TPS - Tax Forms

advertisement

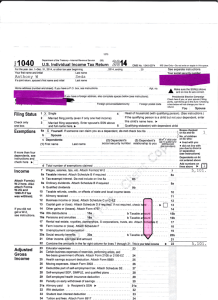

Prepared For: UNCW STUDENT 01/30/2013 Today's Savings * In simple terms, the Marginal Tax Rate is the tax rate that you pay on your last dollar of taxable income. It is the highest federal tax bracket that affects your tax calculation. The Effective Tax Rate is the percentage of your total income that you paid in taxes. For 2012, your Marginal Tax Rate is 10% and your Effective Tax Rate is 0%. Total Savings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.00 Filing, Refund and Balance Due Information Tax Return efile Refund / (Balance Due) Federal No ($26.00) Balance Due North Carolina No ($272.00) Balance Due Summary Message ($26.00) See the Filing Checklist for instructions. ($272.00) See the Filing Checklist for mailing instructions. Th is H &R B lock Ad vant age d ocument provid es inf ormat ion t h at could h elp y ou improve y our t ax and f inancial sit uat ion. It s cont ent s sh ould b e consid ered in conj unct ion w it h inf ormat ion you receive f rom ot h er sources t h at are f amiliar w it h your specif ic circumst ances. Tax services of f ered t h rough sub sid iaries of H RB Tax Group, Inc. Advantage (2012) FDADVICE-1WV 1.0 Form Sof t w are Copyrigh t 1996 - 2013 H RB Tax Group, Inc. 2012 Tax Return Summary Federal Year over Year Comparison INCOME Year 2012 Other income Total income Year 2011 Change($) $10,000 $10,000 $0 $0 $10,000 $10,000 $10,000 $0 $10,000 $5,950 $3,800 $250 $0 $0 $0 $5,950 $3,800 $250 $26 $26 $0 $0 $26 $26 $26 $0 $26 $26 $0 $26 $10,000 10% Single $0 $10,000 ADJUSTED GROSS INCOME Total income less total adjustments TAXABLE INCOME Standard deductions Exemptions Taxable income TAX COMPUTATION Income tax Tax before credits OTHER TAXES Total tax AMOUNT DUE Amount owed with return OTHER COMPUTATIONS Alternative minimum taxable income Marginal tax bracket Filing status Client Sum (2012) FDBASUM-1WV 1.0 Form Sof t w are Copyrigh t 1996 - 2013 H RB Tax Group, Inc. 2012 Federal Tax Return Filing Instructions FOR THE YEAR ENDING December 31, 2012 UNCW STUDENT Prepared for Tax Summary Gross Income Adjusted Gross Income Total Deductions Total Taxable Income Total Tax Total Payments Refund Amount Amount You Owe Make check payable to United States Treasury Mailing Address Internal Revenue Service Center P.O. Box 931000 Louisville, KY 40293-1000 $ $ $ $ $ $ $ $ 10,000 10,000 9,750 250 26 0 0 26 Instructions STEP 1 - Sign and date Form 1040 STEP 2 - Assemble what you need to mail Attach any schedules and forms behind Form 1040 in order of the Attachment Sequence Number shown in the upper right corner of the schedule or form. If there are supporting statements, arrange them in the same order as the schedules or forms they support and attach them last. Do not attach correspondence or other items unless required to do so. Attach a copy of each W-2, W-2G, and 2439 to the front of Form 1040. Also attach Form(s) 1099-R or 1099-G if tax was withheld. STEP 3 - Pay balance due on your taxes Make your check or money order for $26 payable to the United States Treasury. Do not send cash and do not forget to sign it. Write your Social Security number(s) and daytime phone number on your check or money order (U.S. funds only). STEP 4 - Mail Form(s) Mail Form 1040 and associated documents to the address above. Retain the proof of mailing to avoid a late filing penalty. We recommend you use one of these methods to send your 1040: - U.S. Postal Service certified mail. If you are not mailing to an address with a post office box, you may also use: - Federal Express (FedEx): Priority Overnight, Standard