y

JOY GLOBAL INC

Trade

300 000

04/10/07

01/23/08

15,075 52

13,800 65

1,27487

Y

METLIFE INC

Trade

400 000

05/16/08

10/02/08

18,024 64

24,995 25

-6,97061

Y

NEWFIELD EXPLORATION COS

Trade

400 000

07/23/08

09/02/08

16,579 05

20,652 58

-4 073 53

Y

ROCKWELL AUTOMATION INC

NEW

Trade

300 000

04/11/07

01/09/08

17,974 47

17,458 25

516 22

Y

TIME WARNER CABLE INC

CLA

Trade

700 000

06/27/08

09/05/08

18,816 34

18,555 25

261 09

Y

TJX COS INC NEW

Trade

300 000

07/16/07

07/01/08

9,21720

8,89925

317 95

Y

UNITEDHEALTH GROUP INC

Trade

Trade

300 000

300 000

07/16/07

05/16/08

06/19/08

06/19/08

8,448 93

8,44893

16,159 25

9,67025

-7,710 32

-1,221.32

Y

Y

WALTER INDUSTRIES INC

Trade

200 000

09/03/08

10/01/08

9,03869

16,333 25

-7,294 56

Y

WHITING PETROLEUM CORP

NEW

Trade

Trade

100 000

100 000

06/20/08

07/18/08

10/07/08

10/07/08

4,72675

4,726.75

10,240 05

8,83025

-5,51330

-4,103.50

Y

Y

271,835.46

322,901.09

-51,065.63

Sale Amount

Cost or Other

Basis

Gam/Loss

4,070 75

9,561 05

Total Short -Term Gain / Loss

Cost or Other

Basis

Garn/Loss

Remarks

Matches

1099 - B

Long-Term Gain/Loss

This section includes securities held for more than one year, and option contracts that are not reported on Form 1099-B

Quantity/

Original Cost Purchase date

Date

Security Description

Activity Type

Face value

Basis

Date Acquired

Sold

AMER INTL GROUP INC

Trade

200 000

02/13/03

09/09/08

Continued on page 12

-5,490 30

2008 1099 / JW 03670 63

Remarks

Matches

1099- B

Y

Account Number JW 03670 63

Your Financial Advisor or Contact

BUTTARAZZI,PATRICK J

Page

12 of

13

UBS Financial Services Inc.

2008 Consolidated Form 1099

410-576-3200/800-622-0073

P07L151624-X16

Long-Term Gain /Loss - continued

This section includes securities hold for more than one year, and option contracts that are not reported on Form 1099-B

Quantity/

Original Cost Purchase date

Date

Security Description

Activity Type

Face value

Basis

Date Acquired

Sold

Sale Amount

Cost or Other

Basis

Gam/Loss

Remarks

Matches

1099- B

AMER INTL GROUP INC

Trade

200 000

02/28/03

09/09/08

4,07075

10,015 24

-5,94449

Y

APACHE CORP

Trade

Trade

100 000

100 000

09/19/05

10/25/05

03/19/08

03/19/08

11,212 34

11,212 34

7,72925

6,48425

3.48309

4,72809

Y

Y

CHESAPEAKE ENERGY CORP

OKLA

Trade

300 000

01/31/06

05/27/08

15,628 66

10,516 25

5,112.41

Y

CHEVRON CORP

Trade

100 000

09/19/05

07/30/08

8,30470

6,471 63

1,83307

Y

CVS CAREMARK CORP

Trade

500 000

08/10/05

08/28/08

18,524 64

15,070 25

3,454 39

Y

DELL INC

Trade

400 000

10/11/06

02/08/08

7,67729

9,38525

-1,70796

Y

GENL ELECTRIC CO

Trade

300 000

07/16/07

12/22/08

4,71472

11,935 25

-7.22053

Y

HEWLETT PACKARD CO

Trade

400 000

05/04/07

05/12/08

19,731 85

17,355 25

2,37660

Y

JOHNSON & JOHNSON COM

Trade

150 000

05/25/06

08/18/08

10,615 84

9,095 13

1,52071

Y

MORGAN STANLEY

Trade

200 000

11/16/05

10/10/08

1,75473

9,12065

-7,36592

NABORS INDUSTRIES LTD

Trade

300 000

10/20/05

07/15/08

13,385 24

9,12572

4,25952

NEW (BERMUDA)

