Document

advertisement

ANNUAL REPORT 2014

TABLE OF CONTENTS

Financial targets

2

Five-year summary

3

Significant events

4

Message from the president

6

IFS and IFS Applications

7

The IFS share

11

Table of contents of the annual report

12

Annual report

13

Board of directors

68

Executive management and auditors

69

Financial trend 2010–2014

70

Definitions and glossary

72

FINANCIAL TARGETS

Over the longer term, IFS aims to achieve an EBIT margin of 15 percent and maintain or exceed a return of 25 percent on

average operating capital. Furthermore, IFS has set the long-term objectives of:

•

Over time pay dividend equivalent to approximately 50 percent of earnings after tax.

•

Using additional surplus capital, which is not required for investments, expansion, and other needs relating to the financial

position of the group, to repurchase shares.

FINANCIAL REPORTS 2015

Interim report January–March

Interim report January–June

Interim report January–September

Year-end report

2

ANNUAL GENERAL MEETING

April 22, 2015

July 21, 2015

October 22, 2015

February 2016

The annual general meeting 2015 will be held on

Wednesday, March 25, 2015 in Stockholm, Sweden.

FIVE-YEAR SUMMARY

Net revenue

2010

2011

2012

2013

2014

SKr, million

2,585

2,576

2,676

2,704

3,034

of which license revenue

SKr, million

402

431

467

535

558

of which maintenance and support revenue

SKr, million

811

823

909

902

1,037

of which consulting revenue

SKr, million

1,357

1,311

1,283

1,256

1,427

%

81%

80%

82%

84%

85%

SKr, million

221

233

200

202

275

%

9%

9%

7%

7%

9%

Net revenue outside Sweden

EBIT

EBIT margin

Profit/loss before tax

SKr, million

189

218

190

184

258

Profit margin

%

7%

8%

7%

7%

9%

License margin

%

90%

94%

94%

93%

91%

Maintenance and support margin

%

62%

67%

69%

72%

75%

Consulting margin

%

23%

22%

18%

19%

20%

Product development expenditure/net revenue

%

8%

9%

10%

10%

10%

Administration expenses/net revenue

%

10%

10%

10%

11%

10%

Return on average operating capital

%

23%

26%

22%

19%

24%

Equity/assets ratio, after full conversion

Net debt

Interest coverage rate

Cash flow after investment operations

%

51%

51%

44%

46%

45%

SKr, million

-328

-273

50

-118

-191

times

12.2

37.3

24.7

19.4

33.2

SKr, million

234

94

-41

122

269

%

21%

20%

19%

19%

18%

Average number of employees

2,644

2,716

2,830

2,688

2,645

Number of employees at year-end

2,675

2,821

2,829

2,616

2,707

Acc rec (avg 12 month)/net revenue (rolling 12 month)

Net revenue

Maintenance and support revenue

3,100

2,900

EBIT

1,200

300

1,000

250

800

200

600

150

400

100

200

50

2,700

2,500

2,300

2,100

'10

'11

'12

'13

'14

0

'10

Cash flow after investments

'11

'12

'13

'14

0

Net liquidity

300

250

'10

'11

'12

'13

'14

Average number of employees

500

2,900

400

2,800

300

2,700

200

2,600

100

2,500

200

150

100

50

0

-50

'10

'11

'12

'13

'14

0

'10

'11

'12

'13

'14

2,400

'10

'11

'12

'13

'14

3

SIGNIFICANT EVENTS

Leading bus manufacturer Wrights Group chose IFS Applications

February 28. IFS announced that Wrights Group, one of Europe’s leading suppliers of public transport vehicles, had

chosen IFS Applications to assist in optimizing its expanding global operations. The agreement included licenses,

maintenance, and services worth approximately £1.2 million.

Oil & Gas drilling contractor Songa Offshore selected IFS

March 10. IFS announced that Songa Offshore, an International midwater drilling contractor active in the North

Atlantic basin, had chosen to deploy IFS Applications for Offshore Service to support its onshore and offshore

operations. The contract included licenses and services worth approximately NKr 40 million.

Port of Dover chose IFS Applications to integrate business processes

March 26. Port of Dover, operating Europe’s busiest international roll-on roll-off ferry port, chose IFS to integrate

and streamline key business processes such as asset and project management. When fully implemented, the solution

will be used by over 300 employees throughout the organization to help improve efficiency and control.

IFS partners with Telvent Global Services

During the first quarter, IFS signed a global partnership agreement with Telvent Global Services, part of Schneider

Electric. The partnership is aimed at delivering added value to new and existing IFS customers in the EMEA region

and Latin America, primarily targeting industries such as energy and utilities and telecommunications.

Leading paint manufacturer Jotun expands globally with IFS Applications

June 2. World-leading paint manufacturer Jotun has decided to expand its use of IFS Applications™ to additional sites

in Europe, Asia, and the Americas. To support its growth targets and to maximize process efficiency and transparency,

Jotun has decided to extend its central IFS ERP solution to include an additional 2,000 users.

IFS signs partnership agreement with Capgemini in Spain

June 20. IFS has signed an agreement with Capgemini Spain, making the consulting, technology, and outsourcing firm

its partner for the sale and implementation of IFS Applications in Spain. Through the agreement, IFS is expanding its

partner network, thereby acquiring greater commercial reach and additional implementation resources.

IFS is the leading supplier of EAM software for the oil and gas industry

August 26. IFS has been identified for the third year running as the number one vendor in market share in enterprise

asset management (EAM) and field service management (FSM) software for the oil and gas industry by ARC Advisory

Group, the leading information technology research and advisory firm for industry and infrastructure.

Launch of IFS-in-a-Box

September 29. Customers can implement Oracle Database Appliance into their existing rack of servers and configure

the set-up using one of the templates that are supplied ‘in-a-Box’. It is a compelling solution for companies wanting to

scale up capacity and users of IFS Applications, whilst keeping total cost of ownership low.

IFS launches global cloud solution on Microsoft Azure

September 29. The cloud-based offer enables customers to easily increase the breadth of their deployment and scale

the number of user seats in line with business growth, while avoiding many of the costs normally associated with onpremise solutions. Customers can leverage Azure as an Infrastructure as a Service (IaaS) and self-manage their

solution, or have it hosted and managed as a service (SaaS).

IFS named a ‘Leader’ in two Gartner Magic Quadrants

On November 26, Gartner released its Magic Quadrant for Single-Instance ERP for Product-Centric Midmarket Companies, in

which IFS was named as a leader for the second consecutive year, improving its position on the ‘completeness of

vision’ and ‘ability to execute’ axis. On December 22, IFS was again recognized as a leader, this time in the Gartner

Magic Quadrant for Field Service Management.

IFS partners with Deloitte Consulting in South Korea

December 3. IFS announced that it has signed an agreement with Deloitte Consulting, making the professional services

firm its strategic partner for the deployment of IFS Applications in the oil & gas, construction, EPC and project-based

manufacturing industries in South Korea.

4

SIGNIFICANT AGREEMENTS SIGNED DURING THE YEAR

Aerospace and Defense

Hafslund

Nova Werke

Prince Minerals

Advanced Integration

Jiangsu Ligang Power Station

PIPE Sistemas Tubulares

Probiotics International

Babcock Marine Division

Liberty Utilities (Canada) Corp.