Overnight, 2Day, International Priority, or International First - United Parcel Service (UPS): Next Day Air, Next Day Air Saver, 2nd Day Air, or Worldwide Express CONTINUED ON NEXT PAGE Checklist (2012) FDCHECKE-1WV 1.0 Form Sof t w are Copyrigh t 1996 - 2013 H RB Tax Group, Inc. UNCW STUDENT 2012 Federal Filing Instructions Continued Instructions STEP 5 - Keep a copy Print a copy of the return for your records. Please attach a copy of each W-2, W-2G, 1099G and 1099R to your return. Checklist (2012) FDCHECKE-2WV 1.0 Form Sof t w are Copyrigh t 1996 - 2013 H RB Tax Group, Inc. Form D epart ment of t h e Treasury - Int ernal Revenue Service (99) 1040 U.S. Individual Income Tax Return OM B No. 1545- 0074 , 2012, ending For t h e year J an. 1- D ec. 31, 2012, or ot h er t ax year b eginning IRS Use Only - D o not w rit e or st aple in t h is space. See separate instructions. Your social security number , 20 555-55-1234 UNCW STUDENT 601 S COLLEGE RD APT. 230A WILMINGTON, NC 28403-5901 Spouse's social security number M ak e sure t h e SSN(s) ab ove and on line 6c are correct . Presidential Election Campaign Foreign count ry name Foreign province/ st at e/ count y Foreign post al cod e Ch eck h ere if y ou, or y our spouse if f iling j oint ly , w ant $3 t o go t o t h is f und . Ch eck ing a b ox b elow w ill not ch ange y our t ax or refund. You Filing Status Check only one box. Exemptions If more than four dependents, see inst and check here X Single 1 2 3 4 Married filing jointly (even if only one had income) Married filing separately.Ent er spouse's SSN ab ove & f ull name h ere. 5 H ead of h ouseh old (w it h q ualif y ing person). (See inst ruct ions.) If t h e q ualif y ing person is a ch ild b ut not y our d epend ent , ent er t h is ch ild 's name h ere. Qualifying widow(er) with dependent child 6a X Yourself. If someone can claim you as a dependent, do not check box 6a Spouse b (2) D epend ent 's c Dependents: social securit y numb er (1) First name Last name 1 (3) D epend ent 's relat ionsh ip t o y ou B oxes ch eck ed on 6a and 6b No. of ch ild ren on 6c who: (4) if qual. ch ild <17 f or lived w it h y ou ch ild t ax cr. d id not live w it h y ou (see inst) d ue t o d ivorce or separat ion (see inst) D epend ent s on 6c not ent ered ab ove Ad d numb ers on lines above d Total number of exemptions claimed 7 Wages, salaries, tips, etc. Attach Form(s) W- 2 Income Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld. If you did not get a W-2, see instructions. Enclose, but do not attach, any payment. Also, please use Form 1040- V. 8a b 9a b 10 11 12 13 14 15a 16a 17 18 19 20a 21 Taxable interest. Attach Schedule B if required 8b Tax- exempt interest. Do not include on line 8a Ordinary dividends. Attach Schedule B if required 9b Qualified dividends Taxable refunds, credits, or offsets of state and local income taxes Alimony received Business income or (loss). Attach Schedule C or C-EZ At t ach Sch ed ule D if req uired . Capital gain or (loss). If not req uired , ch eck h ere Other gains or (losses). Attach Form 4797 15a b Taxable amt IRA distributions 16a b Taxable amt Pensions and annuities Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F Unemployment compensation 20a b Taxable amount Social security benefits Other income. List type and amount WORKSTUDY GRAND 22 23 24 10,000. Combine the amounts in the far right column for lines 7 through 21. This is your total income 23 Educator expenses Adjusted Certain business expenses of reservists, performing artists, and Gross fee-basis government officials. Attach Form 2106 or 2106-EZ 24 Income 25 Health savings account