Shoppers Stop Ltd.

advertisement

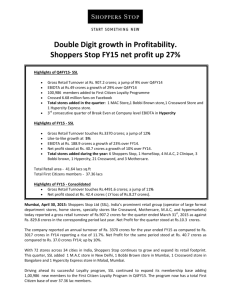

Ashika Research - Equities 29 September 2012 Shoppers Stop Ltd. Recommendation Shoppers Stop Ltd. (SSL) is one of the largest chains of department stores at present in India. At present SSL has a retail network of 4.64 mn square feet and 160 stores in different formats. Presently, SSL has 12 Hypercity Stores, 54 Shoppers Stop stores, 12 Home Shop(Home Décor), 40 Mother Care, 82 Crossword, 22 M.A.C(cosmetics), 12 Clinique, 5 Estee Lauder, 17 Timezone entertainment and 1 duty free shop in International airport. It has a customer base of 2.6mn customers through its customer loyalty program “First Citizen” which account for 70% of SSL’s sales (FY12). Investment Rationale FDI in retail- a big positive for the retail sector Ashika Stock Broking Limited Recently Govt. of India has approved FDI up to 51% in multi-brand retail (earlier foreign investors can hold upto 24% stake but they were not allowed to invest directly), subject to State Goat’s approval. Nine states and three union territories have already shown support to FDI. SSL have ~62% stores in these states. In the month of January 2012, govt. of India allowed 100% FDI in single brand retail (from 51% earlier). With these two positive update, Shoppers Stop is open to strategic tie -ups with foreign retailers especially in the food and grocery segment, under the Hypercity Brand. The company will be looking at various options available for strategic partnerships in terms of sourcing and logistics strength. Even in the departmental store format, the tie up would be in the food and grocery format. We believe that this reform would be a key positive for the company for its hypermarket format and will help the company to succeed its expansion programme faster. Target price Closing price Potential upside Buy Rs. 465 Rs. 393 22% Company Information BSE Code 532638 NSE Code SHOPERSTOP Bloomberg Code SHOP IN ISIN INE498B01024 Market Capital Rs 3252 Cr. O/shares (nos.) 8.26 Cr. 52-wk High/Low Rs. 427/Rs. 251 1year Avg. volume (NSE) 1,11,841 Face value Rs. 5 Book value Rs. 79.5 Relative performance chart (one year) Expansion plans on track During June’12 quarter, the company opened 2 Shoppers Stop, 1 Mothercare, 3 MAC, 1 Clinique & 4 Crossword stores. Customer footfall too has increased by 10 per cent in the June’12 quarter. HyperCITY Crossword is the leader in the lifestyle bookstore category with a unique product mix of books, magazines, CDROMs, music, stationery and toys. This is further enhanced with services like ‘Diala- Book’, and facilities like Gift Vouchers and ‘Return, Exchange, & Refunds’ policy. Currently, there are 82 Crossword stores / doors in operation. It has forayed into the entertainment sector with a stake of 47% in Timezone Entertainment Private Ltd, which is in the business of operating Family Entertainment Centers (FECs). It currently has 17 doors in leading metros. Hyper CITY is the value retailing format of the company. Shoppers Stop holds 51% stake in the business, balance being held by the Raheja group. The company plans to reach 18 stores by 2014 from 12 stores operating presently. Hypercity has already achieved operating (EBITDA) breakeven during 3QFY12 and is targeting to achieve PAT breakeven in FY14E. Key drivers for enhancing profitability for this format will be scale benefits, healthy SSS growth rates and improved product mix. Food which currently contributes 50- 55% of sales mix is likely to come down to ~45% levels and share of apparel (more profitable) is likely to move up from 7-8% currently to ~12- 14% over medium term. In Rs. Cr. NetSales FY12 FY13E FY14E 3060 3629 4588 28 18.6 26.4 EBITDA 111 167 294 EBITDA Margin 3.62 4.6 6.4 Growth(%) Net profit -24 78 149 Net profit Margin (%) -0.8 2.16 3.24 9.5 18 EPS (Rs) Share Holding – as on 30 June 2012 Trinity, 226/1,A.J.C. Bose Rd., 7th Floor,Kolkata:700 020, Ph- 033-4010 2500, Extn. -129 www.ashikagroup.com 1 Ashika Research - Equities Ashika Stock Broking Limited Indian Retail – huge opportunity Indian retail industry is approximately ~$500 Bn industry. Out of this total retail pie, organized retail sector has market share of 5-6 percent only. This retail sector may increase to $675 Bn in 2016 and organized retail may increase to $84 Bn (12.4% market share). Trinity, 226/1,A.J.C. Bose Rd., 7th Floor,Kolkata:700 020, Ph- 033-4010 2500, Extn. -129 www.ashikagroup.com 2 Ashika Research - Equities ConcernDeterioration in the economic scenario can impact the revenues of the company adversely. Sales per Sq.ft on chargeable area has decreased in the June’12 quarter. Outlook & Valuation: Going forward we believe that the company’s expansion in the retail space, coupled with the rise in discretionary spending, will drive its company’s overall sales. The company’s aggressive expansion in current economic scenario will start paying off as the Hypercity turns into a full fledged profit center & new departmental stores also starts contributing to optimum level. Also, FDI in retail will act as a big trigger, there by attracting global equity capital for expansion & investing the same in their supply chain. This will provide greater access to systems & processes established by global retailers and thereby reducing cost for the end consumers. At the CMP of Rs. 393, the scrip is trading at a P/E of 41x & 22x based on the expected earnings of Rs. 9.50 & Rs. 18.0 in FY13E & FY14E respectively. We recommend a ‘BUY’ for long term investment point of view. Ashika Stock Broking Limited Disclaimer: This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ashika Stock Broking Ltd., is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon such. Ashika Stock Broking Ltd. or any of its affiliates or employees shall not be in anyway responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Ashika Stock Broking Ltd., or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. “Ashika Stock Broking Ltd., and/or its affiliates and /or employees may have interests/positions, financial or otherwise in the securities mentioned in this report.” Trinity, 226/1,A.J.C. Bose Rd., 7th Floor,Kolkata:700 020, Ph- 033-4010 2500, Extn. -129 www.ashikagroup.com 3