Promag

Rovese

BAE Systems

Mørenett

Robertson Fuel System

Silvermill Holdings

BAE Systems – Saudi Arabia

Nanjing Metro

ROL

Sumi Agro Europe

Forsvaret / Norwegian Armed

OKG Aktiebolag

Roxtec International

Teknos Group

General Dynamics IT

Onesourcewater

Samson AG Meß- und

Vitacress

Lockheed Martin JSF

PGNIG Termika

Saueressig

Whitworths

Saab

Renova

Stolle Machinery Company

William Grant & Sons

Sporveien Oslo

SDIC BaiYin Power Co.

Survitec Group

Retail

Asset Intensive

SDIC Qinzhou Electric Power Co.

Tatsuno Engineering & Service

Assist Trend

Forest-Papír

Teollisuuden Voima Oyj

V-Zug

BYGGmax

Kangra Coal

TrønderEnergi Kraft

WNA

D Samson & Sons

Klondex Mines

Warsaw Water and Sewerage

Zeon Advanced Polymix Co.

Gina Tricot

Unimin Corporation

High Tech

Oil and Gas

Midcounties Co-operative

Automotive

Axis Communications

Apply Group

Oriflame Cosmetics

Agility Fuel Systems

Fr. Sauter

Archer Management

Shanghai Garnor Sealing

CalsonicKansei North America

Genesis Technology USA

British Engines

Swedish Orphan Biovitrum

Dan T. Moore Company

Habia Cable

BW Offshore Norway

Service Providers

FEV

Integrated Microwave

Ceona Services

Advanced Technology Services

Huf Hülsbeck & Fürst

Minco Products

Mermaid Marine Australia

Dataprev

Schlemmer

Mitutoyo

Odfjell Drilling

Dover Harbour Board

The Morgan Motor Company

NEC Corporation

PGS Geophysical

DSL

Toyota Lanka

Olympus KeyMed

Rosenberg WorleyParsons

Eltel Networks Infranet

Toyota Material Handling Europe

Renco Electronics

Shawcor

Landmark Information Group

Volvo Lastvagnar

SEAKR Engineering

Songa Offshore

Loomis Sverige

Volvohandelns Utvecklings AB

Teledyne Oil & Gas

Teledyne ODI

PHS Group

Wright Bus

Trüb

Thalassa Holdings

Polygon International

Construction and Contracting

Young Innovations

Trelleborg Offshore Norway

SSI Services

Baltic Yachts

Industrial Manufacturing

Wood Group Mustang Norway

Swarco Nordic

Eurofeu

ACS Industries

Process Manufacturing

Tatsuno Engineering & Service

Grandweld Shipyards

Advanced Integration

Al Rabie

Tibah Airport Operations Co.

IHC Merwede Holding

Allu Group

American Iron & Metal Company

United Subcontractors

IMI

Aluminum Precision Products

Benders Paper Cup Company

Veolia Water Solutions & Tech.

K-Híd

Avanco

Bronco Wine Company

Wilhelmsen Ships Service

Pindan Group

Baier + Köppel

Cisbio Bioassays

Miscellaneous

Serimax Holdings

Belvac Production Machinery

EP Minerals

ADP Ingénierie

Systra

Dankotuwa Porcelain

Fundação Butantan

Beijing Mass Transit Railway

VWS Westgarth

Dipex

Grecian Delight Foods

CD Projekt

Energy and Utilities

Eickhoff

Guangzhou Grain Group

City of Uppsala

Agder Energi

Estudio Cerámico

Guangzhou Taiqi Food Co.

Établissements Darty et Fils

BaiYin Power

Hymer-Leichtmetallbau

Jotun

Evry

Brookfield Renewable Power

Hypnos

Legacy Pharmaceuticals

SEFI Transmission

Central Nuclear Embalse

Jamestown Metal Marine Sales

Marabu

Shantou Zhongyeda

CYPC Jinsha River Hydropower

Moelven Industrier

Nature's Path Foods

Toronto Transit Commission

ENEA Wytwarzanie

Molins Tobacco Machinery

Omega Protein

GDF Suez Énergie Services

Nidec Minster Corporation

Omni Industries

5

MESSAGE FROM THE PRESIDENT

Significant improvement in earnings

Net revenue for the year increased by 9 percent, currency

adjusted, with license revenue being affected in the last

quarter by the timing of deals that moved into 2015. Even

though it meant we did not achieve the license-growth target

for the year, it points to the fact that we are targeting

increasingly larger deals, by their nature the timing of which is

harder to predict. To a limited degree there has also been an

impact resulting from the drop in oil price. This may reduce

future investment in a number of oil and gas related industries

but the overall impact is expected to be limited due to our

broad and strong presence in other sectors—infrastructure,

transportation, project-based industries, manufacturing, and

service management—most of which are likely to benefit

from a lower oil price. In particular, our execution in service

management has improved considerably, with Gartner now

rating us as a leader in its Magic Quadrant for Field Service

Management.

Maintenance revenue for the year increased by

11 percent, currency adjusted, resulting from license sales and

strong customer loyalty, the ongoing development of which

remains a priority. Customers extending their use of

IFS Applications within their global organizations will

continue to contribute to our future growth. The maintenance

margin increased to 75 percent ('13: 72 percent) resulting

from investments in improving efficiency within our global

support operation.

Consulting revenue for the year increased by 11 percent,

currency adjusted, with a steadily larger proportion of services

being delivered from our growing partner ecosystem. We

continue to invest in our ecosystem to offer customer choice,

create go-to-market alliances, and increase scalability within

our business. We added a number of new strategic partners in

2014 that have contributed to our global implementation

capability. Despite the higher proportion of services being

delivered by partners, the consulting margin increased to

20 percent ('13: 19 percent).

We continue to see a steady increase of interest in clouddeployed systems, especially where IFS Applications is

offered in partnership with Microsoft on their Azure Cloud.

We cater for all interests, whether off or on premise, and in

the latter choice we launched ‘IFS in a Box’ in co-operation

with Oracle to allow a simplified and even easier option to

deploy our solution.

During the year, companies in need of consolidating their

business solution or expanding its functionality moved

6

forward with their investments and the gradual improvement

of the buying environment seen over the last couple of years

continued. However, based on preliminary figures, the ERP

market as a whole did not perform in 2014 as well as

originally projected and grew by around 4 percent. Industry

analyst firms such as Gartner expect this trend of rather slight

overall growth to persist in 2015.

We expect 2015 will be a year when we will see further

benefit from our investment in sales and marketing, which is

continuing to gain us recognition as being the intelligent

alternative to the global giants for internationally-deployed

solutions delivered in our target markets. Also in 2015 we will

have our release to market of our latest version of IFS

Applications; in this release we have a number of exciting new

features and an enhanced architecture designed to better

enable our partners to work with our product. On the back of

our strong cash flow and finances we are actively searching

the market for acquisitions we believe will strengthen our

portfolio and create value. We expect to see good growth in

both license revenue and EBIT in 2015.

Alastair Sorbie

PRESIDENT & CEO

IFS AND IFS APPLICATIONS

IFS, one of the world’s leading suppliers of business software,

offers applications that enable companies to respond quickly

to market changes and use resources in a more agile way to

achieve better business performance and competitive

advantages.

IFS was founded in 1983 and has 2,700 employees

worldwide. With IFS Applications™, now in its eighth

generation, IFS has pioneered component-based ERP

software. The company now

has

nearly

30

years’

experience

in

the

implementation of ERP

systems, with consultants

with deep industry expertise

and who understand the

customer’s business and

needs.

The

component

architecture

provides

solutions that are easier to

implement, run, and upgrade.