deduction. Attach Form 8889 25 26 Moving expenses. Attach Form 3903 26 27 Deductible part of self-employment tax. Attach Schedule SE 27 28 Self-employed SEP, SIMPLE, and qualified plans 28 29 Self-employed health insurance deduction 29 30 Penalty on early withdrawal of savings 30 31a Alimony paid b Recipient's SSN 31a 32 32 IRA deduction 33 Student loan interest deduction 33 34 Tuition and fees. Attach Form 8917 34 35 35 Domestic production activities deduction. Attach Form 8903 36 Add lines 23 through 35 37 Subtract line 36 from line 22. This is your adjusted gross income KBA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. 1040 (2012) Spouse FD1040-1WV 1.25 Form Sof t w are Copyrigh t 1996 - 2013 H RB Tax Group, Inc. 1 7 8a 9a 10 11 12 13 14 15b 16b 17 18 19 20b 21 22 36 37 10,000. 10,000. 10,000. Form 1040 (2012) Form 1040 (2012) UNCW STUDENT 38 Amount from line 37 (adjusted gross income) You were born before January 2, 1948, Blind. Total boxes 39a Check Spouse was born before January 2, 1948, Blind. if: checked 39a b If your spouse itemizes on a separate return or you were a dual- status alien, check here 39b Tax and Credits Standard Deduction for People who check any box on line 39a or 39b or who can be claimed as a dependent, see instr. 40 Itemized deductions (from Schedule A) or your standard deduction (see left margin) 555-55-1234 Page 2 10,000. 38 40 5,950. 4,050. Subtract line 40 from line 38 41 3,800. Exemptions. Multiply $3,800 by the number on line 6d 42 250. 43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter - 026. c 44 Tax Check if any from: a Form(s) 8814 b Form 4972 962 election Alternative minimum tax (see instructions). Attach Form 6251 45 All others: Single or 26. 46 Add lines 44 and 45 M arried f iling separat ely, Foreign tax credit. Attach Form 1116 if required 47 $5,950 Credit for child and dependent care expenses. Attach Form 2441 48 M arried f iling j oint ly or Education credits from Form 8863, line 19 49 Qualifying Retirement savings contributions credit. Attach Form 8880 50 widow(er), $11,900 Child tax credit. Attach Schedule 8812, if required 51 Head of Residential energy credit. Attach Form 5695 h ouseh old , 52 $8,700 Ot h er cred it s c 53 3800 8801 b a from Form: Add ln 47 through 53. These are your total credits 54 26. 55 Subtract line 54 from line 46. If line 54 is more than line 46, enter - 055 56 56 Self-employment tax. Attach Schedule SE Other b 57 8919 4137 57 Unreported social security and Medicare tax from Form: a Taxes 58 58 Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required 59a 59a Household employment taxes from Schedule H 59b b First- time homebuyer credit repayment. Attach Form 5405 if required 60 60 Other taxes. Enter code(s) from instructions 26. 61 61 Add lines 55 through 60. This is your total tax Federal income tax withheld from Forms W-2 and 1099 62 62 Payments 63 2012 estimated tax payments and amount applied from 2011 return 63 If you have a NO Earned income credit (EIC) 64a 64a qualifying 64b b Nontaxable combat pay election child, attach Schedule EIC. 65 Additional child tax credit. Attach Schedule 8812 65 66 66 American opportunity credit from Form 8863, line 8 67 67 Reserved 68 68 Amount paid with request for extension to file 69 Excess social security and tier 1 RRTA tax withheld 69 70 Credit for federal tax on fuels. Attach Form 4136 70 Re2439 b 71 Credits from Form:a 71 8801 d 8885 served c 0. 