Measuring Progress in Nutrition and Marketing

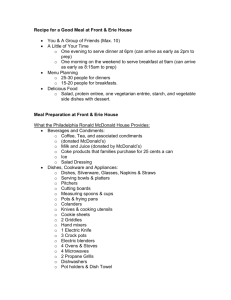

advertisement