IFS Applications business

software provides increased

ERP functionality, including

CRM, SCM, PLM, CPM,

enterprise asset management,

and MRO capabilities.

IFS is an organization with a truly global reach and is

today represented in approximately 50 countries through

wholly or jointly-owned subsidiaries, and partners. IFS has

more than 2,400 customers and over 900,000 users and its

solution is installed in over 60 countries in about

20 languages.

With its own resources and in cooperation with partners, IFS

develops, sells and implements the component-based ERP

software IFS Applications.

provides customers with competitive advantages in their own

markets and has made IFS the leader in several industries.

Within maintenance and logistics systems for aerospace and

defense, for example, IFS is the global market leader.

In addition to the processes supported by all business

systems, such as finances, inventories, customer management

and traditional manufacturing, IFS Applications is specialized

in a number of specific manufacturing processes and in

support for the entire life

cycle of products, from

construction to maintenance

and aftermarket services.

This provides substantial

advantages for customers,

the information created

during construction and

manufacturing

being

important when the products

are later maintained, possibly

during several decades.

In recent years, IFS has

seen increased demand for

IT support for projectoriented activities in several

of its targeted industries. IFS

has worked quickly to provide enhanced software

components to better manage challenges such as cost, time,

resources, liquidity, and risk in project-driven activities. The

optimization of these key areas results in better control and is

the key to enhanced efficiency and control. It also provides

increased opportunities to capitalize on new business

opportunities. The use of traditional organizational structures

and systems makes it difficult to handle operational situations

in real time and reduces flexibility, as it is necessary to balance

resources in relation to expected deliveries. It is expensive and

difficult to assess whether new business opportunities, but

also ongoing operations, will be profitable.

IFS APPLICATIONS

CREATIVITY AND INNOVATION

BUSINESS CONCEPT

IFS Applications is a comprehensive business system for midsized and large organizations, and is specialized in a number

of business processes. Experience from customers, user

groups, industry analysts and the company’s strong network

of partners has been combined to create leading industry

solutions to meet specific customer needs.

Structural changes such as globalization, market

transparency

through

the

Internet,

consolidation,

specialization, etc. are making it harder to label companies

based purely on their industrial belonging. As a matter of fact,

the landscape of processes in which a company is operating

often offers a better illustration of its actual business and

challenges than the industry under which it is labeled.

IFS focuses on agile businesses where any of four core

processes are strategic: service and asset management,

manufacturing, supply chain, and projects. This focus

IFS has two distinct advantages over competitors: the single

integrated product line in IFS Applications and the fact that it

has been component-based for more than a decade. This

means that IFS is uniquely placed to supply business

components that take advantage of today’s service-oriented

architectures (SOA).

The Group’s product development is primarily

conducted at IFS’s R&D centers in Sri Lanka, Poland, and

Sweden. During the year, product development focused on

IFS Applications 9, which is the next core release of IFS

Applications and will be officially released in 2015.

A beta version of IFS Applications 9 was delivered to

selected customers during 2014. The upcoming version offers

new and existing customers major enhancements in terms of

agility and usability, as well as powerful capabilities tailored to

support customers in IFS’s target industries.

7

In addition, new versions of IFS Field Service Management

and IFS Mobile Workforce Management have been released,

as well as a number of important improvements, aimed at

increasing the business benefits of existing versions.

STRATEGIES IN BRIEF

•

IFS will strengthen its profit, cash flow, and financial

position by focusing on increasing sales, reducing costs,

and increasing its market share in selected industries.

•

The company’s product development will focus on

maintaining IFS’s position as a technical leader in

component-based business software for a global market.

•

IFS Applications, will support the standards that are

important for the customers. IFS will supply integrated

Internet-based solutions that enable increased

cooperation among customers, suppliers, and partners.

•

The product, methods, support system, and infrastructure

will support customers with global operations.

•

To meet the market’s increased demands for solutions

with broad functionality combined with in-depth industry

knowledge, IFS will focus on a limited number of

industry segments.

•

The company will continue to develop global and local

cooperation with partners to enable continued

development of IFS’s competence and market presence

with lower risk and capital requirements.

•

IFS will maintain its own supplier capacity for consultant

services related to the implementation and use of

IFS Applications in important markets and to support its

partners.

•

The company’s ability to offer resources from IFS’s Sri

Lankan unit for customer projects and cooperation with

partners will increase its competitiveness.

8

•

IFS will stimulate increased mobility among all its

employees to increase competence and understanding of

various international markets.

PARTNERS

The development of the IFS’s partner ecosystem continues to

be a priority and remains a key part of the company’s global

strategy to expand its footprint in key markets and to give its

customers greater choice when choosing their service or

technology partner. During 2014 many new modules were

added to the IFS Academy content catalogue and IFS also

continued to develop and expand the IFS Partner Program to

extend its joint sales and marketing activities and improve

access to IFS resources. All regions were actively engaged

with their local partner ecosystem to identify and develop

sales opportunities, with strong incremental pipeline

development as a result.

In addition to the network of system integrator partners

(SIs), IFS also continued the development of its ecosystem of

technology partners. During 2014, the company successfully

launched the IFS on Microsoft Azure Cloud solution and

gained its first customers with this new offering. The

company also launched “IFS-in-a-Box,” which is a fullyintegrated, on premise, pre-configured, tested and optimized,

complete hardware and software solution developed in

partnership with Oracle. Both these solutions offer major

advantages to customers in IFS’s key markets wishing to

speed up deployment time and reduce project risk.

During 2015, the company will continue to develop its

relationships with its existing partner ecosystem and will also

enter into new partnerships with both service and technology

partners around the world.

SOCIAL RESPONSIBILITY AND ENVIRONMENT

IFS operates in a distinctly low-risk industry in terms of the

direct impact of its activities on people and the environment.

This applies to the entire value chain, including software

development, for which IFS’s largest unit is located in Sri

Lanka. In addition, the company distributes information

efficiently through its intranet, where all employees have

access to policies and guidelines pertaining to sustainability,

including environmental impact, gender equality, diversity,

and work environment.

Corporate social responsibility (CSR) is becoming

increasingly important in the global marketplace—both in

terms of mitigating risks associated with legal compliance as

well as enhancing business insight to boost profitability. IFS’s

unique ERP offering includes a broad variety of solutions for

efficient reporting and enhanced control in the field of CSR

and non-financial reporting. The solutions are fully integrated

with IFS Applications to promote user productivity and

reduce time spent on non-value-adding administration and

thereby cut costs. Through its Eco-footprint Management

component, IFS Applications can be used to manage much of

the information required for a company to monitor its

sustainability issues, report its environmental impact, and

comply with legislation and regulations governing

environmental issues. IFS is working actively on product

development to further improve functionality in this regard.

Implementation and monitoring of the Code of Conduct and

Environmental Policy

IFS attaches great importance to the issues of sustainability

and corporate responsibility, such as the environment, health

and safety, equal opportunities, diversity, anti-corruption

work and business ethics, and the company’s and employees’

values. IFS’s Code of Conduct is based on the UN Global

Compact’s ten principles and both the Code of Conduct and

the Environmental Policy are set down formally by the CEO.

Interest in these documents has increased from both the

stock market and customers and prospects. Questions about

IFS’s various policies and CSR work are increasingly common

in enterprise software procurements, which is why IFS has

intensified its efforts to communicate its commitment and

concrete initiatives.

