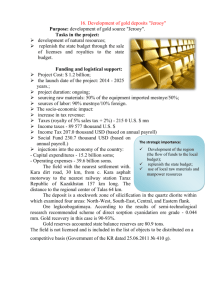

Accounting principles and notes

advertisement