72 72 Add lines 62, 63, 64a, and 65 through 71. These are your total payments 73 If line 72 is more than line 61, subtract line 61 from line 72. This is the amount you overpaid 73 Refund 74a Amount of line 73 you want refunded to you. If Form 8888 is attached, check here 74a xxxxx xxxx XXXXXXXXX c Type: Checking Savings b Routing number Direct deposit? XXXXXXXXXXXXXXXXXX See d Account number instructions. 75 Amount of line 73 you want applied to your 2013 estimated tax 75 26. Amount 76 Amount you owe. Subtract line 72 from line 61. For details on how to pay, see instructions 76 You Owe 77 Estimated tax penalty (see instructions) 77 X No Do you want to allow another person to discuss this return with the IRS (see instructions)? Yes. Complete below. Third Party Designee's name Phone no. Personal ID number Designee (PIN) 41 42 43 44 45 46 47 48 49 50 51 52 53 54 Und er penalt ies of perj ury, I d eclare t h at I h ave examined t h is ret urn and accompany ing sch ed ules and st at ement s, and t o t h e b est of my k now led ge and b elief , t h ey are t rue, correct , and complet e. D eclarat ion of preparer (ot h er t h an t axpay er) is b ased on all inf ormat ion of w h ich preparer h as any k now led ge. Sign Here Your signature Joint return? See instructions. Keep a copy for your records. Paid Preparer Use Only Your occupation Date Daytime phone number STUDENT Spouse's signature. If a joint return, both must sign. Print/Type preparer's name Preparer's signature Firm's name Firm's address Date Spouse's occupation Date Check if self-employed If t h e IRS sent y ou an ID Prot ect ion PIN, ent er it h ere (see inst .) PTIN Firm's EIN Phone no. Form 1040 (2012) 1040 (2012) FD1040-2WV 1.25 Form Sof t w are Copyrigh t 1996 - 2013 H RB Tax Group, Inc. 2012 STATE TAX RETURN FILING INSTRUCTIONS NORTH CAROLINA FOR THE YEAR ENDING December 31, 2012 Prepared for Tax Summary UNCW STUDENT Gross Income Adjusted Gross Income Total Deductions Total Taxable Income Total Tax Total Payments Refund Amount Amount You Owe Make check payable to NC Department of Revenue Mailing Address North Carolina Dept. of Revenue P.O. Box 25000 Raleigh, NC 27640-0640 Special Instructions SIGN AND DATE YOUR RETURN Please sign and date Form NC D-400. $ $ $ $ $ $ $ $ 250 4,500 0 4,500 272 0 0 272 ASSEMBLE WHAT YOU NEED TO MAIL Attach any schedules and forms behind Form NC D-400. If there are supporting statements, arrange them in the same order as the schedules and forms they support and attach them last. Attach a copy of each W-2, W-2G, 1099R and 1099G for which NC tax has been withheld. PAY BALANCE DUE ON YOUR TAXES Complete your check or money order for $272. Do not send cash and do not forget to sign the check. Write your Social Security number(s), daytime phone number, 2012, and Form NC D-400on your check or money order (U.S. funds only). MAIL FORM NC D-400 & NC D-400V & OTHER DOCUMENTS TO: Mailing Address listed above. To retain the proof of mailing, we recommend using certified mail to send your form(s). When mailing to an address without a P.O. box, you may also use: Airborne Express, DHL Worldwide Express, FedEx, or UPS. KEEP A COPY Click on Main Menu and then E-File or Print to print your return. Attach your copy of each W-2, W-2G, 1099R or 1099G with withholding. Keep with your records for three years. Check List (2012) STCHECK-1WV 1.0 Form Sof t w are Copyrigh t 1996 - 2013 H RB Tax Group, Inc. D-400 (48) Individual Income Tax Return 2012 9-24-12 North Carolina Department of Revenue < Staple All Pages of Your Return and W-2s Here 12 For calendar year 2012, or fiscal year beginning UNCW STUDENT 601 S COLLEGE RD WILMINGTON NC 28403-5901 NEW H Filing Status X Year spouse died: 230A Select b ox if ret urn is f iled and signed b y Execut or or Ad minist rat or. 3. M arried Filing Separat ely 1 