Sustainability, education, and company employees

In 2014 and 2015, a project is underway to more clearly

visualize IFS’s commitment to the outside world. Within the

framework of this project, three areas have been identified in

which the Group is actively working and all major

commitments can be divided into. These three areas are the

local/global environment and society (sustainability), training

and support for future generations of workers (education),

and good treatment and job satisfaction among IFS’s staff

(company employees).

IFS has a low environmental risk. The Group’s most

significant environmental impact is energy consumption from

its premises, business travel, purchasing of office material and

9

handling of used hardware. In all these areas there are

initiatives to reduce the company’s environmental impact, e.g.

through technology that enables remote work and meetings

(thus minimizing travel), sensors that regulate power supply in

the offices, and smart solutions that minimize paper waste

from printers, for instance. IFS is also centralizing servers and

other computer equipment in a few locations managed by

suppliers that meet the Group’s environmental requirements,

thus reducing the emissions from cooling and power

consumption. All employees

are encouraged to respect the

environment and strive to

work with sustainability

issues such as recycling and

energy

efficiency

when

possible.

In many parts of the

world, education is not a

matter of course, and many

times

it

is

economic

conditions that determine

whether a person can receive

training or not. The company

has

therefore

made

significant investments in

helping financially vulnerable

people get training that leads

to work, which in turn

affects the wider community

in a positive way. IFS’s

efforts have mainly been

concentrated to Sri Lanka,

where the Group has a large

number of its employees and

where access to a highly

educated workforce with

good expertise in IT and

business

systems

has

previously not been a given.

IFS collaborates with the

country’s largest universities through various initiatives to

offer more people the opportunity to study at university level.

Through one of the programs, IFS covers tuition fees and

living costs during the time the student is studying for a

university degree. Stundents begin their education with a sixmonth study period at IFS: four days a week at IFS and two

days at the university. Following this, the student works as an

intern four days a week at IFS and continues to study two

days at the university. There is no obligation attached to the

10

scholarship to continue working within IFS; yet, as many as

90 percent choose to do so. To invest in scholarship

programs and support the universities in Sri Lanka benefit

society in the long term. IFS not only helps with scholarships

to economically disadvantaged students, but also sponsors a

professorship at the University of Moratuwa. IFS Sri Lanka

employees regularly give guest lectures at universities to offer

students insight into how global IT companies work and IFS

donates equipment to the computer labs on campus. Guest

lectures and the donation of

computer equipment are

initiatives taken in other

parts of the IFS Group as

well, for instance in Germany

and Sweden.

Although CSR is usually

associated

with

the

environment and helping

society’s weakest members, it

is equally important to

ensure that it contributes to

the positive development of

the company’s employees.

IFS

employees

are

ambassadors for the Group

and their value system is the

prerequisite for success in

CSR as well as in the

company’s daily operations.

IFS is working actively with

equality and wants to set a

good example to inspire the

entire IT industry to improve

equality and attract more

women to enter the industry.

The basis of this is a genderneutral

view

of

the

workplace,

including

discussions in workshops

and in conjunction with the

annual salary revision. IFS is sponsoring networks for women

in IT, such as Oda of Norway, and participates with many

other global companies in the Womentor initiative to support

female managers in the IT industry with the help of mentors.

Additionally, IFS wants to increase interest in technology

among younger women and participates in this year’s

NextUp, a Swedish competition for eighth-graders to which

IFS contributes both financially and with a case that the

contestants work on.

IFS SHARE

IFS B share is listed since April 28, 1998 on the Stockholm

stock exchange and is traded on the Nasdaq OMX Stockholm

Mid-Cap list (sector: information technology). The company’s

A share has been on the same list since June 18, 1998.

As of December 31, 2014, IFS’s capital stock amounted

to SKr 499,436,600, represented by 24,971,830 shares, before

dilution, with a nominal value of SKr 20 per share. These

comprised 1,084,103 A shares and 23,887,727 B shares. On

December 31, 2014, the Company held 200,000 B shares in

its own custody.

Each A share carries the right to one vote and each

B share carries the right to one tenth of a vote. All shares

carry equal rights to dividends.

During the year, a total of 0.0 million A shares and

5.3 million B shares were traded, corresponding to 21 percent

of the average total number of listed shares. The principal

owner is Gustaf Douglas with associated companies, who

controlled 21.5 percent of the capital and 21.2 percent of the

voting rights on December 31, 2014.

