VALS Analysis - WordPress.com

advertisement

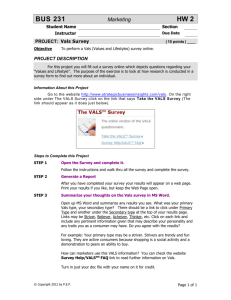

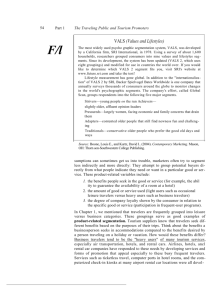

Dan Hoff VALS Analysis For our most recent assignment, we were asked to take a VALS analysis on ourselves which is designed to group the people that take it into one of eight segments which helps to predict consumer behavior. The first thing that threw me off about the survey was that they repeated a lot of questions over and over, even though they may have been worded slightly differently each time. I always wonder why questionnaires do this because I feel that it narrows the scope of the questions that they are asking, and also the results. After taking the survey, it told me that my primary type is “Experiencer”. After clicking the link to tell me more about what exactly that means, I found out that they have summed me up pretty well, however basic. It explained to me that “experiencers” are the types of consumers that are motivated by self-expression. It went on to further say that “avid consumers and spend a comparatively high proportion of their income on fashion, entertainment, and socializing.” I am assuming that this test reflects when the consumer has an actual disposable income. I am working on a tight budget, and cannot afford to splurge right now. Thinking back, however, when my finances were a little more solid, I can recognize my spending habits in this analysis. The majority of my disposable income is spent on going out with friends and having a good time (socializing and entertainment). This part is very accurate, but I think those types of spending is very reflective upon my age group as a whole, because socializing and entertainment is what we are all about in the early twenties age group. The survey went on to tell me that my secondary type is “Innovator”. Again, this summary did not describe me completely, but a few points from it certainly applied. Surveys are tricky to use to analyze results because they often offer very broad generalizations which are not usually 100% true. It is hard to sum up a group of people into one paragraph. The survey described my secondary type as “change leaders who are the most receptive to new ideas and technologies. Innovators are very active consumers, and their purchases reflect cultivated tastes for upscale, niche products and services.” Again, I have to agree that most people in my age group are receptive to new ideas and equipment because we have grown up so closely with technology. It says that “innovators” value their image, and continually seek challenges in life to keep the variety. I thrive on variety, and get claustrophobic when I am stuck in a routine for too long. Again, I think that this is common amongst young people. We don’t like to be tied down at this point in our lives, and we like to look good and present ourselves well. I don’t think that I would use the VALS survey if I was a marketing manager for a company. For me, it didn’t offer any information besides broad, cliché generalizations. Sure, some of the ideas translated to me, but I would have a hard time trying to find the connection between my product and the results. I think that the VALS survey may offer good insight into different consumer niches (like young adults), but doesn’t extend into much detail beyond the simplifications. It could probably be used as a tool to summarize different demographics of potential and current customers. I think that surveys are a very effective way for marketers to get a firm grasp on their consumer base, however, it needs to be much more comprehensive than the just the VALS assessment that offers only a small amount of questions to use in the analysis. In order for a company to be successful in their sales, they need to truly understand the different market segmentations that they are selling to, and I think that combining multiple factors into a more comprehensive survey is the best way to do so. The VALS survey focuses only on psychographic segmentation, which is based on consumer lifestyles. I think that these questions should be combined with questions that are geared towards benefit segmentation. Clearly, the more that is known about why a consumer is purchasing particular products will help the marketer understand what their merchandise lacks. A good example of this segmentation would be the survey devised by Russell Haley. I also think that in addition to the benefit and psychographic segmentation, the more comprehensive survey needs to include questions about person/situation segmentation. This is important to include because it looks beyond just the consumer as a type of person to include information that is relevant about their current situation. Personality types are not the only basis when it comes to purchasing, and the situation surrounding the acquisition also plays a big role in understanding different habits. The final piece that I would include in a more comprehensive survey would be geodemographic segmentation. I think that areas where people are living also reveal a lot about the type of consumer they most likely are. This can also aid a business in knowing where to place their locations so that they are most accessible to the regions that contain the types of consumers that they are targeting. A good example of this type of survey would be the PRIZM NE system. In summary, I think that surveys are a great way for marketers to better understand their target markets, and the consumer behaviors in these different segments. However, I don’t think that any of these assessments are effective when standing alone. I think that a single, more comprehensive test could be compiled using various questions regarding consumer lifestyles, neighborhood geography, usage situation dimensions, and benefits sought from different products.