STUD EX 01 601 PP N 28403 UNCW No Yes Yes No NC Political Parties Financing Fund Your Spouse You 01 Select appropriat e b ox if y ou w ant t o d esignat e $3 t o t h is f und . Your t ax remains t h e same w h et h er or not y ou mak e a d esignat ion. You N OC N NRT N PYT N PCT DS N EA N NRS N PYS N PCS Your Spouse Democratic Republican Libertarian Unspecified Spouse DT STUDENT X 555551234 You Select b ox if you or your spouse w ere a nonresid ent of NC f or t h e ent ire year. Select b ox if you or your spouse moved int o or out of NC d uring t h e year. 5. Wid ow (er) w it h D epend ent Ch ild FS Your SSN: Spouse's SSN: 1. Single 4. H ead of H ouseh old Select 'Yes' if y ou w ant t o d esignat e $3 of t axes t o t h is special Fund f or vot er ed ucat ion mat erials and f or cand id at es w h o accept spend ing limit s. Select ing 'Yes' d oes not ch ange y our t ax or ref und . Number of Exemptions Claimed: Return for deceased taxpayer Date of death: Return for deceased spouse Date of death: Select b ox if you or y our spouse w ere out of t h e count ry on April 15 and a U.S. cit izen or resid ent . 2. M arried Filing J oint ly NC Public Campaign Fund and ending N PFT 0 PFS 0 Democratic Republican Libertarian Unspecified 555551234 NC 230A 601 S COLLEGE RD 06 10000 23A 0 27D 07 0 23B 0 EU 09 0 24A 0 28 3000 24B 0 13 2500 24C 16 0.0000 17 28403 WILMINGTON 39 0 40 0 272 41 0 30 0 42 0 0 31 0 43 0 24D 0 33 0 44A 0 46 0 4500 25 0 34 0 44B 0 47 0 18 272 27A 272 35 0 44C 0 48 0 19 0 27B 0 36 0 44D 0 49 0 21 0 27C 0 38 0 45A 0 51 0 45B 0 52 0 11 TN S 9109622502 Sign Return Below PN 0 PP 0 Refund Due I cert if y t h at , t o t h e b est of my know led ge, t h is ret urn is accurat e and complet e. X Payment Due 272 If prepared b y a person ot h er t h an t axpay er, t h is cert if icat ion is b ased on all inf ormat ion of w h ich t h e preparer h as any k now led ge. Your Signat ure Date Spouse's Signat ure (If f iling j oint ret urn, b ot h must sign.) Date Paid Preparer's Signat ure Date 910 962 2502 H ome Teleph one Numb er (Includ e area cod e) Paid Preparer's FEIN, SSN, or PTIN Paid Preparer's Teleph one Numb er If you ARE NOT due a refund, mail return, any payment, and Form D- 400V to: NCDOR, P.O. Box 25000, Raleigh, N.C. 27640- 0640 If REFUND mail to: NCDOR, P.O. Box R, Raleigh, N.C. 27634- 0001 D-400 2012 Page 2 (48) Last Name (First 10 Characters) STUDENT Your Social Security Number 555551234 D-400 Line-by-Line Information 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. Federal adjusted gross income Additions to federal adjusted gross income Add Lines 6 and 7 Deductions from federal adjusted gross income Subtract Line 9 from Line 8 Deduction Type N.C. standard deduction N.C. itemized deduction Subtract Line 11 from Line 10 N.C. personal exemption allowance Subtract Line 13 from Line 12 Same as Line 14 Part-year residents and nonresidents N.C. Taxable Income N.C. Income Tax Tax Credits Subtract Line 19 from Line 18 Consumer Use Tax Add Lines 20 and 21 North Carolina Income Tax Withheld 23a. Your Income Tax Withheld 23b. Spouse's Income Tax Withheld 24a. 24b. 24c. 24d. 25. 26. 27a. 27b. 27c. EU 27d. 28. 29. Other Tax Payments 2012 Estimated Tax Paid with Extension Partnership S Corporation North Carolina Earned Income Tax Credit Add Lines 23a through 25 Tax Due - If Line 22 is more than Line 26, subtract and enter the result Penalties Interest Exception to underpayment of estimated tax Interest on the underpayment of estimated income tax Pay this Amount Overpayment - If Line 22 is less than Line 26, subtract and enter the result 6. 7. 8. 10000 0 10000 9. 10. 36. 37. 11. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 0 10000 S 3000 7000 2500 4500 4500 0.0000 4500 272 0 272 0 272 38. 39. 23a. 23b. 0 0 34. 35. 40. 41. 42. 43. 44. 44a. 44b. 44c. 44d. 44e. 45. 24a. 24b. 24c. 24d. 25. 26. 0 0 0 0 0 0 27a. 27b. 27c. 272 0 0 EU 45a. 44b. 45c. 46. 47. 48. 49. 27d. 28. 0 272 50. 29. 0 51. Additions to Federal Adjusted Gross Income Interest income from other states 34. Adjustment for bonus depreciation 35. (See instructions) 36. Ot h er f ed eral ad j ust ed gross income ad d it ions 37. Total additions Deductions from Federal Adjusted Gross Income State or local income tax refund 38. Interest income from obligations of 39. US or US' possessions Social Security and Railroad Retirement Benefits 40. 41. Bailey settlement retirement benefits 42. Other retirement benefits Severance wages 43. Adjustment for bonus depreciation added back in 2008, 2009, 2010 and 2011 2008 44a. 2009 44b. 2010 44c. 2011 44d. Add Lines 44a, 44b, 44c and 44d and enter on 44e 44e. Adjustment for section 179 expense deduction added back in 2010 and 2011 2010 45a. 2011 45b. Add Lines 45a and 45b and enter on 45c 45c. Contributions to North Carolina's National College Savings Program (NC 529 Plan) (See instructions) 46. Adjustment for absorbed NOL added back in 2003, 2004, 2005, and 2006 47. Adjustment for net business income that is not considered passive income 48. Other federal adjusted gross income deductions 49. 50. Total deductions 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Part-Year Residents and Nonresidents 52. 53. Amount of Refund to Apply to: 30. Amount of Line 29 to be applied to 2013 Estimated Income Tax 31. N.C. Nongame and Endangered Wildlife Fund 32. Add Lines 30 and 31 30. 0 31. 32. 0 0 33. Amount to be Refunded 33. 0 This page must be filed with the first page of this form. All income while a part-year NC resident and NC source income while a nonresident 51. Total income from all sources 52. Divide Line 51 by Line 52 53. N.C. Residency Dates for Part-Year Residents Beginning Ending Taxpayer: Spouse: 0 0 0.0000 D-400TC (48) Individual Tax Credits 2012 9-25-12 North Carolina Department of Revenue If you claim a tax credit on Line 19 or Line 25 of Form D- 400, you must attach this form to the return. If you do not, the tax credit may be disallowed. Last Name (First 10 Characters) STUDENT Your Social Security Number 01 0 16 0 27B 0 02 0 20A 0 28A 04 0 20B 0 06 0 21 07A 0 07B FM N GC N 0 HD N PC N 28B 0 CT N OS N 0 29A 0 32 0 22 0 29B 0 36 0 0 23 0 30A 0 36 478 N 08 0 24 0 30B 0 38 QC 0 09 0 25 0 31 0 38 10 0 26 0 12 0 27A 0 14. Credit for Income Tax Paid to Another State or Country N. C. Residents Only 1. 2. 3. 4. 5. 6. 7a. 7b. Total income from 1040, Line 22; 1040A, Line 15; 1040EZ, Line 4, while a N.C. resident, adjusted by applicable additions & deductions. Do not adjust any portion of Lines 36 or 49 that does not relate to gross income. 1. Portion of Line 1 taxed outside N.C. 2. Divide Line 2 by Line 1 3. N.C. income tax (From D-400, Line 18) 4. 5. Computed credit (Multiply Line 3 by Line 4) Amount of net tax paid outside N.C. from Line 2 (See instructions for definition of net 6. tax paid) 7a. Enter the lesser of Line 5 or Line 6 Number of states that credits are claimed 7b. 15. 0 0 0.0000 0 0 0 0 0 Credit for Child and Dependent Care Expenses 8. 9. 10. 11. 12. 13. Enter the expenses from Line 3 of Federal Form 2441 (See instructions) 8. Portion of Line 8 incurred for qualifying 9. dependent(s) Credit for Line 9 expenses (Use the Child 10. and Dependent Care Credit Table) Other qualifying expenses 11. Credit for Line 11 expenses (Use the Child and Dependent Care Credit Table) 12. Total credit for child and dependent care expenses. Full-year residents enter the amount here and on Line 15 below 13. This page must be filed with Form D- 400. 