SHARE CATEGORIES

Number of

shares

Number of

voting rights

Share of

capital

Share of

votes

A shares

1,084,103

B shares

23,887,727

1,084,103

4.3%

31.2%

2,388,773

95.7%

Total

24,971,830

68.8%

3,472,876

100.0%

100.0%

Source: SIS Ägarservice, Dec. 30, 2014

DISTRIBUTION OF SHAREHOLDERS

Share of

capital

Share of

votes

Swedish individuals

30.1%

46.5%

Swedish mutual funds

41.2%

29.8%

Swedish institutional owners

12.5%

8.4%

Swedish owners

83.8%

84.7%

16.2%

15.3%

International owners

Total

100.0% 100.0%

Source: SIS Ägarservice, Dec. 30, 2014

SHAREHOLDER STATISTICS

Shareholders

Ownership

Number of shares held

Number

Proportion

1–1 000

93.6%

673,470

2.7%

2.2%

147

2.5%

218,897

0.9%

0.7%

2 001–5 000

85

1.6%

294,089

1.2%

1.1%

5 001–10 000

39

0.7%

283,092

1.1%

1.4%

10 001–50 000

49

0.8%

1,290,392

5.2%

5.6%

50 001–100 000

13

0.2%

976,856

3.9%

4.9%

100 001–

36

0.6%

21,235,034

85.0%

84.1%

5,778

100.0%

24,971,830

MAJOR SHAREHOLDERS

Shareholder

250,000

200,000

200

150,000

180

100,000

50,000

Q

1

Volume

Q

2

IFS B

Q

3

0

Q

4

All-share index

Number of

B shares

Share of

capital

Share of

votes

217,201

5,161,000

21.5%

21.2%

Anders Böös*

427,010

0

1.7%

12.4%

Lannebo funds

-

2,966,580

11.9%

8.6%

Catella funds

-

2,362,356

9.5%

6.8%

NEC Corporation

110,000

679,000

3.2%

5.2%

Bengt Nilsson*

150,000

0

0.6%

4.4%

Swedbank Robur funds

-

1,466,698

5.9%

4.3%

SEB funds

-

1,220,652

4.9%

3.5%

Skandia Liv

-

858,648

3.4%

2.5%

Unionen

-

807,196

3.2%

2.3%

78,932

12,500

0.4%

2.3%

Handelsbanken funds

-

801,402

3.2%

2.3%

Fourth Sw. Nat'l Pension Fund

-

734,238

2.9%

2.1%

100,960

6,617,457

26.9%

22.1%

1,084,103

23,687,727

-

200,000

1,084,103

23,887,727

Other shareholders

140

Number of

A shares

Gustaf Douglas*

Heinz Kopfinger

160

100.0% 100.0%

Source: SIS Ägarservice, Dec. 30, 2014

300,000

220

Voting

rights

5,409

PRICE DEVELOPMENT AND TRADE VOLUME 2014

240

Capital

1 001–2 000

Total

260

Number of

shares

External shareholders

IFS's own custody

Total

*and associated companies

99.2% 100.0%

0.8%

-

100.0% 100.0%

Source: SIS Ägarservice, Dec. 30, 2014

11

TABLE OF CONTENTS OF THE ANNUAL REPORT

BOARD OF DIRECTORS’ REPORT

13

Notes to the financial statements

Corporate governance report

20

Note

1

Accounting principles

FINANCIAL STATEMENTS

26

Note

2

Segment reporting

44

Consolidated income statement

26

Note

3

License revenue

46

Note

4

Maintenance and support revenue

46

Consolidated statement of comprehensive income

27

Note

5

Other revenue

46

Consolidated balance sheet—assets

28

Note

6

Development expenditure

47

Note

7

Sales and marketing expenses

47

35

Consolidated balance sheet—equity and liabilities

28

Consolidated capital account

29

Note

8

Other operating income

47

Note

9

Other operating expenses

47

Consolidated statement of cash flows

30

Note 10

Transactions between subsidiaries

47

Income statement of the parent company

31

Note 11

Operating expenses per type of cost

47

Statement of comprehensive income of the parent company

31

Note 12

Auditors’ fees

47

Balance sheet of the parent company—assets

32

Note 13

Salaries, other remunerations, and social costs

47

Note 14

Remunerations paid to the board and executive management 47

Balance sheet of the parent company—equity and liabilities

32

Note 15

Transactions with related parties

Capital account of the parent company

33

Note 16

Average number of employees per country

49

Statement of cash flows of the parent company

34

Note 17

Results from participations in subsidiaries

49

NOTES TO THE FINANCIAL STATEMENTS

35

Note 18

Results from participations in associated companies

49

Note 19

Other interest income and similar income

49

Note 20

Interest expenses and similar expenses

49

Note 21

Taxes

49

Note 22

Profit and dividend per share

50

Note 23

Intangible fixed assets

50

Note 24

Tangible fixed assets

52

AUDITOR’S REPORT

12

67

48

Note 25

Operating lease agreements

53

Note 26

Participations in subsidiaries

54

Note 27

Participations in associated companies and joint ventures

55

Note 28

Receivables in subsidiaries

55

Note 29

Deferred tax claims and tax liabilities

55

Note 30

Other long-term receivables

56

Note 31

Accounts receivable

56

Note 32

Other receivables

56

Note 33

Liquid assets

56

Note 34

Stockholders’ equity

56

Note 35

Liabilities to credit institutions

58

Note 36

Risk structure pertaining to interest and financing

58

Note 37

Pension commitments

59

Note 38

Other provisions and other liabilities

61

Note 39

Other liabilities

61

Note 40

Accrued expenses and prepaid income

61

Note 41

Pledged assets

61

Note 42

Contingent liabilities

61

Note 43

Adjustments for items not included in cash flow

61

Note 44

Business combinations

61

62

Note 45

Net acquisition of tangible fixed assets

Note 46

Financial risk management and derivatives

62

Note 47

Application of IFRS 11 ”Joint Arrangements”

64

Note 48

Conversion rates

65

Note 49

Information about the Parent company

65

BOARD OF DIRECTORS’ REPORT

GENERAL

The board of directors and the chief executive officer of

Industrial and Financial Systems, IFS AB (publ), corporate

identity number 556122-0996, herewith submit the annual

accounts and consolidated accounts for the fiscal year 2014.

Unless otherwise stated, all amounts are in SKr million.

Information in parentheses refers to the preceding fiscal year.

The terms “IFS”, “Group”, and “Company” all refer to the

Parent Company—Industrial and Financial Systems,

IFS AB—and its subsidiaries.

SUMMARY

The overall objective for 2014 was to achieve strong license

growth and a significant improvement in EBIT. IFS

continued its focus on project-oriented industry and markets

with a strong need for well-functioning processes within

logistics, maintenance, and service and the Company won

during 2014 highly-competitive contracts in its target sectors.

Net revenue for the year increased by 9 percent, currency

adjusted, with license revenue being affected in the last

quarter by the timing of deals that moved into 2015. Even

though it meant the company did not achieve the licensegrowth target for the year, it points to the fact that it is

targeting increasingly larger deals, by their nature the timing

of which is harder to predict. Maintenance revenue increased

by 11 percent, currency adjusted, resulting from license sales

and strong customer loyalty, the ongoing development of

which remains a priority. Consulting revenue increased by

11 percent, currency adjusted, with a steadily larger

proportion of services being delivered from a growing partner

ecosystem. Despite the higher proportion of services being

delivered by partners, the consulting margin increased to

20 percent. Net revenue amounted to SKr 3,034 million

('13: SKr 2,704 million). EBIT increased to SKr 275 million

('13: SKr 202 million) and cash flow after investments was

SKr 269 million ('13: SKr 122 million).

OPERATIONS

IFS is a leading provider of component-based business

software developed using open standards and based on

service-oriented architecture (SOA). The solutions enable

companies to respond quickly to market changes and use

resources in a more agile way to achieve better business

performance and competitive advantage.

Founded in 1983, IFS has more than 2,700 employees

worldwide. With IFS Applications™, now in its eighth

generation, IFS has pioneered component-based ERP

software. The component architecture provides solutions that

are easier to implement, run and upgrade. IFS Applications is

installed in more than 60 countries in about 20 languages.

IFS has some 2,400 customers and over 900,000 users

across seven key vertical sectors: aerospace and defense;

automotive; manufacturing; process industries; construction,

contracting, and service management; retail and wholesale

distribution; and utilities and telecom. IFS Applications

provide extended ERP functionality, including CRM, SCM,

PLM, CPM, enterprise asset management, and MRO

capabilities.

IFS is today represented in approximately 50 countries

through wholly and jointly owned subsidiaries, joint ventures,

and partners. Operations are divided into six operating

segments: Europe North; Europe West; Europe Central; Europe

East; Americas; and Africa, Asia, and Pacific. These segments

have the operational responsibility for sales and delivery to

customers. Product development and support are included in

corporate functions.

MARKET ANALYSIS

Globalization entails increased competition and more

complex supply chains. Companies are meeting these

challenges by investing in new, improved ERP solutions to

streamline operations and simplify collaboration with

suppliers, customers, and partners. Moreover, an increasing

number of companies are doing business internationally, in

part with new business models. Legislation and regulations

are becoming more comprehensive, mergers and acquisitions

are increasing as the economy strengthens, and many

companies

are

moving

from

traditional

manufacturing/distribution to more project-based and

service-oriented business models. These drivers led to a

successive recovery of the ERP market from the middle of

the first decade of this century to the end of 2008, when the

trend was broken and the market weakened in the wake of

events in the global economy. These drivers will, however,

continue to be a force in the long term.

Uncertainties surrounding the prospects for an upturn in

global economic growth remain the major retardants of IT

growth. This uncertainty has engendered the pessimistic

business and consumer sentiment in evidence throughout

much of the world. Despite caution among buyers due to the

prevailing macroeconomic environment, companies in need

of a business solution moved forward with their investment

plans in 2014 and the enterprise application market showed a

slow but steady rate of growth of approximately 4 percent.

The buying environment’s trajectory leads industry analyst

firms such as Gartner to expect that this trend of rather slight

overall growth will persist in 2015.

The competitive position has not changed during 2014

and is not expect to change over the coming years. After the

consolidations of recent years, SAP, Oracle, and Microsoft are

the principal global competitors in the industries and

processes in which IFS operates. In specific segments and

geographic markets, IFS also competes with a number of

niche vendors.

