How Much to Invest in Stocks and Bonds – The Dough Roller

1 of 3

http://www.doughroller.net/investing/asset-allocation/invest-stocks-bonds/

The Dough Roller

Money Management and Personal Finance | The Dough Roller

Home

Mortgage Rates

Best Online Banks

Credit Cards

Free Credit Score

Insurance

Investing

Smart Money Deals

by DR on August 8, 2007

The allocation of your investments between stock and bond mutual funds is one of the most important asset allocation

decisions you’ll make. Fortunately, there are some really easy to apply rules of thumb to help us make a reasonable

decision. Before we get to how much to invest in stocks vs bonds, however, here are several things to keep in mind:

Your Allocation Will Change Over Time: The allocation between stocks and bonds typically changes as your

investing horizon draws closer. Somebody with 40 years to go before retirement will likely want far more invested in

stocks than somebody who will retire in 5 years. When I began investing in my mid-20s, I didn’t own any bond

funds. I didn’t buy my first bond fund until my late thirties, and at 40, my allocation is 80/20 in favor of stock

mutual funds. The point isn’t that my choices are best, but rather that the allocation between stock and bond funds

will change over time.

There is No One Right Answer: Although the rules of thumb discussed below are helpful, there is no one right

allocation between stocks and bonds. As I discussed in the article yesterday about why asset allocation is important,

understanding your tolerance for risk and desired returns will influence your allocation between stocks and bonds,

and these decisions vary from one individual to another.

Your Tolerance For Risk Changes Over Time: In your 20s when you first start investing, you may not be concerned with a 30% drop in the market.

In your 40s with 3 kids and a 5 or 6 figure portfolio, a 30% drop in the market will take on a whole new meaning (trust me).

Investing is a Learning Process: I’ve learned a lot in the 15 years I’ve invested, and my opinions about asset allocation and a lot of other financial

issues have changed over that time. The point is not to approach these decisions rigidly, recognizing that your views will change.