0 0 0 0 0 0 31 555551234 Part-year residents and nonresidents multiply the amount on Line 13 by the decimal amount from Form D- 400, Line 16. If Line 16 is more than 1.0000, enter amount from Line 13 here Total credit for child and dependent care expenses from Line 13 or Line 14 0 14. 0 15. 0 Credit for Children under 17 on Last Day of Tax Year Credit may be claimed only if amounts for your filing status do not exceed: - Married filing jointly/qualifying widow(er) - $100,000 - Head of household - $80,000 - Single - $60,000 - Married filing separately - $50,000 16. Multiply the number of children for whom you are entitled to claim the federal child tax credit by $100 (Fullyear residents enter this amount here and on Line 18) 16. 17. Part-year residents and nonresidents multiply the amount on Line 16 by the decimal amount 17. from Form D-400, Line 16 and enter the result here and on Line 18 18. Credit for Children 18. 0 0 0 D-400TC 2012 Page 2 (48) Last Name (First 10 Characters) STUDENT Your Social Security Number D-400TC Line-by-Line Information Other Tax Credits 19. Add Lines 7a, 15, and 18 20a. Total charitable contributions Credit for charitable contributions 20b. Credit for long-term care insurance premiums (See instructions) 21. Credit for adoption expenses (See instructions) 22. Credit for children with disabilities who require special education 23. 24. Credit for Qualified Business Investments (You must attach a copy of the tax credit approval letter that you received from the Department of Revenue.) Credit for the disabled (Complete Form D- 429. Enter amount from Line 13 or 14) 25. 26. Credit for certain real property land donations (See Instructions) Enter expenditures and expenses on Lines 27a, 28a, 29a, and 30a only in the first year the credit is taken Credit for rehabilitating an income-producing historic structure (See Instructions) 27. 27a. Enter qualified rehabilitation expenditures 27b. Enter installment amount of credit 28. Credit for rehabilitating a nonincome-producing historic structure (See Instructions) 28a. Enter rehabilitation expenses 28b. Enter installment amount of credit 29. Credit for rehabilitating an income-producing historic mill facility (See Instructions) 29a. Enter qualified rehabilitation expenditures 29b. Enter amount of credit 30. Credit for rehabilitating a nonincome-producing historic mill facility (See Instructions) Enter rehabilitation expenses 30a. Enter installment amount of credit 30b. 31. Other miscellaneous income tax credits Property Taxes on Farm Machinery Gleaned Crops Handicapped Dwelling Units Poultry Composting Recycling Oyster Shells Conservation Tillage Equipment Tax credits carried over from previous year. Do not include NC- 478 carryovers. 32. 33. Total (Add Lines 19, 20b, 21, 22, 23, 24, 25, 26, 27b, 28b, 29b, 30b, 31 and 32) 34. Amount of tax (From D-400, Line 18) 35. Enter the lesser of Line 33 or Line 34 36. Business incentive and energy tax credits (Attach NC- 478 forms) Is NC-478 attached? 37. Add Lines 35 and 36 555551234 19. 20a. 20b. 21. 22. 23. 0 0 0 0 0 0 24. 25. 26. 0 0 0 27a. 27b. 0 0 28a. 28b. 0 0 29a. 29b. 0 0 30a. 30b. 31. 0 0 0 32. 33. 34. 35. 36. 0 0 0 0 0 N 0 37. Earned Income Tax Credit You are allowed a credit equal to 5% of the Earned Income Tax Credit allowed on your federal return. For part- year residents and nonresidents, the credit must be prorated based on the ratio of income subject to North Carolina tax to total federal income. 