13

SKr, million

2014

actual

Translation

effect

Structural

changes

2014

adjusted

2013

actual

Organic

change

Reported

change

NET REVENUE

License revenue

558

-19

-10

529

535

-1%

4%

Maintenance and support revenue

1,037

-35

-22

980

902

9%

15%

Total product revenue

1,595

-54

-32

1,509

1,437

5%

11%

Consulting revenue

1,427

-35

-25

1,367

1,256

9%

14%

Net revenue (including other revenue)

3,034

-89

-58

2,887

2,704

7%

12%

2,759

-81

-48

2,630

2,502

5%

10%

-1

-1

-

-2

43

OPERATING EXPENSES

Operating expenses

Other operating income/costs net

Capital gains/losses

-

0

-

0

0

Exchange rate gains/losses

-24

-3

-

-27

-14

Restructuring costs/redundancy costs

-15

1

-

-14

-96

2

-

-

2

14

-175

-

-

-175

-153

Amortization of acquired intangibles

-38

2

-

-36

-31

Other amortization/depreciation

-29

1

-1

-29

-28

Capitalized product development

190

-

-

190

188

Adjusted operating expenses

2,669

-81

-49

2,539

2,425

5%

10%

Adjusted EBITDA

365

-8

-9

348

279

25%

31%

Adjusted EBITDA/net revenue

12%

12%

10%

Reversal of restructuring costs

Amortization of capitalized product development

NET REVENUE

PERSONNEL NUMBERS AND EFFICIENCY

License revenue for 2014 was 1 percent higher than in the

previous year, currency adjusted. During the year, the ten

largest license deals had a total value of SKr 107 million; the

corresponding figure for 2013 was SKr 128 million. A total of

28 license agreements exceeding US$ 0.5 million in value were

sold during the year. No single customer accounted for more

than 10 percent of net revenue. Maintenance and support

revenue continued to grow and consulting revenue was also

higher than in the previous year, currency adjusted. Net

revenue was SKr 330 million higher than in 2013, an increase

of 9 percent, currency adjusted.

The average number of employees decreased, amounting to

2,645 (2,688). The headcount for product development at the

end of the year was 593 (582), of whom 359 (340) worked at

the development center in Sri Lanka. Net revenue per

employee increased by 11 percent, currency adjusted, and by

14 percent non-currency adjusted to SKr 1,147 thousand

(1,006). Personnel-related expenses per employee amounted

to SKr 670 (605), an increase of 5 percent, currency adjusted.

The number of employees at year end was 2,707 (2,616).

COSTS AND EXPENSES

Operating expenses were SKr 257 million higher than in

2013, which represents an increase of 7 percent, currency

adjusted. Variable expenses such as costs related to thirdparty suppliers, partners, and subcontracted consultants

amounted to SKr 367 million (290), an increase of 23 percent,

currency adjusted. Other operating expenses amounted to

SKr 2,392 million (2,212), an increase of 5 percent, currency

adjusted. Payroll expenses amounted to SKr 1,771 million

(1,627), an increase of 6 percent, currency adjusted.

PRODUCT-DEVELOPMENT EXPENDITURE

Product development expenditure for the year amounted to

SKr 318 million (295). Capitalized product development

totaled SKr 190 million (188) and amortization of previously

capitalized

product

development

amounted

to

SKr 175 million (153).

14

EBIT

EBIT amounted to SKr 275 million (202), an increase of

36 percent compared with 2013. EBIT before amortization

and depreciation but after reversal of capitalized development

expenditure and adjusted for nonrecurring items consisting of

severance costs and capital gains and losses, i.e. adjusted

EBITDA, amounted to SKr 365 million (279), corresponding

to a margin of 12 percent.

PROFIT FOR THE YEAR

Net financial items were SKr -17 million (-18). Adjusted for

exchange rate effects, the net financial items, including bank

costs, were SKr -9 million (-19). Net interest income was

SKr -5 million (-7). Profit before tax increased to

SKr 258 million (184) while profit for the year increased to

SKr 211 million (143).

OPERATING AREAS

EUROPE CENTRAL

In the comments, comparisons with the previous year refer to currencyadjusted values unless otherwise stated.

SKr, million

License revenue

61

66

-8%

EUROPE NORTH

Maintenance and support revenue

98

87

13%

Consulting revenue

178

145

23%

Net revenue

375

341

10%

81

70

16%

229

197

16%

SKr, million

2014

2013

Δ*

License revenue

149

140

6%

Maintenance and support revenue

361

343

5%

Consulting revenue

649

579

12%

Net revenue

1,185

1,083

9%

EBIT, undistributed**

359

297

21%

Number of employees at the end of the period

465

437

6%

* Change between the years not adjusted for currency effects

** EBIT before allocation of corporate revenue and expenses

Europe North’s revenue increased by 9 percent, with licenses

growing by 8 percent and maintenance revenue by 5 percent.

Consulting revenue increased by 11 percent, to a large extent

as a result of the planned augmented usage of partners in

implementation, which also explains the growth of 36 percent

or SKr 55 million in variable expenses. Fixed expenses

increased by 3 percent, mainly due to inflation. Other

operating items net were SKr 40 million lower, due to the

restructuring costs in the first quarter 2013. The earnings

thereby improved by 21 percent, non-currency-adjusted.

Larger license deals included Jotun, Saab, and Songa.

Number of employees at the end of the period

2014

2013

Δ*

License revenue

124

104

19%

Maintenance and support revenue

224

174

29%

Consulting revenue

188

152

24%

Net revenue

628

487

29%

EBIT, undistributed*

163

192

-15%

Number of employees at the end of the period

327

323

1%

* Change between the years not adjusted for currency effects

** EBIT before allocation of corporate revenue and expenses

The numbers in 2014 were affected by the merge of the

segment Defense. Net revenue increased by 18 percent, mainly

due to a growth in product revenue. License revenue

increased by 18 percent, maintenance revenue by 19 percent,

and consulting by 22 percent. Operating expenses, excluding

other operating items, were 21 percent higher. Earnings

decreased by 15 percent, non-currency-adjusted, as 2013 was

positively affected by a one-off item of SKr 47 million

relating to the reorganization and acquisition of IFS Defence.

Larger license deals included Aspire Defence, IMI, and

Montupet.

2013

Δ*

* Change between the years not adjusted for currency effects

** EBIT before allocation of corporate revenue and expenses

Net revenue for Europe Central was 4 percent better than in

2013, mainly due to an increase in consulting but also

maintenance revenue increased. Earnings improved by

16 percent, non-currency-adjusted, as a result of the increased

revenue. Some of the larger license deals in Europe Central

were Huf, IHC Merwede, and Marabu.

EUROPE EAST

SKr, million

2014

2013

Δ*

License revenue

29

26

Maintenance and support revenue

66

63

5%

Consulting revenue

74

65

14%

192

171

12%

13

-21

n/a

208

228

-9%

Net revenue

EBIT, undistributed**

Number of employees at the end of the period

EUROPE WEST

SKr, million

EBIT, undistributed**

2014

12%

* Change between the years not adjusted for currency effects

** EBIT before allocation of corporate revenue and expenses

Net revenue increased by 9 percent, following increases in all

revenue streams. Costs, excluding other operating items, were

6 percent lower, mainly as a result of a restructuring program

carried out in the fourth quarter 2013. Earnings thereby

improved by SKr 34 million, non-currency-adjusted. Some of

the major license contracts were CD Projekt, ENEA, and

JSC Energo.

