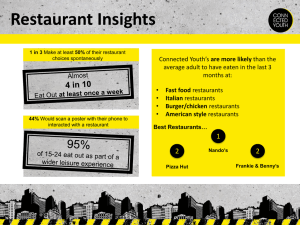

Measuring Progress in Nutrition and Marketing

advertisement