Trade

300 000

10/20/05

07/23/08

11,866 68

9,12572

2,74096

Y

Y

SCHERING PLOUGH CORP

Trade

400 000

12/12/06

03/31/08

5,58468

9,11960

-3,53492

Y

STATE STREET CORP

Trade

Trade

100 000

100 000

06/02/06

06/15/06

03/14/08

03/14/08

7,45529

7,45529

6,35325

5,84525

1,10204

1,61004

Y

Y

TEXAS INSTRUMENTS

Trade

Trade

300 000

200 000

09/07/05

09/20/05

01/15/08

01/15/08

8,96971

5,97981

10,105.25

6,62950

-1,13554

-649 69

Trade

100 000

09/20/05

04/22/08

2,929 93

3,314 74

-384 81

Trade

400 000

12/12/06

04/22/08

11,719 73

11,815 25

-95 52

Y

Y

Y

Y

TJX COS INC NEW

Trade

600 000

11/29/06

07/01/08

18,434 39

16 , 535 25

1,899 14

Y

UNITEDHEALTH GROUP INC

Trade

300 000

02/20/07

03 / 11/08

11,269 62

16,420 25

-5,150.63

Y

Continued on page 13

2008 1099 1 JW 03670 63

1

Y

Account Number JW0367063

Page

13 of

13

UBS Financial Services Inc.

Your Financial Advisor or Contact

BUTTARAZZI,PATRICK J

2008 Consolidated Form 1099

410-576-3200/800-622-0073

P07L151625-X16

Long-Term Gain/Loss - continued

This section includes securities held for more than one year. and option contracts that are not reported on Form 1099-B

Quantity/

Original Cost Purchase date

Date

Sold

Security Description

Activity Type

Face value

Basis

Date Acquired

WAL MART STORES INC

WASTE MGMT INC NEW

Total Long -Term Gain/Loss

Sale Amount

Cost or Other

Basis

Gam/Loss

Remarks

Matches

1099- B

Trade

200 000

10/04/06

08/07/08

11, 429 10

9,965 25

1,46385

Y

Trade

100 000

11/15/06

08 /07/08

5,714 55

4,828 63

885 92

Y

Trade

500 000

02/09/07

04/ 10/08

16,975.65

17,745 15

-769 50

Y

256,688 . 28

259 , 668.26

-2,979.98

2008 1099 / JW 03670 63

Page 2

Form 8868 (Rev. 4-2009)

P If you are filing for an Additional ( Not Automatic ) 3-Month Extension , complete only Part II and check this box

Note . Only co,,iplete Part II if you have already been granted an automatic 3-month extension on a previously filed Form 8868

• If you are filing for an Automatic 3-Month Extension , complete only Part I (on page 1)

Additional (Not Automatic) 3-Month Extension of Time . Only file the original (no copies needed)

Part II

Name of Exempt Organization

Employer identification number

Number, street, and room or suite no If a P 0 box, see instructions.

For IRS use only

Type or

MUNICIPAL ART SOCIETY OF BALTIMORE CITY

print

O BEVERLEY C. COMPTON , JR.

File by the

extended

due date for

filing the

return see

nstructions

^

52-6046691

1110 ROLANDVUE ROAD

City, town or post office, state , and ZIP code . For a foreign address , see instructions

BALTIMORE ,

MD

21204

Check type of return to be filed (File a separate application for each return)

Form 990-EZ

Form 990-T (sec 401 (a) or 408 (a) trust)

Form 990

Form 990-T (trust other than above)

Form 990-BL

® Form 990-PF

Form 1041-A

Form 4720

0 Form 5227

Form 6069

Form 8870

STOP! Do not complete Part II if you were not already granted an automatic 3-mont h exten s ion on a previously filed Form 8868.

• The books are in the care of

BEVERLEY C. COMPTON

^ 1110 ROLANDVUE ROAD - BALTIMORE ,

MD 212 0 4

377-6428

FAX No ^

^ 0

• If the organization does not have an office or place of business in the United States , check this box

If this is for the whole group , check this

• If this is for a Group Return , enter the organization's four digit Group Exemption Number (GEN)

box ^ 0 If it is for part of the group , check this box ^ = and attach a list with the names and EINs of all members the extension is for

Telephone

( 410 )

4

I request an additional 3-month extension of time until

5

6

7

For calendar year 2 0 0 8 , or other tax year beginning

If this tax year is for less than 12 months, check reason

State in detail why you need the extension

NOVEMBER

0 Initial return

15,

2009 .

, and ending

0 Final return

0 Change in accounting period

ADDITIONAL TIME IS NEEDED TO FILE A COMPLETE AND ACCURATE RETURN.

8a

b

If this application is for Form 990-BL, 990 - PF, 990 -T, 4720, or 6069, enter the tentative tax, less any

nonrefundable credits See

If this application is for Form 990-PF, 990-T, 4720, or 6069, enter any refundable credits and estimated

tax payments made Include any prior year overpayment allowed as a credit and any amount paid

0.

Balance Due. Subtract line 8b from line 8a . Include your payment with this form, or, if required, deposit

with FTD coupon or, if required , by using EFTPS ( Electronic Federal Tax Payment System) See instructions

Signature and Verification

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements , and to the best of my knowledge and belief,

thonzed to prepare this form.

it is true, correct and complete , and that I a

c.,,nf,,ro ^n

i CYs

\

U (^ Mn A

Tine lll^

4

1^\

Hato :a

Form 8868 (Rev. 4-2009)

823832

05-28-09