AMERICAS

SKr, million

2014

2013

Δ*

License revenue

129

120

8%

Maintenance and support revenue

205

172

19%

Consulting revenue

243

225

8%

Net revenue

636

575

11%

EBIT, undistributed**

179

168

7%

Number of employees at the end of the period

280

283

-1%

* Change between the years not adjusted for currency effects

** EBIT before allocation of corporate revenue and expenses

Americas increased its net revenue by 7 percent, mainly due to

higher maintenance but also growing consulting. Costs

increased, mainly due to higher variable costs as a result of the

planned increased usage of partners in implementation.

Earnings were 7 percent better than in 2013, non-currencyadjusted. Some of the largest deals during the year were

Advanced Technology Services, Calsonic, and Lockheed

Martin.

15

AFRICA, ASIA, AND PACIFIC

SKr, million

2014

2013

Δ*

License revenue

66

78

-15%

Maintenance and support revenue

83

61

36%

Consulting revenue

98

87

13%

274

245

12%

48

38

26%

264

255

4%

Net revenue

EBIT, undistributed**

Number of employees at the end of the period

* Change between the years not adjusted for currency effects

** EBIT before allocation of corporate revenue and expenses

Net revenue increased by 11 percent, due to improvements in

maintenance and consulting revenue. Costs were 9 percent

higher than in 2013, mainly due to reversed provisions for

bad debts in 2013. Earnings improved by 26 percent, noncurrency-adjusted. Larger license deals included DSI Samson,

Mermaid Marine, and Pindan Asset Management.

PRODUCT DEVELOPMENT

The Group’s product development is primarily conducted at

IFS’s R&D centers in Sri Lanka, Poland, and Sweden. During

the year, product development focused on IFS Applications

9, which is the next core release of IFS Applications and will

be officially released in 2015.

A beta version of IFS Applications 9 was delivered to

selected customers during 2014. The upcoming version offers

new and existing customers major enhancements in terms of

agility and usability, as well as powerful capabilities tailored to

support customers in IFS’s target industries.

In addition, new versions of IFS Field Service

Management and IFS Mobile Workforce Management have

been released, as well as a number of important

improvements, aimed at increasing the business benefits of

existing versions.

PARTNERS

The development of the IFS’s partner ecosystem continues to

be a priority and remains a key part of the company’s global

strategy to expand its footprint in key markets and to give its

customers greater choice when choosing their service or

technology partner. During 2014 many new modules were

added to the IFS Academy content catalogue and IFS also

continued to develop and expand the IFS Partner Program to

extend its joint sales and marketing activities and improve

access to IFS resources. All regions were actively engaged

with their local partner ecosystem to identify and develop

sales opportunities, with strong incremental pipeline

development as a result.

In addition to the network of system integrator partners

(SIs), IFS also continued the development of its ecosystem of

technology partners. During 2014, the company successfully

launched the IFS on Microsoft Azure Cloud solution and

gained its first customers with this new offering. The

company also launched “IFS-in-a-Box,” which is a fullyintegrated, on premise, pre-configured, tested and optimized,

complete hardware and software solution developed in

partnership with Oracle. Both these solutions offer major

16

advantages to customers in IFS’s key markets wishing to

speed up deployment time and reduce project risk.

During 2015, the company will continue to develop its

relationships with its existing partner ecosystem and will also

enter into new partnerships with both service and technology

partners around the world.

CASH FLOW, LIQUIDITY, AND FINANCIAL POSITION

Cash flow from current operations before change in working

capital amounted to SKr 450 million (336). Change in tied

working capital amounted to SKr 51 million (70). Days of

sales outstanding (DSO) at year-end was 76 days (79). DSO

calculated on the monthly receivables’ positions during the

year was 55 days (55).

Investments totaled SKr 232 (284) million. Product

development expenditure was capitalized in an amount of

SKr 190 million (188). Cash flow after investments totaled

SKr 269 million (122). Cash flow from financing operations

was SKr -164 million (-13). Loans from credit institutions

decreased by SKr 67 million during the year (increase by 18).

Cash and cash equivalents on December 31, 2014 totaled

SKr 489 million (354). The Group’s net liquidity position at

year end, excluding pension liabilities, amounted to SKr 359

million (157). Cash and unutilized credit totaled SKr 859

million (657). External financing amounted to SKr 130

million (197).

During the year, the Company distributed a dividend of

SKr 87 million (87). During the year, the Company bought

back warrants for an amount of SKr 11 million (2).

IFS SHARE

The Parent Company is listed on the Nasdaq OMX

Stockholm Mid-Cap list. The number of shareholders on

December 31, 2014 was 5,778. The number of shares on

December 31, 2014 was 24,971,830, of which 1,084,103 were

A shares, carrying the right to 1.0 vote per share, and

23,887,727 were B shares, carrying the right to 0.1 vote per

share. On December 31, 2014, the Company held 200,000

B shares in its own custody.

There is no limit to the number of votes a stockholder

may cast at the AGM. The Company is not aware of any

agreements between stockholders that limit the right to

transfer shares.

Two stockholders in the Company, through direct or

indirect holdings in the Company, represent at least one tenth

of the voting rights of the total number of shares. They are

Gustaf Douglas with family and associated companies, and

Anders Böös through associated companies. The Company’s

pension trust does not exercise direct ownership of company

stock. The Company is party to loan agreements that may be

affected if a change in the control of the Company occurs.

GUIDELINES FOR THE REMUNERATION OF MEMBERS OF THE BOARD

AND EXECUTIVE MANAGEMENT

Directors’ fees are paid to the chairman and the other

directors of the board as resolved by the AGM. For

2014/2015, director’s fees totaled SKr 3.05 million, of which

the chairman of the board received an amount of

SKr 1.4 million and each of the other directors received an

amount of SKr 375 000. The chief executive officer was not

remunerated for work on the board. Remuneration for work

on the audit committee was unchanged from the previous

year: the chairman received SKr 100,000 and another director

received SKr 50,000.

In accordance with the guidelines adopted by the AGM

of 2014, the remuneration of the CEO and other members of

executive management consists of basic salary, variable

remuneration, other benefits, and pension contributions. For

the CEO, the maximum variable remuneration shall not

exceed 50 percent of the basic salary, and for the other

members of executive management variable remuneration

shall be payable in the interval 25–60 percent of the basic

salary, based on achievement of 80–120 percent of individual

goals. The AGM of 2014 resolved to establish an incentive

program whereby the Company offered executive

management and other key personnel the opportunity to

acquire warrants in the Company. The acquisition of one

warrant at market price carried the right, subject to certain

terms and performance conditions, to receive up to three

additional warrants at no charge.

In 2014, the CEO received a basic annual salary of

£ 366,000 and a premium-based pension with a premium

corresponding to 20.0 percent of the basic salary. For 2014,

variable remuneration to the CEO has been linked to Group

EBIT and will be payable in the amount of £ 36,600. For

further information, see note 14.

INCENTIVE PROGRAM

In accordance with the resolution of the AGM of 2014, IFS

issued during the year warrants that were offered to, and

acquired by, executive management, other officers, and other

key employees of the Group. For each warrant acquired at

market price and subject to certain conditions, the

participants were entitled to receive a maximum of three

additional warrants free of charge.

The allotment of additional warrants free of charge has

been dependent on the outcome of a performance condition

linked to the company’s earnings-per-share (EPA) target for

2014 (SKr 8.32), under which a target completion rate of

85 percent would result in one (1), 100 percent in two (2), and

115 percent in three (3) additional warrants free of charge.

