Exploring the UK Freelance Workforce, 2011

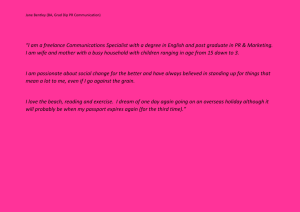

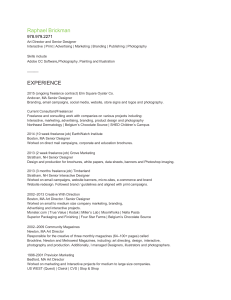

advertisement