38. QC. 39. 40. Enter the amount of your federal earned income tax credit. Number of qualifying children Multiply Line 38 by 5% (.05) Full- year residents enter this amount here and on Line 25 of form D- 400. Part- year residents and nonresidents multiply the amount on Line 39 by the decimal amount from Form D- 400, Line 12 and enter the result here and on Line 25 of Form D- 400. If Line 16 of Form D- 400 is more than 1.0000, enter the amount from Line 39 here and on Line 25 of Form D- 400. This page must be filed with the first page of this form. 38. QC. 39. 40. 0 0 0 Department of the Treasury Internal Revenue Service Form 1040-V Detach Coupon Below Before Mailing Make your check payable to the 'United States Treasury'. Include in the check's memo section '2012 FORM 1040' and your SSN. Mail payment voucher to: INTERNAL REVENUE SERVICE P. O. BOX 931000 LOUISVILLE, KY 40293-1000 KBA Form 1040- V (2012) Detach Here and Mail With Your Payment and Return Department of the Treasury Internal Revenue Service 2012 Use t h is vouch er w h en making a payment w it h Form 1040 D o not st aple t h is vouch er or your payment t o Form 1040 M ak e your ch eck or money ord er payab le t o t h e "Unit ed St at es Treasury " Writ e your Social Securit y Numb er (SSN) on your ch eck or money ord er Form 1040-V Payment Voucher Amount you are paying by check or money order Dollars 26. 1029 UNCW STUDENT 601 S COLLEGE RD APT 230A WILMINGTON NC 28403-5901 INTERNAL REVENUE SERVICE P O BOX 931000 LOUISVILLE KY 40293-1000 555551234 CY STUD 30 0 201212 610 Instructions for Form D-400V, Payment Voucher Enter "2012 Form D-400," your daytime phone number, and your SSN on your check or money order. If you are filing a joint return, enter the SSN shown first on your return. What Is Form D-400V and Why Should You Use It? It is a statement you send with your payment of any balance due on your 2012 Form D-400. Using Form D-400V allows N.C. to process your payment more accurately and efficiently. We strongly encourage you to use Form D-400V. If you choose to file electronically and have a balance due, follow your transmitter's or preparer's instructions for making your payment. Make your check or money order payable in U.S. dollars to the NC Department of Revenue. Note: The Department will not accept a check, money order, or cashier's check unless it is drawn on a U.S. (domestic) bank and the funds are payable in U.S. dollars. Do not use the voucher to pay quarterly estimated tax Do not use a photocopy of the voucher Do not use another person's voucher Other Payment Methods In lieu of using the payment voucher below, you may pay your tax online by bank draft, or debit or credit card using Visa or Mastercard. For details, go to our website at www.dornc.com and click on Electronic Services. Make sure your name and address appear on your check or money order. Do not staple, tape, paper clip or otherwise attach your check or money order to the voucher Do not fold the voucher or check What if You File Electronically? Preparing and Sending Your Payment Important Reminders Do not send cash Do not use this payment voucher if you pay your tax on-line. Cut Here D-400V (48) Individual Income Payment Voucher North Carolina Department of Revenue 9-16-08 555551234 STUD UNCW 601 28403 STUDENT 601 S COLLEGE RD APT 230A WILMINGTON NC For Calendar Year 2012 28403 $ Taxpayer/ Paid Preparer: Date: AMOUNT OF THIS PAYMENT This must match the amount shown on your check or money order. Phone: 272.00 7270148006 Mail to: 20125 5555512343 0000000 06408 NCD OR, PO B ox 25000, Raleigh , NC 27640- 0640