The outcome of the 2014 EPA has now been established to

SKr 8.45, corresponding to a target completion rate of 101.6

percent and meaning that the participants in the program will

be allotted two additional warrants free of charge for each

warrant they have acquired at market price.

The warrants can be exercised for subscription of

B shares no later than June 2019. The strike price is

SKr 206.80 per share. The warrants refer to a maximum of

179,430 B shares.

During the year, the Company bought back a number of

warrants from program TO9B.

RESOLUTION CONCERNING GUIDELINES FOR THE REMUNERATION OF

EXECUTIVE MANAGEMENT

The board proposes that the AGM of 2015 resolve that the

following guidelines for remuneration of the president and

other members of executive management be applied. The

Board strives for continuity and the proposals are thus

essentially in line with the current guidelines and

remuneration policy approved by the AGM 2014. The

guidelines deal with remuneration and other terms and

conditions of employment of the executive management of

the Group, including its chief executive officer (CEO).

The principles apply to employment contracts entered

into after the resolution is adopted by the AGM and to

changes made to existing terms and conditions after this point

in time.

Remuneration to the executive management in IFS shall

be aligned with market terms and conditions, shall be

individual and differentiated, and shall support the interests of

the stockholders. Remuneration principles shall be

predictable, both in terms of costs for the company and

benefits for the individual, and shall be based on factors such

as competence, experience, responsibility and performance.

Total remuneration paid to executive management shall

consist of a basic salary, variable remuneration, an incentive

program, pension contributions, and other benefits.

The total annual monetary remuneration paid to each

member of executive management, i.e., basic salary and

variable remuneration, shall correspond to a competitive level

of remuneration in the respective executive's country of

residence.

Variable remuneration shall be linked to predetermined

measurable criteria designed to promote long-term value

generation in the company. The relationship between basic

salary and variable remuneration shall be proportionate to the

executive’s responsibility and powers. Variable remuneration

varies according to position. For 2015, it is proposed that the

guidelines for the variable remuneration payable to the

executive management be unchanged from the previous year.

For the CEO this means that the maximum variable

remuneration shall not exceed 50 percent of the basic salary,

and for the other members of executive management variable

remuneration shall be payable in the interval 25–60 percent of

the basic salary, based on achievement of 80–120 percent of

individual goals.

The board proposes that the AGM resolves to adopt an

incentive program with a corresponding structure as last year,

which entails that executive management, other officers, and

key personnel in the IFS group are offered the opportunity to

subscribe for warrants in the company at market price. For

each warrant acquired at market price, on certain terms and

conditions a maximum of three additional warrants may be

received free of charge. The proposal entails the issue of not

more than 247,000 warrants which shall be exercisable to

subscribe for Series-B shares during an exercise period from

the day after the release of the first quarterly report 2018 until

17

and including June 30, 2020. For information on IFS’s other

equity-related incentive programs, see Note 34.

Pension benefits shall correspond to a competitive level

in the respective executive’s country of residence and shall, as

in previous years, consist of a premium-based pension plan.

The CEO is entitled to a premium-based pension plan with a

premium that is 20 percent of the basic salary. The retirement

age for the CEO and other members of executive

management is 65, but the CEO and the company are entitled

to invoke the right to early retirement for the CEO at the age

of 64. In such a case, the CEO shall receive the equivalent of

60 percent of the basic salary until he is 65. Furthermore, the

CEO’s retirement should not affect the warrants acquired by

him in the framework of the adopted incentive programs.

Other benefits are chiefly related to company cars and

telephones and shall, where they exist, constitute a limited

portion of the remuneration and be competitive in the local

market.

If the company terminates the employment, the period of

notice is normally 6–12 months; if the executive terminates

the employment, the period of notice is normally 3–6 months.

The basic salary during the period of notice, together with

severance pay, shall not exceed an amount corresponding to

two years’ basic salary.

The board of directors shall have the right to deviate

from the above guidelines in individual cases if there is good

reason to do so. In such an event, the board shall inform the

immediately following AGM and explain the reason for the

deviation.

STOCK MARKET INFORMATION, ETC.

IFS issues information in accordance with the information

policy established by the board. The annual and quarterly

reports and press releases are published in Swedish and

English. Press conferences for analysts, brokers, and

journalists are held in connection with the quarterly reports.

Information sessions and meetings are held regularly during

the year with the media and the financial market.

Corporate governance information, annual and quarterly

reports, and press releases are available at www.ifsworld.com,

where information can be ordered or subscribed for. The

annual report for 2014 will be distributed in a corresponding

manner, and not in printed form.

The board, executive management, and certain other

officers who are registered as insiders may trade in shares

according to applicable legislation and current market praxis.

No additional internal regulations exist.

FINANCIAL-RISK MANAGEMENT

In the course of its business, the Group is exposed to risk

related to currency, financing and interest rates. Such risks

and their management are described in note 46 and in the

section covering risks and uncertainties below.

18

ACCOUNTING PRINCIPLES

The Group applies the IFRS accounting principles approved

by the European Commission. The new standards,

recommendations, and interpretations that are adjudged to

affect the Group were applied when preparing the financial

statements for 2014.

SOCIAL RESPONSIBILITY

IFS operates in a distinctly low-risk industry in terms of the

direct impact of its activities on people and the environment.

This applies to the entire value chain, including product

development, for which IFS’s largest unit is located in Sri

Lanka. In addition, the Company has efficient information

distribution through its intranet, where all employees have

access to policies and guidelines pertaining to sustainability,

including environmental impact, gender equality, diversity,

work environment, and the values of the Company and

employees in relation to colleagues and customers.

Group management has adopted and published the IFS

Code of Conduct, which is based on the 10 principles of the

U.N. Global Compact embracing human rights, labor rights,

the environment and anti-corruption. In addition, corporate

management has adopted and published an environmental policy.

A number of Group-wide processes, tools, and guidelines

related to personnel were implemented during the year. For

Group-wide processes, targets are established and the

outcome is monitored on a regular basis.

Continuous actions are taken to improve the Company’s

psychosocial environment. In most countries, discussions are

held annually with all employees. Those who choose to leave

IFS are interviewed, and their reasons for departing are

compiled to increase employees’ job satisfaction and reduce

personnel turnover. Absence related to illness was 4.3 days

annually per Group employee and personnel turnover was

5.9 percent in 2014.

In 2014, the percentage of female employees was

31 percent. The percentage of female members on the

Company’s boards was 21 percent, and the percentage of

female senior managers was 22 percent. The share of female

members on the Parent Company’s board of directors was

33 percent. The lower percentage of women in the Company

is a frequently occurring phenomenon in the software

industry as a whole.

Diversity is encouraged through exchange programs that

contribute to exposure to other cultures. The Company

believes that an understanding of other cultures is necessary

to conduct business effectively, because both IFS and the

majority of its customers are active throughout the world.

IFS’s largest research and development center is located

in Sri Lanka. At the center, a comprehensive corporate social

responsibility project comprising support to schools and

universities has been operating for 10 years. Investments were

increased after the 2004 tsunami disaster, and since then,

more than 700 stipends have been distributed. IFS also strives

to attain leadership in Sri Lanka with respect to salaries and

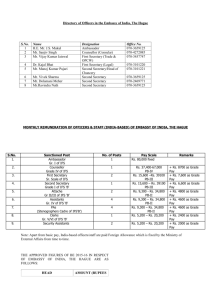

other benefits. The Company actively works to promote