Rules of Thumb

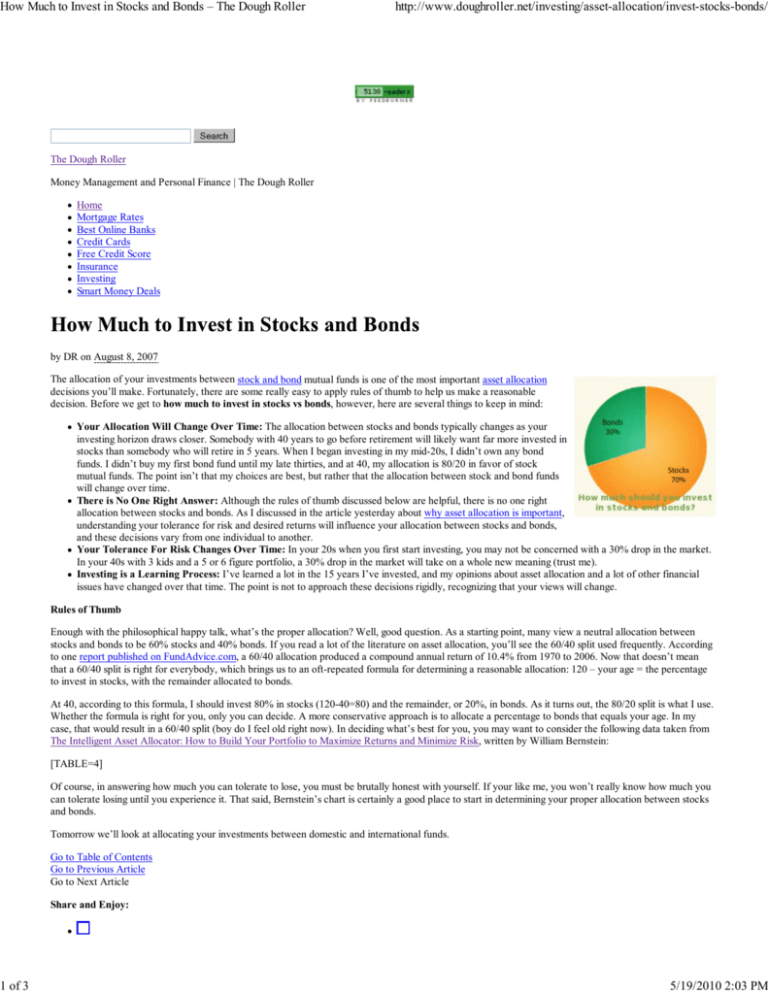

Enough with the philosophical happy talk, what’s the proper allocation? Well, good question. As a starting point, many view a neutral allocation between

stocks and bonds to be 60% stocks and 40% bonds. If you read a lot of the literature on asset allocation, you’ll see the 60/40 split used frequently. According

to one report published on FundAdvice.com, a 60/40 allocation produced a compound annual return of 10.4% from 1970 to 2006. Now that doesn’t mean

that a 60/40 split is right for everybody, which brings us to an oft-repeated formula for determining a reasonable allocation: 120 – your age = the percentage

to invest in stocks, with the remainder allocated to bonds.

At 40, according to this formula, I should invest 80% in stocks (120-40=80) and the remainder, or 20%, in bonds. As it turns out, the 80/20 split is what I use.

Whether the formula is right for you, only you can decide. A more conservative approach is to allocate a percentage to bonds that equals your age. In my

case, that would result in a 60/40 split (boy do I feel old right now). In deciding what’s best for you, you may want to consider the following data taken from

The Intelligent Asset Allocator: How to Build Your Portfolio to Maximize Returns and Minimize Risk, written by William Bernstein:

[TABLE=4]

Of course, in answering how much you can tolerate to lose, you must be brutally honest with yourself. If your like me, you won’t really know how much you

can tolerate losing until you experience it. That said, Bernstein’s chart is certainly a good place to start in determining your proper allocation between stocks

and bonds.

Tomorrow we’ll look at allocating your investments between domestic and international funds.

Go to Table of Contents

Go to Previous Article

Go to Next Article

Share and Enjoy:

5/19/2010 2:03 PM

How Much to Invest in Stocks and Bonds – The Dough Roller

2 of 3

http://www.doughroller.net/investing/asset-allocation/invest-stocks-bonds/

Related Posts:

Stocks vs Bonds

After-Tax Asset Allocation: Is there a gremlin lurking in your 401(k)?

Asset Allocation for Generation X (20s & 30s)

Building a Sound Asset Allocation Plan

Asset Allocation for Mid-Lifers (40s & 50s)

Leave a Comment

Name *

E-mail *

Website

{ 1 trackback }

The Investment Known As Dating | Finance Blog

Previous post: Asset Allocation in Action–Why Bother?

Next post: Asset Allocation in Action–Domestic vs. International Mutual Funds

Page 1 of 0

Popular Deals

0% Balance Transfer Offers

Copyright © 2007–2010, The Dough Roller. All rights reserved, unless otherwise noted. About |

0% APR Credit Cards

Archives | Subscribe

Instant Approval Cards

WordPress Admin

Cash Back Credit Cards

Interest Free Credit Cards

Prepaid Credit Cards

High Yield CD Rates

High Yield Savings Account Rates

Discount Brokers

Topics

Banking

Credit

Earn Extra Income

Money Management

News & Analysis

P2P Lending

Personal Finance

Retirement-Planning

Smart Spending

Tools & Resources

Reviews

Scottrade Review

Citi Platinum Select MasterCard

OptionsXpress Review

American Express Blue

Zecco Review

5/19/2010 2:03 PM

How Much to Invest in Stocks and Bonds – The Dough Roller

3 of 3

http://www.doughroller.net/investing/asset-allocation/invest-stocks-bonds/

offers and rates shown on the Dough Roller can and do change without notice. Visit the official site of the offer for up-to-date information.

For additional information, please review our privacy policy.

5/19/2010 2:03 PM