Accounting principles and notes

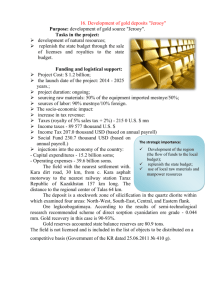

advertisement